It’s the word on everyone’s lips – recession. Investors are worried about it. Moreover, they do not know how to invest during a recession.

Despite the widespread predictions the U.S. (or the world itself) is about to enter one, there remains quite a bit of confusion over recessions. Experts and officials can’t seem to agree if one has started. Moreover, there is little consensus on whether the classic definition of a recession (two straight quarters of negative growth) should even apply in these circumstances.

Regardless of where you stand on the issue, the risk of a recession is far too great to ignore. For in investing, forewarned is forearmed.

Economists surveyed by Bloomberg gave a 70% likelihood of a recession hitting the U.S. this year. That should be enough warning to us all. This post will look at defensive investing for the stock market and weigh the potential for purchasing real estate during a recession.

How to Invest During a Recession

Buckle Up

The U.S. is experiencing a bear market, defined as when stock prices fall by 20% or more from recent highs (as opposed to a “correction,” which is a drop between 10% to 20%). The market officially entered bear territory last June and has yet to emerge from the woods.

During bear markets, prices get suppressed by investors’ negative expectations about companies’ future earnings, which impacts their potential return from the stock.

With firms announcing their profit updates during the coming earnings season, the sell-off could continue, depending on whether the results are worse (or better) than investors anticipate. However, investors can protect their capital during a sustained market downturn like this by hedging into safer asset classes and stable income-generating stocks.

Volatility in the Market

Relentless volatility can make for tough going. While low volatility creates a sense of security for investors, high volatility can spread fear, uncertainty, and doubt (“FUD”) in the market, causing even seasoned traders to make irrational decisions.

Investing in and holding overly volatile stocks can create unnecessary psychological pressure during recession periods. As a result, long-term investors may instead want to minimize their portfolio’s vulnerability to volatility.

To identify which stocks are most susceptible to volatility, consider the beta. This metric reflects a stock’s relative price volatility. Stocks that yoyo wildly have a beta above 1; for instance, Tesla at 2.03. While less-reactive stocks will be less than 1.0, like AT&T, at 0.5.

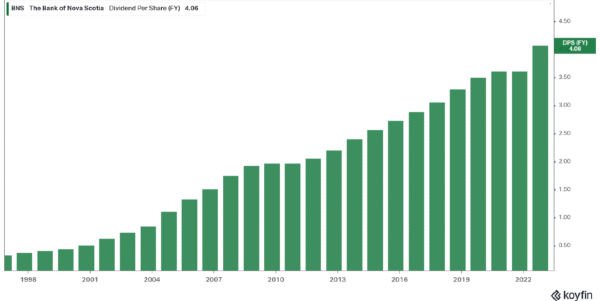

Buying up some “recession-proof stocks” with low beta scores and high dividend yields provides shelter from the storm. Diversifying beyond stocks, investors may consider another form of literal shelter – real estate.

Buy the Housing Dip?

Buying property during a recession comes with a few unique factors.

The U.S. is witnessing a serious price correction, with homes dipping 2.67% nationally in Q3 2022 – one of the sharpest drops since the 1940s.

The western half of the country has seen a substantial reversal. San Francisco, San Diego, Denver, Portland, Phoenix, and Seattle are among the cities with the steepest price declines nationwide. The drop in valuations presents an opportunity, especially for first-time buyers who were priced out of the previously overheated market.

Recessionary real estate is not quite that simple, though. House sticker prices may be down, but the interest to pay off your mortgage during a recession could be higher.

As of January 11, interest rates averaged 5.52% and 6.33% for 15 and 30-year mortgages, respectively, according to data from Freddie Mac. That’s at least half a percentage point down from their November highs. Despite that recent cool-off, the market remains extremely sensitive, with minor rate changes triggering significant swings in purchase demand.

Joblessness May Rise

Another risk is joblessness. The threat of getting retrenched during a recession is enough to make prospective homeowners think twice before jumping into a multi-decade debt obligation.

Despite some high-profile layoffs in Silicon Valley, the broader job market remains fairly resilient for now. Yet the market may not hold – economists surveyed by Bankrate at the end of last year see unemployment reaching an average of 4.4% at some stage this year.

There are ways to offset these risks, though. When preparing to buy property, size up different banks and find an optimal mortgage with as low an interest rate as possible. You can improve your position when negotiating credit terms by coming to the table with a larger downpayment, a higher credit score, and a detailed repayment plan.

There’s no knowing the returns from buying a house in a recession. Historical data shows home buyers who purchased during the last recession – when the pandemic first broke – have seen their assets appreciate by almost 30% since then. Unfortunately, those who bought during the recession before that weren’t so lucky. On average, properties took a decade to recover their value after 2007.

Recessions appear daunting, but investors can often come out on top if handled correctly.

Should You Follow Warren Buffett’s Advice About Investing During a Recession?

As veteran Warren Buffet is fond of saying, “Be fearful when others are greedy, and greedy when others are fearful.” Indeed, recessions can present opportunities for level-headed investors to take advantage of the low prices to buy quality equities at a discount.

Each investor will have to tailor their portfolio to their own risk profile, and, as always, past performance cannot predict future results. Yet, with patience and persistence, many will likely see strong gains once the economy recovers.

Related Articles on Dividend Power

It’s the word on everyone’s lips – recession. Investors are worried about it. Moreover, they do not know how to invest during a recession.

Despite the widespread predictions the U.S. (or the world itself) is about to enter one, there remains quite a bit of confusion over recessions. Experts and officials can’t seem to agree if one has started. Moreover, there is little consensus on whether the classic definition of a recession (two straight quarters of negative growth) should even apply in these circumstances.

Regardless of where you stand on the issue, the risk of a recession is far too great to ignore. For in investing, forewarned is forearmed.

Economists surveyed by Bloomberg gave a 70% likelihood of a recession hitting the U.S. this year. That should be enough warning to us all. This post will look at defensive investing for the stock market and weigh the potential for purchasing real estate during a recession.

How to Invest During a Recession

Buckle Up

The U.S. is experiencing a bear market, defined as when stock prices fall by 20% or more from recent highs (as opposed to a “correction,” which is a drop between 10% to 20%). The market officially entered bear territory last June and has yet to emerge from the woods.

During bear markets, prices get suppressed by investors’ negative expectations about companies’ future earnings, which impacts their potential return from the stock.

With firms announcing their profit updates during the coming earnings season, the sell-off could continue, depending on whether the results are worse (or better) than investors anticipate. However, investors can protect their capital during a sustained market downturn like this by hedging into safer asset classes and stable income-generating stocks.

Volatility in the Market

Relentless volatility can make for tough going. While low volatility creates a sense of security for investors, high volatility can spread fear, uncertainty, and doubt (“FUD”) in the market, causing even seasoned traders to make irrational decisions.

Investing in and holding overly volatile stocks can create unnecessary psychological pressure during recession periods. As a result, long-term investors may instead want to minimize their portfolio’s vulnerability to volatility.

To identify which stocks are most susceptible to volatility, consider the beta. This metric reflects a stock’s relative price volatility. Stocks that yoyo wildly have a beta above 1; for instance, Tesla at 2.03. While less-reactive stocks will be less than 1.0, like AT&T, at 0.5.

Buying up some “recession-proof stocks” with low beta scores and high dividend yields provides shelter from the storm. Diversifying beyond stocks, investors may consider another form of literal shelter – real estate.

Buy the Housing Dip?

Buying property during a recession comes with a few unique factors.

The U.S. is witnessing a serious price correction, with homes dipping 2.67% nationally in Q3 2022 – one of the sharpest drops since the 1940s.

The western half of the country has seen a substantial reversal. San Francisco, San Diego, Denver, Portland, Phoenix, and Seattle are among the cities with the steepest price declines nationwide. The drop in valuations presents an opportunity, especially for first-time buyers who were priced out of the previously overheated market.

Recessionary real estate is not quite that simple, though. House sticker prices may be down, but the interest to pay off your mortgage during a recession could be higher.

As of January 11, interest rates averaged 5.52% and 6.33% for 15 and 30-year mortgages, respectively, according to data from Freddie Mac. That’s at least half a percentage point down from their November highs. Despite that recent cool-off, the market remains extremely sensitive, with minor rate changes triggering significant swings in purchase demand.

Joblessness May Rise

Another risk is joblessness. The threat of getting retrenched during a recession is enough to make prospective homeowners think twice before jumping into a multi-decade debt obligation.

Despite some high-profile layoffs in Silicon Valley, the broader job market remains fairly resilient for now. Yet the market may not hold – economists surveyed by Bankrate at the end of last year see unemployment reaching an average of 4.4% at some stage this year.

There are ways to offset these risks, though. When preparing to buy property, size up different banks and find an optimal mortgage with as low an interest rate as possible. You can improve your position when negotiating credit terms by coming to the table with a larger downpayment, a higher credit score, and a detailed repayment plan.

There’s no knowing the returns from buying a house in a recession. Historical data shows home buyers who purchased during the last recession – when the pandemic first broke – have seen their assets appreciate by almost 30% since then. Unfortunately, those who bought during the recession before that weren’t so lucky. On average, properties took a decade to recover their value after 2007.

Recessions appear daunting, but investors can often come out on top if handled correctly.

Should You Follow Warren Buffett’s Advice About Investing During a Recession?

As veteran Warren Buffet is fond of saying, “Be fearful when others are greedy, and greedy when others are fearful.” Indeed, recessions can present opportunities for level-headed investors to take advantage of the low prices to buy quality equities at a discount.

Each investor will have to tailor their portfolio to their own risk profile, and, as always, past performance cannot predict future results. Yet, with patience and persistence, many will likely see strong gains once the economy recovers.

Related Articles on Dividend Power

Originally Posted in Dividend Power