Introduction

Small-cap industrial stocks—those with market capitalizations between $300 million and $2 billion—are often overlooked in favor of their large-cap counterparts. Yet, these nimble, innovative firms are essential to the functioning and growth of the global economy. From manufacturing and infrastructure to logistics, automation, and engineering, small-cap industrials are the unsung heroes that drive progress across sectors. As the world faces rapid technological change, supply chain disruptions, and the need for sustainable solutions, these companies are more important than ever.

This essay explores why small-cap industrial stocks are vital to economic growth, what makes them attractive investments, the key drivers and risks involved, and how to identify the most promising opportunities. Two detailed tables are included to illustrate the macroeconomic drivers of small-cap industrial performance and highlight standout companies in the sector.

Why Small-Cap Industrial Stocks Matter

Small-cap industrials play a unique role in the economic ecosystem. Their agility allows them to adapt quickly to changing market demands and technological advancements. Many focus on niche markets or provide highly specialized solutions, making them indispensable partners for larger corporations and government projects. Their contributions extend beyond innovation—they are significant employers in local communities, supporting skilled labor and regional economic development. The growth of these firms often has a multiplier effect, stimulating demand for suppliers, logistics, and related services.

In addition, small-cap industrials are crucial for supply chain resilience. They frequently fill critical gaps in supply chains, especially in specialized components, materials, or processes. Their flexibility and willingness to innovate help ensure the resilience and efficiency of broader industrial networks. Many are also exporters, bringing in foreign revenue and helping to balance trade deficits.

Macroeconomic Drivers of Small-Cap Industrial Performance

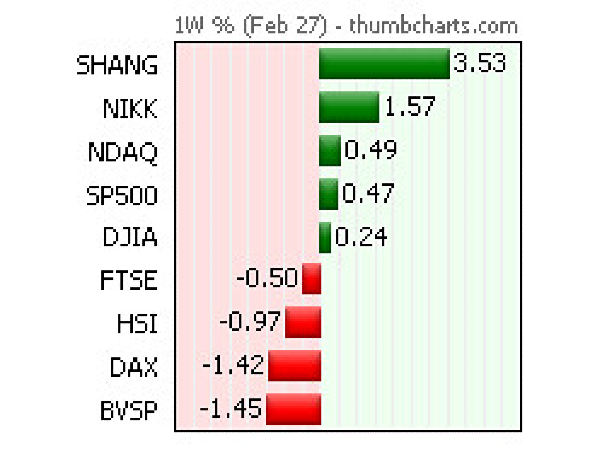

Small-cap industrials are highly sensitive to macroeconomic variables. Understanding these drivers is essential for investors seeking to capitalize on the sector’s growth potential. The table below summarizes key macroeconomic factors and their expected relationship with small-cap industrial stock returns:

Macroeconomic Variable Expected Impact on Small-Cap Returns

GDP Positive (+)

Consumer Price Index Negative (–)

Producer Price Index Negative (–)

Industrial Production Positive (+)

Retail Sales Positive (+)

Housing Starts Positive (+)

Consumer Confidence Positive (+)

Interest Rate Negative (–)

Money Supply Positive (+)

Public Debt Negative (–)

Tax Rate Negative (–)

Energy Prices Negative (–)

Source: FranchSabaidini, MScBA, University of Twente (2023)

As shown, economic expansion, robust industrial production, and strong consumer confidence all support small-cap industrial growth. Conversely, rising interest rates, inflation, and energy prices can weigh on performance. This cyclical sensitivity means small-cap industrials often outperform during economic recoveries and periods of infrastructure investment.

Key Growth Drivers

- Infrastructure Investment

Government spending on infrastructure—roads, bridges, utilities, and public transportation—directly benefits small-cap industrials involved in construction, engineering, and materials supply. The recent emphasis on infrastructure renewal in the United States, Europe, and parts of Asia has created strong tailwinds for these companies.

- Technological Advancements

The adoption of automation, robotics, and smart manufacturing technologies is creating new opportunities for small-cap firms specializing in industrial software, sensors, and advanced machinery. These companies are often at the forefront of the “Industry 4.0” revolution, helping manufacturers increase efficiency, reduce costs, and improve product quality.

- Reshoring and Localization

Geopolitical tensions and supply chain disruptions have accelerated trends toward domestic manufacturing and sourcing. Small-cap industrials are often at the forefront of reshoring efforts, providing local alternatives to global suppliers and helping to strengthen national supply chains.

- Sustainability and Green Initiatives

As industries strive to reduce their environmental footprint, small-cap companies developing energy-efficient equipment, recycling technologies, or sustainable materials are seeing increased demand. These firms are well-positioned to benefit from the global push toward decarbonization and resource efficiency.

What Makes Small-Cap Industrials Attractive Investments?

Small-cap industrials offer several advantages for investors:

● Higher Growth Potential: Their smaller size allows for faster expansion and market penetration.

● Access to Innovation: Many operate in emerging industries and niche markets, leading in new technologies.

● Diversification: They provide exposure to sectors and industries underrepresented in large-cap portfolios.

● Value Opportunities: Small-caps often trade at discounts due to less analyst coverage and institutional ownership.

● Outperformance in Recovery: Historically, they outperform large-caps during economic upturns.

However, these advantages come with heightened risks, including greater volatility, liquidity challenges, and sensitivity to economic cycles.

Examples of Promising Small-Cap Industrial Stocks

The table below highlights several standout small-cap industrial companies, their focus areas, recent performance, and key strengths:

Ticker Company Name Focus Area 1-Year Return (%) Key Strengths Website

ASTE Astec Industries Road & infrastructure equip. 25.2 Innovation, infrastructure astecindustries.com

GTLS Chart Industries Cryogenic & clean energy tech 34.7 LNG, clean energy, patents chartindustries.com

BMI Badger Meter Flow measurement/smart infra 19.6 Water tech, sustainability badgermeter.com

EOSE Eos Energy Grid-scale battery storage 887.2 Energy storage innovation eose.com

NGS Natural Gas Services Gas compression equipment 79.0 Diversified, energy sector ngsgi.com

Sources: NerdWallet, Alice Blue, Company Reports

These companies exemplify the diversity and innovation found within the small-cap industrial sector. From advanced energy storage and clean energy infrastructure to smart water management, they are positioned to benefit from secular growth trends and infrastructure investment.

Risks and Challenges

Investing in small-cap industrials is not without challenges. The sector is highly cyclical, and performance can lag during recessions or periods of economic uncertainty. Lower trading volumes can increase price volatility and execution risk. Rising input costs, such as materials and energy, can squeeze margins, while regulatory changes—especially around environmental standards—can increase compliance costs. As with all small-caps, company-specific risks such as management quality and customer concentration must be carefully evaluated.

How to Identify the Best Opportunities

When evaluating small-cap industrial stocks, investors should focus on:

● Revenue Growth: Look for consistent, double-digit growth, especially in expanding end-markets.

● Operating Margin: High and rising margins indicate operational efficiency.

● Debt/Equity Ratio: Manageable debt levels reduce risk during downturns.

● Return on Equity (ROE): High ROE shows effective use of capital.

● Management Quality: Experienced, transparent leadership is crucial.

● Diversified Customer Base: Reduces reliance on single markets or clients.

Conclusion

Small-cap industrial stocks are the backbone of economic growth, driving innovation, supporting local economies, and ensuring the resilience of supply chains. Their agility, exposure to cyclical upswings, and focus on niche markets make them attractive for investors seeking higher growth and diversification. However, their sensitivity to macroeconomic variables and inherent volatility require careful analysis and risk management. By focusing on firms with strong fundamentals, technological leadership, and diversified operations, investors can tap into the backbone of economic expansion and participate in the next wave of industrial innovation.

Introduction Small-cap industrial stocks—those with market capitalizations between $300 million and $2 billion—are often overlooked in favor of their large-cap counterparts. Yet, these nimble, innovative firms are essential to the functioning and growth of the global economy. From manufacturing and infrastructure to logistics, automation, and engineering, small-cap industrials are the unsung heroes that drive progress across sectors. As the world faces rapid technological change, supply chain disruptions, and the need for sustainable solutions, these companies are more important than ever. This essay explores why small-cap industrial stocks are vital to economic growth, what makes them attractive investments, the key drivers and risks involved, and how to identify the most promising opportunities. Two detailed tables are included to illustrate the macroeconomic drivers of small-cap industrial performance and highlight standout companies in the sector.

Why Small-Cap Industrial Stocks Matter Small-cap industrials play a unique role in the economic ecosystem. Their agility allows them to adapt quickly to changing market demands and technological advancements. Many focus on niche markets or provide highly specialized solutions, making them indispensable partners for larger corporations and government projects. Their contributions extend beyond innovation—they are significant employers in local communities, supporting skilled labor and regional economic development. The growth of these firms often has a multiplier effect, stimulating demand for suppliers, logistics, and related services. In addition, small-cap industrials are crucial for supply chain resilience. They frequently fill critical gaps in supply chains, especially in specialized components, materials, or processes. Their flexibility and willingness to innovate help ensure the resilience and efficiency of broader industrial networks. Many are also exporters, bringing in foreign revenue and helping to balance trade deficits.

Macroeconomic Drivers of Small-Cap Industrial Performance Small-cap industrials are highly sensitive to macroeconomic variables. Understanding these drivers is essential for investors seeking to capitalize on the sector’s growth potential. The table below summarizes key macroeconomic factors and their expected relationship with small-cap industrial stock returns: Macroeconomic Variable Expected Impact on Small-Cap Returns GDP Positive (+) Consumer Price Index Negative (–) Producer Price Index Negative (–) Industrial Production Positive (+) Retail Sales Positive (+) Housing Starts Positive (+) Consumer Confidence Positive (+) Interest Rate Negative (–) Money Supply Positive (+) Public Debt Negative (–) Tax Rate Negative (–) Energy Prices Negative (–) Source: FranchSabaidini, MScBA, University of Twente (2023) As shown, economic expansion, robust industrial production, and strong consumer confidence all support small-cap industrial growth. Conversely, rising interest rates, inflation, and energy prices can weigh on performance. This cyclical sensitivity means small-cap industrials often outperform during economic recoveries and periods of infrastructure investment.

Key Growth Drivers

What Makes Small-Cap Industrials Attractive Investments? Small-cap industrials offer several advantages for investors: ● Higher Growth Potential: Their smaller size allows for faster expansion and market penetration. ● Access to Innovation: Many operate in emerging industries and niche markets, leading in new technologies. ● Diversification: They provide exposure to sectors and industries underrepresented in large-cap portfolios. ● Value Opportunities: Small-caps often trade at discounts due to less analyst coverage and institutional ownership. ● Outperformance in Recovery: Historically, they outperform large-caps during economic upturns. However, these advantages come with heightened risks, including greater volatility, liquidity challenges, and sensitivity to economic cycles.

Examples of Promising Small-Cap Industrial Stocks The table below highlights several standout small-cap industrial companies, their focus areas, recent performance, and key strengths: Ticker Company Name Focus Area 1-Year Return (%) Key Strengths Website ASTE Astec Industries Road & infrastructure equip. 25.2 Innovation, infrastructure astecindustries.com

GTLS Chart Industries Cryogenic & clean energy tech 34.7 LNG, clean energy, patents chartindustries.com

BMI Badger Meter Flow measurement/smart infra 19.6 Water tech, sustainability badgermeter.com

EOSE Eos Energy Grid-scale battery storage 887.2 Energy storage innovation eose.com

NGS Natural Gas Services Gas compression equipment 79.0 Diversified, energy sector ngsgi.com

Sources: NerdWallet, Alice Blue, Company Reports These companies exemplify the diversity and innovation found within the small-cap industrial sector. From advanced energy storage and clean energy infrastructure to smart water management, they are positioned to benefit from secular growth trends and infrastructure investment.

Risks and Challenges Investing in small-cap industrials is not without challenges. The sector is highly cyclical, and performance can lag during recessions or periods of economic uncertainty. Lower trading volumes can increase price volatility and execution risk. Rising input costs, such as materials and energy, can squeeze margins, while regulatory changes—especially around environmental standards—can increase compliance costs. As with all small-caps, company-specific risks such as management quality and customer concentration must be carefully evaluated.

How to Identify the Best Opportunities When evaluating small-cap industrial stocks, investors should focus on: ● Revenue Growth: Look for consistent, double-digit growth, especially in expanding end-markets. ● Operating Margin: High and rising margins indicate operational efficiency. ● Debt/Equity Ratio: Manageable debt levels reduce risk during downturns. ● Return on Equity (ROE): High ROE shows effective use of capital. ● Management Quality: Experienced, transparent leadership is crucial. ● Diversified Customer Base: Reduces reliance on single markets or clients.

Conclusion Small-cap industrial stocks are the backbone of economic growth, driving innovation, supporting local economies, and ensuring the resilience of supply chains. Their agility, exposure to cyclical upswings, and focus on niche markets make them attractive for investors seeking higher growth and diversification. However, their sensitivity to macroeconomic variables and inherent volatility require careful analysis and risk management. By focusing on firms with strong fundamentals, technological leadership, and diversified operations, investors can tap into the backbone of economic expansion and participate in the next wave of industrial innovation.