Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

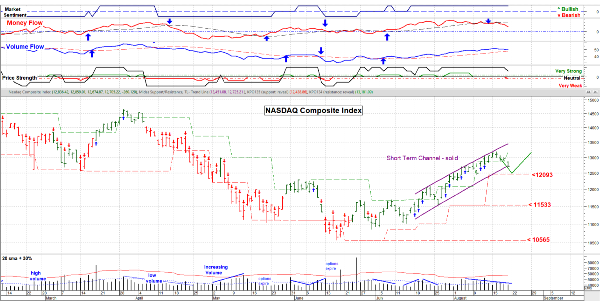

August 19, 2022 - I’ve been expecting to see a modest pullback from the recent market rally for a couple of weeks, the question was ‘When’ would it start. Well we got our answer late this week with what I think is that correction from an ‘overbought’ condition. The S&P 500 Index has touched the declining 200 day moving average and that could have ‘spooked’ investors as prices have gone up rather quickly from the late June low. Time for a pause to refresh.

This ebb and flow, back and forth of prices is to be expected especially when everyone is on “the same side of the boat”. So while this may cause some concern, it is really ‘normal’. Now, where will this go? I’m initially thinking around the 12093 level on the NASDAQ Composite Index; that would be a ‘natural’ place to stop. At that point we’ll have to see what volume has come in on down bars (selling), so far rather light, and what volume is coming in on up bars (buying). Also is there an appetite for risk? The small cap index (Russell 2000 / IWM) will give us an idea if folks are bailing out or seeing this as a buying opportunity.

This past week we’ve seen core and defensive sectors rise to the top and more aggressive sectors (technologies, pharma & biotech) fall off; less risk.

The Short Term Sector table shows this at www.special-risk.net

Let’s see how this pullback develops as next week unfolds. Many traders are on vacation in the Hamptons so volume is typically light which means it’s easier to move price, but price and volume remain as significant clues as to direction. I’m still thinking that the “low is in” for this trend swing in the market, but that does not preclude a correction somewhere in between now and the previous low.

Have a good week. ……….. Tom ……….. Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.