Is QQQ a Large-Cap ETF? A Simple Guide for Long-Term Investors

Understanding what’s under the hood of QQQ—and whether it fits your portfolio strategy

Is QQQ the Right Large-Cap ETF for Your Growth Strategy in 2025?

QQQ gets a lot of love from investors—and for good reason. It’s loaded with household tech giants, posts eye-catching returns, and feels like a direct ticket to the innovation economy. But before you hit buy, it’s worth looking under the hood. Is QQQ truly a large-cap fund, or just a high-growth tech proxy wrapped in an ETF label? This article breaks it down in plain English. You'll learn what QQQ really holds, how it stacks up against traditional large-cap funds like SPY or VOO, and whether it deserves a spot in your long-term portfolio. If you're aiming for growth but don’t want surprises, knowing what’s inside your fund is half the battle.

What You’re Really Buying with QQQ: A Look Inside the NASDAQ-100 Powerhouse

The Invesco QQQ Trust QQQ is one of the most popular ETFs on the market—and for good reason. It tracks the NASDAQ-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq exchange. That means no banks, but plenty of tech. With over $330 billion in assets under management and an expense ratio of 0.20%, QQQ offers a low-cost way to tap into the innovation economy. It’s a favorite among growth-focused investors who want exposure to companies like Apple AAPL, Microsoft MSFT, and NVIDIA NVDA—all of which dominate the fund’s top holdings.

While technology makes up around 60% of its portfolio, it also includes consumer discretionary giants like Amazon AMZN and Tesla TSLA, along with healthcare and communication services. For a deeper dive into how QQQ fits into a modern portfolio, check out the We Study Billionaires podcast. In their episode “Tech ETFs and the Future of Growth Investing,” guest Lyn Alden notes at 15:22 ⏱️, “QQQ is a concentrated bet on innovation—but it’s not the whole market.” The episode also explores how QQQ compares to broader index funds like SPY.

Another great listen is the Invest Like the Best podcast. In “Understanding Index Construction,” Patrick O’Shaughnessy breaks down how funds like QQQ are built and why market-cap weighting matters. At 19:48 ⏱️, he says, “QQQ gives you the winners—but it also gives you the volatility that comes with them.” These insights help clarify what you’re really buying when you invest in QQQ: a high-growth, tech-tilted slice of the market that’s anything but boring.

Sources

Is QQQ Really a Large-Cap ETF? Here’s What You’re Actually Holding

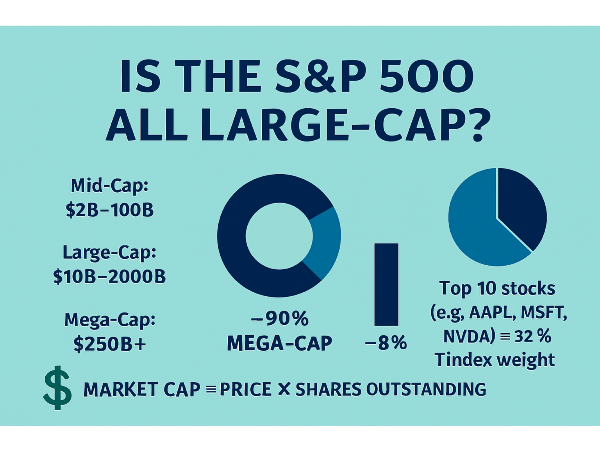

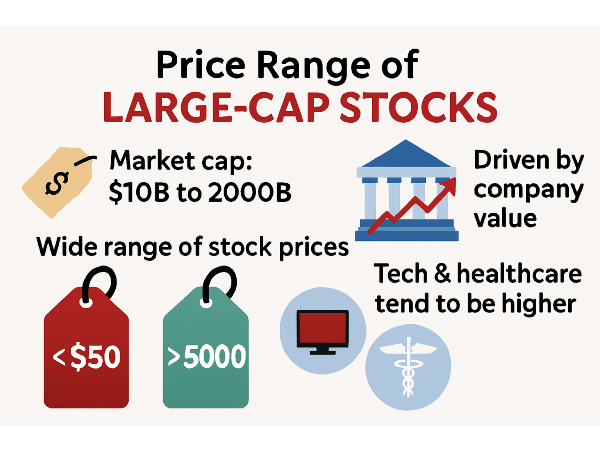

It’s classified as a large-cap growth ETF because it holds the 100 largest non-financial companies listed on the Nasdaq. That means you’re getting a concentrated dose of mega-cap tech and innovation leaders. As of now, over 50% of QQQ’s assets are in just ten companies, including Microsoft MSFT, Apple AAPL, NVIDIA NVDA, Amazon AMZN, and Meta Platforms META. These aren’t just large-cap—they’re the largest of the large.

QQQ’s average market cap skews significantly higher than broader large-cap ETFs like SPDR S&P 500 ETF SPY or Vanguard S&P 500 ETF VOO. While SPY and VOO include financials, energy, and industrials, QQQ skips banks entirely and underweights sectors like healthcare and utilities. That makes it more volatile—but also more growth-oriented.

For a deeper breakdown, the All About Investing podcast episode “QQQ vs SPY: Which One Wins in the Long Run?” is a must-listen. At 13:05 ⏱️, the host explains, “QQQ is like a turbocharged version of large-cap investing—it’s fast, but it’s not for everyone.” Meanwhile, the Morningstar Long View podcast dives into fund structure in “Understanding Growth ETFs.” At 17:42 ⏱️, guest analyst Susan Dziubinski notes, “QQQ is large-cap by definition, but it behaves more like a sector fund in disguise.”

Sources

When QQQ Shines—and When It Might Leave You in the Dust

It’s packed with high-octane companies that thrive on innovation, disruption, and scale. That makes it a powerful tool when tech is leading the charge. In bull markets—especially those driven by AI, cloud computing, or digital transformation—QQQ tends to outperform broader large-cap blends like SPDR S&P 500 ETF SPY or Vanguard S&P 500 ETF VOO. But that same growth tilt comes with a price: volatility.

QQQ is ideal for investors who want to lean into innovation without betting the whole farm. For a deeper look at QQQ’s strengths and weaknesses, check out the Money for the Rest of Us podcast. In the episode “Should You Overweight Tech in 2025?”, host David Stein notes at 14:18 ⏱️, “QQQ is a momentum machine—but it’s not built for balance.” The episode also explores how to pair QQQ with more diversified funds for smoother returns.

Another solid listen is the The Long Term Investor podcast. In “Growth vs. Blend: What’s Right for You?”, at 11:03 ⏱️, host Peter Lazaroff explains, “QQQ can supercharge your gains—but it can also test your patience.” The key takeaway? QQQ is a tool for growth, not a one-size-fits-all solution.

Sources

How to Use QQQ Without Letting It Take Over Your Portfolio

Because of its tech-heavy tilt and growth focus, most advisors suggest keeping QQQ to 10–25% of your equity allocation. The rest of your portfolio can be anchored by broader index funds like Vanguard Total Stock Market ETF VTI or SPDR S&P 500 ETF SPY, which offer more sector balance and stability. Pairing QQQ with a diversified core fund helps smooth out the ride. You’re still exposed to innovation, but you’re not betting the farm on it. For tax efficiency, QQQ is best held in tax-advantaged accounts like Roth IRAs or 401(k)s. Its low dividend yield means fewer taxable distributions, but if you’re sitting on gains, selling in a taxable account could trigger capital gains taxes. Dollar-cost averaging into QQQ—investing a fixed amount regularly—can help reduce the impact of market swings and keep emotions out of the equation.

For more on this strategy, the Millennial Investing Podcast episode “How to Build a Growth-Weighted Portfolio” is worth a listen. At 12:55 ⏱️, guest Brian Feroldi says, “QQQ is a great growth engine—but it needs a chassis to ride on.” Also check out The Long View Podcast, where at 18:03 ⏱️, Christine Benz notes, “Blending QQQ with a total market fund gives you the best of both worlds—growth and resilience.”

Sources

Final Thoughts

QQQ is a large-cap fund—but it’s not your typical vanilla index. It’s a growth engine wrapped in a lean, tech-heavy package that rewards optimism but punishes complacency. If you’re clear about what it brings to the table—outsized potential, sector concentration, and a bit of whiplash along the way—it can be a powerful complement to a more balanced portfolio. Use it with intention, pair it with broader funds for ballast, and you’ve got a strategy that captures upside without losing sleep. As always, investing isn’t about chasing shiny objects—it’s about knowing what you own, why you own it, and letting time do the rest. That’s the path to building wealth—smart, simple, and sustainable.

Podcast Transcripts 🎙️

1. We Study Billionaires – Tech ETFs and the Future of Growth Investing

Summary: This episode explores how tech-focused ETFs like QQQ fit into a long-term growth strategy. At 15:22 ⏱️, Lyn Alden remarks, “QQQ is a concentrated bet on innovation—but it’s not the whole market.”

[Transcript] (https://www.theinvestorspodcast.com/we-study-billionaires/)

2. Invest Like the Best – Understanding Index Construction

Summary: Patrick O’Shaughnessy breaks down how ETFs like QQQ are structured and why market-cap weighting matters. At 19:48 ⏱️, he says, “QQQ gives you the winners—but it also gives you the volatility that comes with them.”

[Transcript]https://www.happyscribe.com/public/invest-like-the-best).

3. All About Investing – QQQ vs SPY: Which One Wins in the Long Run?

Summary: This episode compares QQQ and SPY in terms of performance, sector exposure, and long-term suitability. At 13:05 ⏱️, the host explains, “QQQ is like a turbocharged version of large-cap investing—it’s fast, but it’s not for everyone.”

Transcript

4. Morningstar Long View – Understanding Growth ETFs

Summary: This episode discusses how growth ETFs like QQQ behave in different market cycles. At 17:42 ⏱️, Susan Dziubinski notes, “QQQ is large-cap by definition, but it behaves more like a sector fund in disguise.”

Transcript.

5. Money for the Rest of Us – Should You Overweight Tech in 2025?

Summary: David Stein explores the risks and rewards of tech-heavy investing. At 14:18 ⏱️, he says, “QQQ is a momentum machine—but it’s not built for balance.”

Transcript

6. The Long Term Investor – Growth vs. Blend: What’s Right for You?

Summary: Peter Lazaroff explains the trade-offs between growth-focused ETFs like QQQ and more balanced blends. At 11:03 ⏱️, he says, “QQQ can supercharge your gains—but it can also test your patience.”

Transcript provides a detailed article on the topic.

7. Millennial Investing – How to Build a Growth-Weighted Portfolio

Summary: Brian Feroldi discusses how to integrate QQQ into a long-term strategy. At 12:55 ⏱️, he says, “QQQ is a great growth engine—but it needs a chassis to ride on.”

Transcript.

8. The Long View – Blending QQQ with a Total Market Fund

Summary: Christine Benz discusses how to pair QQQ with broader index funds for a more resilient portfolio. At 18:03 ⏱️, she notes, “Blending QQQ with a total market fund gives you the best of both worlds—growth and resilience.”

Transcript.

📌Read More About:

Top Large-Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Why VOO over SPY?- https://stockbossup.com/pages/post/39131/voo-vs-spy-which-s-p-500-etf-offers-better-long-term-value

Is VOO Large-Cap Growth?- https://stockbossup.com/pages/post/39145/is-voo-a-large-cap-growth-etf-understanding-its-investment-strategy

Why VOO Is One of the Most Popular ETFs for Long-Term Investors in 2025- https://stockbossup.com/pages/post/39211/why-voo-is-one-of-the-most-popular-et-fs-for-long-term-investors-in-2025

Does VOO Automatically Reinvest Dividends?- https://stockbossup.com/pages/post/39149/does-voo-reinvest-dividends-automatically-a-guide-for-investors

Is QQQ a Large-Cap ETF? A Simple Guide for Long-Term Investors Understanding what’s under the hood of QQQ—and whether it fits your portfolio strategy

Is QQQ the Right Large-Cap ETF for Your Growth Strategy in 2025?

QQQ gets a lot of love from investors—and for good reason. It’s loaded with household tech giants, posts eye-catching returns, and feels like a direct ticket to the innovation economy. But before you hit buy, it’s worth looking under the hood. Is QQQ truly a large-cap fund, or just a high-growth tech proxy wrapped in an ETF label? This article breaks it down in plain English. You'll learn what QQQ really holds, how it stacks up against traditional large-cap funds like SPY or VOO, and whether it deserves a spot in your long-term portfolio. If you're aiming for growth but don’t want surprises, knowing what’s inside your fund is half the battle.

What You’re Really Buying with QQQ: A Look Inside the NASDAQ-100 Powerhouse

The Invesco QQQ Trust QQQ is one of the most popular ETFs on the market—and for good reason. It tracks the NASDAQ-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq exchange. That means no banks, but plenty of tech. With over $330 billion in assets under management and an expense ratio of 0.20%, QQQ offers a low-cost way to tap into the innovation economy. It’s a favorite among growth-focused investors who want exposure to companies like Apple AAPL, Microsoft MSFT, and NVIDIA NVDA—all of which dominate the fund’s top holdings.

While technology makes up around 60% of its portfolio, it also includes consumer discretionary giants like Amazon AMZN and Tesla TSLA, along with healthcare and communication services. For a deeper dive into how QQQ fits into a modern portfolio, check out the We Study Billionaires podcast. In their episode “Tech ETFs and the Future of Growth Investing,” guest Lyn Alden notes at 15:22 ⏱️, “QQQ is a concentrated bet on innovation—but it’s not the whole market.” The episode also explores how QQQ compares to broader index funds like SPY.

Another great listen is the Invest Like the Best podcast. In “Understanding Index Construction,” Patrick O’Shaughnessy breaks down how funds like QQQ are built and why market-cap weighting matters. At 19:48 ⏱️, he says, “QQQ gives you the winners—but it also gives you the volatility that comes with them.” These insights help clarify what you’re really buying when you invest in QQQ: a high-growth, tech-tilted slice of the market that’s anything but boring.

Sources

Is QQQ Really a Large-Cap ETF? Here’s What You’re Actually Holding

It’s classified as a large-cap growth ETF because it holds the 100 largest non-financial companies listed on the Nasdaq. That means you’re getting a concentrated dose of mega-cap tech and innovation leaders. As of now, over 50% of QQQ’s assets are in just ten companies, including Microsoft MSFT, Apple AAPL, NVIDIA NVDA, Amazon AMZN, and Meta Platforms META. These aren’t just large-cap—they’re the largest of the large.

QQQ’s average market cap skews significantly higher than broader large-cap ETFs like SPDR S&P 500 ETF SPY or Vanguard S&P 500 ETF VOO. While SPY and VOO include financials, energy, and industrials, QQQ skips banks entirely and underweights sectors like healthcare and utilities. That makes it more volatile—but also more growth-oriented.

For a deeper breakdown, the All About Investing podcast episode “QQQ vs SPY: Which One Wins in the Long Run?” is a must-listen. At 13:05 ⏱️, the host explains, “QQQ is like a turbocharged version of large-cap investing—it’s fast, but it’s not for everyone.” Meanwhile, the Morningstar Long View podcast dives into fund structure in “Understanding Growth ETFs.” At 17:42 ⏱️, guest analyst Susan Dziubinski notes, “QQQ is large-cap by definition, but it behaves more like a sector fund in disguise.”

Sources

When QQQ Shines—and When It Might Leave You in the Dust

It’s packed with high-octane companies that thrive on innovation, disruption, and scale. That makes it a powerful tool when tech is leading the charge. In bull markets—especially those driven by AI, cloud computing, or digital transformation—QQQ tends to outperform broader large-cap blends like SPDR S&P 500 ETF SPY or Vanguard S&P 500 ETF VOO. But that same growth tilt comes with a price: volatility.

QQQ is ideal for investors who want to lean into innovation without betting the whole farm. For a deeper look at QQQ’s strengths and weaknesses, check out the Money for the Rest of Us podcast. In the episode “Should You Overweight Tech in 2025?”, host David Stein notes at 14:18 ⏱️, “QQQ is a momentum machine—but it’s not built for balance.” The episode also explores how to pair QQQ with more diversified funds for smoother returns.

Another solid listen is the The Long Term Investor podcast. In “Growth vs. Blend: What’s Right for You?”, at 11:03 ⏱️, host Peter Lazaroff explains, “QQQ can supercharge your gains—but it can also test your patience.” The key takeaway? QQQ is a tool for growth, not a one-size-fits-all solution.

Sources

How to Use QQQ Without Letting It Take Over Your Portfolio

Because of its tech-heavy tilt and growth focus, most advisors suggest keeping QQQ to 10–25% of your equity allocation. The rest of your portfolio can be anchored by broader index funds like Vanguard Total Stock Market ETF VTI or SPDR S&P 500 ETF SPY, which offer more sector balance and stability. Pairing QQQ with a diversified core fund helps smooth out the ride. You’re still exposed to innovation, but you’re not betting the farm on it. For tax efficiency, QQQ is best held in tax-advantaged accounts like Roth IRAs or 401(k)s. Its low dividend yield means fewer taxable distributions, but if you’re sitting on gains, selling in a taxable account could trigger capital gains taxes. Dollar-cost averaging into QQQ—investing a fixed amount regularly—can help reduce the impact of market swings and keep emotions out of the equation.

For more on this strategy, the Millennial Investing Podcast episode “How to Build a Growth-Weighted Portfolio” is worth a listen. At 12:55 ⏱️, guest Brian Feroldi says, “QQQ is a great growth engine—but it needs a chassis to ride on.” Also check out The Long View Podcast, where at 18:03 ⏱️, Christine Benz notes, “Blending QQQ with a total market fund gives you the best of both worlds—growth and resilience.”

Sources

Final Thoughts QQQ is a large-cap fund—but it’s not your typical vanilla index. It’s a growth engine wrapped in a lean, tech-heavy package that rewards optimism but punishes complacency. If you’re clear about what it brings to the table—outsized potential, sector concentration, and a bit of whiplash along the way—it can be a powerful complement to a more balanced portfolio. Use it with intention, pair it with broader funds for ballast, and you’ve got a strategy that captures upside without losing sleep. As always, investing isn’t about chasing shiny objects—it’s about knowing what you own, why you own it, and letting time do the rest. That’s the path to building wealth—smart, simple, and sustainable.

Podcast Transcripts 🎙️ 1. We Study Billionaires – Tech ETFs and the Future of Growth Investing

Summary: This episode explores how tech-focused ETFs like QQQ fit into a long-term growth strategy. At 15:22 ⏱️, Lyn Alden remarks, “QQQ is a concentrated bet on innovation—but it’s not the whole market.”

[Transcript] (https://www.theinvestorspodcast.com/we-study-billionaires/) 2. Invest Like the Best – Understanding Index Construction

Summary: Patrick O’Shaughnessy breaks down how ETFs like QQQ are structured and why market-cap weighting matters. At 19:48 ⏱️, he says, “QQQ gives you the winners—but it also gives you the volatility that comes with them.”

[Transcript]https://www.happyscribe.com/public/invest-like-the-best). 3. All About Investing – QQQ vs SPY: Which One Wins in the Long Run?

Summary: This episode compares QQQ and SPY in terms of performance, sector exposure, and long-term suitability. At 13:05 ⏱️, the host explains, “QQQ is like a turbocharged version of large-cap investing—it’s fast, but it’s not for everyone.”

Transcript 4. Morningstar Long View – Understanding Growth ETFs

Summary: This episode discusses how growth ETFs like QQQ behave in different market cycles. At 17:42 ⏱️, Susan Dziubinski notes, “QQQ is large-cap by definition, but it behaves more like a sector fund in disguise.”

Transcript.

5. Money for the Rest of Us – Should You Overweight Tech in 2025?

Summary: David Stein explores the risks and rewards of tech-heavy investing. At 14:18 ⏱️, he says, “QQQ is a momentum machine—but it’s not built for balance.”

Transcript 6. The Long Term Investor – Growth vs. Blend: What’s Right for You?

Summary: Peter Lazaroff explains the trade-offs between growth-focused ETFs like QQQ and more balanced blends. At 11:03 ⏱️, he says, “QQQ can supercharge your gains—but it can also test your patience.”

Transcript provides a detailed article on the topic. 7. Millennial Investing – How to Build a Growth-Weighted Portfolio

Summary: Brian Feroldi discusses how to integrate QQQ into a long-term strategy. At 12:55 ⏱️, he says, “QQQ is a great growth engine—but it needs a chassis to ride on.”

Transcript. 8. The Long View – Blending QQQ with a Total Market Fund

Summary: Christine Benz discusses how to pair QQQ with broader index funds for a more resilient portfolio. At 18:03 ⏱️, she notes, “Blending QQQ with a total market fund gives you the best of both worlds—growth and resilience.”

Transcript.

📌Read More About:

Top Large-Cap Stocks- https://stockbossup.com/pages/topics/large-cap

What Are Large US Cap Stocks?- https://stockbossup.com/pages/post/39168/what-are-large-cap-stocks-a-complete-guide-to-big-companies-in-the-u-s-market

Why VOO over SPY?- https://stockbossup.com/pages/post/39131/voo-vs-spy-which-s-p-500-etf-offers-better-long-term-value

Is VOO Large-Cap Growth?- https://stockbossup.com/pages/post/39145/is-voo-a-large-cap-growth-etf-understanding-its-investment-strategy

Why VOO Is One of the Most Popular ETFs for Long-Term Investors in 2025- https://stockbossup.com/pages/post/39211/why-voo-is-one-of-the-most-popular-et-fs-for-long-term-investors-in-2025

Does VOO Automatically Reinvest Dividends?- https://stockbossup.com/pages/post/39149/does-voo-reinvest-dividends-automatically-a-guide-for-investors