Introduction

Small-cap financial stocks—those with market capitalizations typically between $300 million and $2 billion—occupy a unique and often misunderstood corner of the investment universe. These companies, which include regional banks, specialty lenders, insurance firms, asset managers, and fintech innovators, can offer investors both significant upside potential and considerable risk. In an era marked by rapid technological change, shifting interest rates, and evolving regulatory landscapes, the question arises: Are small-cap financial stocks worth the risk?

This essay explores the opportunities and challenges associated with investing in small-cap financial stocks. It examines the characteristics that distinguish these companies, the factors that drive their performance, the risks involved, and the strategies investors can use to navigate this dynamic sector.

Why Consider Small-Cap Financial Stocks?

- Growth Potential

Small-cap financial firms often operate in niche markets or underserved regions, giving them room to grow faster than their large-cap counterparts. Regional banks, for example, may have deep local relationships and knowledge that national chains lack. Fintech startups can disrupt traditional banking models by leveraging technology to reach new customer segments or streamline operations.

- Acquisition Targets

Large financial institutions frequently acquire successful small-caps to expand their geographic footprint, diversify product offerings, or gain access to innovative technologies. Such acquisitions often come at a premium, providing shareholders with attractive returns.

- Under-the-Radar Value

Many small-cap financial stocks are overlooked by institutional investors and analysts, resulting in attractive valuations relative to their growth prospects. This lack of attention can create opportunities for diligent investors to find undervalued gems.

- Dividend Income

Some small-cap financials, especially community banks and insurance companies, pay steady dividends. For income-focused investors, these stocks can provide a reliable stream of cash flow, sometimes with higher yields than large-cap peers.

Key Drivers of Performance

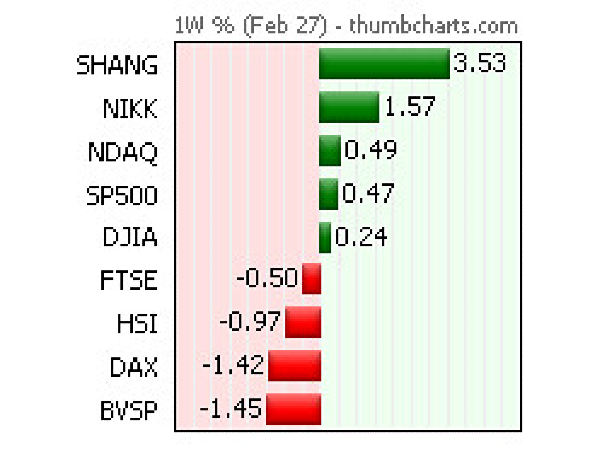

- Interest Rate Environment

Financial firms are highly sensitive to changes in interest rates. Banks and lenders benefit from rising rates, which expand net interest margins, while insurers may see improved investment returns. Conversely, falling rates can compress margins and reduce profitability.

- Credit Quality and Loan Growth

For lenders, credit quality is paramount. Strong underwriting standards and diversified loan portfolios help mitigate the risk of defaults. Loan growth, especially in expanding regional economies, can drive earnings higher.

- Regulatory Environment

Financial companies face significant regulatory oversight. Changes in capital requirements, lending standards, or consumer protection rules can impact profitability. Smaller firms may be more agile in adapting to regulatory shifts, but they also have fewer resources to absorb compliance costs.

- Technological Innovation

Fintech small-caps are leveraging technology to disrupt traditional financial services, offering everything from digital payments and peer-to-peer lending to robo-advisory and blockchain solutions. Success in innovation can translate into rapid customer acquisition and revenue growth.

Risks of Investing in Small-Cap Financial Stocks

- Higher Volatility

Small-cap stocks in general are more volatile than large-caps, and financials are no exception. Their share prices can swing dramatically in response to economic data, earnings reports, or regulatory news.

- Limited Diversification

Many small-cap financials operate in specific regions or sectors, making them vulnerable to local economic downturns or sector-specific shocks. For example, a community bank concentrated in a single state may suffer if that state’s economy weakens.

- Liquidity Risk

Small-cap stocks often have lower trading volumes, which can make it harder to buy or sell shares without affecting the price. This illiquidity can exacerbate losses during market downturns.

- Credit and Default Risk

Lenders and insurers face the risk that borrowers or policyholders will default on their obligations. Small-caps may have less diversified portfolios and fewer resources to absorb losses, increasing their vulnerability in economic downturns.

- Regulatory and Compliance Risk

While small-caps can be nimble, they may also struggle to keep up with complex and evolving regulations. Regulatory penalties or compliance failures can have outsized impacts on smaller firms.

What to Look for in the Best Small-Cap Financial Stocks

- Strong Balance Sheet

Look for companies with solid capital ratios, manageable debt, and ample liquidity. A strong balance sheet provides a cushion against economic shocks.

- Prudent Risk Management

Assess the company’s underwriting standards, loan diversification, and approach to managing credit and market risks.

- Consistent Profitability

Firms with a track record of steady earnings, even during economic downturns, are generally safer bets.

- Growth Prospects

Consider the company’s potential for loan growth, customer acquisition, or expansion into new markets or products.

- Management Quality

Experienced, shareholder-aligned management teams are crucial in navigating the complexities of the financial sector.

Examples of Small-Cap Financial Stocks

The First of Long Island Corporation (FLIC)

A community bank serving Long Island and New York City, FLIC has a long history of prudent lending and steady dividend payments. Its focus on relationship banking and conservative risk management has helped it weather economic cycles.

Website: https://www.flic.com

Axos Financial (AX)

Axos is a digital-first bank offering consumer and business banking nationwide. Its technology-driven model enables low costs and rapid growth, making it a standout among small-cap fintechs.

Website: https://www.axosbank.com

Goosehead Insurance (GSHD)

Goosehead is a rapidly growing independent insurance agency platform, leveraging technology to match clients with policies from a wide range of carriers. Its franchise model supports scalable growth.

Website: https://www.goosehead.com

Strategies for Investing in Small-Cap Financial Stocks

- Diversify Across Sub-Sectors

Spread investments among banks, insurers, asset managers, and fintechs to reduce sector-specific risk.

- Focus on Fundamentals

Prioritize companies with strong financials, disciplined risk management, and clear growth strategies.

- Monitor the Macro Environment

Stay attuned to interest rate trends, economic indicators, and regulatory changes that can impact the sector.

- Use Limit Orders

Due to lower liquidity, use limit orders when buying or selling small-cap financial stocks to avoid unfavorable price execution.

- Be Patient

Small-cap financials can be volatile in the short term, but patient investors who focus on quality may be rewarded over time.

Conclusion

Small-cap financial stocks offer a compelling blend of growth potential, innovation, and, in some cases, income. However, they come with heightened risks, including volatility, credit exposure, and regulatory challenges. For investors willing to do their homework—analyzing balance sheets, management teams, and business models—these stocks can be worth the risk, especially as the financial sector evolves in response to technological disruption and changing economic conditions.

As with all investments, diversification and a long-term perspective are key. By carefully selecting high-quality small-cap financial stocks and staying attuned to the macroeconomic and regulatory environment, investors can tap into the hidden opportunities this sector provides—potentially reaping substantial rewards while managing the inherent risks.

Introduction Small-cap financial stocks—those with market capitalizations typically between $300 million and $2 billion—occupy a unique and often misunderstood corner of the investment universe. These companies, which include regional banks, specialty lenders, insurance firms, asset managers, and fintech innovators, can offer investors both significant upside potential and considerable risk. In an era marked by rapid technological change, shifting interest rates, and evolving regulatory landscapes, the question arises: Are small-cap financial stocks worth the risk? This essay explores the opportunities and challenges associated with investing in small-cap financial stocks. It examines the characteristics that distinguish these companies, the factors that drive their performance, the risks involved, and the strategies investors can use to navigate this dynamic sector.

Why Consider Small-Cap Financial Stocks?

Key Drivers of Performance

Risks of Investing in Small-Cap Financial Stocks

What to Look for in the Best Small-Cap Financial Stocks

Examples of Small-Cap Financial Stocks The First of Long Island Corporation (FLIC) A community bank serving Long Island and New York City, FLIC has a long history of prudent lending and steady dividend payments. Its focus on relationship banking and conservative risk management has helped it weather economic cycles. Website: https://www.flic.com Axos Financial (AX) Axos is a digital-first bank offering consumer and business banking nationwide. Its technology-driven model enables low costs and rapid growth, making it a standout among small-cap fintechs. Website: https://www.axosbank.com Goosehead Insurance (GSHD) Goosehead is a rapidly growing independent insurance agency platform, leveraging technology to match clients with policies from a wide range of carriers. Its franchise model supports scalable growth. Website: https://www.goosehead.com

Strategies for Investing in Small-Cap Financial Stocks

Conclusion Small-cap financial stocks offer a compelling blend of growth potential, innovation, and, in some cases, income. However, they come with heightened risks, including volatility, credit exposure, and regulatory challenges. For investors willing to do their homework—analyzing balance sheets, management teams, and business models—these stocks can be worth the risk, especially as the financial sector evolves in response to technological disruption and changing economic conditions. As with all investments, diversification and a long-term perspective are key. By carefully selecting high-quality small-cap financial stocks and staying attuned to the macroeconomic and regulatory environment, investors can tap into the hidden opportunities this sector provides—potentially reaping substantial rewards while managing the inherent risks.