Introduction

Dividend growth investing is a strategy that focuses on building wealth through companies that not only pay dividends but consistently increase their payouts over time. While large-cap stocks are often the go-to for dividend investors due to their stability and established track records, small-cap stocks—companies with market capitalizations typically between $300 million and $2 billion—offer unique opportunities for those seeking both income and capital appreciation. Small-cap dividend growers can provide higher growth potential, diversification, and the chance to get in early on the next generation of blue-chip companies.

This essay explores why small-cap stocks are an attractive choice for dividend growth investors, the characteristics that define the best candidates, and a selection of top small-cap dividend growth stocks to consider in 2025. It also covers the risks, screening methods, and practical tips for building a successful dividend growth portfolio with small-caps.

Why Consider Small-Cap Stocks for Dividend Growth?

- Growth Potential

Small-cap companies are often in the early stages of their business life cycle. They have more room to expand revenues, profits, and, crucially, dividends. While their dividend yields may be modest compared to large-caps, their payout growth rates can be much higher. Over time, this compounding effect can lead to significant income and capital gains.

- Under-the-Radar Opportunities

Many small-cap dividend stocks are overlooked by institutional investors and analysts, resulting in attractive valuations. This lack of attention can create opportunities for individual investors to buy quality companies before they become widely recognized.

- Diversification

Adding small-cap dividend growers to a portfolio of large-cap dividend stocks can provide diversification across sectors, industries, and company sizes, reducing overall risk and smoothing out returns.

- Potential for Re-Rating

As small-cap companies grow and consistently raise dividends, they may attract more investor attention, leading to a higher valuation multiple and capital appreciation.

Key Characteristics of the Best Small-Cap Dividend Growth Stocks

Not all small-cap stocks are suitable for dividend growth investing. The best candidates typically share several important traits:

- Consistent Dividend Growth

Look for companies with a multi-year track record of increasing dividends. This demonstrates financial strength and management’s commitment to returning capital to shareholders.

- Strong Cash Flow

Reliable and growing free cash flow is essential for sustaining and increasing dividend payments.

- Healthy Balance Sheet

A manageable debt load and strong liquidity reduce the risk of dividend cuts during economic downturns.

- Reasonable Payout Ratio

A payout ratio (dividends as a percentage of earnings) below 60% is generally considered sustainable, allowing room for future increases.

- Competitive Advantage

Companies with durable business models, niche market leadership, or proprietary products are more likely to maintain growth and profitability.

- Positive Industry Trends

Favorable sector tailwinds—such as demographic shifts, regulatory changes, or technological innovation—can support long-term growth.

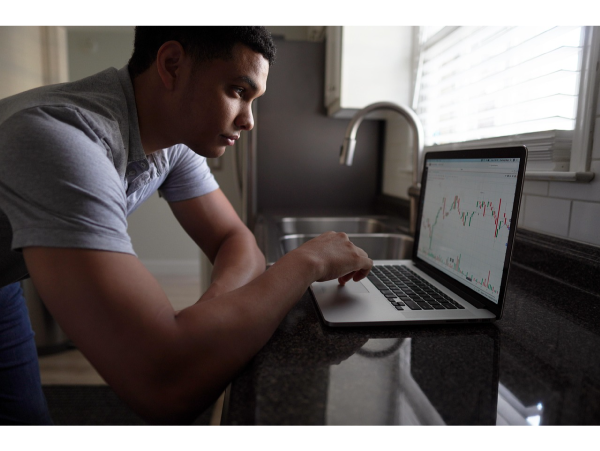

How to Find the Best Small-Cap Dividend Growth Stocks

- Use Stock Screeners

Platforms like Finviz, Yahoo Finance, and Seeking Alpha allow you to filter for small-cap stocks with positive dividend growth rates, low payout ratios, and strong financial metrics.

- Review Dividend Aristocrats and Champions Lists

While most dividend aristocrats are large-caps, some lists include small-caps with at least five or ten years of consecutive dividend increases.

- Analyze Company Financials

Study annual reports and earnings releases for evidence of growing revenues, profits, and free cash flow.

- Monitor Insider Ownership and Buybacks

High insider ownership and share repurchase programs can signal management’s confidence in the company’s prospects.

Risks of Investing in Small-Cap Dividend Growth Stocks

- Volatility

Small-cap stocks are generally more volatile than large-caps, leading to larger short-term price swings.

- Dividend Cuts

Smaller companies may be more vulnerable to economic downturns, which can force dividend reductions or suspensions.

- Liquidity

Lower trading volumes can result in wider bid-ask spreads and difficulty entering or exiting positions.

- Limited Analyst Coverage

Less coverage can mean fewer resources for investors to analyze, increasing the importance of due diligence.

Top Small-Cap Dividend Growth Stocks for 2025

Here are several small-cap stocks with a strong history of dividend growth, solid fundamentals, and promising outlooks. (Always conduct your own research before investing.)

Symbol Company Name Sector Market Cap Dividend Yield Years of Increases Company Website

SJI South Jersey Industries Utilities $1.1B 3.2% 21 https://www.sjindustries.com

UHT Universal Health Realty REIT/Healthcare $800M 5.5% 39 https://www.uhrit.com

NWN Northwest Natural Holding Utilities $1.3B 4.3% 68 https://www.nwnatural.com

FLIC First of Long Island Corp. Financials $350M 4.7% 47 https://www.flic.com

ODC Oil-Dri Corporation of America Materials $400M 2.0% 21 https://www.oildri.com

MGEE MGE Energy Utilities $2.0B 2.1% 48 https://www.mgeenergy.com

Case Study: Northwest Natural Holding (NWN)

Northwest Natural Holding is a regulated natural gas utility serving customers in the Pacific Northwest. With 68 consecutive years of dividend increases, NWN stands out as one of the most reliable small-cap dividend growth stocks in the market. The company benefits from stable cash flows, prudent management, and a supportive regulatory environment. While its yield is solid, the real attraction for long-term investors is the consistency of its dividend growth, which has averaged 3–4% annually over the past decade.

Building a Small-Cap Dividend Growth Portfolio

- Diversify Across Sectors

Don’t concentrate your holdings in a single industry. Utilities, REITs, financials, industrials, and consumer staples all offer small-cap dividend growth opportunities.

- Reinvest Dividends

Take advantage of compounding by reinvesting dividends, either through a dividend reinvestment plan (DRIP) or manually purchasing additional shares.

- Monitor Payout Ratios and Earnings

Keep an eye on payout ratios and earnings growth to ensure dividends remain sustainable.

- Regularly Review Holdings

Economic conditions and company fundamentals can change. Review your portfolio at least quarterly and be prepared to make adjustments if a company’s outlook deteriorates.

Practical Tips for Success

● Start Small: Build your portfolio gradually as you gain confidence in your research and the companies you select.

● Focus on Quality: Prioritize companies with long histories of dividend growth and strong balance sheets.

● Be Patient: Small-cap dividend growth investing is a long-term strategy. Don’t be discouraged by short-term volatility.

● Stay Informed: Follow company news, earnings reports, and industry trends to stay ahead of potential risks and opportunities.

Conclusion

Small-cap stocks can be a powerful addition to a dividend growth investor’s portfolio. While they come with higher risks, the potential rewards—including faster dividend growth, capital appreciation, and diversification—make them worth considering for investors with a long-term horizon and a willingness to do their homework. By focusing on companies with strong fundamentals, a proven track record of dividend increases, and a commitment to shareholder returns, investors can build a resilient and rewarding income stream that grows over time.

The best small-cap dividend growth stocks are those that combine financial strength, consistent performance, and the ability to adapt to changing market conditions. With careful selection and ongoing monitoring, these companies can help investors achieve their goals of growing income and building wealth for the future.

Introduction Dividend growth investing is a strategy that focuses on building wealth through companies that not only pay dividends but consistently increase their payouts over time. While large-cap stocks are often the go-to for dividend investors due to their stability and established track records, small-cap stocks—companies with market capitalizations typically between $300 million and $2 billion—offer unique opportunities for those seeking both income and capital appreciation. Small-cap dividend growers can provide higher growth potential, diversification, and the chance to get in early on the next generation of blue-chip companies. This essay explores why small-cap stocks are an attractive choice for dividend growth investors, the characteristics that define the best candidates, and a selection of top small-cap dividend growth stocks to consider in 2025. It also covers the risks, screening methods, and practical tips for building a successful dividend growth portfolio with small-caps.

Why Consider Small-Cap Stocks for Dividend Growth?

Key Characteristics of the Best Small-Cap Dividend Growth Stocks Not all small-cap stocks are suitable for dividend growth investing. The best candidates typically share several important traits:

How to Find the Best Small-Cap Dividend Growth Stocks

Risks of Investing in Small-Cap Dividend Growth Stocks

Top Small-Cap Dividend Growth Stocks for 2025 Here are several small-cap stocks with a strong history of dividend growth, solid fundamentals, and promising outlooks. (Always conduct your own research before investing.) Symbol Company Name Sector Market Cap Dividend Yield Years of Increases Company Website SJI South Jersey Industries Utilities $1.1B 3.2% 21 https://www.sjindustries.com

UHT Universal Health Realty REIT/Healthcare $800M 5.5% 39 https://www.uhrit.com

NWN Northwest Natural Holding Utilities $1.3B 4.3% 68 https://www.nwnatural.com

FLIC First of Long Island Corp. Financials $350M 4.7% 47 https://www.flic.com

ODC Oil-Dri Corporation of America Materials $400M 2.0% 21 https://www.oildri.com

MGEE MGE Energy Utilities $2.0B 2.1% 48 https://www.mgeenergy.com

Case Study: Northwest Natural Holding (NWN) Northwest Natural Holding is a regulated natural gas utility serving customers in the Pacific Northwest. With 68 consecutive years of dividend increases, NWN stands out as one of the most reliable small-cap dividend growth stocks in the market. The company benefits from stable cash flows, prudent management, and a supportive regulatory environment. While its yield is solid, the real attraction for long-term investors is the consistency of its dividend growth, which has averaged 3–4% annually over the past decade.

Building a Small-Cap Dividend Growth Portfolio

Practical Tips for Success ● Start Small: Build your portfolio gradually as you gain confidence in your research and the companies you select. ● Focus on Quality: Prioritize companies with long histories of dividend growth and strong balance sheets. ● Be Patient: Small-cap dividend growth investing is a long-term strategy. Don’t be discouraged by short-term volatility. ● Stay Informed: Follow company news, earnings reports, and industry trends to stay ahead of potential risks and opportunities.

Conclusion Small-cap stocks can be a powerful addition to a dividend growth investor’s portfolio. While they come with higher risks, the potential rewards—including faster dividend growth, capital appreciation, and diversification—make them worth considering for investors with a long-term horizon and a willingness to do their homework. By focusing on companies with strong fundamentals, a proven track record of dividend increases, and a commitment to shareholder returns, investors can build a resilient and rewarding income stream that grows over time. The best small-cap dividend growth stocks are those that combine financial strength, consistent performance, and the ability to adapt to changing market conditions. With careful selection and ongoing monitoring, these companies can help investors achieve their goals of growing income and building wealth for the future.