Mining stocks don’t really have a reputation for consistently paying substantial dividends due to the industry’s cyclical nature.

That said, Fortitude Gold Corporation (FTCO), a small, prudently-managed gold miner, has so far managed to maintain a strong and stable dividend profile.

The 8.3% yielding company is one of the monthly dividend stocks and one of the high-yield stocks in our database.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

This article will analyze Fortitude Gold Corporation (FTCO).

Business Overview

Fortitude Gold is a small gold mining firm that was separated from Gold Resource Corporation and turned into a public company in December 2021.

They operate in Nevada, a region well known for being welcoming to the mining industry, and focus on extracting high-grade gold using open pit heap leach methods. It owns six properties, all located within a 30-mile radius and situated in the productive Walker Lane Mineral Belt.

It should be noted that their shares are traded in the OTC market, meaning that they are not listed on major stock exchanges.

The company skilfully manages its gold production, resulting in rather stable results despite the fluctuations in the price of gold. This was once again illustrated in its most recent Q3 results.

The company sold around 9.4K ounces of gold for the quarter, 18.2% lower than last year. This is due to a drop in total gold production, which declined by 17.3% to 9.5K ounces, as the company likely anticipated better gold prices in Q4. Indeed, they have been right, with the price of gold rebounding in Q4.

The company maintained its 2022 annual outlook, targeting a production of 40K gold ounces. We expect this to result in the company generating around $0.55 for the year based on the current gold price levels.

Growth Prospects

When it comes to Fortitude Gold’s future growth prospects, it’s hard to make very accurate predictions, as fluctuations in the price of gold can sway the company’s results either way.

On the one hand, rising gold prices and improved operating processes can significantly enhance the company’s financial performance amid higher profit margins.

On the other hand, declining gold prices and rising expenses, particularly during an inflationary environment like the current one, could negatively affect profitability.

That said, management has added some predictability to Fortitude Gold’s investment case by predicting that their yearly gold output will stay around 40,000 ounces until 2028.

Accretive acquisitions of other mines could also benefit results over the medium term.

Competitive Advantages

Fortitude Gold’s edge in the industry lies in the expertise of its management team and its history of creating significant value for shareholders. Before the spin-off from Gold Resource Corporation, they had generated over $1 billion in revenue there, maintained profitability for ten consecutive years, and distributed over $116 million in dividends to shareholders.

Furthermore, Fortitude Gold’s properties have high-grade ore and surface deposits, which results in low-cost operations compared to their competitors. The company’s financial position is also quite solid, with $127.4 million in assets and only $12.6 million in liabilities, resulting in a strong equity value of $114.8 million.

Although the company’s future performance is partially linked to gold prices, and gold prices typically decrease in recession times, the company’s low operating costs and solid balance sheet could help to mitigate the negative effects during an economic downturn.

Dividend Analysis

Fortitude Gold has an ambitious approach to dividends. The company’s goal is to pay out as much cash to shareholders as soon as possible while still taking into account the need for capital for operations, reinvestment for growth, and taxes.

The company’s CEO, Jason Reid, has mentioned that the company wants to address the common criticism that mining equities provide no yield by providing a desirable yield and paying out dividends on a monthly basis.

The leadership team is of the opinion that this attribute will make the company stand out from its mining competitors in the eyes of investors, preventing shares from trading at a discount, which is common in the industry.

We consider Fortitude Gold’s annual dividend of $0.48 to be relatively dependable, as it should be sustainable even in the event of a notable decrease in gold prices. However, a dividend cut in the event of a prolonged adverse situation in the gold market is not unlikely.

Final Thoughts

Fortitude Gold Corporation might be a suitable choice for income-oriented investors looking for a company in the gold mining industry that provides consistent and hefty dividends.

The stock has one of the highest yields in the industry, yet payouts should remain well-covered, especially near the current gold price levels.

However, it’s worth noting that the company’s future profits will be closely tied to the fluctuations in the price of gold, and thus the dividend should not be blindly trusted.

Mining stocks don’t really have a reputation for consistently paying substantial dividends due to the industry’s cyclical nature.

That said, Fortitude Gold Corporation (FTCO), a small, prudently-managed gold miner, has so far managed to maintain a strong and stable dividend profile.

The 8.3% yielding company is one of the monthly dividend stocks and one of the high-yield stocks in our database.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

This article will analyze Fortitude Gold Corporation (FTCO).

Business Overview

Fortitude Gold is a small gold mining firm that was separated from Gold Resource Corporation and turned into a public company in December 2021.

They operate in Nevada, a region well known for being welcoming to the mining industry, and focus on extracting high-grade gold using open pit heap leach methods. It owns six properties, all located within a 30-mile radius and situated in the productive Walker Lane Mineral Belt.

It should be noted that their shares are traded in the OTC market, meaning that they are not listed on major stock exchanges.

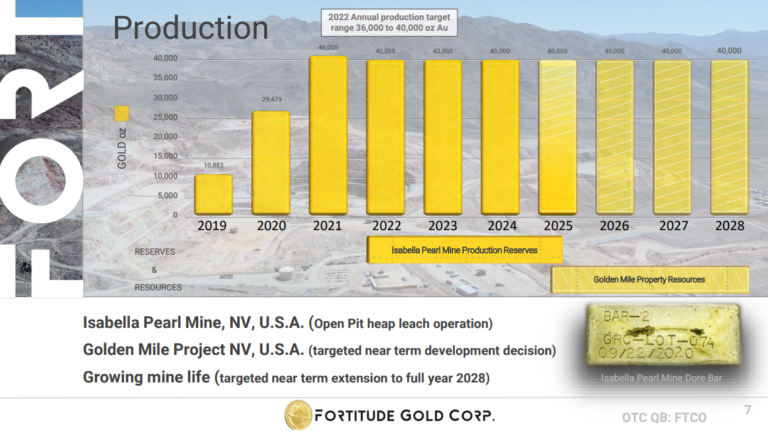

Source: Investor Presentation

The company skilfully manages its gold production, resulting in rather stable results despite the fluctuations in the price of gold. This was once again illustrated in its most recent Q3 results.

The company sold around 9.4K ounces of gold for the quarter, 18.2% lower than last year. This is due to a drop in total gold production, which declined by 17.3% to 9.5K ounces, as the company likely anticipated better gold prices in Q4. Indeed, they have been right, with the price of gold rebounding in Q4.

The company maintained its 2022 annual outlook, targeting a production of 40K gold ounces. We expect this to result in the company generating around $0.55 for the year based on the current gold price levels.

Growth Prospects

When it comes to Fortitude Gold’s future growth prospects, it’s hard to make very accurate predictions, as fluctuations in the price of gold can sway the company’s results either way.

On the one hand, rising gold prices and improved operating processes can significantly enhance the company’s financial performance amid higher profit margins.

On the other hand, declining gold prices and rising expenses, particularly during an inflationary environment like the current one, could negatively affect profitability.

That said, management has added some predictability to Fortitude Gold’s investment case by predicting that their yearly gold output will stay around 40,000 ounces until 2028.

Source: Investor Presentation

Accretive acquisitions of other mines could also benefit results over the medium term.

Competitive Advantages

Fortitude Gold’s edge in the industry lies in the expertise of its management team and its history of creating significant value for shareholders. Before the spin-off from Gold Resource Corporation, they had generated over $1 billion in revenue there, maintained profitability for ten consecutive years, and distributed over $116 million in dividends to shareholders.

Furthermore, Fortitude Gold’s properties have high-grade ore and surface deposits, which results in low-cost operations compared to their competitors. The company’s financial position is also quite solid, with $127.4 million in assets and only $12.6 million in liabilities, resulting in a strong equity value of $114.8 million.

Although the company’s future performance is partially linked to gold prices, and gold prices typically decrease in recession times, the company’s low operating costs and solid balance sheet could help to mitigate the negative effects during an economic downturn.

Dividend Analysis

Fortitude Gold has an ambitious approach to dividends. The company’s goal is to pay out as much cash to shareholders as soon as possible while still taking into account the need for capital for operations, reinvestment for growth, and taxes.

The company’s CEO, Jason Reid, has mentioned that the company wants to address the common criticism that mining equities provide no yield by providing a desirable yield and paying out dividends on a monthly basis.

The leadership team is of the opinion that this attribute will make the company stand out from its mining competitors in the eyes of investors, preventing shares from trading at a discount, which is common in the industry.

We consider Fortitude Gold’s annual dividend of $0.48 to be relatively dependable, as it should be sustainable even in the event of a notable decrease in gold prices. However, a dividend cut in the event of a prolonged adverse situation in the gold market is not unlikely.

Final Thoughts

Fortitude Gold Corporation might be a suitable choice for income-oriented investors looking for a company in the gold mining industry that provides consistent and hefty dividends.

The stock has one of the highest yields in the industry, yet payouts should remain well-covered, especially near the current gold price levels.

However, it’s worth noting that the company’s future profits will be closely tied to the fluctuations in the price of gold, and thus the dividend should not be blindly trusted.

Originally Posted on suredividend.com