Discover why tech dominates the market, what it means for your portfolio, and how to invest with confidence—not complexity.

Understanding Market Cap by Industry: A Straightforward Look

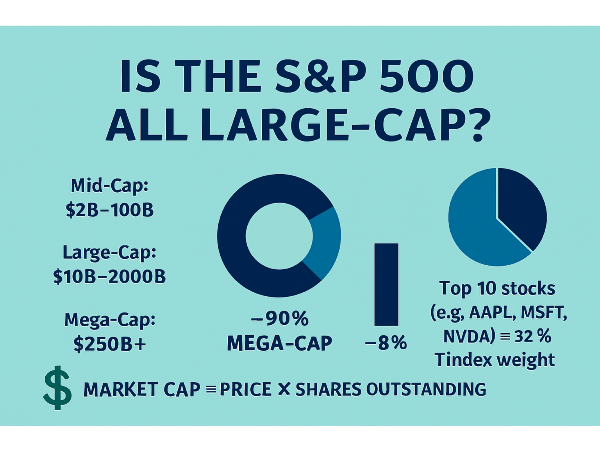

Market capitalization, or market cap, is one of the simplest ways to gauge a company’s size—but its implications run deeper than most realize. By multiplying a company’s share price by its total outstanding shares, market cap offers a snapshot of how the market values that business at any given moment. But zooming out from individual companies to entire industries reveals something even more powerful: where the biggest money is flowing. Industry-level market cap helps investors understand which sectors dominate the economy, where capital is concentrating, and which trends are shaping the future of investing.

In 2025, technology continues to lead the charge, with giants like Microsoft, Apple, and Nvidia pushing the sector’s valuation to historic highs. But this isn’t just about tech’s headline-grabbing growth—it’s about what that leadership means for your portfolio, your diversification strategy, and your long-term financial confidence. Understanding where the market’s weight lies can help you invest not just in companies, but in the forces driving the economy forward.

Want expert insights from leading investment podcasts? Scroll to the end to the Podcast Transcripts📜

Tech Stocks in 2025: Why the Market’s Biggest Players Still Lead

In 2025, the technology sector continues to dominate global market capitalization, with four of the five largest companies in the world hailing from this space. Apple AAPL, Nvidia NVDA, Microsoft MSFT, and Alphabet GOOGL collectively represent trillions in market value. Apple leads with a staggering $3.68 trillion, followed closely by Nvidia at $3.54 trillion and Microsoft at $3.15 trillion.

These companies aren’t just large—they’re foundational to the digital economy. What makes these companies so valuable isn’t just size—it’s scalability. Tech firms can grow revenue exponentially without a matching rise in costs, thanks to digital infrastructure and global reach.

Two standout podcast episodes offer deeper insight into this trend. In RBC Capital Markets’ Markets in Motion, Lori Calvasina explains how tech’s valuation strength is driven by earnings momentum and investor flows. “We’re seeing a structural shift in how capital is allocated,” she notes at 12:47 ⏱️, highlighting Nvidia’s AI leadership and Microsoft’s cloud dominance. Meanwhile, Investing.com Insights explores sector earnings projections, with a focus on how Alphabet’s ad revenue and Apple’s services ecosystem are fueling long-term growth. At 08:22 ⏱️, the host emphasizes, “Tech isn’t just a growth story—it’s a cash flow machine.”

Sources:

CompaniesMarketCap.com – Industry Rankings

Statista – Leading Tech Companies by Market Cap 2025

Forbes India – Top 10 Tech Companies by Market Cap

SmartAsset – Long-Term Investing Guide

Investing.com – Long-Term Investments

Beyond Tech: The Sectors Powering Stability and Spending in 2025

While technology grabs headlines, three other sectors—Financials, Healthcare, and Consumer Discretionary—continue to anchor the market with a blend of resilience and relevance. Financials remain a backbone of the economy, offering steady earnings through interest income, asset management, and insurance.

Their systemic importance means they often benefit from regulatory support during downturns, making them a stabilizing force in diversified portfolios. Banks like JPMorgan Chase JPM and insurers like UnitedHealth Group UNH exemplify this consistency. Healthcare, meanwhile, is undergoing a renaissance. With aging populations and breakthroughs in biotech, the sector is seeing renewed investor interest.

A SciTechDaily podcast highlights a Harvard-MIT discovery that chemically reprograms cells to a more youthful state. At 10:03 ⏱️, the host notes, “This could redefine how we treat age-related diseases—without gene therapy.” Another episode from LumaGroup explores longevity drug development, with a standout quote at 07:45 ⏱️: “Biotech is no longer speculative—it’s foundational to the future of medicine.”

Then there’s Consumer Discretionary, where companies like Amazon AMZN and Tesla TSLA thrive on the power of spending. As consumer confidence rebounds, discretionary ETFs like XLY are outperforming broader indices. These companies benefit from brand loyalty, innovation, and global demand—traits that mirror tech’s growth profile. Compared to tech, these sectors offer a different kind of strength. Financials and healthcare provide defensive stability, while consumer discretionary adds cyclical upside.

Sources:

Forbes – Top Sectors to Invest in 2025

MarketBeat – Consumer Discretionary Sector Insights

CFA Institute – Quality of Earnings

MarketBeat – Tesla and Amazon Earnings

Harvard/MIT – Age Reversal Research

Investing.com – Sector Earnings

RBC Capital Markets – Sector Outlook

Looking Beyond Market Cap: What Really Drives Company Value

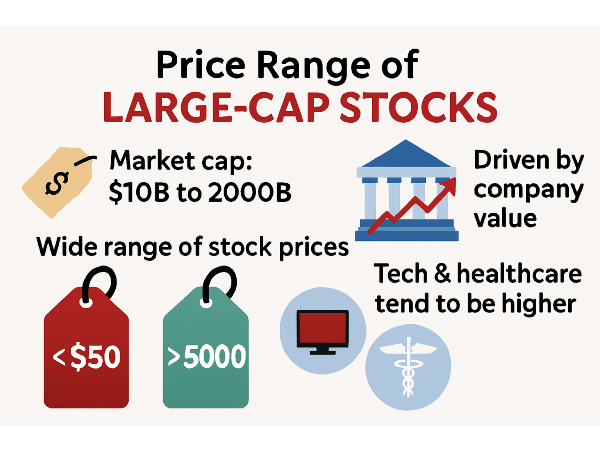

While market cap tells you how much the market values a company based on its stock price and outstanding shares, it doesn’t reveal how efficiently that company earns revenue, manages costs, or sustains growth. That’s where valuation multiples come in. Metrics like price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA help investors compare companies based on profitability and operational efficiency.

For instance, a tech firm trading at 30x earnings may look expensive—unless it’s growing revenue at 40% annually with high margins. It’s also crucial to distinguish between cyclical and secular growth. Cyclical sectors—like autos or construction—rise and fall with the economy. Secular growth, on the other hand, is driven by long-term trends like digital transformation or aging demographics.

Sources:

Alphanome.AI – Why Market Cap is a Misleading Valuation Metric

Eqvista – Revenue Multiples by Industry (2025)

Accounting Insights – What Is a Multiplier in Business

Smart Sector Investing: Simple Strategies for a Resilient Portfolio

Funds like SPDR’s XLK (tech), XLV (healthcare), and XLF (financials) let you ride the momentum of sector leaders while staying diversified. When choosing sector ETFs, it’s worth understanding the difference between market-cap-weighted and equal-weighted strategies. Market-cap-weighted ETFs give more influence to larger companies—think Apple or Microsoft—while equal-weighted ETFs like RSP spread investments evenly across all holdings. For those seeking growth beyond traditional sectors, thematic ETFs are gaining traction.

Funds like ARKK (disruptive innovation), XT (exponential technologies), and ARTY (AI and tech) focus on long-term trends such as artificial intelligence, clean energy, and digital infrastructure.

To balance sector exposure, aim for a mix of cyclical and defensive sectors. Tools like sector rotation strategies and periodic rebalancing can help you stay aligned with economic cycles. Allocating across 5–7 sectors can reduce volatility and improve long-term returns. The goal isn’t to predict the next hot sector—it’s to build a portfolio that thrives across market conditions.

Sources:

The Motley Fool – Sector ETFs: A Diversified Strategy

Vanguard – Index Weighting Approaches

Investopedia – Sector ETF Basics

MarketBeat – Sector ETF Trends

World Economic Forum – Sector Trends

Investing.com – Sector Earnings

RBC Capital Markets – Sector Outlook

Conclusion

Understanding which sectors lead the market—and why—can simplify your investment decisions without watering down your strategy. While tech’s dominance in 2025 is undeniable, financials, healthcare, and consumer discretionary remind us that resilience and relevance often go hand in hand. Digging deeper than market cap into fundamentals like earnings, growth trends, and economic cycles gives you a more grounded view of where your money is going. With tools like sector and thematic ETFs, balanced exposure is easier than ever, letting you align your portfolio with both stability and innovation. The goal isn’t to chase headlines—it’s to own a slice of progress in a way that fits your financial path. Simple, consistent investing wins the long game. Always has. Probably always will.

Podcast Transcripts 🎧

1. Markets in Motion – Early Thoughts on the 2025 S&P 500 Sector Outlook

Podcast Channel: RBC Capital Markets

This episode features Lori Calvasina discussing sector positioning for 2025. She highlights how tech’s valuation strength is supported by earnings momentum and capital flows.

Highlighted Quote: “We’re seeing a structural shift in how capital is allocated.”

Time-stamped Insight: 12:47 ⏱️ – Nvidia’s AI leadership and Microsoft’s cloud dominance are driving investor confidence.

2. S&P 500: Which Sectors Are Poised for Strong Earnings Growth in 2025?

Podcast Channel: Investing.com Insights

This episode explores projected earnings growth across sectors, with a focus on tech, industrials, and healthcare.

Highlighted Quote: “Tech isn’t just a growth story—it’s a cash flow machine.”

Time-stamped Insight: 08:22 ⏱️ – Alphabet’s ad revenue and Apple’s services ecosystem are spotlighted as long-term growth drivers.

3. SciTechDaily – Age Reversal Breakthrough: Harvard-MIT Discovery Could Enable Whole-Body Rejuvenation

Podcast Channel: SciTechDaily

This episode covers a groundbreaking biotech discovery that reprograms cells to a more youthful state.

Highlighted Quote: “This could redefine how we treat age-related diseases—without gene therapy.”

Time-stamped Insight: 10:03 ⏱️ – Discussion on the implications of chemical reprogramming in healthcare innovation.

4. Decoding Aging: Breakthroughs, Challenges, and the Future of Longevity Drug Development

Podcast Channel: LumaGroup

This episode dives into the science and strategy behind longevity-focused biotech.

Highlighted Quote: “Biotech is no longer speculative—it’s foundational to the future of medicine.”

Time-stamped Insight: 07:45 ⏱️ – Insights into how biotech is reshaping healthcare investing.

📌Read More About:

Top Large Cap Stocks https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Large Cap Sector Breakdown: How Each Industry Shapes the Market- https://stockbossup.com/pages/post/39242/large-cap-sector-breakdown-how-each-industry-shapes-the-market

What Are the Largest Market Cap Sectors?- https://stockbossup.com/pages/post/39159/largest-market-cap-sectors-key-industries-driving-global-investment

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence

Discover why tech dominates the market, what it means for your portfolio, and how to invest with confidence—not complexity.

Understanding Market Cap by Industry: A Straightforward Look

Market capitalization, or market cap, is one of the simplest ways to gauge a company’s size—but its implications run deeper than most realize. By multiplying a company’s share price by its total outstanding shares, market cap offers a snapshot of how the market values that business at any given moment. But zooming out from individual companies to entire industries reveals something even more powerful: where the biggest money is flowing. Industry-level market cap helps investors understand which sectors dominate the economy, where capital is concentrating, and which trends are shaping the future of investing.

In 2025, technology continues to lead the charge, with giants like Microsoft, Apple, and Nvidia pushing the sector’s valuation to historic highs. But this isn’t just about tech’s headline-grabbing growth—it’s about what that leadership means for your portfolio, your diversification strategy, and your long-term financial confidence. Understanding where the market’s weight lies can help you invest not just in companies, but in the forces driving the economy forward.

Want expert insights from leading investment podcasts? Scroll to the end to the Podcast Transcripts📜

Tech Stocks in 2025: Why the Market’s Biggest Players Still Lead

In 2025, the technology sector continues to dominate global market capitalization, with four of the five largest companies in the world hailing from this space. Apple AAPL, Nvidia NVDA, Microsoft MSFT, and Alphabet GOOGL collectively represent trillions in market value. Apple leads with a staggering $3.68 trillion, followed closely by Nvidia at $3.54 trillion and Microsoft at $3.15 trillion.

These companies aren’t just large—they’re foundational to the digital economy. What makes these companies so valuable isn’t just size—it’s scalability. Tech firms can grow revenue exponentially without a matching rise in costs, thanks to digital infrastructure and global reach.

Two standout podcast episodes offer deeper insight into this trend. In RBC Capital Markets’ Markets in Motion, Lori Calvasina explains how tech’s valuation strength is driven by earnings momentum and investor flows. “We’re seeing a structural shift in how capital is allocated,” she notes at 12:47 ⏱️, highlighting Nvidia’s AI leadership and Microsoft’s cloud dominance. Meanwhile, Investing.com Insights explores sector earnings projections, with a focus on how Alphabet’s ad revenue and Apple’s services ecosystem are fueling long-term growth. At 08:22 ⏱️, the host emphasizes, “Tech isn’t just a growth story—it’s a cash flow machine.”

Sources:

CompaniesMarketCap.com – Industry Rankings

Statista – Leading Tech Companies by Market Cap 2025

Forbes India – Top 10 Tech Companies by Market Cap

SmartAsset – Long-Term Investing Guide

Investing.com – Long-Term Investments

Beyond Tech: The Sectors Powering Stability and Spending in 2025

While technology grabs headlines, three other sectors—Financials, Healthcare, and Consumer Discretionary—continue to anchor the market with a blend of resilience and relevance. Financials remain a backbone of the economy, offering steady earnings through interest income, asset management, and insurance.

Their systemic importance means they often benefit from regulatory support during downturns, making them a stabilizing force in diversified portfolios. Banks like JPMorgan Chase JPM and insurers like UnitedHealth Group UNH exemplify this consistency. Healthcare, meanwhile, is undergoing a renaissance. With aging populations and breakthroughs in biotech, the sector is seeing renewed investor interest.

A SciTechDaily podcast highlights a Harvard-MIT discovery that chemically reprograms cells to a more youthful state. At 10:03 ⏱️, the host notes, “This could redefine how we treat age-related diseases—without gene therapy.” Another episode from LumaGroup explores longevity drug development, with a standout quote at 07:45 ⏱️: “Biotech is no longer speculative—it’s foundational to the future of medicine.”

Then there’s Consumer Discretionary, where companies like Amazon AMZN and Tesla TSLA thrive on the power of spending. As consumer confidence rebounds, discretionary ETFs like XLY are outperforming broader indices. These companies benefit from brand loyalty, innovation, and global demand—traits that mirror tech’s growth profile. Compared to tech, these sectors offer a different kind of strength. Financials and healthcare provide defensive stability, while consumer discretionary adds cyclical upside.

Sources:

Forbes – Top Sectors to Invest in 2025

MarketBeat – Consumer Discretionary Sector Insights

CFA Institute – Quality of Earnings

MarketBeat – Tesla and Amazon Earnings

Harvard/MIT – Age Reversal Research

Investing.com – Sector Earnings

RBC Capital Markets – Sector Outlook

Looking Beyond Market Cap: What Really Drives Company Value

While market cap tells you how much the market values a company based on its stock price and outstanding shares, it doesn’t reveal how efficiently that company earns revenue, manages costs, or sustains growth. That’s where valuation multiples come in. Metrics like price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA help investors compare companies based on profitability and operational efficiency.

For instance, a tech firm trading at 30x earnings may look expensive—unless it’s growing revenue at 40% annually with high margins. It’s also crucial to distinguish between cyclical and secular growth. Cyclical sectors—like autos or construction—rise and fall with the economy. Secular growth, on the other hand, is driven by long-term trends like digital transformation or aging demographics.

Sources:

Alphanome.AI – Why Market Cap is a Misleading Valuation Metric

Eqvista – Revenue Multiples by Industry (2025)

Accounting Insights – What Is a Multiplier in Business

Smart Sector Investing: Simple Strategies for a Resilient Portfolio

Funds like SPDR’s XLK (tech), XLV (healthcare), and XLF (financials) let you ride the momentum of sector leaders while staying diversified. When choosing sector ETFs, it’s worth understanding the difference between market-cap-weighted and equal-weighted strategies. Market-cap-weighted ETFs give more influence to larger companies—think Apple or Microsoft—while equal-weighted ETFs like RSP spread investments evenly across all holdings. For those seeking growth beyond traditional sectors, thematic ETFs are gaining traction.

Funds like ARKK (disruptive innovation), XT (exponential technologies), and ARTY (AI and tech) focus on long-term trends such as artificial intelligence, clean energy, and digital infrastructure. To balance sector exposure, aim for a mix of cyclical and defensive sectors. Tools like sector rotation strategies and periodic rebalancing can help you stay aligned with economic cycles. Allocating across 5–7 sectors can reduce volatility and improve long-term returns. The goal isn’t to predict the next hot sector—it’s to build a portfolio that thrives across market conditions.

Sources:

The Motley Fool – Sector ETFs: A Diversified Strategy

Vanguard – Index Weighting Approaches

Investopedia – Sector ETF Basics

MarketBeat – Sector ETF Trends

World Economic Forum – Sector Trends

Investing.com – Sector Earnings

RBC Capital Markets – Sector Outlook

Conclusion

Understanding which sectors lead the market—and why—can simplify your investment decisions without watering down your strategy. While tech’s dominance in 2025 is undeniable, financials, healthcare, and consumer discretionary remind us that resilience and relevance often go hand in hand. Digging deeper than market cap into fundamentals like earnings, growth trends, and economic cycles gives you a more grounded view of where your money is going. With tools like sector and thematic ETFs, balanced exposure is easier than ever, letting you align your portfolio with both stability and innovation. The goal isn’t to chase headlines—it’s to own a slice of progress in a way that fits your financial path. Simple, consistent investing wins the long game. Always has. Probably always will.

Podcast Transcripts 🎧

1. Markets in Motion – Early Thoughts on the 2025 S&P 500 Sector Outlook

Podcast Channel: RBC Capital Markets

This episode features Lori Calvasina discussing sector positioning for 2025. She highlights how tech’s valuation strength is supported by earnings momentum and capital flows.

Highlighted Quote: “We’re seeing a structural shift in how capital is allocated.”

Time-stamped Insight: 12:47 ⏱️ – Nvidia’s AI leadership and Microsoft’s cloud dominance are driving investor confidence.

2. S&P 500: Which Sectors Are Poised for Strong Earnings Growth in 2025?

Podcast Channel: Investing.com Insights

This episode explores projected earnings growth across sectors, with a focus on tech, industrials, and healthcare.

Highlighted Quote: “Tech isn’t just a growth story—it’s a cash flow machine.”

Time-stamped Insight: 08:22 ⏱️ – Alphabet’s ad revenue and Apple’s services ecosystem are spotlighted as long-term growth drivers.

3. SciTechDaily – Age Reversal Breakthrough: Harvard-MIT Discovery Could Enable Whole-Body Rejuvenation

Podcast Channel: SciTechDaily

This episode covers a groundbreaking biotech discovery that reprograms cells to a more youthful state.

Highlighted Quote: “This could redefine how we treat age-related diseases—without gene therapy.”

Time-stamped Insight: 10:03 ⏱️ – Discussion on the implications of chemical reprogramming in healthcare innovation.

4. Decoding Aging: Breakthroughs, Challenges, and the Future of Longevity Drug Development

Podcast Channel: LumaGroup

This episode dives into the science and strategy behind longevity-focused biotech.

Highlighted Quote: “Biotech is no longer speculative—it’s foundational to the future of medicine.”

Time-stamped Insight: 07:45 ⏱️ – Insights into how biotech is reshaping healthcare investing.

📌Read More About:

Top Large Cap Stocks https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Large Cap Sector Breakdown: How Each Industry Shapes the Market- https://stockbossup.com/pages/post/39242/large-cap-sector-breakdown-how-each-industry-shapes-the-market

What Are the Largest Market Cap Sectors?- https://stockbossup.com/pages/post/39159/largest-market-cap-sectors-key-industries-driving-global-investment

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence