Explore the largest sectors by market capitalization, their leading companies, and what this means for investors and ETF strategies.

Why Sector Market Cap Is the Key to Understanding Market Leadership

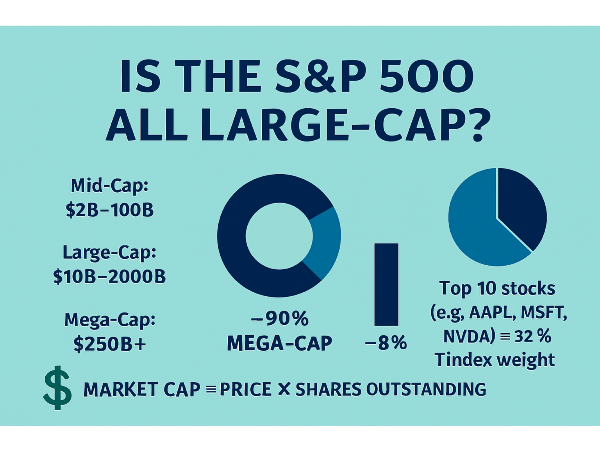

Market capitalization, or market cap, is a measure of a company’s total value in the stock market, calculated by multiplying its share price by the number of outstanding shares. While it’s commonly used to classify individual companies into small-, mid-, or large-cap tiers, market cap also plays a critical role in analyzing entire sectors. Sector-level market capitalization reveals which industries dominate the global economy, influence index performance, and attract the most investor capital. For example, the technology and financial sectors consistently lead in total market value, shaping the direction of major indices like the S&P 500 and MSCI World.

Understanding which sectors hold the most market cap helps investors identify where capital is concentrated, assess diversification, and align their portfolios with long-term trends. In this article, we’ll explore how sector market cap is calculated, rank the largest sectors globally in 2025, highlight the companies driving their dominance, and examine the implications for ETF strategies and portfolio construction. Whether you're a passive investor or an active allocator, knowing which sectors lead the market can sharpen your investment decisions and risk management.

Want expert insights from leading investment podcasts? Scroll to the end to the Podcast Transcripts📜

What Is Sector Market Capitalization and Why It Shapes the Stock Market

It’s calculated by summing the individual market caps of each company in that sector—where market cap equals share price multiplied by the number of outstanding shares. This aggregate figure helps investors understand which sectors dominate the market in terms of size and influence. For example, the Information Technology sector, led by giants like Apple AAPL and Microsoft MSFT, consistently ranks among the highest in global market cap. Sectors are typically classified using standardized systems such as the Global Industry Classification Standard (GICS) and the Industry Classification Benchmark (ICB).

These frameworks group companies based on their primary business activities, allowing for consistent comparison across markets. In Morningstar’s Investing Insights, analysts explained, “Sector weightings aren’t just passive—they’re a mirror of where capital flows and where investors see growth” (🎧 08:30).

Meanwhile, The Investor’s Podcast Network emphasized, “Understanding sector cap helps decode index behavior and ETF performance” (🎧 09:45).

A sector’s market cap also influences how much sway it holds in cap-weighted indices. For instance, if the tech sector comprises 30% of the S&P 500’s total market cap, then tech stocks will account for 30% of the index’s movement. This concentration can amplify gains during bull markets or magnify losses during downturns. As a result, investors tracking broad-market ETFs may unknowingly carry sector-specific risk.

Sources:

Macromicro – S&P 500 Sector Weightings

SmartAsset – Guide to the 11 Market Sectors

FasterCapital – Measuring Sector Impact on the Market

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Investopedia – Sector Investing Explained

CompaniesMarketCap – Sector Rankings

Visual Capitalist – Global Stock Market by Sector

Top 5 Sectors by Global Market Capitalization in 2025

As of 2025, the global stock market is dominated by five powerhouse sectors, led by Information Technology with a staggering market cap of approximately $25.7 trillion. This sector alone accounts for over 20% of global equity value, driven by giants like Apple AAPL, Microsoft MSFT, and Nvidia NVDA.

The U.S. and China continue to lead in tech innovation, with American firms dominating software and semiconductors, while Chinese companies expand in hardware and AI infrastructure. Financials follow closely with a market cap of around $21.1 trillion, reflecting the sector’s foundational role in global economies. Major players include JPMorgan Chase JPM, Bank of America BAC, and Industrial and Commercial Bank of China IDCBY.

Industrials rank third at $15.3 trillion, encompassing aerospace, logistics, and manufacturing. Consumer Discretionary, valued at $13.6 trillion, includes companies like Amazon AMZN and Tesla TSLA, reflecting global consumer demand. Health Care rounds out the top five at $10.7 trillion, led by firms such as UnitedHealth Group UNH and Eli Lilly LLY, with strongholds in the U.S. and Europe.

In Morningstar’s Investing Insights, analysts noted, “Tech’s dominance isn’t just about size—it’s about influence across every other sector” (🎧 10:15). Meanwhile, The Investor’s Podcast Network emphasized, “Sector weightings are a silent force behind ETF performance and market momentum” (🎧 11:40).

Sources:

Visual Capitalist – Global Stock Market by Sector

CompaniesMarketCap – Sector Rankings

Deloitte – 2025 Technology Industry Outlook

CRN – Top Tech Markets in 2025

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Investopedia – Sector Investing Explained

Key Companies Powering the World’s Largest Sectors

The dominance of global sectors is largely driven by a handful of mega-cap companies that shape index performance and ETF allocations. In the Information Technology sector, Microsoft MSFT, Apple AAPL, and Nvidia NVDA lead the charge, each with market caps exceeding $3 trillion. These firms anchor ETFs like XLK and VGT, often comprising over 40% of the fund’s total weight. In Financials, JPMorgan Chase JPM and Industrial and Commercial Bank of China IDCBY top the list.

These institutions represent the backbone of global banking and are heavily weighted in ETFs such as XLF and VFH. Their earnings reports and interest rate sensitivity often set the tone for the sector’s performance. Meanwhile, in Health Care, UnitedHealth Group UNH and Eli Lilly LLY dominate due to their scale, innovation pipelines, and consistent revenue growth.

In Morningstar’s Investing Insights, analysts noted, “When a handful of companies make up half a sector ETF, you’re not just betting on a theme—you’re betting on the giants” (🎧 11:10). The Investor’s Podcast Network added, “Mega-cap stocks don’t just lead—they define the sector’s trajectory” (🎧 12:25). These insights highlight why understanding sector leaders is essential for ETF investors and index followers alike.

Sources:

The Motley Fool – Largest Tech Companies by Market Cap

CompaniesMarketCap – Sector Rankings

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Investopedia – Sector Investing Explained

Visual Capitalist – Global Stock Market by Sector

Sector Concentration Risks: When a Few Giants Drive the Market

Mega-cap stocks have an outsized influence on sector weightings, especially in cap-weighted indices like the S&P 500. In 2025, companies such as Apple AAPL, Microsoft MSFT, and Nvidia NVDA collectively account for over 30% of the Information Technology sector’s weight. This concentration means that a handful of stocks can disproportionately sway the performance of entire sectors—and by extension, the broader index.

This imbalance has broader implications. According to Morningstar’s Investing Insights, “Cap-weighted ETFs can silently amplify risk if you’re not watching sector weights” (🎧 11:50). The Investor’s Podcast Network adds, “When tech stocks dominate, the S&P 500 becomes a tech fund in disguise” (🎧 12:40). These insights highlight the importance of understanding sector concentration when building portfolios.

Sources:

Concentration Risks in the S&P – CFA Society New York

S&P Global – Sector Concentration and Equal Weighting

J.P. Morgan – Addressing Market Concentration Risks

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

CompaniesMarketCap – Sector Rankings

Visual Capitalist – Global Stock Market by Sector

Investopedia – Sector Investing Explained

Sector Trends and Growth Outlook: What’s Driving Momentum in 2025

The Information Technology sector continues to lead, fueled by rapid advancements in artificial intelligence. Companies like Nvidia NVDA, Meta Platforms META, and Alphabet GOOGL are leveraging AI to drive innovation in semiconductors, cloud computing, and digital advertising. According to Morningstar’s Investing Insights, “AI isn’t just a tech trend—it’s a cross-sector catalyst reshaping everything from logistics to healthcare” (🎧 10:50).

Meanwhile, the Financials sector is embracing fintech and automation to streamline operations and enhance customer experience, with firms like JPMorgan JPM investing heavily in AI-driven analytics. Sectors gaining momentum in 2025 include Clean Energy, Cybersecurity, and Healthcare Technology.

Industrial companies are also undergoing a digital transformation. Automation, robotics, and smart manufacturing are redefining productivity, especially in logistics and aerospace.

In The Investor’s Podcast Network, analysts noted, “Industrial automation is the quiet revolution—boosting margins while reducing labor dependency” (🎧 11:30). Sector rotation is also in play: cyclical sectors like Consumer Discretionary and Industrials are gaining traction as economic growth stabilizes, while defensive sectors such as Utilities and Consumer Staples are seeing reduced inflows.

Sources:

Forbes – Top Sectors to Invest in 2025

Charles Schwab – Monthly Stock Sector Outlook

Perplexity – Top Sectors’ 2025 Outlook

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Visual Capitalist – Global Stock Market by Sector

CompaniesMarketCap – Sector Rankings

Investopedia – Sector Investing Explained

How to Invest in Sector Leaders

Investing in sector leaders offers a powerful way to capture growth and stability across the market’s most influential industries. Sector ETFs like XLK (Technology), XLF (Financials), XLI (Industrials), and XLV (Healthcare) provide targeted exposure to top-performing companies within each segment. To balance sector exposure, start by assessing your current portfolio’s sector weightings and comparing them to a benchmark like the S&P 500. Overconcentration in one area—like tech—can magnify risks during downturns.

For those seeking a different tilt, equal-weighted ETFs distribute holdings evenly across companies rather than by market cap, reducing dominance by mega-caps and potentially enhancing performance in mid-cycle environments. Meanwhile, thematic ETFs focus on emerging trends like AI, green energy, or digital infrastructure, allowing for forward-looking exposure beyond traditional sector definitions.

Conclusion

By strategically investing in sector leaders through ETFs, investors can tap into the performance engines of the economy while maintaining diversification and control. Whether using market-cap-weighted giants like XLK or XLV, rebalancing with equal-weighted alternatives, or positioning for innovation via thematic ETFs, the key lies in aligning sector exposure with broader market cycles and personal investment goals. As leadership shifts across sectors in response to economic trends, a thoughtfully structured sector strategy can provide both stability and growth potential—anchoring portfolios for long-term success.

Podcast Transcripts 🎧

1. Markets in Motion – Early Thoughts on the 2025 S&P 500 Sector Outlook

Podcast Channel: RBC Capital Markets

This episode, hosted by Lori Calvasina, dives into sector positioning for 2025. Key takeaways include an upgrade of Communication Services to overweight, a downgrade of Health Care due to policy uncertainty, and insights into valuation trends and earnings revisions across sectors. The transcript highlights how sentiment, flows, and macro conditions are shaping sector leadership.

2. S&P 500: Which Sectors Are Poised for Strong Earnings Growth in 2025?

Podcast Channel: Investing.com Insights

This discussion focuses on projected earnings growth across sectors like Energy, Healthcare, Industrials, and Technology. The transcript outlines how forward estimates have shifted since early 2024, with notable momentum in industrial and basic materials sectors, suggesting a pivot toward cyclical growth.

📌Read More About:

Top Large Cap Stocks https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Which Industry Has the Highest Market Cap in 2025? A Simple Guide for Smart Investors- https://stockbossup.com/pages/post/39258/which-industry-has-the-highest-market-cap-in-2025-a-simple-guide-for-smart-investors

What Are the Largest Market Cap Sectors?- https://stockbossup.com/pages/post/39159/largest-market-cap-sectors-key-industries-driving-global-investment

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence

Explore the largest sectors by market capitalization, their leading companies, and what this means for investors and ETF strategies.

Why Sector Market Cap Is the Key to Understanding Market Leadership

Market capitalization, or market cap, is a measure of a company’s total value in the stock market, calculated by multiplying its share price by the number of outstanding shares. While it’s commonly used to classify individual companies into small-, mid-, or large-cap tiers, market cap also plays a critical role in analyzing entire sectors. Sector-level market capitalization reveals which industries dominate the global economy, influence index performance, and attract the most investor capital. For example, the technology and financial sectors consistently lead in total market value, shaping the direction of major indices like the S&P 500 and MSCI World.

Understanding which sectors hold the most market cap helps investors identify where capital is concentrated, assess diversification, and align their portfolios with long-term trends. In this article, we’ll explore how sector market cap is calculated, rank the largest sectors globally in 2025, highlight the companies driving their dominance, and examine the implications for ETF strategies and portfolio construction. Whether you're a passive investor or an active allocator, knowing which sectors lead the market can sharpen your investment decisions and risk management.

Want expert insights from leading investment podcasts? Scroll to the end to the Podcast Transcripts📜

What Is Sector Market Capitalization and Why It Shapes the Stock Market

It’s calculated by summing the individual market caps of each company in that sector—where market cap equals share price multiplied by the number of outstanding shares. This aggregate figure helps investors understand which sectors dominate the market in terms of size and influence. For example, the Information Technology sector, led by giants like Apple AAPL and Microsoft MSFT, consistently ranks among the highest in global market cap. Sectors are typically classified using standardized systems such as the Global Industry Classification Standard (GICS) and the Industry Classification Benchmark (ICB).

These frameworks group companies based on their primary business activities, allowing for consistent comparison across markets. In Morningstar’s Investing Insights, analysts explained, “Sector weightings aren’t just passive—they’re a mirror of where capital flows and where investors see growth” (🎧 08:30).

Meanwhile, The Investor’s Podcast Network emphasized, “Understanding sector cap helps decode index behavior and ETF performance” (🎧 09:45). A sector’s market cap also influences how much sway it holds in cap-weighted indices. For instance, if the tech sector comprises 30% of the S&P 500’s total market cap, then tech stocks will account for 30% of the index’s movement. This concentration can amplify gains during bull markets or magnify losses during downturns. As a result, investors tracking broad-market ETFs may unknowingly carry sector-specific risk.

Sources:

Macromicro – S&P 500 Sector Weightings

SmartAsset – Guide to the 11 Market Sectors

FasterCapital – Measuring Sector Impact on the Market

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Investopedia – Sector Investing Explained

CompaniesMarketCap – Sector Rankings

Visual Capitalist – Global Stock Market by Sector

Top 5 Sectors by Global Market Capitalization in 2025

As of 2025, the global stock market is dominated by five powerhouse sectors, led by Information Technology with a staggering market cap of approximately $25.7 trillion. This sector alone accounts for over 20% of global equity value, driven by giants like Apple AAPL, Microsoft MSFT, and Nvidia NVDA.

The U.S. and China continue to lead in tech innovation, with American firms dominating software and semiconductors, while Chinese companies expand in hardware and AI infrastructure. Financials follow closely with a market cap of around $21.1 trillion, reflecting the sector’s foundational role in global economies. Major players include JPMorgan Chase JPM, Bank of America BAC, and Industrial and Commercial Bank of China IDCBY.

Industrials rank third at $15.3 trillion, encompassing aerospace, logistics, and manufacturing. Consumer Discretionary, valued at $13.6 trillion, includes companies like Amazon AMZN and Tesla TSLA, reflecting global consumer demand. Health Care rounds out the top five at $10.7 trillion, led by firms such as UnitedHealth Group UNH and Eli Lilly LLY, with strongholds in the U.S. and Europe.

In Morningstar’s Investing Insights, analysts noted, “Tech’s dominance isn’t just about size—it’s about influence across every other sector” (🎧 10:15). Meanwhile, The Investor’s Podcast Network emphasized, “Sector weightings are a silent force behind ETF performance and market momentum” (🎧 11:40).

Sources:

Visual Capitalist – Global Stock Market by Sector

CompaniesMarketCap – Sector Rankings

Deloitte – 2025 Technology Industry Outlook

CRN – Top Tech Markets in 2025

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Investopedia – Sector Investing Explained

Key Companies Powering the World’s Largest Sectors

The dominance of global sectors is largely driven by a handful of mega-cap companies that shape index performance and ETF allocations. In the Information Technology sector, Microsoft MSFT, Apple AAPL, and Nvidia NVDA lead the charge, each with market caps exceeding $3 trillion. These firms anchor ETFs like XLK and VGT, often comprising over 40% of the fund’s total weight. In Financials, JPMorgan Chase JPM and Industrial and Commercial Bank of China IDCBY top the list.

These institutions represent the backbone of global banking and are heavily weighted in ETFs such as XLF and VFH. Their earnings reports and interest rate sensitivity often set the tone for the sector’s performance. Meanwhile, in Health Care, UnitedHealth Group UNH and Eli Lilly LLY dominate due to their scale, innovation pipelines, and consistent revenue growth.

In Morningstar’s Investing Insights, analysts noted, “When a handful of companies make up half a sector ETF, you’re not just betting on a theme—you’re betting on the giants” (🎧 11:10). The Investor’s Podcast Network added, “Mega-cap stocks don’t just lead—they define the sector’s trajectory” (🎧 12:25). These insights highlight why understanding sector leaders is essential for ETF investors and index followers alike.

Sources:

The Motley Fool – Largest Tech Companies by Market Cap

CompaniesMarketCap – Sector Rankings

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Investopedia – Sector Investing Explained

Visual Capitalist – Global Stock Market by Sector

Sector Concentration Risks: When a Few Giants Drive the Market

Mega-cap stocks have an outsized influence on sector weightings, especially in cap-weighted indices like the S&P 500. In 2025, companies such as Apple AAPL, Microsoft MSFT, and Nvidia NVDA collectively account for over 30% of the Information Technology sector’s weight. This concentration means that a handful of stocks can disproportionately sway the performance of entire sectors—and by extension, the broader index.

This imbalance has broader implications. According to Morningstar’s Investing Insights, “Cap-weighted ETFs can silently amplify risk if you’re not watching sector weights” (🎧 11:50). The Investor’s Podcast Network adds, “When tech stocks dominate, the S&P 500 becomes a tech fund in disguise” (🎧 12:40). These insights highlight the importance of understanding sector concentration when building portfolios.

Sources:

Concentration Risks in the S&P – CFA Society New York

S&P Global – Sector Concentration and Equal Weighting

J.P. Morgan – Addressing Market Concentration Risks

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

CompaniesMarketCap – Sector Rankings

Visual Capitalist – Global Stock Market by Sector

Investopedia – Sector Investing Explained

Sector Trends and Growth Outlook: What’s Driving Momentum in 2025

The Information Technology sector continues to lead, fueled by rapid advancements in artificial intelligence. Companies like Nvidia NVDA, Meta Platforms META, and Alphabet GOOGL are leveraging AI to drive innovation in semiconductors, cloud computing, and digital advertising. According to Morningstar’s Investing Insights, “AI isn’t just a tech trend—it’s a cross-sector catalyst reshaping everything from logistics to healthcare” (🎧 10:50).

Meanwhile, the Financials sector is embracing fintech and automation to streamline operations and enhance customer experience, with firms like JPMorgan JPM investing heavily in AI-driven analytics. Sectors gaining momentum in 2025 include Clean Energy, Cybersecurity, and Healthcare Technology. Industrial companies are also undergoing a digital transformation. Automation, robotics, and smart manufacturing are redefining productivity, especially in logistics and aerospace.

In The Investor’s Podcast Network, analysts noted, “Industrial automation is the quiet revolution—boosting margins while reducing labor dependency” (🎧 11:30). Sector rotation is also in play: cyclical sectors like Consumer Discretionary and Industrials are gaining traction as economic growth stabilizes, while defensive sectors such as Utilities and Consumer Staples are seeing reduced inflows.

Sources:

Forbes – Top Sectors to Invest in 2025

Charles Schwab – Monthly Stock Sector Outlook

Perplexity – Top Sectors’ 2025 Outlook

Morningstar’s Investing Insights

The Investor’s Podcast Network

StockBossUp – Sector Representation in Large-Cap Stocks

ETF.com – Sector ETF Overview

Visual Capitalist – Global Stock Market by Sector

CompaniesMarketCap – Sector Rankings

Investopedia – Sector Investing Explained

How to Invest in Sector Leaders

Investing in sector leaders offers a powerful way to capture growth and stability across the market’s most influential industries. Sector ETFs like XLK (Technology), XLF (Financials), XLI (Industrials), and XLV (Healthcare) provide targeted exposure to top-performing companies within each segment. To balance sector exposure, start by assessing your current portfolio’s sector weightings and comparing them to a benchmark like the S&P 500. Overconcentration in one area—like tech—can magnify risks during downturns.

For those seeking a different tilt, equal-weighted ETFs distribute holdings evenly across companies rather than by market cap, reducing dominance by mega-caps and potentially enhancing performance in mid-cycle environments. Meanwhile, thematic ETFs focus on emerging trends like AI, green energy, or digital infrastructure, allowing for forward-looking exposure beyond traditional sector definitions.

Conclusion

By strategically investing in sector leaders through ETFs, investors can tap into the performance engines of the economy while maintaining diversification and control. Whether using market-cap-weighted giants like XLK or XLV, rebalancing with equal-weighted alternatives, or positioning for innovation via thematic ETFs, the key lies in aligning sector exposure with broader market cycles and personal investment goals. As leadership shifts across sectors in response to economic trends, a thoughtfully structured sector strategy can provide both stability and growth potential—anchoring portfolios for long-term success.

Podcast Transcripts 🎧

1. Markets in Motion – Early Thoughts on the 2025 S&P 500 Sector Outlook

Podcast Channel: RBC Capital Markets

This episode, hosted by Lori Calvasina, dives into sector positioning for 2025. Key takeaways include an upgrade of Communication Services to overweight, a downgrade of Health Care due to policy uncertainty, and insights into valuation trends and earnings revisions across sectors. The transcript highlights how sentiment, flows, and macro conditions are shaping sector leadership.

2. S&P 500: Which Sectors Are Poised for Strong Earnings Growth in 2025?

Podcast Channel: Investing.com Insights

This discussion focuses on projected earnings growth across sectors like Energy, Healthcare, Industrials, and Technology. The transcript outlines how forward estimates have shifted since early 2024, with notable momentum in industrial and basic materials sectors, suggesting a pivot toward cyclical growth.

📌Read More About:

Top Large Cap Stocks https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Which Industry Has the Highest Market Cap in 2025? A Simple Guide for Smart Investors- https://stockbossup.com/pages/post/39258/which-industry-has-the-highest-market-cap-in-2025-a-simple-guide-for-smart-investors

What Are the Largest Market Cap Sectors?- https://stockbossup.com/pages/post/39159/largest-market-cap-sectors-key-industries-driving-global-investment

🌐Global & Industrial Picks:

Is Microsoft a Mega-Cap Stock?- https://www.stockbossup.com/pages/post/38850/is-microsoft-considered-a-mega-cap-stock

Is Apple a Mega-Cap?- https://stockbossup.com/pages/post/39186/is-apple-a-mega-cap-stock-understanding-its-market-influence

Is Amazon a Mega-Cap?- https://stockbossup.com/pages/post/39191/is-amazon-a-mega-cap-stock-evaluating-its-market-influence