Introduction

For decades, the S&P 500 has served as the benchmark for U.S. stock market performance. Its blue-chip constituents—giant companies with global reach—are synonymous with stability, resilience, and long-term growth. Yet, beneath the surface, a less-heralded group of small-cap stocks has, at times, delivered returns that far outpace the S&P 500. These companies, typically valued between $300 million and $2 billion, offer investors a unique blend of risk and reward. In recent years, and especially in 2024 and 2025, small-cap stocks have begun to shine anew, capturing the attention of savvy investors eager for outsized gains.

This essay explores the drivers behind small-cap outperformance, presents recent examples, and examines why the current environment may be especially favorable for these nimble market players.

The Cyclical Nature of Small-Cap vs. Large-Cap Performance

Stock market leadership is cyclical. For much of the past decade, large-cap stocks—especially the “Magnificent Seven” tech giants—have dominated returns, overshadowing small- and mid-cap peers2. However, history shows that these cycles eventually reverse. According to Furey Research Partners, leadership alternates between large- and small-caps in cycles typically lasting seven to ten years2. The current era of large-cap outperformance has been unusually long, but signs suggest a shift is underway as we move through 2025.

Several factors are converging to support small-cap outperformance:

● Earnings Growth Acceleration: After lagging for several years, small-cap earnings growth is now expected to surpass that of large-caps, as smaller firms benefit from economic recovery, regulatory relief, and increased consumer demand25.

● Attractive Valuations: Small-cap stocks are trading at significant discounts to their large-cap peers. For instance, the S&P 600 trades at 15.5 times forward earnings, well below the S&P 500’s 21.6 times, making small-caps a relative bargain6.

● Market Rotation: As mega-cap tech stocks’ growth slows, investors are seeking new sources of return, leading to renewed interest in small- and mid-cap equities25.

● M&A and IPO Activity: A more favorable regulatory environment and pent-up demand for deals are expected to boost merger, acquisition, and IPO activity among small-caps, providing additional catalysts for outperformance25.

Why Small-Cap Stocks Can Outperform

- Growth Potential

Small-cap companies are often in the early stages of their growth cycle, with ample room to expand revenues and profits. Unlike mature large-caps, these firms can double or triple in size more easily, especially when they introduce innovative products or disrupt established markets.

- Market Niche Mastery

Many successful small-caps dominate specific niches, allowing them to achieve higher margins and customer loyalty. Their focused strategies can lead to rapid market share gains, especially when larger competitors overlook these segments.

- Acquisition Targets

Small-caps with unique technology or strong growth prospects are frequent acquisition targets for larger firms. Such buyouts often occur at significant premiums, rewarding shareholders handsomely.

- Under-the-Radar Value

With less analyst coverage and institutional ownership, small-caps can be inefficiently priced. Diligent investors who identify undervalued opportunities before the broader market catches on can reap substantial rewards.

Recent Examples: Small-Cap Stocks Outpacing the S&P 500

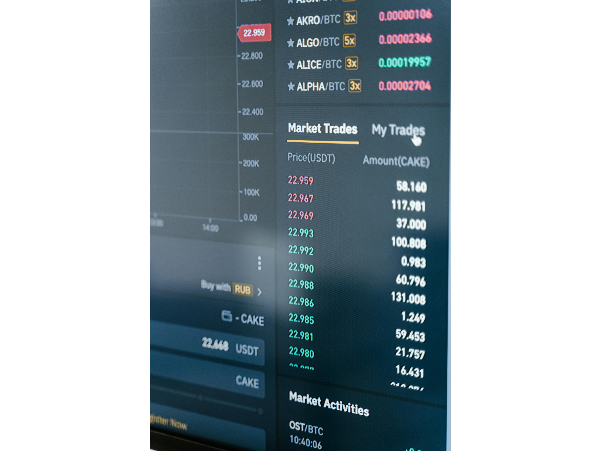

The past year has seen a remarkable resurgence in small-cap performance. According to Forbes, the Russell 2000 small-cap index rose 15% in the second half of 2024, beating the S&P 500 by more than five percentage points3. This rally was fueled by interest rate cuts, political shifts, and renewed optimism about economic growth.

NerdWallet’s May 2025 data highlights several small-cap stocks with extraordinary one-year returns, vastly exceeding the S&P 500’s performance4:

Ticker Company Name 1-Year Return (%)

RGC Regencell Bioscience Holdings Ltd 8385.49

DRUG Bright Minds Biosciences Inc 2952.54

NUTX Nutex Health Inc 2385.84

QUBT Quantum Computing Inc 1123.68

EXOD Exodus Movement Inc 1092.00

UAMY United States Antimony Corp 1084.03

MNPR Monopar Therapeutics Inc 1071.68

ASTS AST SpaceMobile Inc 1071.43

EOSE Eos Energy Enterprises Inc 887.23

... ... ...

Source: Finviz, NerdWallet, as of May 15, 20254

These returns dwarf those of the S&P 500, which, while positive, have not approached the triple- or quadruple-digit gains seen among the best-performing small-caps.

What’s Driving This Outperformance?

- Economic Recovery and Policy Tailwinds

Interest rate cuts and a more relaxed regulatory landscape have boosted small-cap stocks, particularly those sensitive to domestic economic conditions36. The Trump administration’s pledge to relax business regulations and analysts’ expectations of increased M&A and IPO activity have further fueled optimism23.

- Bargain Valuations

After years of underperformance, small-caps are trading at some of the most attractive valuations in decades. By multiple metrics, they are better bargains than large-caps, making them appealing for value-oriented investors36.

- Sector Diversification

Small- and mid-cap stocks offer more diverse sector exposures than the S&P 500, which is heavily weighted toward information technology and communication services. This diversification can provide protection if large-cap tech stocks falter5.

- Innovation and Disruption

Many small-cap winners are at the forefront of innovation—whether in healthcare, technology, clean energy, or financial services. Their ability to quickly adapt and capitalize on new trends gives them an edge over slower-moving giants.

Risks and Considerations

While the potential for outperformance is real, small-cap stocks are not without risk:

● Volatility: Small-caps are more volatile than large-caps, with larger price swings in both directions.

● Liquidity: Lower trading volumes can make it harder to buy or sell shares without affecting the price.

● Execution Risk: Smaller companies may be more vulnerable to management missteps or operational setbacks.

● Economic Sensitivity: Many small-caps are more exposed to domestic economic cycles and may suffer disproportionately in downturns.

Investors should diversify across sectors and individual names, conduct thorough due diligence, and be prepared for short-term volatility in pursuit of long-term gains.

Outlook for 2025 and Beyond

After years in the shadows, small-cap stocks are poised for a period of renewed outperformance. Earnings growth is accelerating, valuations are attractive, and market conditions are increasingly favorable for smaller companies2356. As the market cycle turns, investors who diversify into high-quality small-caps may capture returns that outpace the S&P 500.

As Ken Farsalas, portfolio manager of the Oberweis Small-Cap Opportunities Fund, puts it: “It’s a generational opportunity to buy small-cap stocks. I would be stunned if small caps didn’t outperform large caps over the next decade.”3

Conclusion

Small-cap stocks have a long history of outperforming the S&P 500 during certain market cycles. Their growth potential, niche focus, and ability to capitalize on economic recoveries make them a compelling addition to a diversified portfolio. While risks remain, the current environment—marked by attractive valuations, policy support, and accelerating earnings—provides fertile ground for small-cap outperformance. For investors willing to embrace some volatility and do their homework, small-cap stocks may offer the best chance to beat the market in the years ahead.

Introduction For decades, the S&P 500 has served as the benchmark for U.S. stock market performance. Its blue-chip constituents—giant companies with global reach—are synonymous with stability, resilience, and long-term growth. Yet, beneath the surface, a less-heralded group of small-cap stocks has, at times, delivered returns that far outpace the S&P 500. These companies, typically valued between $300 million and $2 billion, offer investors a unique blend of risk and reward. In recent years, and especially in 2024 and 2025, small-cap stocks have begun to shine anew, capturing the attention of savvy investors eager for outsized gains. This essay explores the drivers behind small-cap outperformance, presents recent examples, and examines why the current environment may be especially favorable for these nimble market players.

The Cyclical Nature of Small-Cap vs. Large-Cap Performance Stock market leadership is cyclical. For much of the past decade, large-cap stocks—especially the “Magnificent Seven” tech giants—have dominated returns, overshadowing small- and mid-cap peers2. However, history shows that these cycles eventually reverse. According to Furey Research Partners, leadership alternates between large- and small-caps in cycles typically lasting seven to ten years2. The current era of large-cap outperformance has been unusually long, but signs suggest a shift is underway as we move through 2025. Several factors are converging to support small-cap outperformance: ● Earnings Growth Acceleration: After lagging for several years, small-cap earnings growth is now expected to surpass that of large-caps, as smaller firms benefit from economic recovery, regulatory relief, and increased consumer demand25. ● Attractive Valuations: Small-cap stocks are trading at significant discounts to their large-cap peers. For instance, the S&P 600 trades at 15.5 times forward earnings, well below the S&P 500’s 21.6 times, making small-caps a relative bargain6. ● Market Rotation: As mega-cap tech stocks’ growth slows, investors are seeking new sources of return, leading to renewed interest in small- and mid-cap equities25. ● M&A and IPO Activity: A more favorable regulatory environment and pent-up demand for deals are expected to boost merger, acquisition, and IPO activity among small-caps, providing additional catalysts for outperformance25.

Why Small-Cap Stocks Can Outperform

Recent Examples: Small-Cap Stocks Outpacing the S&P 500 The past year has seen a remarkable resurgence in small-cap performance. According to Forbes, the Russell 2000 small-cap index rose 15% in the second half of 2024, beating the S&P 500 by more than five percentage points3. This rally was fueled by interest rate cuts, political shifts, and renewed optimism about economic growth. NerdWallet’s May 2025 data highlights several small-cap stocks with extraordinary one-year returns, vastly exceeding the S&P 500’s performance4: Ticker Company Name 1-Year Return (%) RGC Regencell Bioscience Holdings Ltd 8385.49 DRUG Bright Minds Biosciences Inc 2952.54 NUTX Nutex Health Inc 2385.84 QUBT Quantum Computing Inc 1123.68 EXOD Exodus Movement Inc 1092.00 UAMY United States Antimony Corp 1084.03 MNPR Monopar Therapeutics Inc 1071.68 ASTS AST SpaceMobile Inc 1071.43 EOSE Eos Energy Enterprises Inc 887.23 ... ... ... Source: Finviz, NerdWallet, as of May 15, 20254 These returns dwarf those of the S&P 500, which, while positive, have not approached the triple- or quadruple-digit gains seen among the best-performing small-caps.

What’s Driving This Outperformance?

Risks and Considerations While the potential for outperformance is real, small-cap stocks are not without risk: ● Volatility: Small-caps are more volatile than large-caps, with larger price swings in both directions. ● Liquidity: Lower trading volumes can make it harder to buy or sell shares without affecting the price. ● Execution Risk: Smaller companies may be more vulnerable to management missteps or operational setbacks. ● Economic Sensitivity: Many small-caps are more exposed to domestic economic cycles and may suffer disproportionately in downturns. Investors should diversify across sectors and individual names, conduct thorough due diligence, and be prepared for short-term volatility in pursuit of long-term gains.

Outlook for 2025 and Beyond After years in the shadows, small-cap stocks are poised for a period of renewed outperformance. Earnings growth is accelerating, valuations are attractive, and market conditions are increasingly favorable for smaller companies2356. As the market cycle turns, investors who diversify into high-quality small-caps may capture returns that outpace the S&P 500. As Ken Farsalas, portfolio manager of the Oberweis Small-Cap Opportunities Fund, puts it: “It’s a generational opportunity to buy small-cap stocks. I would be stunned if small caps didn’t outperform large caps over the next decade.”3

Conclusion Small-cap stocks have a long history of outperforming the S&P 500 during certain market cycles. Their growth potential, niche focus, and ability to capitalize on economic recoveries make them a compelling addition to a diversified portfolio. While risks remain, the current environment—marked by attractive valuations, policy support, and accelerating earnings—provides fertile ground for small-cap outperformance. For investors willing to embrace some volatility and do their homework, small-cap stocks may offer the best chance to beat the market in the years ahead.