Yogi Berra once said, “Nobody goes to that restaurant anymore because it’s too crowded.” A phrase that could just as easily apply to Facebook. People love to say it's obsolete—but behind the scenes, Meta’s products quietly dominate half the globe. It’s why Meta is one of only 11 companies in the world valued at over a trillion dollars.

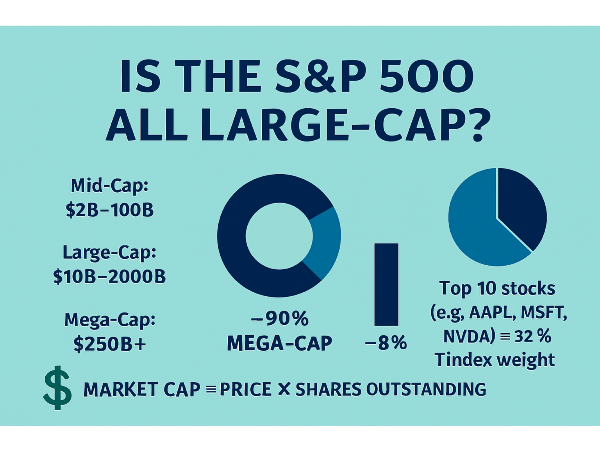

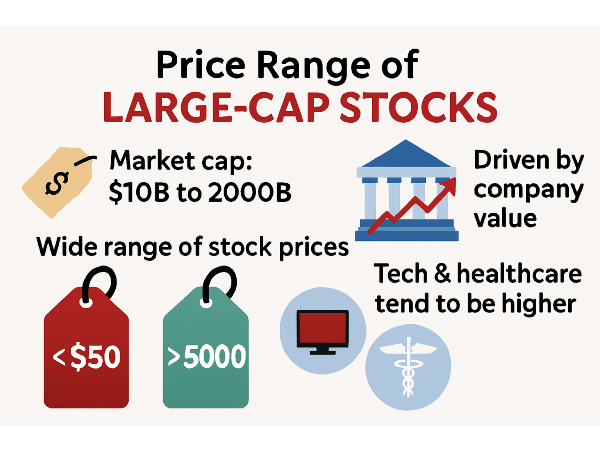

What’s fueling Meta’s resurgence? What does their AI strategy really look like? And does Meta still belong in your portfolio? Spoiler alert: If you own a broad market index fund, it already is. Meta’s the sixth largest company in the world by market cap. And for those playing along at home, yes—Tesla is the trillion-dollar company mysteriously missing from the Top 10 graphic.

Meta’s Revenue Rocket: Still Fuel in the Tank?

Meta’s rise has been anything but average. Growing from a $12 billion base, their revenue expansion is downright impressive. To put it in perspective, Palantir’s entire annual revenue looks like a blip next to Meta’s growth curve—yet Palantir still commands a premium valuation based on that potential.

When we talk trendlines, breaking them means something. So what happened in 2022 when Meta’s revenue growth hit a wall? Grok breaks it down: Apple’s privacy updates, a fickle user base, TikTok snatching attention spans, and a lot of hand-waving toward macroeconomic headwinds.

Still, not all users are created equal. North America and Europe represent a minority of users but the majority of revenue—emphasizing the importance of where the digital eyeballs come from. Revenue growth resumed in 2023, and while Grok fumbles the difference between income and revenue, it’s fair to say AI and smarter ad strategies played a key role.

Read More: 5 Stocks Maybe Better Than Meta

| Stock |

Company Name |

Why Better Than META |

| GOOG |

Alphabet Inc. |

Diversified revenue from search, cloud, and YouTube; stronger AI infrastructure and global ad dominance. |

| TCEHY |

Tencent Holdings |

Massive exposure to gaming and fintech in Asia; WeChat ecosystem offers unmatched user engagement. |

| BIDU |

Baidu, Inc. |

Leading AI and autonomous driving initiatives in China; strong government alignment and R&D investment. |

| SNAP |

Snap Inc. |

Younger demographic focus with AR innovation; leaner structure allows for faster product iteration. |

| PINS |

Pinterest Inc. |

High intent user base ideal for e-commerce; less controversy and more brand-safe environment than META. |

Gross Margins and Operating Leverage: A Double-Edged Sword

It’s not just about growing revenue—it’s what you keep that counts. In 2022, gross margins took a hit, falling alongside revenue. That speaks to Meta’s operating leverage working both ways. But with margins historically hovering near 80% and operating margins once touching 50%, Meta’s ability to trim fat and let AI take the wheel could restore those historic highs.

Where the Money Comes From

Let’s not complicate things: “Substantially all” of Meta’s revenue comes from advertising on Facebook and Instagram. That sentence speaks volumes. WhatsApp, Threads, Messenger? Not pulling their financial weight—yet.

Even more intriguing, more than 90% of Meta’s ad revenue comes from mobile devices. So Meta’s total addressable market effectively mirrors the world’s smartphone count, minus China. Ericsson’s mobile report helps us estimate that number—and the math shows that about 3.35 billion people use Meta daily, roughly 54% of the global smartphone population.

Astonishing, considering the challenges in tracking this data. Despite Meta’s vast digital ecosystem, their 10-K admits key metrics have limitations, especially due to WhatsApp’s encryption. Yet only 3% of users are flagged as bots or violating accounts.

Not All Phones Are Created Equal

Looking at ARPU (Average Revenue Per User), the value differences are eye-opening. Back in Q3 2022, Meta pulled in $49 per user per quarter in the U.S. and Canada, compared to just $3 in other regions. While Meta no longer provides this regional ARPU breakdown, the global average recently spiked to $14—a notable bump from previous years.

Meanwhile, ad impressions are leveling off, but the price per ad is soaring. Thanks to AI, Meta’s ad engine now delivers smarter, more targeted ads that actually work. That means higher prices, happier marketers, and more profits. Remember that meme where a kid accuses Zuckerberg of spying, and Zuck says, “He’s not your dad”? Classic. And kind of the point.

Interestingly, Meta once claimed they wouldn’t run ads on WhatsApp. Fast forward to today—they’re reversing course. More ads, more data, more monetization potential.

Spend on the Metaverse by META

| Year |

Estimated Spending (USD) |

Notes |

| 2020 |

~$6 billion |

Initial ramp-up of Reality Labs; early investments in VR/AR hardware |

| 2021 |

~$10 billion |

Official rebrand to Meta; major push into Metaverse development |

| 2022 |

~$13.7 billion |

Continued expansion; Reality Labs posted significant operating losses |

| 2023 |

~$16 billion |

Peak annual loss; Horizon Worlds struggled with user adoption |

| 2024 |

~$14.3 billion |

Spending slowed slightly; strategic pivot toward AI integration |

The Metaverse Money Sink (or Springboard?)

Let’s not forget where Meta’s betting the farm: Reality Labs. While their Family of Apps (FOA) remains the revenue powerhouse (claiming 79% of expenses in 2024), Reality Labs—home to their metaverse dreams—soaked up the remaining 21%, burning through nearly $20 billion.

Despite mounting losses, Meta’s not slowing down. They recently acquired a major stake in Scale AI, a firm focused on data labeling. With $77 billion in cash and nearly $50 billion in debt, Meta still has deep pockets for future bets.

Critics argue the metaverse push feels “overfunded and underthought.” Perhaps. But Meta insists generative AI will boost content discovery, ad performance, and product development. The magic number? ARPP—the dollars Meta can extract per user. And owning a data-labeling firm only sharpens their ability to do just that.

Here’s the second half of your SEO-friendly article, picking up from where we left off—carrying forward the transcript’s tone, structure, and personality while keeping bolding light:

Meta’s Data Muscle: The Core of Its AI Edge

If AI is the new oil, then Meta owns the refinery. The company’s proprietary datasets are unlike anything else in tech. Meta knows who your digital friends are versus your real-life crew. It’s seen enough cookouts to tell when you’ve worn that grill out. And with both WhatsApp and Facebook feeding its algorithms, Meta’s AI knows more about you than your own group chat does.

This personalization lets Meta serve up some of the most efficient ads in the business. That moat remains sturdy—as long as users stick around. Remember the WhatsApp privacy hiccup? A misstep like that and user trust starts to wobble.

The Metaverse Isn’t Dead, Just Fashionably Late

Despite what the skeptics claim, Meta hasn’t moved on from the metaverse. In fact, their 10-K still repeats a very telling phrase—many of their bets are “not on the market today and may only be fully realized in the next decade.” Translation? Buckle in, this is a long game.

The vision: an augmented world where your glasses serve up running stats or historical trivia mid-hike. Imagine reality turned role-playing game, where your day-to-day gets gamified enough to distract from the bots taking all the jobs. Ray-Ban smart glasses could be the first step—2 million sold and a production ramp toward 10 million suggests they’re not just a novelty item.

Whether it becomes the new norm or the next Google Glass, Meta’s doubling down. And that brings us to their ace in the hole: AI.

WhatsApp, but Make It a Super App

With half the planet using Meta’s suite of apps, it’s clear the data advantage runs deep. AI can optimize just about everything from ad placements to content discovery—but what if it could do more?

Enter the “super app” ambition. In Asia, platforms like Gojek and WeChat already serve as all-in-one ecosystems. Meta could position WhatsApp as the Western version—where messaging, payments, services, and entertainment live side by side. If executed right, it’s an enormous growth lever.

Meta’s internal estimates show $2 billion in generative AI-driven revenue today—a sliver of their $160 billion total. But by 2030, that number could balloon to $460 billion in a base case, or up to $1.4 trillion in a bull case.

| Platform |

Monthly Active Users (MAU) |

Key Features & Ecosystem |

Revenue (2023) |

Notable Markets |

| WeChat |

1.38 billion |

Messaging, Mini Programs, WeChat Pay, Social Feed |

~$16.38 billion |

China, Hong Kong, SE Asia |

| Gojek |

20+ million |

Ride-hailing, Food Delivery, Payments, Insurance, Shopping |

~$1.05 billion (est.) |

Indonesia, Vietnam, Thailand |

| WhatsApp |

2.95 billion |

Messaging, Voice/Video Calls, WhatsApp Business, Payments |

~$382 million (Business) |

India, Brazil, Global |

Final Thoughts: Can Meta Out-AI Everyone Else?

Ask yourself: will Meta outperform other AI titans in the top 10? Everyone’s chasing AI efficiency and new revenue streams. For Meta to beat them all, the runway needs to be long, the strategy crisp, and user engagement unwavering.

Then again, finding the right entry point is half the battle. The team here spotted Google and NVIDIA at around $40 billion market caps. Meta? Already soaring past the trillion-dollar mark.

The big question isn’t just whether Meta will win. It’s when to bet—and when to cash out if the story changes. The AI race is still running, and while Meta’s data and ecosystem offer clear tailwinds, timing is everything.

https://youtu.be/8EHL__QiJJ8?si=ghDJr0wMFMYSaohl

Yogi Berra once said, “Nobody goes to that restaurant anymore because it’s too crowded.” A phrase that could just as easily apply to Facebook. People love to say it's obsolete—but behind the scenes, Meta’s products quietly dominate half the globe. It’s why Meta is one of only 11 companies in the world valued at over a trillion dollars.

What’s fueling Meta’s resurgence? What does their AI strategy really look like? And does Meta still belong in your portfolio? Spoiler alert: If you own a broad market index fund, it already is. Meta’s the sixth largest company in the world by market cap. And for those playing along at home, yes—Tesla is the trillion-dollar company mysteriously missing from the Top 10 graphic.

Meta’s Revenue Rocket: Still Fuel in the Tank?

Meta’s rise has been anything but average. Growing from a $12 billion base, their revenue expansion is downright impressive. To put it in perspective, Palantir’s entire annual revenue looks like a blip next to Meta’s growth curve—yet Palantir still commands a premium valuation based on that potential.

When we talk trendlines, breaking them means something. So what happened in 2022 when Meta’s revenue growth hit a wall? Grok breaks it down: Apple’s privacy updates, a fickle user base, TikTok snatching attention spans, and a lot of hand-waving toward macroeconomic headwinds.

Still, not all users are created equal. North America and Europe represent a minority of users but the majority of revenue—emphasizing the importance of where the digital eyeballs come from. Revenue growth resumed in 2023, and while Grok fumbles the difference between income and revenue, it’s fair to say AI and smarter ad strategies played a key role.

Gross Margins and Operating Leverage: A Double-Edged Sword

It’s not just about growing revenue—it’s what you keep that counts. In 2022, gross margins took a hit, falling alongside revenue. That speaks to Meta’s operating leverage working both ways. But with margins historically hovering near 80% and operating margins once touching 50%, Meta’s ability to trim fat and let AI take the wheel could restore those historic highs.

Where the Money Comes From

Let’s not complicate things: “Substantially all” of Meta’s revenue comes from advertising on Facebook and Instagram. That sentence speaks volumes. WhatsApp, Threads, Messenger? Not pulling their financial weight—yet.

Even more intriguing, more than 90% of Meta’s ad revenue comes from mobile devices. So Meta’s total addressable market effectively mirrors the world’s smartphone count, minus China. Ericsson’s mobile report helps us estimate that number—and the math shows that about 3.35 billion people use Meta daily, roughly 54% of the global smartphone population.

Astonishing, considering the challenges in tracking this data. Despite Meta’s vast digital ecosystem, their 10-K admits key metrics have limitations, especially due to WhatsApp’s encryption. Yet only 3% of users are flagged as bots or violating accounts.

Not All Phones Are Created Equal

Looking at ARPU (Average Revenue Per User), the value differences are eye-opening. Back in Q3 2022, Meta pulled in $49 per user per quarter in the U.S. and Canada, compared to just $3 in other regions. While Meta no longer provides this regional ARPU breakdown, the global average recently spiked to $14—a notable bump from previous years.

Meanwhile, ad impressions are leveling off, but the price per ad is soaring. Thanks to AI, Meta’s ad engine now delivers smarter, more targeted ads that actually work. That means higher prices, happier marketers, and more profits. Remember that meme where a kid accuses Zuckerberg of spying, and Zuck says, “He’s not your dad”? Classic. And kind of the point.

Interestingly, Meta once claimed they wouldn’t run ads on WhatsApp. Fast forward to today—they’re reversing course. More ads, more data, more monetization potential.

The Metaverse Money Sink (or Springboard?)

Let’s not forget where Meta’s betting the farm: Reality Labs. While their Family of Apps (FOA) remains the revenue powerhouse (claiming 79% of expenses in 2024), Reality Labs—home to their metaverse dreams—soaked up the remaining 21%, burning through nearly $20 billion.

Despite mounting losses, Meta’s not slowing down. They recently acquired a major stake in Scale AI, a firm focused on data labeling. With $77 billion in cash and nearly $50 billion in debt, Meta still has deep pockets for future bets.

Critics argue the metaverse push feels “overfunded and underthought.” Perhaps. But Meta insists generative AI will boost content discovery, ad performance, and product development. The magic number? ARPP—the dollars Meta can extract per user. And owning a data-labeling firm only sharpens their ability to do just that.

Here’s the second half of your SEO-friendly article, picking up from where we left off—carrying forward the transcript’s tone, structure, and personality while keeping bolding light:

Meta’s Data Muscle: The Core of Its AI Edge

If AI is the new oil, then Meta owns the refinery. The company’s proprietary datasets are unlike anything else in tech. Meta knows who your digital friends are versus your real-life crew. It’s seen enough cookouts to tell when you’ve worn that grill out. And with both WhatsApp and Facebook feeding its algorithms, Meta’s AI knows more about you than your own group chat does.

This personalization lets Meta serve up some of the most efficient ads in the business. That moat remains sturdy—as long as users stick around. Remember the WhatsApp privacy hiccup? A misstep like that and user trust starts to wobble.

The Metaverse Isn’t Dead, Just Fashionably Late

Despite what the skeptics claim, Meta hasn’t moved on from the metaverse. In fact, their 10-K still repeats a very telling phrase—many of their bets are “not on the market today and may only be fully realized in the next decade.” Translation? Buckle in, this is a long game.

The vision: an augmented world where your glasses serve up running stats or historical trivia mid-hike. Imagine reality turned role-playing game, where your day-to-day gets gamified enough to distract from the bots taking all the jobs. Ray-Ban smart glasses could be the first step—2 million sold and a production ramp toward 10 million suggests they’re not just a novelty item.

Whether it becomes the new norm or the next Google Glass, Meta’s doubling down. And that brings us to their ace in the hole: AI.

WhatsApp, but Make It a Super App

With half the planet using Meta’s suite of apps, it’s clear the data advantage runs deep. AI can optimize just about everything from ad placements to content discovery—but what if it could do more?

Enter the “super app” ambition. In Asia, platforms like Gojek and WeChat already serve as all-in-one ecosystems. Meta could position WhatsApp as the Western version—where messaging, payments, services, and entertainment live side by side. If executed right, it’s an enormous growth lever.

Meta’s internal estimates show $2 billion in generative AI-driven revenue today—a sliver of their $160 billion total. But by 2030, that number could balloon to $460 billion in a base case, or up to $1.4 trillion in a bull case.

Final Thoughts: Can Meta Out-AI Everyone Else?

Ask yourself: will Meta outperform other AI titans in the top 10? Everyone’s chasing AI efficiency and new revenue streams. For Meta to beat them all, the runway needs to be long, the strategy crisp, and user engagement unwavering.

Then again, finding the right entry point is half the battle. The team here spotted Google and NVIDIA at around $40 billion market caps. Meta? Already soaring past the trillion-dollar mark.

The big question isn’t just whether Meta will win. It’s when to bet—and when to cash out if the story changes. The AI race is still running, and while Meta’s data and ecosystem offer clear tailwinds, timing is everything.

https://youtu.be/8EHL__QiJJ8?si=ghDJr0wMFMYSaohl