“Monday morning quarterbacking” refers to the fact that most NFL football games are played on Sunday, and most Monday mornings find at least two disgruntled football fans huddled in a corporate America break room, complaining about their team’s decisions.

It’s hard to be an NFL quarterback making split-second decisions while defenders try to injure you.

It’s not hard to be a Staff Accountant, Level 3 and complain about the quarterback’s passing choices the day before.

It’s too easy, and too human, to criticize choices after the fact. This so-called hindsight bias is incredibly common, affecting people and decisions far beyond the realm of football.

Psychologists and behavioral economists have studied hindsight bias since the 1970s, finding that humans frequently:

- Change their opinions after the fact, so their new opinions more closely match how reality unfolded.

- Create explanations after the fact, incorporating events that happened to rationalize their decisions.

Hindsight bias is a frequent and troublesome problem in the investing world.

I recently spoke with an 80-year old—let’s call him Peyton—who had a few complaints about his 60% stock, 40% bond portfolio.

Complaint #1: since 40% of his portfolio is not exposed to the stock market, Peyton has missed out on serious gains over the past decade.

- Peyton’s stock investments are up ~13% per year over the past decade. That provides 7.8% of annual portfolio return (60% * 13% = 7.8%)

- But his bond allocation is only up 1.5% per year over the past decade, or 0.6% of annual portfolio return.

The sum of these two leads to Peyton’s total portfolio return of 8.4% per year for the past 10 years. And 8.4% is considerably less than the 13% that a 100% stock allocation would have provided him.

Complaint #2: Peyton’s portfolio is down about 10% this year. And that stinks. Losing value is never fun.

When the market was great, Peyton’s portfolio was merely good. And now that the market is down, Peyton’s portfolio is down too.

Peyton’s questions are simple:

- Why wasn’t I invested 100% in stocks up until the end of 2021?

- Why didn’t I sell to all cash at the beginning of 2022, and miss this current crash?

Peyton, it would seem, is suffering from hindsight bias.

The Perfect Investor

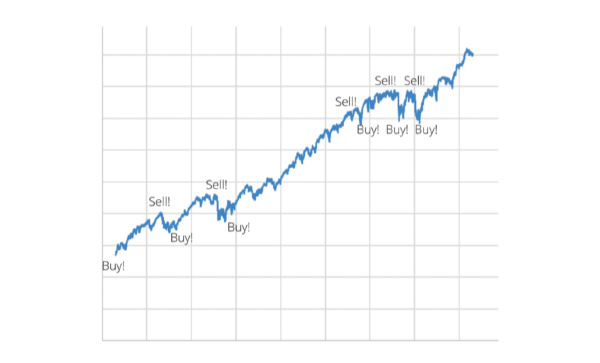

Let’s start answering Peyton’s question by examining “The Perfect Investor.”

The Perfect Investor allocates their portfolio to 100% stocks when the market is at a local bottom. And they allocate to 100% bonds (or perhaps cash, to be even more conservative) when the market is at a local top.

Buy the lows, sell the highs. Perfectly

They have a perfectly rational brain that can handle all risk (stocks) or zero risk (cash), depending on market conditions. There’s no in-between.

And they time the market perfectly. Every time.

The Perfect Investors is, well, perfect.

The Imperfect Investor

Now let’s look at “The Imperfect Investor.”

First, they cannot time the market. They don’t know how the market will move today, tomorrow, this month, or this year. But they have faith that, over decades, the thousands of companies comprising the stock market will, on average, grow their revenues. And that’s good for investors.

And The Imperfect Investor also knows that cash (or bonds) will tend to underperform the stock market over time. But, despite that underperformance, bonds and cash still have a useful purpose:

- For short-term financial needs, low-risk assets provide “safe money.” This is a key component of the “bucket your money” accounting system.

- Low-risk assets help investors to rebalance.

And the Imperfect Investor has an irrational brain. They feel anxious about the idea of an all-stock (100% risk) portfolio. And they fear missing out on rewarding opportunities if they hold 100% cash.

The Amateur Investors

When I speak to amateurs and non-investors, they often believe The Perfect Investor is not only real, but can be found at every advisory firm in America. They expect their financial professionals should resemble The Perfect Investor.

“Put me in stocks when the market is about to boom, and in bonds or cash when the market is about to crash.”

It’s challenging – and probably disappointing – to explain to novices that nobody is actually that good. In fact, nobody is even close to being that good.

The Perfect Investor does not exist. Far from it.

Why?

First, timing the market is famously challenging, even for financial professionals.

But surely a professional can get their timing close, right? They can see the market drop for a few weeks, then sell before it drops more. Or they can see the market rises for a month, and buy before the bull market progresses further.

..right?

Again, no.

This is getting a bit technical. The stock market is anything but smooth and often exhibits “long tail” behavior, where a small number of trading days account for a large portion of overall return.

Let’s look at the S&P 500 from 1990 until 2019, which returned an annualized average of 7.7% per year (before accounting for dividends).

- The best day each year accounted for, on average, a 3.8% return.

- The two best days each year accounted for, on average, a 6.9% return.

- The three best days each year accounted for, on average, a 9.5% return.

In other words, missing the three best days each year would turn the average investor’s performance from a 7.7% gain to a 1.8% loss.

That, in a nutshell, is the problem with timing the market. It’s very easy to get your timing wrong by a week, or a month, or a quarter. And if you miss the best day (or two, or ten, etc), then you can hamstring your portfolio’s return.

Remember: markets are comprised of people, and those people vote with their dollars, creating demand for particular assets which affects those assets’ prices. It’s hard to vote correctly every time, every day. And, as the simple example shows above, getting votes wrong a few days a year can be punishing.

The Perfect Investor doesn’t exist. It’s too hard for real humans to be that perfect.

Then Who Are The Best Investors?

Ironically, the best investors tend to be versions of The Imperfect Investor. And their best skill, by far, is self-awareness.

- They eliminate the desire to time the market because they know they can’t do it. They don’t worry about buying or selling. Instead, they buy and hold.

- They pick an asset allocation by understanding two criteria: their need for return and their risk appetite. They ignore the vicissitudes of the market.

- They accept that their portfolio will never be perfect. When the market rises, they know part of their portfolio won’t be exposed to the good times. Bummer. When the market falls, they know part of their portfolio will be exposed to the carnage. Ouch. It’s not perfect, but it’s better than the alternative. Because the alternative – The Perfect Investor – doesn’t exist!

- They don’t make perfect the enemy of good enough. As Bill Bernstein quipped: “The purpose of investing is not to simply optimize returns and make yourself rich. The purpose is not to die poor.”

- They don’t fall victim to results-oriented thinking or Monday-morning quarterbacking. They know their portfolio was designed with a purpose. Whether the market is up or down, that original purpose remains a guiding compass.

The best investors would look at today’s circumstances and ask:

Based on Peyton’s goals, risk tolerance, and timeline, how do we maximize his probability of hitting his goals and minimize his probability of financial failure?

Perhaps the answer is a 60/40 portfolio like the one Peyton is already invested in.

If the market goes up next week, Peyton might ask: “Why wasn’t I in 100% stocks?!”

And if the market goes down, he’ll ask: “Why do I own any stocks?”

He’s Monday-morning quarterbacking. He’s suffering hindsight bias. And he’s asking the wrong questions.

Because the simple truth is that the 60/40 portfolio maximized the probability that Peyton hit his goals and minimized his probability of financial failure. We made the best decision based on Peyton’s circumstances at that time. The future changes in the market neither confirm nor deny that we were right.

Two things determine how your life will turn out: luck and the quality of your decisions.

Annie Duke

The more you accept your investing imperfection, the closer to perfect you’ll be.

Thank you for reading! If you enjoyed this article, Subscribe to get future articles emailed to your inbox.

-Jesse

P.S – I wrote a book! Check out the ebook here and the physical Amazon book here.

this was written by The Best Interest, a free investing newsletter. Click https://bestinterest.blog/ to subscribe.

“Monday morning quarterbacking” refers to the fact that most NFL football games are played on Sunday, and most Monday mornings find at least two disgruntled football fans huddled in a corporate America break room, complaining about their team’s decisions.

It’s hard to be an NFL quarterback making split-second decisions while defenders try to injure you.

It’s not hard to be a Staff Accountant, Level 3 and complain about the quarterback’s passing choices the day before.

It’s too easy, and too human, to criticize choices after the fact. This so-called hindsight bias is incredibly common, affecting people and decisions far beyond the realm of football.

Psychologists and behavioral economists have studied hindsight bias since the 1970s, finding that humans frequently:

Hindsight bias is a frequent and troublesome problem in the investing world.

I recently spoke with an 80-year old—let’s call him Peyton—who had a few complaints about his 60% stock, 40% bond portfolio.

Complaint #1: since 40% of his portfolio is not exposed to the stock market, Peyton has missed out on serious gains over the past decade.

The sum of these two leads to Peyton’s total portfolio return of 8.4% per year for the past 10 years. And 8.4% is considerably less than the 13% that a 100% stock allocation would have provided him.

Complaint #2: Peyton’s portfolio is down about 10% this year. And that stinks. Losing value is never fun.

When the market was great, Peyton’s portfolio was merely good. And now that the market is down, Peyton’s portfolio is down too.

Peyton’s questions are simple:

Peyton, it would seem, is suffering from hindsight bias.

The Perfect Investor

Let’s start answering Peyton’s question by examining “The Perfect Investor.”

The Perfect Investor allocates their portfolio to 100% stocks when the market is at a local bottom. And they allocate to 100% bonds (or perhaps cash, to be even more conservative) when the market is at a local top.

Buy the lows, sell the highs. Perfectly

They have a perfectly rational brain that can handle all risk (stocks) or zero risk (cash), depending on market conditions. There’s no in-between.

And they time the market perfectly. Every time.

The Perfect Investors is, well, perfect.

The Imperfect Investor

Now let’s look at “The Imperfect Investor.”

First, they cannot time the market. They don’t know how the market will move today, tomorrow, this month, or this year. But they have faith that, over decades, the thousands of companies comprising the stock market will, on average, grow their revenues. And that’s good for investors.

And The Imperfect Investor also knows that cash (or bonds) will tend to underperform the stock market over time. But, despite that underperformance, bonds and cash still have a useful purpose:

And the Imperfect Investor has an irrational brain. They feel anxious about the idea of an all-stock (100% risk) portfolio. And they fear missing out on rewarding opportunities if they hold 100% cash.

The Amateur Investors

When I speak to amateurs and non-investors, they often believe The Perfect Investor is not only real, but can be found at every advisory firm in America. They expect their financial professionals should resemble The Perfect Investor.

“Put me in stocks when the market is about to boom, and in bonds or cash when the market is about to crash.”

It’s challenging – and probably disappointing – to explain to novices that nobody is actually that good. In fact, nobody is even close to being that good.

The Perfect Investor does not exist. Far from it.

Why?

First, timing the market is famously challenging, even for financial professionals.

But surely a professional can get their timing close, right? They can see the market drop for a few weeks, then sell before it drops more. Or they can see the market rises for a month, and buy before the bull market progresses further.

..right?

Again, no.

This is getting a bit technical. The stock market is anything but smooth and often exhibits “long tail” behavior, where a small number of trading days account for a large portion of overall return.

Let’s look at the S&P 500 from 1990 until 2019, which returned an annualized average of 7.7% per year (before accounting for dividends).

In other words, missing the three best days each year would turn the average investor’s performance from a 7.7% gain to a 1.8% loss.

That, in a nutshell, is the problem with timing the market. It’s very easy to get your timing wrong by a week, or a month, or a quarter. And if you miss the best day (or two, or ten, etc), then you can hamstring your portfolio’s return.

Remember: markets are comprised of people, and those people vote with their dollars, creating demand for particular assets which affects those assets’ prices. It’s hard to vote correctly every time, every day. And, as the simple example shows above, getting votes wrong a few days a year can be punishing.

The Perfect Investor doesn’t exist. It’s too hard for real humans to be that perfect.

Then Who Are The Best Investors?

Ironically, the best investors tend to be versions of The Imperfect Investor. And their best skill, by far, is self-awareness.

Based on Peyton’s goals, risk tolerance, and timeline, how do we maximize his probability of hitting his goals and minimize his probability of financial failure?

Perhaps the answer is a 60/40 portfolio like the one Peyton is already invested in.

If the market goes up next week, Peyton might ask: “Why wasn’t I in 100% stocks?!”

And if the market goes down, he’ll ask: “Why do I own any stocks?”

He’s Monday-morning quarterbacking. He’s suffering hindsight bias. And he’s asking the wrong questions.

Because the simple truth is that the 60/40 portfolio maximized the probability that Peyton hit his goals and minimized his probability of financial failure. We made the best decision based on Peyton’s circumstances at that time. The future changes in the market neither confirm nor deny that we were right.

Two things determine how your life will turn out: luck and the quality of your decisions.

Annie Duke

The more you accept your investing imperfection, the closer to perfect you’ll be.

Thank you for reading! If you enjoyed this article, Subscribe to get future articles emailed to your inbox.

-Jesse

P.S – I wrote a book! Check out the ebook here and the physical Amazon book here.

this was written by The Best Interest, a free investing newsletter. Click https://bestinterest.blog/ to subscribe.

Originally Posted on bestinterest.blog