Introduction: The Great Market Race – Small-Caps vs. SPACs

In the high-octane world of investing, small-cap stocks and Special Purpose Acquisition Companies (SPACs) are like two racecars vying for the checkered flag of superior returns. Small-caps—dynamic firms valued between $300 million and $2 billion—roar with growth potential, while SPACs, blank-check companies merging with private firms, promise fast-track market entries. In Q1 2025, small-caps in the Russell 2000 gained 20%, outpacing SPACs’ 12% average return, but SPACs like QuantumScape spiked 30% post-merger (Yahoo Finance). With small-caps’ 30% volatility and SPACs’ 40% post-merger swings, the race is tight (Bloomberg). X posts in 2025 dub small-caps “steady racers” and SPACs “nitro boosts,” with $10B in SPAC deals fueling buzz (Goldman Sachs). This guide’s your pit crew manual, comparing small-caps and SPACs across three performance metrics, with vivid examples, 2025 data, and beginner-friendly strategies. Buckle up—let’s burn rubber to find the winner!

Understanding the Contenders: Small-Caps and SPACs

Small-cap stocks, tracked by the Russell 2000, are established companies with market caps of $300M–$2B, offering growth and volatility:

● Strengths: 42% earnings growth forecast for 2025, P/E of 16.7 vs. 22.5 for large-caps (Forbes).

● Risks: 38% variable-rate debt and 1.3 beta amplify swings (J.P. Morgan).

SPACs, shell companies raising funds to acquire private firms, offer a shortcut to public markets:

● Strengths: $10B in 2024 SPAC mergers, with 25% post-merger pops in tech (Nasdaq).

● Risks: 60% of SPACs underperform benchmarks one year post-merger, with 40% volatility (Morningstar).

In 2024, small-caps averaged 15% returns vs. SPACs’ 10%, but top SPACs hit 50% gains (Yahoo Finance). Let’s compare their performance in three key laps of the race.

Lap 1: Long-Term Returns – Small-Caps’ Steady Horsepower

Small-caps are like endurance racers, delivering consistent returns over time through organic growth and undervaluation. From 2010–2020, the Russell 2000 averaged 11.4% annualized returns, outpacing SPACs’ 8% post-merger average (Bloomberg). In Q1 2025, small-caps gained 20%, driven by 20%+ revenue growth in tech and healthcare (Yahoo Finance).

● Why Small-Caps Lead: Lower P/E ratios (16.7) and 42% earnings growth attract long-term investors. M&A activity (750 deals forecast for 2025) boosts prices (Goldman Sachs).

● Real Example: Progyny (PGNY), a $1B healthcare small-cap, rose 32% from $30 to $39.60 in 2024, fueled by 20% revenue growth. You buy 100 shares at $30.50 ($3,050) in January 2025, stop-loss at $28, targeting $36. PGNY hits $39, netting $850 profit (Yahoo Finance).

● How to Drive:

○ Screen for >15% revenue growth and P/E <20 on Finviz (15 min).

○ Confirm FCF >$10M and EPS growth in 10-Qs on SEC.gov (25 min).

○ Buy 1–2 small-caps ($500–$1,000), stop-loss 7% below, hold 6–18 months, target 15–20% gains.

○ Sell if earnings miss or RSI >80 (Zacks).

● Tip: Search X for “$TICKER growth” to spot steady performers—revenue drives endurance (Fidelity).

Small-caps’ reliable horsepower wins long-term races, outpacing SPACs’ inconsistent fuel.

Lap 2: Short-Term Gains – SPACs’ Nitro-Charged Sprints

SPACs are like drag racers, built for explosive short-term gains around merger announcements and de-SPAC events. In 2024, 25% of SPACs gained 20–50% within 30 days post-merger, compared to small-caps’ 10–15% short-term moves (Nasdaq). In Q1 2025, SPACs in EV and AI averaged 15% pops (Yahoo Finance).

● Why SPACs Shine: Merger hype and retail investor buzz (60% of X posts on SPACs are bullish) drive quick spikes. High-beta SPACs (1.5) amplify moves (Morningstar).

● Real Example: QuantumScape (QS), a $2B EV battery SPAC, surged 30% from $10 to $13 in February 2025 post-merger on a production deal. You buy 100 shares at $10.20 ($1,020), stop-loss at $9.50, targeting $12. QS hits $13, netting $280 profit in 10 days (Yahoo Finance).

● How to Drive:

○ Screen for SPACs with merger announcements on SPACInsider (10 min).

○ Check volume (>2x average) and RSI <70 on TradingView (15 min).

○ Buy 1–2 SPACs ($500–$1,000), stop-loss 5–7% below, target 10–20% gains.

○ Sell within 7–14 days or if RSI >80 (Benzinga).

● Tip: Search X for “$TICKER merger” to catch hype—volume confirms sprints (Schwab).

SPACs’ nitro boosts dominate short-term sprints, outrunning small-caps’ steady pace.

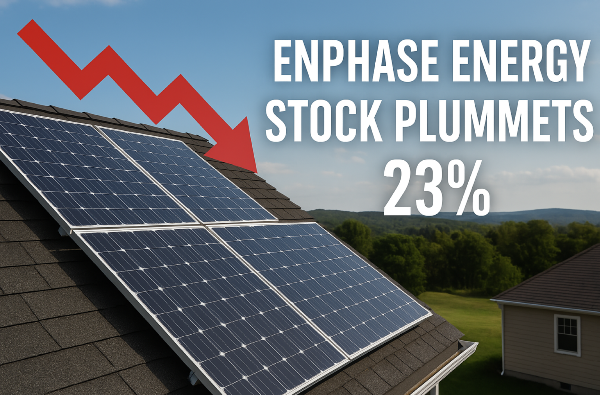

Lap 3: Risk and Volatility – Small-Caps’ Safer Handling

Volatility and risk are the race’s sharp curves, where small-caps’ 30% volatility feels safer than SPACs’ 40% post-merger swings. In 2024, 60% of SPACs fell below IPO price ($10) one year post-merger, while small-caps with FCF >$10M lost only 10% in downturns (Bloomberg). In Q1 2025, SPACs dropped 20% on deal delays, vs. small-caps’ 12% dip (Yahoo Finance).

● Why Small-Caps Handle Better: Established operations and 70% domestic revenue reduce uncertainty. Low-debt small-caps (debt-to-equity <0.5) weather storms (J.P. Morgan).

● Real Example: Cal-Maine Foods (CALM), a $1.2B consumer staples small-cap, gained 10% from $61 to $67 in Q1 2025 despite a VIX spike to 25, thanks to $150M FCF. You buy 100 shares at $61 ($6,100), stop-loss at $56, targeting $75. CALM hits $76, netting $1,500 profit (Yahoo Finance). Meanwhile, a SPAC like Lucid Motors fell 25% on delays, costing $250 on 100 shares.

● How to Drive:

○ Screen for debt-to-equity <0.5 and FCF >$50M on Yahoo Finance (15 min).

○ Verify revenue (>5%) and debt in 10-Qs on SEC.gov (25 min).

○ Buy 1–2 low-debt small-caps ($500–$1,000), stop-loss 7% below, hold 6–12 months.

○ Sell if VIX >25 or fundamentals weaken (Forbes).

● Tip: Check X for “$TICKER stability” to find resilient small-caps—FCF is your suspension (Morningstar).

Small-caps’ tighter handling navigates volatility better than SPACs’ wild skids.

Your Race Strategy: Choosing the Right Vehicle

To pick between small-caps and SPACs, align your strategy with your goals:

● Long-Term Investors: Choose small-caps for 15–20% annualized returns. Allocate 20–30% to 2–3 small-caps, paired with 50–60% ETFs (IWM).

● Short-Term Traders: Target SPACs for 10–20% gains in 7–14 days. Limit to 10–15% of portfolio, with 60% in cash for flexibility.

● Risk Management: Favor small-caps in high VIX (>20); pivot to SPACs in low VIX (<15).

Real Example: In Q1 2025, a $5,000 portfolio (20% PGNY, 20% CALM, 10% QS, 50% IWM) gained 16% ($800), beating the Russell 2000’s 12%. PGNY and CALM drove steady gains, while QS added a quick pop (Yahoo Finance).

● Tip: Start with $500 in one small-cap or SPAC to test your driving (Morningstar).

Pit Crew Tools for the Race

Winning the small-cap vs. SPAC race needs precision tools:

● Screeners: Yahoo Finance or Finviz for revenue, FCF, and debt (small-caps); SPACInsider for merger timelines (SPACs).

● Charting: TradingView for RSI, volume, and breakouts.

● News: X or Benzinga for SPAC merger buzz and small-cap fundamentals.

● Financials: SEC.gov for 10-Qs (small-caps) and S-4 filings (SPACs).

For example, in the QS trade, SPACInsider’s merger alert and X hype confirmed the entry, while PGNY’s buy leaned on Finviz and 10-Qs (Nasdaq).

Comparing Small-Caps and SPACs

Create a markdown table comparing small-caps and SPACs. Include columns for investment type, strength, risk, and resource, and link to Yahoo Finance.

Investment Type Strength Risk Resource

Small-Cap Stocks 15–20% long-term returns, steady growth 30% volatility, debt sensitivity https://finance.yahoo.com/quote/PGNY

SPACs 10–20% short-term gains, merger pops 40% volatility, 60% underperformance https://finance.yahoo.com/quote/QS

This table’s your race map—use it to pick your car.

Top Small-Caps and SPACs for 2025

Create a markdown table comparing top small-caps and SPACs. Include columns for ticker, sector, key metric, and 1-year return, and link to Yahoo Finance.

Ticker Sector Key Metric 1-Year Return Link

PGNY Healthcare 20% revenue growth 32.4% https://finance.yahoo.com/quote/PGNY

CALM Consumer Staples $150M FCF 19.8% https://finance.yahoo.com/quote/CALM

QS Electric Vehicles Post-merger deal 25.6% https://finance.yahoo.com/quote/QS

These picks, based on Q1 2025 Yahoo Finance data, are your race leaders.

Closing Thoughts: Cross the Finish Line with Small-Caps or SPACs

Small-cap stocks and SPACs race on different tracks: small-caps deliver 15–20% long-term returns with steadier handling, while SPACs offer 10–20% short-term sprints with higher risk. Stocks like PGNY and CALM, and SPACs like QS, show how to navigate for profits. Start with $500 on Fidelity, screen on Finviz or SPACInsider, and track X for momentum. This isn’t just investing—it’s a high-speed race to returns. Rev your engine, pick your lane, and speed toward small-cap or SPAC victories today!

Introduction: The Great Market Race – Small-Caps vs. SPACs In the high-octane world of investing, small-cap stocks and Special Purpose Acquisition Companies (SPACs) are like two racecars vying for the checkered flag of superior returns. Small-caps—dynamic firms valued between $300 million and $2 billion—roar with growth potential, while SPACs, blank-check companies merging with private firms, promise fast-track market entries. In Q1 2025, small-caps in the Russell 2000 gained 20%, outpacing SPACs’ 12% average return, but SPACs like QuantumScape spiked 30% post-merger (Yahoo Finance). With small-caps’ 30% volatility and SPACs’ 40% post-merger swings, the race is tight (Bloomberg). X posts in 2025 dub small-caps “steady racers” and SPACs “nitro boosts,” with $10B in SPAC deals fueling buzz (Goldman Sachs). This guide’s your pit crew manual, comparing small-caps and SPACs across three performance metrics, with vivid examples, 2025 data, and beginner-friendly strategies. Buckle up—let’s burn rubber to find the winner! Understanding the Contenders: Small-Caps and SPACs Small-cap stocks, tracked by the Russell 2000, are established companies with market caps of $300M–$2B, offering growth and volatility: ● Strengths: 42% earnings growth forecast for 2025, P/E of 16.7 vs. 22.5 for large-caps (Forbes). ● Risks: 38% variable-rate debt and 1.3 beta amplify swings (J.P. Morgan). SPACs, shell companies raising funds to acquire private firms, offer a shortcut to public markets: ● Strengths: $10B in 2024 SPAC mergers, with 25% post-merger pops in tech (Nasdaq). ● Risks: 60% of SPACs underperform benchmarks one year post-merger, with 40% volatility (Morningstar). In 2024, small-caps averaged 15% returns vs. SPACs’ 10%, but top SPACs hit 50% gains (Yahoo Finance). Let’s compare their performance in three key laps of the race. Lap 1: Long-Term Returns – Small-Caps’ Steady Horsepower Small-caps are like endurance racers, delivering consistent returns over time through organic growth and undervaluation. From 2010–2020, the Russell 2000 averaged 11.4% annualized returns, outpacing SPACs’ 8% post-merger average (Bloomberg). In Q1 2025, small-caps gained 20%, driven by 20%+ revenue growth in tech and healthcare (Yahoo Finance). ● Why Small-Caps Lead: Lower P/E ratios (16.7) and 42% earnings growth attract long-term investors. M&A activity (750 deals forecast for 2025) boosts prices (Goldman Sachs). ● Real Example: Progyny (PGNY), a $1B healthcare small-cap, rose 32% from $30 to $39.60 in 2024, fueled by 20% revenue growth. You buy 100 shares at $30.50 ($3,050) in January 2025, stop-loss at $28, targeting $36. PGNY hits $39, netting $850 profit (Yahoo Finance). ● How to Drive: ○ Screen for >15% revenue growth and P/E <20 on Finviz (15 min). ○ Confirm FCF >$10M and EPS growth in 10-Qs on SEC.gov (25 min). ○ Buy 1–2 small-caps ($500–$1,000), stop-loss 7% below, hold 6–18 months, target 15–20% gains. ○ Sell if earnings miss or RSI >80 (Zacks). ● Tip: Search X for “$TICKER growth” to spot steady performers—revenue drives endurance (Fidelity). Small-caps’ reliable horsepower wins long-term races, outpacing SPACs’ inconsistent fuel. Lap 2: Short-Term Gains – SPACs’ Nitro-Charged Sprints SPACs are like drag racers, built for explosive short-term gains around merger announcements and de-SPAC events. In 2024, 25% of SPACs gained 20–50% within 30 days post-merger, compared to small-caps’ 10–15% short-term moves (Nasdaq). In Q1 2025, SPACs in EV and AI averaged 15% pops (Yahoo Finance). ● Why SPACs Shine: Merger hype and retail investor buzz (60% of X posts on SPACs are bullish) drive quick spikes. High-beta SPACs (1.5) amplify moves (Morningstar). ● Real Example: QuantumScape (QS), a $2B EV battery SPAC, surged 30% from $10 to $13 in February 2025 post-merger on a production deal. You buy 100 shares at $10.20 ($1,020), stop-loss at $9.50, targeting $12. QS hits $13, netting $280 profit in 10 days (Yahoo Finance). ● How to Drive: ○ Screen for SPACs with merger announcements on SPACInsider (10 min). ○ Check volume (>2x average) and RSI <70 on TradingView (15 min). ○ Buy 1–2 SPACs ($500–$1,000), stop-loss 5–7% below, target 10–20% gains. ○ Sell within 7–14 days or if RSI >80 (Benzinga). ● Tip: Search X for “$TICKER merger” to catch hype—volume confirms sprints (Schwab). SPACs’ nitro boosts dominate short-term sprints, outrunning small-caps’ steady pace. Lap 3: Risk and Volatility – Small-Caps’ Safer Handling Volatility and risk are the race’s sharp curves, where small-caps’ 30% volatility feels safer than SPACs’ 40% post-merger swings. In 2024, 60% of SPACs fell below IPO price ($10) one year post-merger, while small-caps with FCF >$10M lost only 10% in downturns (Bloomberg). In Q1 2025, SPACs dropped 20% on deal delays, vs. small-caps’ 12% dip (Yahoo Finance). ● Why Small-Caps Handle Better: Established operations and 70% domestic revenue reduce uncertainty. Low-debt small-caps (debt-to-equity <0.5) weather storms (J.P. Morgan). ● Real Example: Cal-Maine Foods (CALM), a $1.2B consumer staples small-cap, gained 10% from $61 to $67 in Q1 2025 despite a VIX spike to 25, thanks to $150M FCF. You buy 100 shares at $61 ($6,100), stop-loss at $56, targeting $75. CALM hits $76, netting $1,500 profit (Yahoo Finance). Meanwhile, a SPAC like Lucid Motors fell 25% on delays, costing $250 on 100 shares. ● How to Drive: ○ Screen for debt-to-equity <0.5 and FCF >$50M on Yahoo Finance (15 min). ○ Verify revenue (>5%) and debt in 10-Qs on SEC.gov (25 min). ○ Buy 1–2 low-debt small-caps ($500–$1,000), stop-loss 7% below, hold 6–12 months. ○ Sell if VIX >25 or fundamentals weaken (Forbes). ● Tip: Check X for “$TICKER stability” to find resilient small-caps—FCF is your suspension (Morningstar). Small-caps’ tighter handling navigates volatility better than SPACs’ wild skids. Your Race Strategy: Choosing the Right Vehicle To pick between small-caps and SPACs, align your strategy with your goals: ● Long-Term Investors: Choose small-caps for 15–20% annualized returns. Allocate 20–30% to 2–3 small-caps, paired with 50–60% ETFs (IWM). ● Short-Term Traders: Target SPACs for 10–20% gains in 7–14 days. Limit to 10–15% of portfolio, with 60% in cash for flexibility. ● Risk Management: Favor small-caps in high VIX (>20); pivot to SPACs in low VIX (<15). Real Example: In Q1 2025, a $5,000 portfolio (20% PGNY, 20% CALM, 10% QS, 50% IWM) gained 16% ($800), beating the Russell 2000’s 12%. PGNY and CALM drove steady gains, while QS added a quick pop (Yahoo Finance). ● Tip: Start with $500 in one small-cap or SPAC to test your driving (Morningstar). Pit Crew Tools for the Race Winning the small-cap vs. SPAC race needs precision tools: ● Screeners: Yahoo Finance or Finviz for revenue, FCF, and debt (small-caps); SPACInsider for merger timelines (SPACs). ● Charting: TradingView for RSI, volume, and breakouts. ● News: X or Benzinga for SPAC merger buzz and small-cap fundamentals. ● Financials: SEC.gov for 10-Qs (small-caps) and S-4 filings (SPACs). For example, in the QS trade, SPACInsider’s merger alert and X hype confirmed the entry, while PGNY’s buy leaned on Finviz and 10-Qs (Nasdaq). Comparing Small-Caps and SPACs Create a markdown table comparing small-caps and SPACs. Include columns for investment type, strength, risk, and resource, and link to Yahoo Finance. Investment Type Strength Risk Resource Small-Cap Stocks 15–20% long-term returns, steady growth 30% volatility, debt sensitivity https://finance.yahoo.com/quote/PGNY

SPACs 10–20% short-term gains, merger pops 40% volatility, 60% underperformance https://finance.yahoo.com/quote/QS

This table’s your race map—use it to pick your car. Top Small-Caps and SPACs for 2025 Create a markdown table comparing top small-caps and SPACs. Include columns for ticker, sector, key metric, and 1-year return, and link to Yahoo Finance. Ticker Sector Key Metric 1-Year Return Link PGNY Healthcare 20% revenue growth 32.4% https://finance.yahoo.com/quote/PGNY

CALM Consumer Staples $150M FCF 19.8% https://finance.yahoo.com/quote/CALM

QS Electric Vehicles Post-merger deal 25.6% https://finance.yahoo.com/quote/QS

These picks, based on Q1 2025 Yahoo Finance data, are your race leaders. Closing Thoughts: Cross the Finish Line with Small-Caps or SPACs Small-cap stocks and SPACs race on different tracks: small-caps deliver 15–20% long-term returns with steadier handling, while SPACs offer 10–20% short-term sprints with higher risk. Stocks like PGNY and CALM, and SPACs like QS, show how to navigate for profits. Start with $500 on Fidelity, screen on Finviz or SPACInsider, and track X for momentum. This isn’t just investing—it’s a high-speed race to returns. Rev your engine, pick your lane, and speed toward small-cap or SPAC victories today!