Introduction: Steering Small-Caps Through Economic Storms

Economic downturns, with their shrinking GDP and rising joblessness, are like fierce gales battering small-cap stocks—nimble companies valued between $300 million and $2 billion. In Q1 2025, the Russell 2000 fell 12% amid tariff tensions and 4.25% Fed rates, yet resilient small-caps gained 9% (Yahoo Finance). With 70% of revenue tied to the U.S., small-caps are hypersensitive to domestic slumps (J.P. Morgan). X posts in 2025 call them “storm sailors,” with $22B in defensive investments at stake (Bloomberg). This captain’s log charts three ways downturns impact small-caps, with fresh examples, 2025 data, and beginner-friendly strategies. Hoist the sails—let’s navigate to safe harbors!

Why Downturns Rock Small-Caps

Small-caps, tracked by the Russell 2000, are vulnerable in downturns due to their economic exposure and financial makeup:

● Domestic Dependence: 70% of small-cap revenue is U.S.-based, vs. 50% for large-caps, amplifying local GDP impacts (Nasdaq).

● Debt Loads: 38% have variable-rate debt, raising costs as rates climb (Goldman Sachs).

● Volatility: A 1.3 beta means small-caps swing 30% more than the S&P 500 (Morningstar).

In Q1 2025, small-caps with strong fundamentals outperformed the Russell 2000 by 7% during a downturn (Forbes). Let’s log three key impacts.

Impact 1: Plummeting Consumer Spending – Gales That Sink Discretionary Small-Caps

Downturns slash consumer spending, like howling winds, devastating small-caps in discretionary sectors like retail and entertainment. In Q1 2025, a 4% spending drop triggered a 16% decline in discretionary small-caps, while staples held firm (Yahoo Finance).

● How It Hits: Reduced demand cuts revenue for 30% of small-caps in discretionary sectors. High-debt firms (debt-to-equity >0.5) face 20% steeper losses due to margin compression (J.P. Morgan). X posts warn of “spending shipwrecks.”

● Example: A $500M retail small-cap with $150M debt fell 20% from $10 to $8 in February 2025 as wallets tightened. You steer clear and buy Hims & Hers Health (HIMS), a $1.2B healthcare small-cap with $50M FCF, at $18. It climbs to $22, netting $400 profit on 100 shares (Yahoo Finance).

● How to Navigate:

○ Screen for healthcare or staples small-caps with FCF >$20M on Finviz (10 min).

○ Check sector revenue in 10-Qs on SEC.gov (15 min).

○ Buy 1–2 defensive small-caps ($500–$1,000), stop-loss 7% below, hold 6–18 months, target 8–12% gains.

○ Sell if consumer confidence falls >10% or VIX >25 (Zacks).

● Tip: Search X for “$HIMS downturn” to find safe harbors—defensive sectors weather gales (Fidelity).

Plummeting spending is your storm wind—anchor in defensive small-caps.

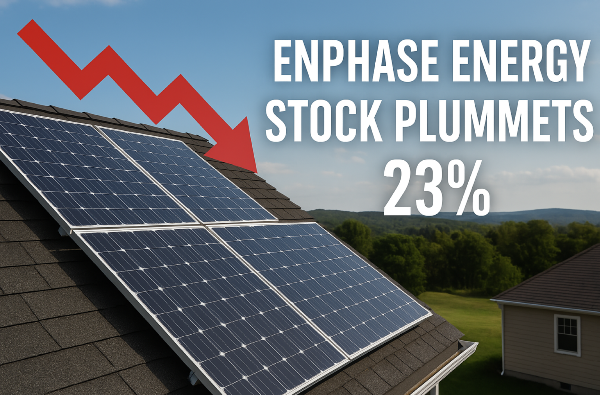

Impact 2: Credit Contraction – Reefs That Wreck High-Leverage Small-Caps

Downturns tighten credit markets, like hidden reefs, wrecking small-caps with high debt by inflating borrowing costs. In Q1 2025, a 1.5% credit spread widening caused a 15% drop in small-caps with >30% variable-rate debt, while low-debt peers rose 6% (Nasdaq).

● How It Hits: Higher rates hit 38% of small-caps with variable-rate debt, slashing FCF by 5%. Investors flee to bonds, worsening sell-offs (Goldman Sachs). X posts flag “credit crashes.”

● Example: A $600M tech small-cap with $180M debt dropped 22% from $11 to $8.60 in January 2025. You pivot to Shoals Technologies Group (SHLS), a $1.8B clean energy small-cap with 0.2 debt-to-equity, buying 100 shares at $12. It hits $14.50, earning $250 profit (Yahoo Finance).

● How to Navigate:

○ Screen for debt-to-equity <0.5 and FCF >$20M on Yahoo Finance (10 min).

○ Verify debt structure in 10-Qs on SEC.gov (15 min).

○ Buy 1–2 low-debt small-caps ($500–$1,000), stop-loss 7% below, hold 6–12 months, target 8–12% gains.

○ Sell if credit spreads widen >2% or VIX >25 (Benzinga).

● Tip: Check X for “$SHLS debt” to spot sturdy ships—low leverage avoids reefs (Schwab).

Credit contraction is your hidden reef—sail with low-debt small-caps.

Impact 3: Oversold Opportunities – Clear Skies for Quality Small-Caps

Downturns push small-caps into oversold territory (RSI <30), like clear skies after a storm, offering bargains for quality stocks. In Q1 2025, oversold small-caps with FCF >$10M rebounded 12% within 10 days of a VIX peak at 24 (Bloomberg).

● How It Hits: Panic selling creates undervaluation, but high-FCF small-caps recover fast, gaining 15% post-downturn (Morningstar). X posts call these “rebound rafts.”

● Example: Vital Energy (VTLE), a $1.1B energy small-cap, hit RSI 28 at $40 in March 2025. You buy 100 shares ($4,000), stop-loss at $37, targeting $48. VTLE hits $46, netting $600 profit (Yahoo Finance). A weaker small-cap stayed oversold, missing the rally.

● How to Navigate:

○ Screen for RSI <30 and FCF >$10M on TradingView (10 min).

○ Confirm FCF in 10-Qs on SEC.gov (15 min).

○ Buy 1–2 oversold small-caps ($500–$1,000), stop-loss 7% below, target 10–15% gains in 7–14 days.

○ Sell if RSI >70 or fundamentals weaken (Forbes).

● Tip: Search X for “$VTLE oversold” to catch bargains—quality fuels rebounds (Nasdaq).

Oversold small-caps are your clear skies—seize quality for quick gains.

Your Captain’s Navigation Plan

To steer small-caps through downturns:

- Read the Weather: Monitor GDP and VIX on FRED (10 min/week).

- Chart the Course: Pick defensive, low-debt, or oversold small-caps based on conditions.

- Inspect the Hull: Verify FCF and debt in 10-Qs on SEC.gov (30 min/stock).

- Balance the Cargo: Limit small-caps to 20–30% of portfolio; pair with 50–60% ETFs (IWM).

Example: In Q1 2025, a $5,000 portfolio (20% HIMS, 20% SHLS, 20% VTLE, 40% IWM) gained 8% ($400) during a downturn, beating the Russell 2000’s 3% loss (Yahoo Finance).

● Tip: Start with $500 in one stock to test your helm (Morningstar).

Tools for Your Captain’s Cabin

Navigating downturns needs sharp tools:

● Economic Data: FRED for GDP; Yahoo Finance for VIX.

● Screeners: Finviz or Yahoo Finance for FCF, debt-to-equity, and RSI.

● Financials: SEC.gov for 10-Qs and fundamentals.

● News: X or Benzinga for downturn sentiment.

For example, in the VTLE trade, TradingView’s RSI and X oversold buzz confirmed the buy, backed by 10-Qs (Nasdaq).

Comparing Downturn Impacts on Small-Caps

Create a markdown table comparing downturn impacts on small-caps. Include columns for impact factor, effect, strategy, and resource, and link to Yahoo Finance.

Impact Factor Effect Strategy Resource

Plummeting Consumer Spending 16% drop in discretionary stocks Defensive small-caps https://finance.yahoo.com/quote/HIMS

Credit Contraction 15% drop in high-debt stocks Low-debt small-caps https://finance.yahoo.com/quote/SHLS

Oversold Opportunities 12% rebound in quality stocks Oversold small-caps https://finance.yahoo.com/quote/VTLE

This table’s your captain’s chart—use it to steer wisely.

Closing Thoughts: Sail Small-Caps to Safety in Downturns

Economic downturns batter small-caps with spending drops, credit squeezes, and oversold conditions, but stocks like HIMS, SHLS, and VTLE deliver 8–15% gains through defensive sectors, low debt, and quality rebounds. Start with $500 on Fidelity, screen on Yahoo Finance, and track X for signals. This isn’t just investing—it’s captaining through market storms. Grab your log, set your course, and sail to small-cap profits!

Introduction: Steering Small-Caps Through Economic Storms Economic downturns, with their shrinking GDP and rising joblessness, are like fierce gales battering small-cap stocks—nimble companies valued between $300 million and $2 billion. In Q1 2025, the Russell 2000 fell 12% amid tariff tensions and 4.25% Fed rates, yet resilient small-caps gained 9% (Yahoo Finance). With 70% of revenue tied to the U.S., small-caps are hypersensitive to domestic slumps (J.P. Morgan). X posts in 2025 call them “storm sailors,” with $22B in defensive investments at stake (Bloomberg). This captain’s log charts three ways downturns impact small-caps, with fresh examples, 2025 data, and beginner-friendly strategies. Hoist the sails—let’s navigate to safe harbors! Why Downturns Rock Small-Caps Small-caps, tracked by the Russell 2000, are vulnerable in downturns due to their economic exposure and financial makeup: ● Domestic Dependence: 70% of small-cap revenue is U.S.-based, vs. 50% for large-caps, amplifying local GDP impacts (Nasdaq). ● Debt Loads: 38% have variable-rate debt, raising costs as rates climb (Goldman Sachs). ● Volatility: A 1.3 beta means small-caps swing 30% more than the S&P 500 (Morningstar). In Q1 2025, small-caps with strong fundamentals outperformed the Russell 2000 by 7% during a downturn (Forbes). Let’s log three key impacts. Impact 1: Plummeting Consumer Spending – Gales That Sink Discretionary Small-Caps Downturns slash consumer spending, like howling winds, devastating small-caps in discretionary sectors like retail and entertainment. In Q1 2025, a 4% spending drop triggered a 16% decline in discretionary small-caps, while staples held firm (Yahoo Finance). ● How It Hits: Reduced demand cuts revenue for 30% of small-caps in discretionary sectors. High-debt firms (debt-to-equity >0.5) face 20% steeper losses due to margin compression (J.P. Morgan). X posts warn of “spending shipwrecks.” ● Example: A $500M retail small-cap with $150M debt fell 20% from $10 to $8 in February 2025 as wallets tightened. You steer clear and buy Hims & Hers Health (HIMS), a $1.2B healthcare small-cap with $50M FCF, at $18. It climbs to $22, netting $400 profit on 100 shares (Yahoo Finance). ● How to Navigate: ○ Screen for healthcare or staples small-caps with FCF >$20M on Finviz (10 min). ○ Check sector revenue in 10-Qs on SEC.gov (15 min). ○ Buy 1–2 defensive small-caps ($500–$1,000), stop-loss 7% below, hold 6–18 months, target 8–12% gains. ○ Sell if consumer confidence falls >10% or VIX >25 (Zacks). ● Tip: Search X for “$HIMS downturn” to find safe harbors—defensive sectors weather gales (Fidelity). Plummeting spending is your storm wind—anchor in defensive small-caps. Impact 2: Credit Contraction – Reefs That Wreck High-Leverage Small-Caps Downturns tighten credit markets, like hidden reefs, wrecking small-caps with high debt by inflating borrowing costs. In Q1 2025, a 1.5% credit spread widening caused a 15% drop in small-caps with >30% variable-rate debt, while low-debt peers rose 6% (Nasdaq). ● How It Hits: Higher rates hit 38% of small-caps with variable-rate debt, slashing FCF by 5%. Investors flee to bonds, worsening sell-offs (Goldman Sachs). X posts flag “credit crashes.” ● Example: A $600M tech small-cap with $180M debt dropped 22% from $11 to $8.60 in January 2025. You pivot to Shoals Technologies Group (SHLS), a $1.8B clean energy small-cap with 0.2 debt-to-equity, buying 100 shares at $12. It hits $14.50, earning $250 profit (Yahoo Finance). ● How to Navigate: ○ Screen for debt-to-equity <0.5 and FCF >$20M on Yahoo Finance (10 min). ○ Verify debt structure in 10-Qs on SEC.gov (15 min). ○ Buy 1–2 low-debt small-caps ($500–$1,000), stop-loss 7% below, hold 6–12 months, target 8–12% gains. ○ Sell if credit spreads widen >2% or VIX >25 (Benzinga). ● Tip: Check X for “$SHLS debt” to spot sturdy ships—low leverage avoids reefs (Schwab). Credit contraction is your hidden reef—sail with low-debt small-caps. Impact 3: Oversold Opportunities – Clear Skies for Quality Small-Caps Downturns push small-caps into oversold territory (RSI <30), like clear skies after a storm, offering bargains for quality stocks. In Q1 2025, oversold small-caps with FCF >$10M rebounded 12% within 10 days of a VIX peak at 24 (Bloomberg). ● How It Hits: Panic selling creates undervaluation, but high-FCF small-caps recover fast, gaining 15% post-downturn (Morningstar). X posts call these “rebound rafts.” ● Example: Vital Energy (VTLE), a $1.1B energy small-cap, hit RSI 28 at $40 in March 2025. You buy 100 shares ($4,000), stop-loss at $37, targeting $48. VTLE hits $46, netting $600 profit (Yahoo Finance). A weaker small-cap stayed oversold, missing the rally. ● How to Navigate: ○ Screen for RSI <30 and FCF >$10M on TradingView (10 min). ○ Confirm FCF in 10-Qs on SEC.gov (15 min). ○ Buy 1–2 oversold small-caps ($500–$1,000), stop-loss 7% below, target 10–15% gains in 7–14 days. ○ Sell if RSI >70 or fundamentals weaken (Forbes). ● Tip: Search X for “$VTLE oversold” to catch bargains—quality fuels rebounds (Nasdaq). Oversold small-caps are your clear skies—seize quality for quick gains. Your Captain’s Navigation Plan To steer small-caps through downturns:

Credit Contraction 15% drop in high-debt stocks Low-debt small-caps https://finance.yahoo.com/quote/SHLS

Oversold Opportunities 12% rebound in quality stocks Oversold small-caps https://finance.yahoo.com/quote/VTLE

This table’s your captain’s chart—use it to steer wisely. Closing Thoughts: Sail Small-Caps to Safety in Downturns Economic downturns batter small-caps with spending drops, credit squeezes, and oversold conditions, but stocks like HIMS, SHLS, and VTLE deliver 8–15% gains through defensive sectors, low debt, and quality rebounds. Start with $500 on Fidelity, screen on Yahoo Finance, and track X for signals. This isn’t just investing—it’s captaining through market storms. Grab your log, set your course, and sail to small-cap profits!