V.F. Corporation (VFC) has an exceptional dividend growth record, with 50 consecutive years of dividend growth. It thus belongs to the best-of-breed group of Dividend Kings.

The company is currently facing a perfect storm and hence it has plunged 59% over the last 12 months, to a nearly 10-year low level. As a result, the stock is offering a nearly 10-year high dividend yield of 6.9% while it is also trading at a nearly 10-year low price-to-earnings ratio of 14.7.

It is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

In this article, we will analyze the prospects of V.F. Corporation.

Business Overview

V.F. Corporation was founded in 1899 and has become one of the world’s largest apparel, footwear and accessories companies. Its brands include The North Face, Vans, Timberland, and Dickies.

V.F. Corporation incurred a 65% plunge in its earnings per share in fiscal 2021 (which ended in March 2021) due to the unprecedented lockdowns implemented in response to the pandemic. However, the retailer recovered strongly last year thanks to the reopening of the economy and the immense fiscal stimulus packages offered by governments around the world.

Unfortunately, V.F. Corporation is currently facing another major downturn due to the surge of inflation to a 40-year high. Excessive inflation has imparted a triple hit on the company and thus it has formed a perfect storm.

First of all, the surge of inflation has greatly increased the cost of raw materials and the freight costs as well as the labor cost of V.F. Corporation. In addition, sky-high inflation has made consumers much more conservative due to a sharp decrease in their purchasing power and thus it has taken its toll on consumer spending.

As if these two effects of inflation were not enough, high inflation also has an effect on the valuation of all the stocks, including V.F. Corporation. Inflation reduces the present value of future cash flows and hence it tends to compress the price-to-earnings ratios of stocks.

This has certainly been the case for V.F. Corporation. Due to the triple impact of inflation on V.F. Corporation, the stock has plunged 59% over the last 12 months.

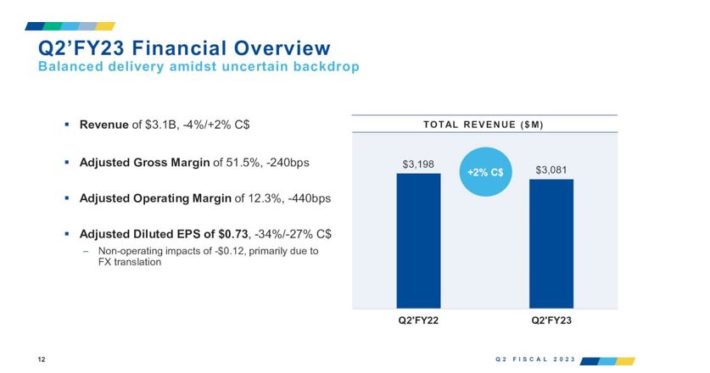

In late October, V.F. Corporation reported financial results for the second quarter of fiscal 2023. Its revenue dipped 4% and its operating margin shrank from 16.7% to 12.3% due to high cost inflation and great discounts offered to customers amid high inventories.

Source: Investor Presentation

Given also the impact of the lockdowns imposed in China, earnings per share plunged 24%, from $1.11 to $0.73, and missed the analysts’ consensus by $0.02.

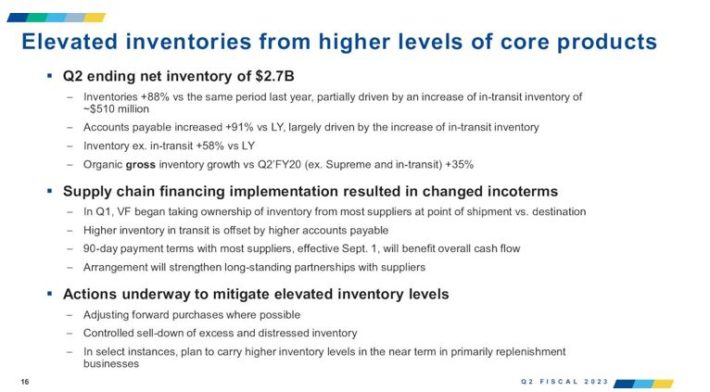

Notably, the inventories of V.F. Corporation have jumped 88% over the prior year’s quarter, primarily due to supply chain issues and the impact of excessive inflation on consumer spending.

Source: Investor Presentation

Management is doing its best to reduce inventories, by pushing forward purchases where possible and by offering attractive discounts in order to enhance consumer purchases. We expect high inventories to continue to weigh on the margins of the company until inflation subsides.

On December 5th, 2022, V.F. Corporation announced the exit of its CEO due to retirement and stated that it will search for his successor. The retailer also revised its outlook due to a greater-than-expected impact of inflation on consumer spending and the resultant excessive inventories, which will force the company to offer even deeper discounts to consumers.

Due to these headwinds, V.F. Corporation lowered its guidance for revenue growth in fiscal 2023 from 5%-6% to 3%-4% and its guidance for adjusted earnings per share once again, from $2.40-$2.50 to $2.00-$2.20. Due to the repeated downward revisions of the company in recent quarters, we expect earnings per share of about $2.00 for the fiscal year, at the low end of the new guidance.

Growth Prospects

Before the pandemic and the ongoing downturn, V.F. Corporation exhibited a solid performance record. Between fiscal 2010 and fiscal 2020, the company grew its earnings per share by 10.5% on average per year. This performance was driven by strong sales growth along with a solid expansion in operating and net profit margins.

As mentioned above, the retailer is currently facing a perfect storm due to the multiple effects of inflation on the stock. Consequently, the company is poised to report its second-worst earnings per share in the last decade in fiscal 2023.

However, the Fed has made it clear that it has prioritized restoring inflation to its long-term target of about 2%, even at the expense of economic growth in the short run. To this end, the Fed is raising interest rates aggressively and thus it is likely to lead inflation towards normal levels in the upcoming quarters.

Whenever inflation subsides, V.F. Corporation is likely to recover strongly from the ongoing downturn. Its operating costs will moderate while consumers will regain their purchasing power. In addition, the stock market will reset its price-to-earnings ratios. Overall, thanks to an expected recovery from the current downturn, we expect V.F. Corporation to grow its earnings per share by 10% per year on average over the next five years off this year’s low comparison base.

Competitive Advantages

V.F. Corporation has a significant competitive advantage, namely the popularity of its premium brands. Thanks to the strength of its brands, the company has meaningful pricing power.

The strong brands of V.F. Corporation render the retailer somewhat resilient to recessions. However, due to the premium character of its brands, the company is not immune to recessions. During the Great Recession, V.F. Corporation posted earnings-per-share of $1.39, $1.29, and $1.61 in the 2008 through 2010 stretch, indicating the resilience of the business.

On the other hand, the company has proved more vulnerable in the ongoing downturn, which has been caused by 40-year high inflation. Nevertheless, thanks to its popular brands and its rock-solid balance sheet, V.F. Corporation can endure the ongoing downturn and recover strongly whenever inflation subsides.

Dividend Analysis

V.F. Corporation has an exceptional dividend growth record. It is a Dividend King, with 50 consecutive years of dividend growth. The outstanding dividend growth record of the company is a testament to the strength of its business model and its solid execution.

V.F. Corporation is currently offering a nearly 10-year high dividend yield of 6.9%. It has grown its dividend by 10.9% per year on average over the last decade but it has markedly decelerated in recent years, with a 4.4% average annual dividend growth rate over the last five years due to the aforementioned headwinds.

Moreover, while the company has maintained a payout ratio of 30%-60% throughout most of the last decade, its payout ratio has jumped to 102% for the first time in more than a decade due to the slump in earnings this year. This has raised some concerns over the safety of the dividend.

However, as inflation is likely to moderate in 2023-2024, V.F. Corporation is likely to recover from the ongoing downturn. In addition, the company has a rock-solid balance sheet, with a negligible amount of debt. As a result, it can easily endure the ongoing crisis and emerge stronger whenever the business headwinds attenuate.

Given also the commitment of the company on growing its dividend, we view its dividend as fairly safe for the foreseeable future. With that said, investors should not expect meaningful dividend growth in the upcoming years.

Final Thoughts

V.F. Corporation is currently facing a perfect storm and thus the stock has slumped to a nearly 10-year low, offering a nearly 10-year high dividend yield of 6.9% with a nearly 10-year low price-to-earnings ratio of 14.7.

The company has been hit by sky-high inflation much more than most companies. This helps explain its vast underperformance over the last 12 months. During this period, the stock of V.F. Corporation has slumped 59% whereas the S&P 500 has declined only 17%.

On the bright side, inflation has begun to subside in recent months. We expect it to subside even further in the upcoming quarters thanks to the aggressive stance of the Fed. This is likely to help V.F. Corporation recover in the upcoming years.

The payout ratio of V.F. Corporation has exceeded 100% for the first time in more than a decade, but we expect it to revert towards sustainable levels in the upcoming years. Given also the rock-solid balance sheet of the retailer, we consider its dividend fairly safe for the foreseeable future.

Overall, those who purchase V.F. Corporation around its current price, which has resulted from an exceptionally unfavorable business landscape, will probably be highly rewarded in the long run. The only caveat is that great patience may be required and hence the stock is suitable only for the investors who can ignore stock price volatility and remain focused on the long run.

V.F. Corporation (VFC) has an exceptional dividend growth record, with 50 consecutive years of dividend growth. It thus belongs to the best-of-breed group of Dividend Kings.

The company is currently facing a perfect storm and hence it has plunged 59% over the last 12 months, to a nearly 10-year low level. As a result, the stock is offering a nearly 10-year high dividend yield of 6.9% while it is also trading at a nearly 10-year low price-to-earnings ratio of 14.7.

It is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

In this article, we will analyze the prospects of V.F. Corporation.

Business Overview

V.F. Corporation was founded in 1899 and has become one of the world’s largest apparel, footwear and accessories companies. Its brands include The North Face, Vans, Timberland, and Dickies.

V.F. Corporation incurred a 65% plunge in its earnings per share in fiscal 2021 (which ended in March 2021) due to the unprecedented lockdowns implemented in response to the pandemic. However, the retailer recovered strongly last year thanks to the reopening of the economy and the immense fiscal stimulus packages offered by governments around the world.

Unfortunately, V.F. Corporation is currently facing another major downturn due to the surge of inflation to a 40-year high. Excessive inflation has imparted a triple hit on the company and thus it has formed a perfect storm.

First of all, the surge of inflation has greatly increased the cost of raw materials and the freight costs as well as the labor cost of V.F. Corporation. In addition, sky-high inflation has made consumers much more conservative due to a sharp decrease in their purchasing power and thus it has taken its toll on consumer spending.

As if these two effects of inflation were not enough, high inflation also has an effect on the valuation of all the stocks, including V.F. Corporation. Inflation reduces the present value of future cash flows and hence it tends to compress the price-to-earnings ratios of stocks.

This has certainly been the case for V.F. Corporation. Due to the triple impact of inflation on V.F. Corporation, the stock has plunged 59% over the last 12 months.

In late October, V.F. Corporation reported financial results for the second quarter of fiscal 2023. Its revenue dipped 4% and its operating margin shrank from 16.7% to 12.3% due to high cost inflation and great discounts offered to customers amid high inventories.

Source: Investor Presentation

Given also the impact of the lockdowns imposed in China, earnings per share plunged 24%, from $1.11 to $0.73, and missed the analysts’ consensus by $0.02.

Notably, the inventories of V.F. Corporation have jumped 88% over the prior year’s quarter, primarily due to supply chain issues and the impact of excessive inflation on consumer spending.

Source: Investor Presentation

Management is doing its best to reduce inventories, by pushing forward purchases where possible and by offering attractive discounts in order to enhance consumer purchases. We expect high inventories to continue to weigh on the margins of the company until inflation subsides.

On December 5th, 2022, V.F. Corporation announced the exit of its CEO due to retirement and stated that it will search for his successor. The retailer also revised its outlook due to a greater-than-expected impact of inflation on consumer spending and the resultant excessive inventories, which will force the company to offer even deeper discounts to consumers.

Due to these headwinds, V.F. Corporation lowered its guidance for revenue growth in fiscal 2023 from 5%-6% to 3%-4% and its guidance for adjusted earnings per share once again, from $2.40-$2.50 to $2.00-$2.20. Due to the repeated downward revisions of the company in recent quarters, we expect earnings per share of about $2.00 for the fiscal year, at the low end of the new guidance.

Growth Prospects

Before the pandemic and the ongoing downturn, V.F. Corporation exhibited a solid performance record. Between fiscal 2010 and fiscal 2020, the company grew its earnings per share by 10.5% on average per year. This performance was driven by strong sales growth along with a solid expansion in operating and net profit margins.

As mentioned above, the retailer is currently facing a perfect storm due to the multiple effects of inflation on the stock. Consequently, the company is poised to report its second-worst earnings per share in the last decade in fiscal 2023.

However, the Fed has made it clear that it has prioritized restoring inflation to its long-term target of about 2%, even at the expense of economic growth in the short run. To this end, the Fed is raising interest rates aggressively and thus it is likely to lead inflation towards normal levels in the upcoming quarters.

Whenever inflation subsides, V.F. Corporation is likely to recover strongly from the ongoing downturn. Its operating costs will moderate while consumers will regain their purchasing power. In addition, the stock market will reset its price-to-earnings ratios. Overall, thanks to an expected recovery from the current downturn, we expect V.F. Corporation to grow its earnings per share by 10% per year on average over the next five years off this year’s low comparison base.

Competitive Advantages

V.F. Corporation has a significant competitive advantage, namely the popularity of its premium brands. Thanks to the strength of its brands, the company has meaningful pricing power.

The strong brands of V.F. Corporation render the retailer somewhat resilient to recessions. However, due to the premium character of its brands, the company is not immune to recessions. During the Great Recession, V.F. Corporation posted earnings-per-share of $1.39, $1.29, and $1.61 in the 2008 through 2010 stretch, indicating the resilience of the business.

On the other hand, the company has proved more vulnerable in the ongoing downturn, which has been caused by 40-year high inflation. Nevertheless, thanks to its popular brands and its rock-solid balance sheet, V.F. Corporation can endure the ongoing downturn and recover strongly whenever inflation subsides.

Dividend Analysis

V.F. Corporation has an exceptional dividend growth record. It is a Dividend King, with 50 consecutive years of dividend growth. The outstanding dividend growth record of the company is a testament to the strength of its business model and its solid execution.

V.F. Corporation is currently offering a nearly 10-year high dividend yield of 6.9%. It has grown its dividend by 10.9% per year on average over the last decade but it has markedly decelerated in recent years, with a 4.4% average annual dividend growth rate over the last five years due to the aforementioned headwinds.

Moreover, while the company has maintained a payout ratio of 30%-60% throughout most of the last decade, its payout ratio has jumped to 102% for the first time in more than a decade due to the slump in earnings this year. This has raised some concerns over the safety of the dividend.

However, as inflation is likely to moderate in 2023-2024, V.F. Corporation is likely to recover from the ongoing downturn. In addition, the company has a rock-solid balance sheet, with a negligible amount of debt. As a result, it can easily endure the ongoing crisis and emerge stronger whenever the business headwinds attenuate.

Given also the commitment of the company on growing its dividend, we view its dividend as fairly safe for the foreseeable future. With that said, investors should not expect meaningful dividend growth in the upcoming years.

Final Thoughts

V.F. Corporation is currently facing a perfect storm and thus the stock has slumped to a nearly 10-year low, offering a nearly 10-year high dividend yield of 6.9% with a nearly 10-year low price-to-earnings ratio of 14.7.

The company has been hit by sky-high inflation much more than most companies. This helps explain its vast underperformance over the last 12 months. During this period, the stock of V.F. Corporation has slumped 59% whereas the S&P 500 has declined only 17%.

On the bright side, inflation has begun to subside in recent months. We expect it to subside even further in the upcoming quarters thanks to the aggressive stance of the Fed. This is likely to help V.F. Corporation recover in the upcoming years.

The payout ratio of V.F. Corporation has exceeded 100% for the first time in more than a decade, but we expect it to revert towards sustainable levels in the upcoming years. Given also the rock-solid balance sheet of the retailer, we consider its dividend fairly safe for the foreseeable future.

Overall, those who purchase V.F. Corporation around its current price, which has resulted from an exceptionally unfavorable business landscape, will probably be highly rewarded in the long run. The only caveat is that great patience may be required and hence the stock is suitable only for the investors who can ignore stock price volatility and remain focused on the long run.

Originally Posted on suredividend.com