Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

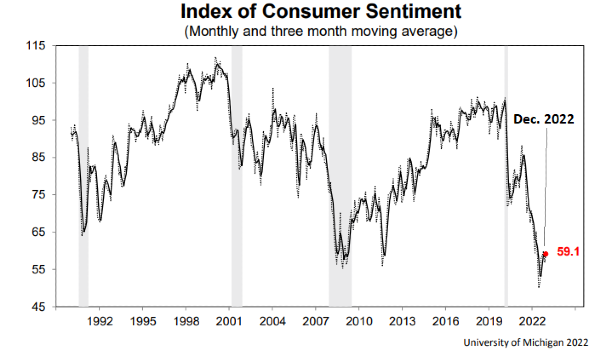

Inflation has peaked, but will remain above pre-Covid levels in 2023, predicts David Mann, chief economist for Asia-Pacific, Middle East and Africa at the Mastercard Economics Institute. “We do expect that we go back down in the direction of where we were back in 2019 where we were still debating how many countries needed negative interest rates.”

Expectations focus on hawkish talk at this week’s Federal Reserve press conference and another rate hike, which contrasts with rising stocks and bonds since the last FOMC meeting. “This has been a struggle for this FOMC the whole year,” says Jan Groen, chief US macro strategist at TD Securities. Fed Chairman “Powell had to come out at Jackson Hole with a big speech and we had this super hawkish press conference in November. And then again, they lost control of it. So I think, again, he has to do something similar.”

Originally Posted on capitalspectator.com