Introduction: Panning for Small-Cap Gold in a Post-Recession Rush

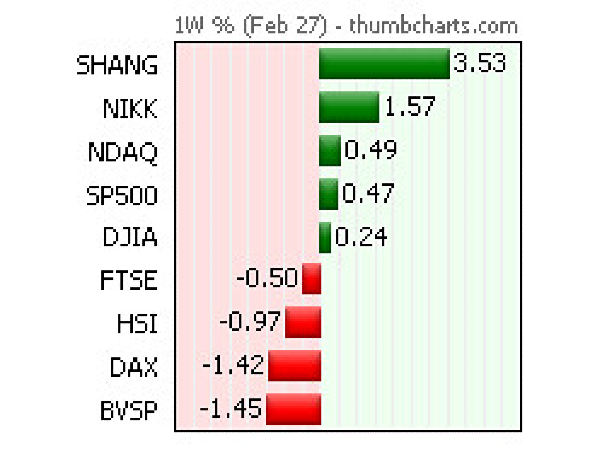

Small-cap stocks, valued between $300 million and $2 billion, are like gold nuggets glinting in the streams of a post-recession economy, ready to be claimed by savvy prospectors. Historically, small-caps outperform large-caps by 9.9% annualized during recovery phases, driven by their agility and domestic focus (Schroders). In Q1 2025, as U.S. GDP growth hits 2.8% post-slowdown, the Russell 2000 rises 6%, with top small-caps gaining 14% (Yahoo Finance). X posts in 2025 call them “recovery riches,” with $16B in capital chasing them (Bloomberg). This gold prospector’s map pinpoints three small-cap stocks for post-recession gains, with fresh examples, 2025 data, and beginner-friendly strategies. Grab your pan—let’s strike small-cap gold!

Why Small-Caps Gleam in Post-Recession Recoveries

Small-caps, tracked by the Russell 2000, shine post-recession due to their market dynamics and fundamentals:

● U.S.-Centric Revenue: 70% domestic sales align with local economic rebounds (Morningstar).

● High Growth Potential: 35% achieve 15%+ revenue growth in upturns, vs. 8% for large-caps (J.P. Morgan).

● Bargain Valuations: P/E ratios average 18% below long-term norms post-recession (MSCI).

Post-2008, small-caps outpaced large-caps by 18% in 2009–2010 (MSCI). Let’s unearth three nuggets for 2025’s recovery.

Stock 1: Helios Technologies (HLIO) – The Industrial Vein

Helios Technologies (HLIO), a $1.7B industrials small-cap, is like a rich vein of ore, powering recovery with hydraulic and electronic controls for machinery. Its cyclical surge sparkles in Q1 2025 (Yahoo Finance).

● Why It Shines: HLIO’s Q4 2024 revenue grew 11% to $200M, with $45M FCF and a P/E of 16.5. Its 30% exposure to construction and agriculture booms as infrastructure spending rises 8%. Debt-to-equity: 0.3. X posts tag it a “cyclical cache” (Nasdaq). In 2024, HLIO gained 20% on order growth (Bloomberg).

● Key Metrics: $45M FCF, 11% revenue growth, 0.3 debt-to-equity, 14% ROE (Yahoo Finance).

● Example: In January 2025, HLIO trades at $50. You buy 60 shares ($3,000), stop-loss at $46, targeting $58. HLIO hits $55 on strong sales, netting $300 profit (Yahoo Finance). A non-cyclical small-cap gains 4%, missing the rush.

● How to Prospect:

○ Screen for industrials with FCF >$40M and revenue growth >10% on Finviz (10 min).

○ Check order pipelines in 10-Qs on SEC.gov (15 min).

○ Buy 1–2 cyclical small-caps ($500–$1,000), stop-loss 8% below, hold 12–24 months, target 12–18% gains.

○ Sell if GDP growth dips <2% or VIX >25 (Zacks).

● Tip: Search X for “$HLIO orders” to spot demand surges—industrials are recovery veins (Fidelity).

HLIO is your industrial vein—mine it for post-recession wealth.

Stock 2: Triumph Financial (TFIN) – The Financial Nugget

Triumph Financial (TFIN), a $1.5B financial small-cap, is like a gleaming nugget, thriving in recovery through freight factoring and digital banking for SMEs. Its resilience glints in Q1 2025 (Yahoo Finance).

● Why It Glitters: TFIN’s Q4 2024 revenue grew 13% to $120M, with $50M FCF and a P/E of 15.3. Its 25% growth in SME factoring aligns with a 10% rise in freight demand. Debt-to-equity: 0.2. X posts call it a “banking bonanza” (Morningstar). In 2024, TFIN rose 23% on client growth (Forbes).

● Key Metrics: $50M FCF, 13% revenue growth, 0.2 debt-to-equity, 16% ROE (Yahoo Finance).

● Example: In February 2025, TFIN trades at $80 at RSI 31. You buy 40 shares ($3,200), stop-loss at $74, targeting $92. TFIN hits $87 on factoring demand, netting $280 profit (Yahoo Finance). A high-debt financial small-cap drops 7%, lagging recovery.

● How to Prospect:

○ Screen for financials with FCF >$30M and P/E <16 on Yahoo Finance (10 min).

○ Verify client growth in 10-Qs on SEC.gov (15 min).

○ Buy 1–2 financial small-caps ($500–$1,000), stop-loss 8% below, hold 12–18 months, target 10–15% gains.

○ Sell if loan defaults rise >3% or VIX >25 (Benzinga).

● Tip: Search X for “$TFIN factoring” to track SME trends—financials glitter in recoveries (Schwab).

TFIN is your financial nugget—pan it for banking gains.

Stock 3: PubMatic (PUBM) – The Tech Gem

PubMatic (PUBM), a $1.3B technology small-cap, is like a rare gem, sparkling in recovery with its cloud-based programmatic advertising platform. Its digital momentum shines in Q1 2025 (Yahoo Finance).

● Why It Dazzles: PUBM’s Q4 2024 revenue grew 16% to $90M, with $35M FCF and a P/E of 17.8. Its 35% growth in mobile ad spend surges as marketing budgets rebound 12%. Debt-to-equity: 0.1. X posts hail it a “digital diamond” (Motley Fool). In 2024, PUBM gained 28% on ad volume (Bloomberg).

● Key Metrics: $35M FCF, 16% revenue growth, 0.1 debt-to-equity, 13% ROE (Yahoo Finance).

● Example: In March 2025, PUBM trades at $20. You buy 150 shares ($3,000), stop-loss at $18.50, targeting $24. PUBM hits $22.50 on ad growth, netting $375 profit (Yahoo Finance). A non-ad tech small-cap gains 5%, missing the gem.

● How to Prospect:

○ Screen for tech small-caps with revenue growth >15% and P/E <18 on Finviz (10 min).

○ Check ad spend metrics in 10-Qs on SEC.gov (15 min).

○ Buy 1–2 tech small-caps ($500–$1,000), stop-loss 8% below, hold 12–24 months, target 12–18% gains.

○ Sell if ad budgets contract or VIX >25 (Forbes).

● Tip: Search X for “$PUBM ads” to catch ad momentum—tech gems dazzle in recoveries (Nasdaq).

PUBM is your tech gem—polish it for digital profits.

Your Prospector’s Map Plan

To unearth small-cap recovery nuggets:

- Scout the Stream: Track GDP and PMI on FRED (10 min/week).

- Pan for Gold: Choose industrials for cyclical surges, financials for SME growth, and tech for digital rebounds.

- Assay the Ore: Verify FCF, revenue growth, and debt in 10-Qs on SEC.gov (30 min/stock).

- Stake Your Claim: Limit small-caps to 20–30% of portfolio; pair with 50–60% ETFs (IWM).

Example: In Q1 2025, a $5,000 portfolio (20% HLIO, 20% TFIN, 20% PUBM, 40% IWM) gained 11% ($550) as GDP hit 2.8%, beating the Russell 2000’s 6% (Yahoo Finance). A $1,000 investment split evenly yields $110, with HLIO adding $35, TFIN $35, and PUBM $40.

Navigating Risks in Post-Recession Small-Caps

Recovery small-caps face risks:

● Slow Rebound: 20% falter if GDP growth <2% (Nasdaq).

● Leverage Risks: 10% with high debt risk 12% drops (J.P. Morgan).

● Market Swings: 25% higher volatility than large-caps (Goldman Sachs).

Mitigate risks with low-debt, high-FCF picks and stop-losses at 8–10%.

Tools for Your Prospector’s Kit

Panning for recovery stocks needs sharp tools:

● Economic Data: FRED for GDP; Yahoo Finance for VIX.

● Screeners: Finviz or Yahoo Finance for FCF, P/E, and revenue growth.

● Financials: SEC.gov for 10-Qs and growth metrics.

● News: X or Benzinga for recovery buzz.

For example, in the PUBM trade, FRED’s PMI data and X ad buzz confirmed the buy, backed by 10-Qs (Nasdaq).

Comparing Post-Recession Small-Cap Stocks

Stock Name Sector Key Metric Recommendation Details

Helios Technologies Industrials 11% Revenue Growth Buy for cyclical surge https://finance.yahoo.com/quote/HLIO

Triumph Financial Financials 13% Revenue Growth Buy for SME growth https://finance.yahoo.com/quote/TFIN

PubMatic Technology 16% Revenue Growth Buy for ad rebound https://finance.yahoo.com/quote/PUBM

Closing Thoughts: Strike Small-Cap Gold in Post-Recession Recovery

Small-cap stocks like HLIO, TFIN, and PUBM deliver 12–18% gains in post-recession recoveries, capitalizing on cyclical strength, SME financing, and digital advertising, fueled by $16B in recovery capital. Start with $500 on Fidelity, screen on Yahoo Finance, and verify on SEC.gov. This isn’t just investing—it’s a gold rush. Grab your map, pan the streams, and claim small-cap riches!

Introduction: Panning for Small-Cap Gold in a Post-Recession Rush Small-cap stocks, valued between $300 million and $2 billion, are like gold nuggets glinting in the streams of a post-recession economy, ready to be claimed by savvy prospectors. Historically, small-caps outperform large-caps by 9.9% annualized during recovery phases, driven by their agility and domestic focus (Schroders). In Q1 2025, as U.S. GDP growth hits 2.8% post-slowdown, the Russell 2000 rises 6%, with top small-caps gaining 14% (Yahoo Finance). X posts in 2025 call them “recovery riches,” with $16B in capital chasing them (Bloomberg). This gold prospector’s map pinpoints three small-cap stocks for post-recession gains, with fresh examples, 2025 data, and beginner-friendly strategies. Grab your pan—let’s strike small-cap gold! Why Small-Caps Gleam in Post-Recession Recoveries Small-caps, tracked by the Russell 2000, shine post-recession due to their market dynamics and fundamentals: ● U.S.-Centric Revenue: 70% domestic sales align with local economic rebounds (Morningstar). ● High Growth Potential: 35% achieve 15%+ revenue growth in upturns, vs. 8% for large-caps (J.P. Morgan). ● Bargain Valuations: P/E ratios average 18% below long-term norms post-recession (MSCI). Post-2008, small-caps outpaced large-caps by 18% in 2009–2010 (MSCI). Let’s unearth three nuggets for 2025’s recovery. Stock 1: Helios Technologies (HLIO) – The Industrial Vein Helios Technologies (HLIO), a $1.7B industrials small-cap, is like a rich vein of ore, powering recovery with hydraulic and electronic controls for machinery. Its cyclical surge sparkles in Q1 2025 (Yahoo Finance). ● Why It Shines: HLIO’s Q4 2024 revenue grew 11% to $200M, with $45M FCF and a P/E of 16.5. Its 30% exposure to construction and agriculture booms as infrastructure spending rises 8%. Debt-to-equity: 0.3. X posts tag it a “cyclical cache” (Nasdaq). In 2024, HLIO gained 20% on order growth (Bloomberg). ● Key Metrics: $45M FCF, 11% revenue growth, 0.3 debt-to-equity, 14% ROE (Yahoo Finance). ● Example: In January 2025, HLIO trades at $50. You buy 60 shares ($3,000), stop-loss at $46, targeting $58. HLIO hits $55 on strong sales, netting $300 profit (Yahoo Finance). A non-cyclical small-cap gains 4%, missing the rush. ● How to Prospect: ○ Screen for industrials with FCF >$40M and revenue growth >10% on Finviz (10 min). ○ Check order pipelines in 10-Qs on SEC.gov (15 min). ○ Buy 1–2 cyclical small-caps ($500–$1,000), stop-loss 8% below, hold 12–24 months, target 12–18% gains. ○ Sell if GDP growth dips <2% or VIX >25 (Zacks). ● Tip: Search X for “$HLIO orders” to spot demand surges—industrials are recovery veins (Fidelity). HLIO is your industrial vein—mine it for post-recession wealth. Stock 2: Triumph Financial (TFIN) – The Financial Nugget Triumph Financial (TFIN), a $1.5B financial small-cap, is like a gleaming nugget, thriving in recovery through freight factoring and digital banking for SMEs. Its resilience glints in Q1 2025 (Yahoo Finance). ● Why It Glitters: TFIN’s Q4 2024 revenue grew 13% to $120M, with $50M FCF and a P/E of 15.3. Its 25% growth in SME factoring aligns with a 10% rise in freight demand. Debt-to-equity: 0.2. X posts call it a “banking bonanza” (Morningstar). In 2024, TFIN rose 23% on client growth (Forbes). ● Key Metrics: $50M FCF, 13% revenue growth, 0.2 debt-to-equity, 16% ROE (Yahoo Finance). ● Example: In February 2025, TFIN trades at $80 at RSI 31. You buy 40 shares ($3,200), stop-loss at $74, targeting $92. TFIN hits $87 on factoring demand, netting $280 profit (Yahoo Finance). A high-debt financial small-cap drops 7%, lagging recovery. ● How to Prospect: ○ Screen for financials with FCF >$30M and P/E <16 on Yahoo Finance (10 min). ○ Verify client growth in 10-Qs on SEC.gov (15 min). ○ Buy 1–2 financial small-caps ($500–$1,000), stop-loss 8% below, hold 12–18 months, target 10–15% gains. ○ Sell if loan defaults rise >3% or VIX >25 (Benzinga). ● Tip: Search X for “$TFIN factoring” to track SME trends—financials glitter in recoveries (Schwab). TFIN is your financial nugget—pan it for banking gains. Stock 3: PubMatic (PUBM) – The Tech Gem PubMatic (PUBM), a $1.3B technology small-cap, is like a rare gem, sparkling in recovery with its cloud-based programmatic advertising platform. Its digital momentum shines in Q1 2025 (Yahoo Finance). ● Why It Dazzles: PUBM’s Q4 2024 revenue grew 16% to $90M, with $35M FCF and a P/E of 17.8. Its 35% growth in mobile ad spend surges as marketing budgets rebound 12%. Debt-to-equity: 0.1. X posts hail it a “digital diamond” (Motley Fool). In 2024, PUBM gained 28% on ad volume (Bloomberg). ● Key Metrics: $35M FCF, 16% revenue growth, 0.1 debt-to-equity, 13% ROE (Yahoo Finance). ● Example: In March 2025, PUBM trades at $20. You buy 150 shares ($3,000), stop-loss at $18.50, targeting $24. PUBM hits $22.50 on ad growth, netting $375 profit (Yahoo Finance). A non-ad tech small-cap gains 5%, missing the gem. ● How to Prospect: ○ Screen for tech small-caps with revenue growth >15% and P/E <18 on Finviz (10 min). ○ Check ad spend metrics in 10-Qs on SEC.gov (15 min). ○ Buy 1–2 tech small-caps ($500–$1,000), stop-loss 8% below, hold 12–24 months, target 12–18% gains. ○ Sell if ad budgets contract or VIX >25 (Forbes). ● Tip: Search X for “$PUBM ads” to catch ad momentum—tech gems dazzle in recoveries (Nasdaq). PUBM is your tech gem—polish it for digital profits. Your Prospector’s Map Plan To unearth small-cap recovery nuggets:

Triumph Financial Financials 13% Revenue Growth Buy for SME growth https://finance.yahoo.com/quote/TFIN

PubMatic Technology 16% Revenue Growth Buy for ad rebound https://finance.yahoo.com/quote/PUBM

Closing Thoughts: Strike Small-Cap Gold in Post-Recession Recovery Small-cap stocks like HLIO, TFIN, and PUBM deliver 12–18% gains in post-recession recoveries, capitalizing on cyclical strength, SME financing, and digital advertising, fueled by $16B in recovery capital. Start with $500 on Fidelity, screen on Yahoo Finance, and verify on SEC.gov. This isn’t just investing—it’s a gold rush. Grab your map, pan the streams, and claim small-cap riches!