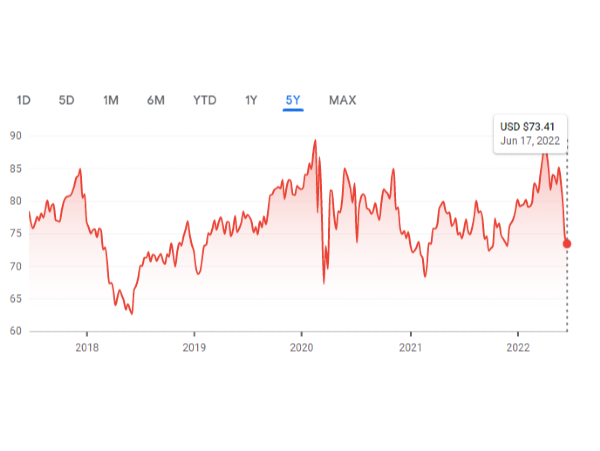

June 17, 2022 - Interest rates are going up (no surprise) and will continue to go up (again, no surprise). The question is how much and how fast, but really the bigger question is whether it will lead into a recession and just how deep and long it could be. Oh yes . . . inflation is a major factor.

In general, a news item typically causes a minor short term effect on the stock market. What REALLY concerns investors is a recession, because that has a major effect on profits, hence earnings. Over the long run, it’s really all about earnings and the future growth of earnings. Stock prices just reflect the “future hopes” (i.e. bets) of investors. I’m NOT predicting, but I do like to anticipate possible market structural scenarios. The idea is not to act on them now, but to be open to the possibility of movements so when they begin to unfold (or don’t) one can react quickly. So, here we go:

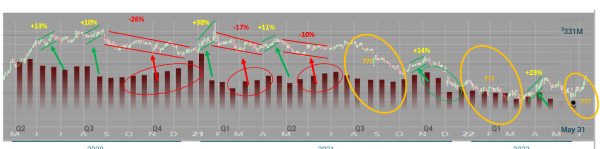

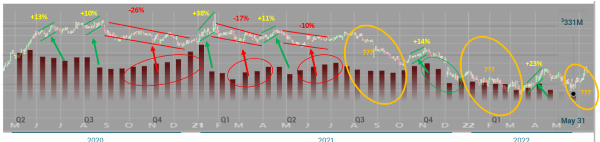

The Green lines represent a bounce up from where we are about now going way back to late September, 2020 (note the red arrow; this is a weekly chart). The idea is that this level is a logical support level and then we spend the next 6 weeks or so in a trading range (then possibly another leg down).

The Red lines represent a continued move lower, perhaps much lower. Sure, there will be small bounces, but the trend would be continued weakness for the foreseeable future.

The good news is that we shouldn’t have to wait much longer to find out. I note that billions of dollars of Put hedges expired on Friday, and since the prices did not fall (indicating option exercising) they appear to have been rolled forward (i.e. close out the June contract and open a July one). Why do we care? Because the big investment houses are continuing to hedge, thus “buying insurance” in case the market falls further. The big guys are cautious, I am too.

*More information and easy to read charts at: www.special-risk.net *

Price chart by MetaStock; & table by www.HighGrowthStock.com. Used with permission.

June 17, 2022 - Interest rates are going up (no surprise) and will continue to go up (again, no surprise). The question is how much and how fast, but really the bigger question is whether it will lead into a recession and just how deep and long it could be. Oh yes . . . inflation is a major factor.

In general, a news item typically causes a minor short term effect on the stock market. What REALLY concerns investors is a recession, because that has a major effect on profits, hence earnings. Over the long run, it’s really all about earnings and the future growth of earnings. Stock prices just reflect the “future hopes” (i.e. bets) of investors. I’m NOT predicting, but I do like to anticipate possible market structural scenarios. The idea is not to act on them now, but to be open to the possibility of movements so when they begin to unfold (or don’t) one can react quickly. So, here we go:

The Green lines represent a bounce up from where we are about now going way back to late September, 2020 (note the red arrow; this is a weekly chart). The idea is that this level is a logical support level and then we spend the next 6 weeks or so in a trading range (then possibly another leg down).

The Red lines represent a continued move lower, perhaps much lower. Sure, there will be small bounces, but the trend would be continued weakness for the foreseeable future.

The good news is that we shouldn’t have to wait much longer to find out. I note that billions of dollars of Put hedges expired on Friday, and since the prices did not fall (indicating option exercising) they appear to have been rolled forward (i.e. close out the June contract and open a July one). Why do we care? Because the big investment houses are continuing to hedge, thus “buying insurance” in case the market falls further. The big guys are cautious, I am too. *More information and easy to read charts at: www.special-risk.net *

Price chart by MetaStock; & table by www.HighGrowthStock.com. Used with permission.