Published on August 17th, 2022, by Felix Martinez

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks, which you can download by clicking below:

Click here to instantly download your free list of all blue chip stocks, along with important investing metrics.

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This article will analyze Lancaster Colony Corporation (LANC) as part of the 2022 Blue Chip Stocks In Focus series.

Business Overview

LANC began its operations in 1961 after combining several small glasses and related houseware manufacturing companies. The new company immediately began rewarding its shareholders with quarterly cash dividends and eventually went public in 1969, the same year it began operations in the foodservice business with the Marzetti brand acquisition.

The company manufactures and distributes a reasonably narrow product assortment split into two major categories: frozen and non-frozen. It makes salad dressings and various dips under the Marzetti brand, frozen bread under the Sister Schubert’s and New York brands, caviar, noodles, croutons, flatbreads, and other bread products under a variety of smaller brands.

Lancaster reported third-quarter earnings on May 5th, 2022, with results coming in mixed. GAAP earnings-per-share missed estimates by $0.98, coming in at -$0.17. Revenue was better than expected at $404 million, up 13% year-over-year, beating estimates by $12.7 million.

Net sales rose to a third-quarter record as the retail segment saw 7.4% growth to $213 million, which was attributable to pricing actions to combat inflation. Volume in the segment declined by 2%, reflecting planned product line reductions and a very tough comparable period a year ago.

The Foodservice segment saw sales soar 20% to $190 million as inflationary pricing and increased demand pushed the top line higher. Volume was down 2% as demand was unfavorably influenced by challenges in the restaurant industry of higher costs, tight labor market conditions, and a cautious consumer.

Gross profit was down $22 million to $68 million, driven by the unfavorable impacts of significantly higher commodity and packaging costs, higher freight and warehousing costs, increased labor costs, etc. The company noted its pricing actions helped offset some of this.

The company continues to experience unprecedented inflation for raw materials and packaging that accelerated during the period and reflects an increase of nearly 30% versus the prior-year quarter. Freight costs also increased approximately 30% compared to last year, pacing well ahead of its previous expectations.

The net impact of its pricing actions lagged these extraordinary levels of cost inflation. The company financial results were also adversely impacted by higher labor costs and supply chain disruptions attributed to COVID-19-related labor shortages, volatility in customer demand, and some severe weather events.

Growth Prospects

Lancaster’s earnings growth has been spotty because it is beholden to volatile restaurant sales. It has therefore made many acquisitions in the past to not only grow the portfolio but attempt to make its revenue more predictable.

We see 6% average earnings growth annually for the next five years as we see nearly all of that driven by revenue increases. We also note that Lancaster will almost certainly not grow linearly, so some years will show declines while others show sizable increases.

For example, since 2010, the company saw four different years of negative earnings growth. In 2011, earnings fell 11%, while in 2014, earnings fell 8%. Also, in 2018, earnings decreased slightly compared to the prior year of 1%.

Over time, Lancaster has proven it can grow through various environments, including a pandemic, and we don’t see that as changing anytime soon.

Competitive Advantages & Recession Performance

Lancaster’s competitive advantages are mainly in its distributor partnerships with major sellers like Walmart (WMT) and McLane Distributors, as well as its leadership positions in certain categories like croutons, frozen bread products, and dressings.

Lancaster has built a niche in these categories over the years, and while its heavy reliance upon two distributors for one-third of its revenue is a potential risk, it also means the company’s competitors don’t necessarily have the same access to those large customers. Indeed, we see Lancaster’s exposure to Walmart as a net positive during the pandemic as Walmart experienced surging grocery sales.

Lancaster is in a strong position within its core categories, but that doesn’t make it immune from recessions. Earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $1.45 (decrease of 42% from 2006)

- 2008 earnings-per-share of $1.28 (decrease of 12%)

- 2009 earnings-per-share of $3.17 (increase of 147%)

- 2010 earnings-per-share of $4.07 (increase of 28%)

Revenue fared pretty well during this period as Lancaster didn’t see any meaningful declines; in fact, revenue was higher in 2008 than in 2007. However, pricing and cost of goods suffered, and as a result, margins declined significantly. This produced the earnings declines Lancaster experienced in 2007 and 2008, but to its credit, the rebound was swift and decisive in 2009 and 2010.

Still, Lancaster is far from recession-proof because it sells products to food service customers – who suffer mightily during recessions and would thus order less from Lancaster – and consumers that may become cash-strapped during recessions and eschew the food accessories that the company offers.

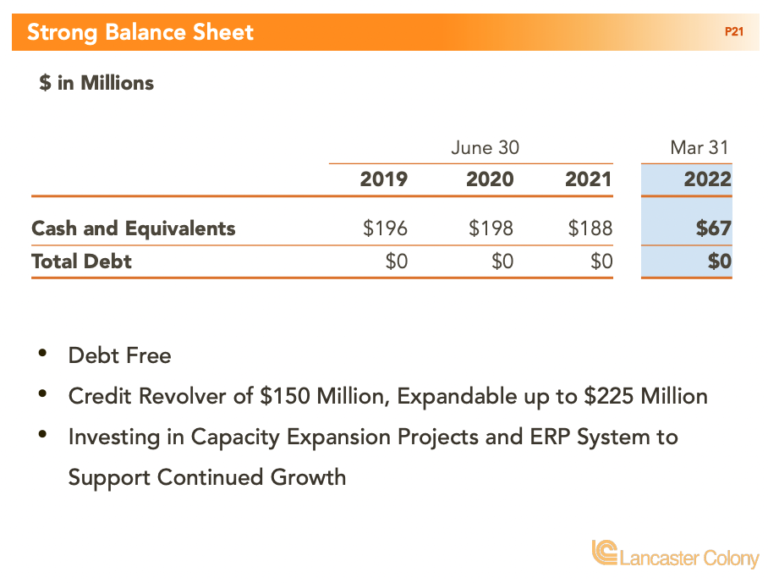

As you see below, the company balance sheet is very strong. The company does not have debts on its balance sheet.

Valuation & Expected Returns

We expect Lancaster to produce $4.45 in earnings-per-share this year. Shares trade at 32 times this year’s EPS estimate, above our fair value estimate. We, therefore, expect that changes in the valuation multiple will be a negative factor in determining the stock’s future returns.

Instead, we feel future returns from Lancaster stock will be derived from earnings-per-share growth, estimated at 6% annually, and the 2.1% dividend yield, leading to total expected returns of 5.1% per year through 2027.

This is a low expected rate of return, which qualifies the stock as a hold at this time. We recommend investors wait for a meaningful pullback before buying shares.

Final Thoughts

Lancaster is undoubtedly not a high-yield income stock due to its low yield, but it does have an impressive track record of dividend increases. Unfortunately, the current yield isn’t high enough to warrant a position simply for the dividend and the modest EPS growth we expect. We note that Lancaster is overvalued, as it has been at times in the recent past. Thus, we rate this stock as a hold at the current price.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Published on August 17th, 2022, by Felix Martinez

There is no exact definition for blue chip stocks. We define it as a stock with at least ten consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks, which you can download by clicking below:

Click here to instantly download your free list of all blue chip stocks, along with important investing metrics.

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This article will analyze Lancaster Colony Corporation (LANC) as part of the 2022 Blue Chip Stocks In Focus series.

Business Overview

LANC began its operations in 1961 after combining several small glasses and related houseware manufacturing companies. The new company immediately began rewarding its shareholders with quarterly cash dividends and eventually went public in 1969, the same year it began operations in the foodservice business with the Marzetti brand acquisition.

The company manufactures and distributes a reasonably narrow product assortment split into two major categories: frozen and non-frozen. It makes salad dressings and various dips under the Marzetti brand, frozen bread under the Sister Schubert’s and New York brands, caviar, noodles, croutons, flatbreads, and other bread products under a variety of smaller brands.

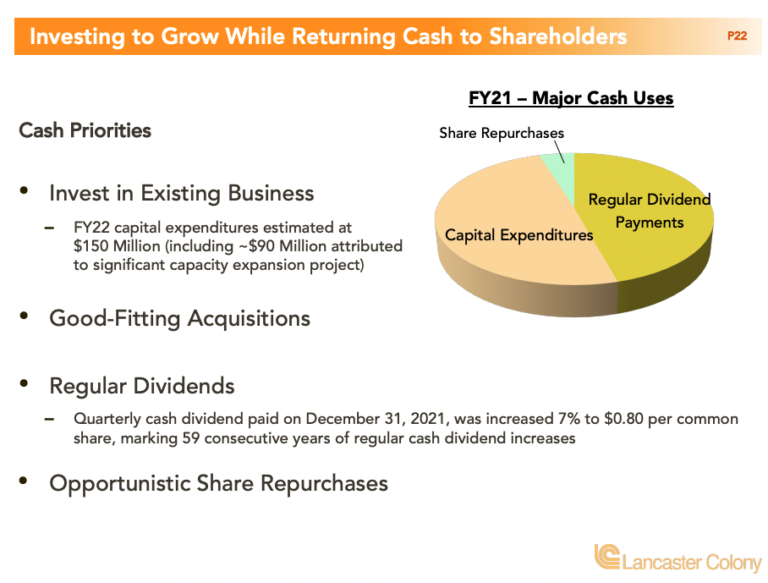

Source: Investor Presentation

Lancaster reported third-quarter earnings on May 5th, 2022, with results coming in mixed. GAAP earnings-per-share missed estimates by $0.98, coming in at -$0.17. Revenue was better than expected at $404 million, up 13% year-over-year, beating estimates by $12.7 million.

Net sales rose to a third-quarter record as the retail segment saw 7.4% growth to $213 million, which was attributable to pricing actions to combat inflation. Volume in the segment declined by 2%, reflecting planned product line reductions and a very tough comparable period a year ago.

The Foodservice segment saw sales soar 20% to $190 million as inflationary pricing and increased demand pushed the top line higher. Volume was down 2% as demand was unfavorably influenced by challenges in the restaurant industry of higher costs, tight labor market conditions, and a cautious consumer.

Gross profit was down $22 million to $68 million, driven by the unfavorable impacts of significantly higher commodity and packaging costs, higher freight and warehousing costs, increased labor costs, etc. The company noted its pricing actions helped offset some of this.

The company continues to experience unprecedented inflation for raw materials and packaging that accelerated during the period and reflects an increase of nearly 30% versus the prior-year quarter. Freight costs also increased approximately 30% compared to last year, pacing well ahead of its previous expectations.

The net impact of its pricing actions lagged these extraordinary levels of cost inflation. The company financial results were also adversely impacted by higher labor costs and supply chain disruptions attributed to COVID-19-related labor shortages, volatility in customer demand, and some severe weather events.

Growth Prospects

Lancaster’s earnings growth has been spotty because it is beholden to volatile restaurant sales. It has therefore made many acquisitions in the past to not only grow the portfolio but attempt to make its revenue more predictable.

We see 6% average earnings growth annually for the next five years as we see nearly all of that driven by revenue increases. We also note that Lancaster will almost certainly not grow linearly, so some years will show declines while others show sizable increases.

For example, since 2010, the company saw four different years of negative earnings growth. In 2011, earnings fell 11%, while in 2014, earnings fell 8%. Also, in 2018, earnings decreased slightly compared to the prior year of 1%.

Over time, Lancaster has proven it can grow through various environments, including a pandemic, and we don’t see that as changing anytime soon.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Lancaster’s competitive advantages are mainly in its distributor partnerships with major sellers like Walmart (WMT) and McLane Distributors, as well as its leadership positions in certain categories like croutons, frozen bread products, and dressings.

Lancaster has built a niche in these categories over the years, and while its heavy reliance upon two distributors for one-third of its revenue is a potential risk, it also means the company’s competitors don’t necessarily have the same access to those large customers. Indeed, we see Lancaster’s exposure to Walmart as a net positive during the pandemic as Walmart experienced surging grocery sales.

Lancaster is in a strong position within its core categories, but that doesn’t make it immune from recessions. Earnings-per-share during and after the Great Recession are below:

Revenue fared pretty well during this period as Lancaster didn’t see any meaningful declines; in fact, revenue was higher in 2008 than in 2007. However, pricing and cost of goods suffered, and as a result, margins declined significantly. This produced the earnings declines Lancaster experienced in 2007 and 2008, but to its credit, the rebound was swift and decisive in 2009 and 2010.

Still, Lancaster is far from recession-proof because it sells products to food service customers – who suffer mightily during recessions and would thus order less from Lancaster – and consumers that may become cash-strapped during recessions and eschew the food accessories that the company offers.

As you see below, the company balance sheet is very strong. The company does not have debts on its balance sheet.

Source: Investor Presentation

Valuation & Expected Returns

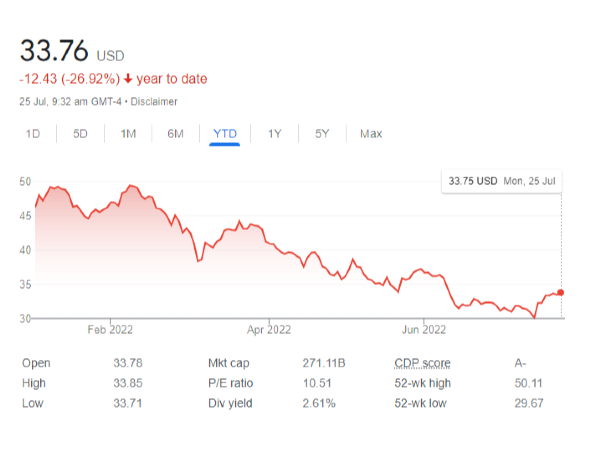

We expect Lancaster to produce $4.45 in earnings-per-share this year. Shares trade at 32 times this year’s EPS estimate, above our fair value estimate. We, therefore, expect that changes in the valuation multiple will be a negative factor in determining the stock’s future returns.

Instead, we feel future returns from Lancaster stock will be derived from earnings-per-share growth, estimated at 6% annually, and the 2.1% dividend yield, leading to total expected returns of 5.1% per year through 2027.

This is a low expected rate of return, which qualifies the stock as a hold at this time. We recommend investors wait for a meaningful pullback before buying shares.

Final Thoughts

Lancaster is undoubtedly not a high-yield income stock due to its low yield, but it does have an impressive track record of dividend increases. Unfortunately, the current yield isn’t high enough to warrant a position simply for the dividend and the modest EPS growth we expect. We note that Lancaster is overvalued, as it has been at times in the recent past. Thus, we rate this stock as a hold at the current price.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Originally Posted on suredividend.com