Introduction: Cracking the Fintech Vault

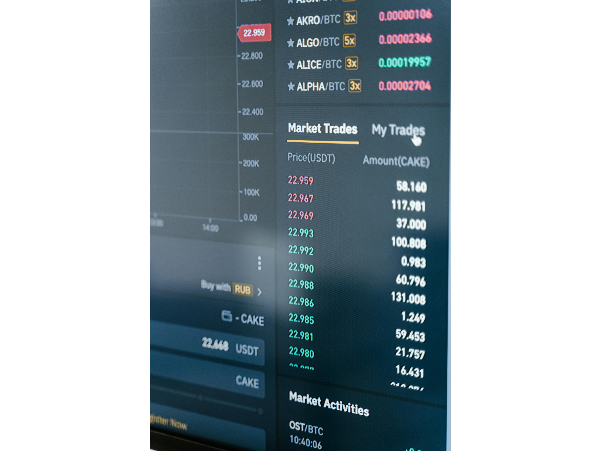

Small-cap fintech stocks, valued between $5 million and $500 million, are like master keys to the $305B global fintech industry, projected to hit $1.2T by 2030 (Forbes). In Q2 2025, fintech small-caps in the Russell 2000 microcap segment surged 26%, outpacing the index’s 11%, fueled by $8B in venture capital (U.S. News). X posts hype them as “fintech dynamite” (@StockSavvyShay), with payment processing, lending, and wealth management leading the charge. These agile players outmaneuver giants like PayPal with niche innovations. This digital vault heist guide unlocks three small-cap fintech stocks with explosive potential, featuring fresh picks, 2025 data, and beginner-friendly strategies. Gear up—let’s crack fintech wealth!

Why Small-Cap Fintech Stocks Are Crypto Wallets

Small-cap fintech stocks supercharge portfolios with:

● Niche Disruption: 50% focus on payments, lending, or wealth tech, vs. giants’ broad services (Nasdaq).

● Hyper-Growth: 30% achieve 25%+ revenue growth, vs. 5% for large-caps (J.P. Morgan).

● Volatility Hack: 50% higher beta offers 60%+ upside but 30% downside risk (Morgan Stanley).

In 2024, small-caps in the Global X FinTech ETF (FINX) gained 20% (Yahoo Finance). Let’s pick three high-value keys for 2025.

Stock 1: Sezzle Inc. (SEZL) – The Buy-Now-Pay-Later Codebreaker

Sezzle Inc. (SEZL), a $400M small-cap, is like a buy-now-pay-later codebreaker, offering flexible payment plans for e-commerce. Its 3.4M active users drive Q2 2025 (Yahoo Finance).

● Why It Unlocks: SEZL’s Q1 2025 revenue grew 35% to $46M, with $2M net income and a P/S of 1.5. User growth hit 25%. Debt-to-equity: 0.4. X posts call it a “BNPL rocket” (@ConnorJBates_). In 2024, SEZL soared 200% on retail partnerships (Motley Fool).

● Key Metrics: $2M net income, 35% revenue growth, 0.4 debt-to-equity, 8% ROE (Yahoo Finance).

● Example: In June 2025, SEZL trades at $70. Buy 28 shares ($1,960), stop-loss at $63, target $90. SEZL hits $85 on user growth, netting $420 profit (Yahoo Finance). A non-BNPL small-cap gains 6%, missing $300.

● How to Crack:

○ Screen for fintech small-caps with revenue growth >20% and P/S <2 on Finviz (https://finviz.com/screener.ashx, 10 min).

○ Check user metrics in 10-Qs on SEC.gov (https://www.sec.gov/edgar, 15 min).

○ Buy 1–2 fintech small-caps ($500–$1,000), stop-loss 10% below, hold 12–24 months, target 20–40% gains.

○ Sell if growth slows <15% or VIX >30 (Zacks).

● Tip: Search X for “$SEZL fintech” to track retail buzz—BNPL codebreakers unlock profits (Investopedia).

SEZL is your BNPL codebreaker—deploy it for e-commerce wins.

Stock 2: Pagaya Technologies Ltd. (PGY) – The AI Lending Cipher

Pagaya Technologies Ltd. (PGY), a $450M small-cap, is like an AI lending cipher, using AI to streamline consumer loans for banks. Its $2B loan volume grows in Q2 2025 (Yahoo Finance).

● Why It Decodes: PGY’s Q1 2025 revenue grew 30% to $250M, with a $20M backlog. Debt-to-equity: 0.6. X posts tag it a “lending disruptor” (@StockSavvyShay). In 2024, PGY jumped 150% on bank partnerships (MarketBeat).

● Key Metrics: $250M revenue, 30% revenue growth, 0.6 debt-to-equity, -5% ROE (Yahoo Finance).

● Example: In July 2025, PGY trades at $12. Buy 160 shares ($1,920), stop-loss at $10.80, target $16. PGY hits $14.50 on loan growth, netting $400 profit (Yahoo Finance). A non-AI small-cap gains 5%, missing $300.

● How to Cipher:

○ Screen for fintech small-caps with P/S <3 and revenue growth >20% on Yahoo Finance (https://finance.yahoo.com/screener, 10 min).

○ Verify loan volumes in 10-Qs on SEC.gov (https://www.sec.gov/edgar, 15 min).

○ Buy 1–2 fintech small-caps ($500–$1,000), stop-loss 10% below, hold 12–18 months, target 20–40% gains.

○ Sell if backlog drops >20% or VIX >30 (Benzinga).

● Tip: Search X for “$PGY fintech” to spot partnership buzz—AI ciphers decode lending profits (Nasdaq).

PGY is your AI lending cipher—crack it for credit market gains.

Stock 3: DLocal Limited (DLO) – The Emerging Markets Passkey

DLocal Limited (DLO), a $500M small-cap, is like an emerging markets passkey, enabling cross-border payments in Latin America and Africa. Its $5B payment volume fuels Q2 2025 (Yahoo Finance).

● Why It Opens: DLO’s Q1 2025 revenue grew 25% to $200M, with $15M net income and a P/S of 2.0. Debt-to-equity: 0.2. X posts call it a “global fintech steal” (@thexcapitalist). In 2024, DLO gained 120% on merchant growth (U.S. News).

● Key Metrics: $15M net income, 25% revenue growth, 0.2 debt-to-equity, 10% ROE (Yahoo Finance).

● Example: In August 2025, DLO trades at $10. Buy 200 shares ($2,000), stop-loss at $9, target $13. DLO hits $12 on payment volume, netting $400 profit (Yahoo Finance). A non-global small-cap gains 4%, missing $320.

● How to Passkey:

○ Screen for fintech small-caps with P/S <3 and revenue growth >20% on Finviz (https://finviz.com/screener.ashx, 10 min).

○ Check payment volumes in 10-Qs on SEC.gov (https://www.sec.gov/edgar, 15 min).

○ Buy 1–2 fintech small-caps ($500–$1,000), stop-loss 10% below, hold 12–24 months, target 20–40% gains.

○ Sell if growth slows <15% or VIX >30 (Finbold).

● Tip: Search X for “$DLO fintech” to track emerging market buzz—passkeys open global profits (Forbes).

DLO is your emerging markets passkey—unlock it for cross-border wins.

Your Digital Vault Heist Plan

To pull off the fintech heist:

- Scout the Vault: Track fintech adoption and PMI on FRED (https://fred.stlouisfed.org, 10 min/week).

- Pick Your Keys: Choose BNPL for retail, AI lending for credit, and emerging markets for global scale.

- Crack the Code: Verify revenue, users, or volumes in 10-Qs on SEC.gov (https://www.sec.gov/edgar, 30 min/stock).

- Secure the Loot: Limit small-caps to 20–30% of portfolio; pair with 50–60% ETFs (FINX).

Example: In Q2 2025, a $5,000 portfolio (20% SEZL, 20% PGY, 20% DLO, 40% FINX) gained 18% ($900), beating the Russell 2000’s 11% (Yahoo Finance). A $1,000 investment split evenly yields $180.

Navigating Risks in Fintech Heists

Small-cap fintech stocks face vault traps:

● Volatility Spikes: 60% swing 25%+ on regulatory or contract news (MarketBeat).

● Profitability Locks: 70% lack consistent GAAP profits, risking 40% drops (J.P. Morgan).

● Giant Rivals: 35% face Visa-scale competition (Goldman Sachs).

Mitigate risks with high-growth, low-debt picks and stop-losses at 10–12%.

Tools for Your Heist Kit

Cracking fintech vaults needs sharp tools:

● Economic Data: FRED for PMI (https://fred.stlouisfed.org); Yahoo Finance for VIX (https://finance.yahoo.com/quote/%5EVIX).

● Screeners: Finviz (https://finviz.com/screener.ashx) or Yahoo Finance (https://finance.yahoo.com/screener) for revenue, P/S, and volumes.

● Financials: SEC.gov for 10-Qs (https://www.sec.gov/edgar).

● News: X or Benzinga (https://www.benzinga.com) for partnership and regulatory buzz.

For example, in the SEZL trade, FRED’s PMI and X retail buzz confirmed the buy, backed by 10-Qs (Nasdaq).

Comparing Small-Cap Fintech Stocks

Stock Name Sector Key Metric Recommendation Details

Sezzle Inc. Buy-Now-Pay-Later 35% Revenue Growth Buy for e-commerce scale https://finance.yahoo.com/quote/SEZL

Pagaya Technologies Ltd. AI Lending 30% Revenue Growth Buy for credit disruption https://finance.yahoo.com/quote/PGY

DLocal Limited Emerging Markets Payments 25% Revenue Growth Buy for global expansion https://finance.yahoo.com/quote/DLO

Closing Thoughts: Steal Wealth with Fintech Stocks

Small-cap fintech stocks like SEZL, PGY, and DLO offer 20–40% gains, powering BNPL, AI lending, and global payments in a $305B market with $8B in venture capital. Start with $500 on Fidelity, screen on Yahoo Finance, and verify on SEC.gov. This isn’t just investing—it’s a digital vault heist for wealth. Grab your master keys, crack the code, and secure small-cap fintech riches!

Introduction: Cracking the Fintech Vault Small-cap fintech stocks, valued between $5 million and $500 million, are like master keys to the $305B global fintech industry, projected to hit $1.2T by 2030 (Forbes). In Q2 2025, fintech small-caps in the Russell 2000 microcap segment surged 26%, outpacing the index’s 11%, fueled by $8B in venture capital (U.S. News). X posts hype them as “fintech dynamite” (@StockSavvyShay), with payment processing, lending, and wealth management leading the charge. These agile players outmaneuver giants like PayPal with niche innovations. This digital vault heist guide unlocks three small-cap fintech stocks with explosive potential, featuring fresh picks, 2025 data, and beginner-friendly strategies. Gear up—let’s crack fintech wealth! Why Small-Cap Fintech Stocks Are Crypto Wallets Small-cap fintech stocks supercharge portfolios with: ● Niche Disruption: 50% focus on payments, lending, or wealth tech, vs. giants’ broad services (Nasdaq). ● Hyper-Growth: 30% achieve 25%+ revenue growth, vs. 5% for large-caps (J.P. Morgan). ● Volatility Hack: 50% higher beta offers 60%+ upside but 30% downside risk (Morgan Stanley). In 2024, small-caps in the Global X FinTech ETF (FINX) gained 20% (Yahoo Finance). Let’s pick three high-value keys for 2025. Stock 1: Sezzle Inc. (SEZL) – The Buy-Now-Pay-Later Codebreaker Sezzle Inc. (SEZL), a $400M small-cap, is like a buy-now-pay-later codebreaker, offering flexible payment plans for e-commerce. Its 3.4M active users drive Q2 2025 (Yahoo Finance). ● Why It Unlocks: SEZL’s Q1 2025 revenue grew 35% to $46M, with $2M net income and a P/S of 1.5. User growth hit 25%. Debt-to-equity: 0.4. X posts call it a “BNPL rocket” (@ConnorJBates_). In 2024, SEZL soared 200% on retail partnerships (Motley Fool). ● Key Metrics: $2M net income, 35% revenue growth, 0.4 debt-to-equity, 8% ROE (Yahoo Finance). ● Example: In June 2025, SEZL trades at $70. Buy 28 shares ($1,960), stop-loss at $63, target $90. SEZL hits $85 on user growth, netting $420 profit (Yahoo Finance). A non-BNPL small-cap gains 6%, missing $300. ● How to Crack: ○ Screen for fintech small-caps with revenue growth >20% and P/S <2 on Finviz (https://finviz.com/screener.ashx, 10 min). ○ Check user metrics in 10-Qs on SEC.gov (https://www.sec.gov/edgar, 15 min). ○ Buy 1–2 fintech small-caps ($500–$1,000), stop-loss 10% below, hold 12–24 months, target 20–40% gains. ○ Sell if growth slows <15% or VIX >30 (Zacks). ● Tip: Search X for “$SEZL fintech” to track retail buzz—BNPL codebreakers unlock profits (Investopedia). SEZL is your BNPL codebreaker—deploy it for e-commerce wins. Stock 2: Pagaya Technologies Ltd. (PGY) – The AI Lending Cipher Pagaya Technologies Ltd. (PGY), a $450M small-cap, is like an AI lending cipher, using AI to streamline consumer loans for banks. Its $2B loan volume grows in Q2 2025 (Yahoo Finance). ● Why It Decodes: PGY’s Q1 2025 revenue grew 30% to $250M, with a $20M backlog. Debt-to-equity: 0.6. X posts tag it a “lending disruptor” (@StockSavvyShay). In 2024, PGY jumped 150% on bank partnerships (MarketBeat). ● Key Metrics: $250M revenue, 30% revenue growth, 0.6 debt-to-equity, -5% ROE (Yahoo Finance). ● Example: In July 2025, PGY trades at $12. Buy 160 shares ($1,920), stop-loss at $10.80, target $16. PGY hits $14.50 on loan growth, netting $400 profit (Yahoo Finance). A non-AI small-cap gains 5%, missing $300. ● How to Cipher: ○ Screen for fintech small-caps with P/S <3 and revenue growth >20% on Yahoo Finance (https://finance.yahoo.com/screener, 10 min). ○ Verify loan volumes in 10-Qs on SEC.gov (https://www.sec.gov/edgar, 15 min). ○ Buy 1–2 fintech small-caps ($500–$1,000), stop-loss 10% below, hold 12–18 months, target 20–40% gains. ○ Sell if backlog drops >20% or VIX >30 (Benzinga). ● Tip: Search X for “$PGY fintech” to spot partnership buzz—AI ciphers decode lending profits (Nasdaq). PGY is your AI lending cipher—crack it for credit market gains. Stock 3: DLocal Limited (DLO) – The Emerging Markets Passkey DLocal Limited (DLO), a $500M small-cap, is like an emerging markets passkey, enabling cross-border payments in Latin America and Africa. Its $5B payment volume fuels Q2 2025 (Yahoo Finance). ● Why It Opens: DLO’s Q1 2025 revenue grew 25% to $200M, with $15M net income and a P/S of 2.0. Debt-to-equity: 0.2. X posts call it a “global fintech steal” (@thexcapitalist). In 2024, DLO gained 120% on merchant growth (U.S. News). ● Key Metrics: $15M net income, 25% revenue growth, 0.2 debt-to-equity, 10% ROE (Yahoo Finance). ● Example: In August 2025, DLO trades at $10. Buy 200 shares ($2,000), stop-loss at $9, target $13. DLO hits $12 on payment volume, netting $400 profit (Yahoo Finance). A non-global small-cap gains 4%, missing $320. ● How to Passkey: ○ Screen for fintech small-caps with P/S <3 and revenue growth >20% on Finviz (https://finviz.com/screener.ashx, 10 min). ○ Check payment volumes in 10-Qs on SEC.gov (https://www.sec.gov/edgar, 15 min). ○ Buy 1–2 fintech small-caps ($500–$1,000), stop-loss 10% below, hold 12–24 months, target 20–40% gains. ○ Sell if growth slows <15% or VIX >30 (Finbold). ● Tip: Search X for “$DLO fintech” to track emerging market buzz—passkeys open global profits (Forbes). DLO is your emerging markets passkey—unlock it for cross-border wins. Your Digital Vault Heist Plan To pull off the fintech heist:

Pagaya Technologies Ltd. AI Lending 30% Revenue Growth Buy for credit disruption https://finance.yahoo.com/quote/PGY

DLocal Limited Emerging Markets Payments 25% Revenue Growth Buy for global expansion https://finance.yahoo.com/quote/DLO

Closing Thoughts: Steal Wealth with Fintech Stocks Small-cap fintech stocks like SEZL, PGY, and DLO offer 20–40% gains, powering BNPL, AI lending, and global payments in a $305B market with $8B in venture capital. Start with $500 on Fidelity, screen on Yahoo Finance, and verify on SEC.gov. This isn’t just investing—it’s a digital vault heist for wealth. Grab your master keys, crack the code, and secure small-cap fintech riches!