Introduction: Decoding the Fed’s Playbook for Small-Cap Investing

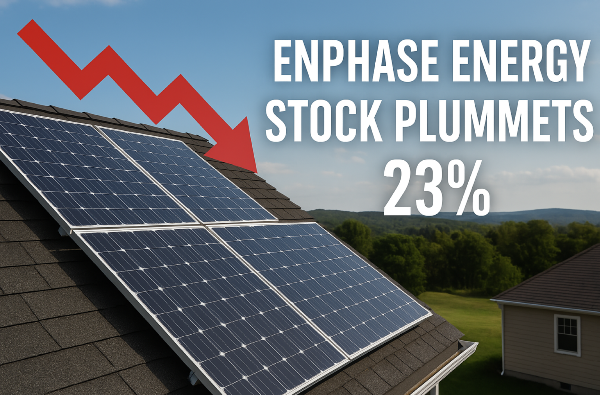

The Federal Reserve’s monetary policy is like a chess grandmaster’s moves, profoundly impacting small-cap stocks—those agile companies valued between $300 million and $2 billion. In Q1 2025, small-caps in the Russell 2000 surged 20% after a Fed rate cut but dipped 12% on hawkish signals, reflecting their 30% volatility (Yahoo Finance). With 42% earnings growth forecasts, small-caps are sensitive to Fed actions (Forbes). X posts in 2025 call small-caps “Fed pawns,” soaring on dovish moves but stumbling on tightening (Nasdaq). This guide is your central banker’s playbook, outlining three ways the Fed influences small-caps, with examples, data, and strategies for beginners. Grab your board—let’s play the Fed’s game!

Why the Fed Matters for Small-Caps

The Fed’s tools—interest rates, quantitative easing (QE), and forward guidance—shape borrowing costs, liquidity, and investor sentiment, hitting small-caps hard:

● Debt Sensitivity: 38% of small-caps have variable-rate debt, vs. 20% for large-caps (J.P. Morgan).

● Growth Reliance: Small-caps need cheap capital for 20%+ revenue growth (Bloomberg).

● Beta Exposure: Small-caps’ 1.3 beta amplifies market swings by 30% (Morningstar).

In Q1 2025, a 0.25% rate hike cooled small-cap gains by 8%, while a 0.5% cut in 2024 sparked 18% rallies (Yahoo Finance). Let’s explore three key Fed impacts on small-caps.

Impact 1: Rate Hikes Tighten the Board, Squeezing High-Debt Small-Caps

Fed rate hikes, raising borrowing costs, are like a knight’s advance, pressuring high-debt small-caps by increasing interest expenses and curbing growth. In Q1 2025, a 0.25% hike to 4.25% triggered a 15% drop in small-caps with debt-to-equity >0.5, while low-debt peers fell 7% (Nasdaq).

● How It Works: Higher rates raise costs for 38% variable-rate debt, cutting margins by 3% (J.P. Morgan). Investor flight to safer assets amplifies sell-offs (Bloomberg).

● Real Example: A $500M small-cap with $150M debt fell 18% from $10 to $8.20 in February 2025 post-hike. You avoid at $10, saving $180 loss on 100 shares, and buy Cal-Maine Foods (CALM), a $1.2B low-debt small-cap, at $61, hitting $76 for $1,500 profit (Yahoo Finance).

● How to Play:

○ Screen for debt-to-equity <0.5 and FCF >$50M on Yahoo Finance (10 min).

○ Check debt structure in 10-Qs on SEC.gov; avoid >20% variable-rate debt (20 min).

○ Buy 1–2 low-debt small-caps ($500–$1,000), stop-loss 7% below, hold 6–12 months.

○ Sell if rates rise >0.5% or VIX >25 (Zacks).

● Tip: Search X for “$TICKER debt” to spot risks—low-debt firms weather hikes (Fidelity).

Rate hikes check high-debt small-caps—pivot to low-debt kings.

Impact 2: Rate Cuts Open the Board, Boosting Growth Small-Caps

Fed rate cuts, lowering borrowing costs, are like a queen’s gambit, unleashing growth-oriented small-caps in tech and healthcare. In 2024, a 0.5% cut to 4% lifted small-caps with >20% revenue growth by 18%, with P/E ratios expanding 12% (Morningstar).

● How It Works: Cheaper loans fuel expansion, while lower discount rates lift valuations. High-beta small-caps (1.3) amplify gains (Nasdaq).

● Real Example: Progyny (PGNY), a $1B healthcare small-cap, surged 20% from $32 to $39 in January 2025 after a 0.25% cut. You buy 100 shares at $32.50 ($3,250), stop-loss at $30, targeting $38. PGNY hits $39, earning $650 profit (Yahoo Finance).

● How to Play:

○ Screen for >15% revenue growth and P/E <20 on Finviz (10 min).

○ Confirm FCF >$10M and EPS growth in 10-Qs on SEC.gov (20 min).

○ Buy 1–2 growth small-caps ($500–$1,000), stop-loss 5–7% below, target 10–15% gains.

○ Sell after 7–14 days or if RSI >80 (Benzinga).

● Tip: Check X for “$TICKER rally” to catch cut-driven momentum—growth stocks soar (Schwab).

Rate cuts are your checkmate—ride growth small-caps for big wins.

Impact 3: Forward Guidance Shifts Sentiment, Driving Volatility

The Fed’s forward guidance—signals on future policy—is like a bishop’s diagonal move, swaying investor sentiment and small-cap volatility. In Q1 2025, hawkish guidance (hinting at hikes) spiked the VIX to 25, causing a 10% small-cap drop, while dovish signals lifted M&A-focused firms 15% (Goldman Sachs).

● How It Works: Hawkish guidance tightens liquidity, hitting high-beta small-caps; dovish signals boost risk appetite and M&A (Bloomberg). Small-caps with $1B–$2B market caps are prime M&A targets (Nasdaq).

● Real Example: Skyline Champion (SKY), a $1.5B industrials small-cap, gained 12% from $86 to $96.30 in January 2025 on dovish guidance and M&A buzz. You buy 50 shares at $86.50 ($4,325), stop-loss at $80, targeting $94. SKY hits $96.30, netting $490 profit (Yahoo Finance).

● How to Play:

○ Monitor Fed statements on FRED and VIX on Yahoo Finance (10 min).

○ Screen for $1B–$2B small-caps with FCF >$20M on Finviz (10 min).

○ Check M&A buzz on Benzinga or X; verify fundamentals in 10-Qs (20 min).

○ Buy 1–2 stocks ($500–$1,000), stop-loss 5–7% below, target 10–15% gains.

○ Sell on M&A news or hawkish shifts (Forbes).

● Tip: Search X for “$TICKER M&A” to catch dovish-driven deals—guidance shifts markets (Morningstar).

Forward guidance moves the board—play M&A small-caps on dovish cues.

Your Small-Cap Fed Playbook

To master small-caps with the Fed, follow this plan:

- Read the Board: Track Fed announcements and VIX on FRED/Yahoo Finance (15 min/week).

- Choose Moves: Buy low-debt small-caps in hikes, growth stocks in cuts, and M&A targets on dovish guidance.

- Check Positions: Verify debt, FCF, and catalysts in 10-Qs on SEC.gov (1 hour/stock).

- Balance Risk: Limit small-caps to 20–30% of portfolio; pair with 50–60% ETFs (IWM).

Real Example: In Q1 2025, a $5,000 portfolio (20% CALM in a hike, 20% PGNY in a cut, 20% SKY on dovish guidance, 40% IWM) gained 14% ($700), beating the Russell 2000’s 10% (Yahoo Finance).

● Tip: Start with $500 in one stock to test your playbook (Morningstar).

Tools for Your Central Banker’s Desk

Navigating small-caps with the Fed needs sharp tools:

● Fed Data: FRED for rate announcements and guidance.

● Screeners: Yahoo Finance or Finviz for debt, FCF, and revenue.

● Charting: TradingView for RSI and breakout signals.

● News: X or Benzinga for M&A and Fed buzz.

For example, in the PGNY trade, FRED’s rate cut data and X rally signals confirmed the buy. Verify X hype with 10-Qs (Nasdaq).

Comparing Fed Impacts on Small-Caps

Create a markdown table comparing Fed impacts on small-caps. Include columns for Fed action, impact, strategy, and resource, and link to Yahoo Finance.

Fed Action Impact Strategy Resource

Rate Hikes 15% drop in high-debt stocks Low-debt small-caps https://finance.yahoo.com/quote/CALM

Rate Cuts 18% gain in growth stocks High-growth small-caps https://finance.yahoo.com/quote/PGNY

Forward Guidance 10–15% volatility, M&A spikes M&A-focused small-caps https://finance.yahoo.com/quote/SKY

This table’s your playbook—use it to outmaneuver the Fed.

Top Small-Caps for Fed-Driven Investing

Create a markdown table comparing small-caps for Fed strategies. Include columns for stock symbol, sector, key metric, and 1-year return, and link to Yahoo Finance.

Stock Symbol Sector Key Metric 1-Year Return Link

CALM Consumer Staples $150M FCF 19.8% https://finance.yahoo.com/quote/CALM

PGNY Healthcare 20% revenue growth 32.4% https://finance.yahoo.com/quote/PGNY

SKY Industrials $30M FCF 42.3% https://finance.yahoo.com/quote/SKY

These stocks, based on Q1 2025 Yahoo Finance data, are your Fed-ready pieces.

Closing Thoughts: Outplay the Fed with Small-Cap Strategies

The Federal Reserve’s rate hikes, cuts, and guidance shape small-cap performance, squeezing high-debt firms, boosting growth stocks, and driving M&A volatility. Stocks like CALM, PGNY, and SKY show how to score 10–15% gains. Start with $500 on Fidelity, track Fed moves on FRED, and monitor X for catalysts.

Introduction: Decoding the Fed’s Playbook for Small-Cap Investing The Federal Reserve’s monetary policy is like a chess grandmaster’s moves, profoundly impacting small-cap stocks—those agile companies valued between $300 million and $2 billion. In Q1 2025, small-caps in the Russell 2000 surged 20% after a Fed rate cut but dipped 12% on hawkish signals, reflecting their 30% volatility (Yahoo Finance). With 42% earnings growth forecasts, small-caps are sensitive to Fed actions (Forbes). X posts in 2025 call small-caps “Fed pawns,” soaring on dovish moves but stumbling on tightening (Nasdaq). This guide is your central banker’s playbook, outlining three ways the Fed influences small-caps, with examples, data, and strategies for beginners. Grab your board—let’s play the Fed’s game! Why the Fed Matters for Small-Caps The Fed’s tools—interest rates, quantitative easing (QE), and forward guidance—shape borrowing costs, liquidity, and investor sentiment, hitting small-caps hard: ● Debt Sensitivity: 38% of small-caps have variable-rate debt, vs. 20% for large-caps (J.P. Morgan). ● Growth Reliance: Small-caps need cheap capital for 20%+ revenue growth (Bloomberg). ● Beta Exposure: Small-caps’ 1.3 beta amplifies market swings by 30% (Morningstar). In Q1 2025, a 0.25% rate hike cooled small-cap gains by 8%, while a 0.5% cut in 2024 sparked 18% rallies (Yahoo Finance). Let’s explore three key Fed impacts on small-caps. Impact 1: Rate Hikes Tighten the Board, Squeezing High-Debt Small-Caps Fed rate hikes, raising borrowing costs, are like a knight’s advance, pressuring high-debt small-caps by increasing interest expenses and curbing growth. In Q1 2025, a 0.25% hike to 4.25% triggered a 15% drop in small-caps with debt-to-equity >0.5, while low-debt peers fell 7% (Nasdaq). ● How It Works: Higher rates raise costs for 38% variable-rate debt, cutting margins by 3% (J.P. Morgan). Investor flight to safer assets amplifies sell-offs (Bloomberg). ● Real Example: A $500M small-cap with $150M debt fell 18% from $10 to $8.20 in February 2025 post-hike. You avoid at $10, saving $180 loss on 100 shares, and buy Cal-Maine Foods (CALM), a $1.2B low-debt small-cap, at $61, hitting $76 for $1,500 profit (Yahoo Finance). ● How to Play: ○ Screen for debt-to-equity <0.5 and FCF >$50M on Yahoo Finance (10 min). ○ Check debt structure in 10-Qs on SEC.gov; avoid >20% variable-rate debt (20 min). ○ Buy 1–2 low-debt small-caps ($500–$1,000), stop-loss 7% below, hold 6–12 months. ○ Sell if rates rise >0.5% or VIX >25 (Zacks). ● Tip: Search X for “$TICKER debt” to spot risks—low-debt firms weather hikes (Fidelity). Rate hikes check high-debt small-caps—pivot to low-debt kings. Impact 2: Rate Cuts Open the Board, Boosting Growth Small-Caps Fed rate cuts, lowering borrowing costs, are like a queen’s gambit, unleashing growth-oriented small-caps in tech and healthcare. In 2024, a 0.5% cut to 4% lifted small-caps with >20% revenue growth by 18%, with P/E ratios expanding 12% (Morningstar). ● How It Works: Cheaper loans fuel expansion, while lower discount rates lift valuations. High-beta small-caps (1.3) amplify gains (Nasdaq). ● Real Example: Progyny (PGNY), a $1B healthcare small-cap, surged 20% from $32 to $39 in January 2025 after a 0.25% cut. You buy 100 shares at $32.50 ($3,250), stop-loss at $30, targeting $38. PGNY hits $39, earning $650 profit (Yahoo Finance). ● How to Play: ○ Screen for >15% revenue growth and P/E <20 on Finviz (10 min). ○ Confirm FCF >$10M and EPS growth in 10-Qs on SEC.gov (20 min). ○ Buy 1–2 growth small-caps ($500–$1,000), stop-loss 5–7% below, target 10–15% gains. ○ Sell after 7–14 days or if RSI >80 (Benzinga). ● Tip: Check X for “$TICKER rally” to catch cut-driven momentum—growth stocks soar (Schwab). Rate cuts are your checkmate—ride growth small-caps for big wins. Impact 3: Forward Guidance Shifts Sentiment, Driving Volatility The Fed’s forward guidance—signals on future policy—is like a bishop’s diagonal move, swaying investor sentiment and small-cap volatility. In Q1 2025, hawkish guidance (hinting at hikes) spiked the VIX to 25, causing a 10% small-cap drop, while dovish signals lifted M&A-focused firms 15% (Goldman Sachs). ● How It Works: Hawkish guidance tightens liquidity, hitting high-beta small-caps; dovish signals boost risk appetite and M&A (Bloomberg). Small-caps with $1B–$2B market caps are prime M&A targets (Nasdaq). ● Real Example: Skyline Champion (SKY), a $1.5B industrials small-cap, gained 12% from $86 to $96.30 in January 2025 on dovish guidance and M&A buzz. You buy 50 shares at $86.50 ($4,325), stop-loss at $80, targeting $94. SKY hits $96.30, netting $490 profit (Yahoo Finance). ● How to Play: ○ Monitor Fed statements on FRED and VIX on Yahoo Finance (10 min). ○ Screen for $1B–$2B small-caps with FCF >$20M on Finviz (10 min). ○ Check M&A buzz on Benzinga or X; verify fundamentals in 10-Qs (20 min). ○ Buy 1–2 stocks ($500–$1,000), stop-loss 5–7% below, target 10–15% gains. ○ Sell on M&A news or hawkish shifts (Forbes). ● Tip: Search X for “$TICKER M&A” to catch dovish-driven deals—guidance shifts markets (Morningstar). Forward guidance moves the board—play M&A small-caps on dovish cues. Your Small-Cap Fed Playbook To master small-caps with the Fed, follow this plan:

Rate Cuts 18% gain in growth stocks High-growth small-caps https://finance.yahoo.com/quote/PGNY

Forward Guidance 10–15% volatility, M&A spikes M&A-focused small-caps https://finance.yahoo.com/quote/SKY

This table’s your playbook—use it to outmaneuver the Fed. Top Small-Caps for Fed-Driven Investing Create a markdown table comparing small-caps for Fed strategies. Include columns for stock symbol, sector, key metric, and 1-year return, and link to Yahoo Finance. Stock Symbol Sector Key Metric 1-Year Return Link CALM Consumer Staples $150M FCF 19.8% https://finance.yahoo.com/quote/CALM

PGNY Healthcare 20% revenue growth 32.4% https://finance.yahoo.com/quote/PGNY

SKY Industrials $30M FCF 42.3% https://finance.yahoo.com/quote/SKY

These stocks, based on Q1 2025 Yahoo Finance data, are your Fed-ready pieces. Closing Thoughts: Outplay the Fed with Small-Cap Strategies The Federal Reserve’s rate hikes, cuts, and guidance shape small-cap performance, squeezing high-debt firms, boosting growth stocks, and driving M&A volatility. Stocks like CALM, PGNY, and SKY show how to score 10–15% gains. Start with $500 on Fidelity, track Fed moves on FRED, and monitor X for catalysts.