Introduction

Small-cap stocks—companies with market capitalizations between $300 million and $2 billion—are often overlooked in favor of their large-cap counterparts. Yet, these companies are frequently the engines of innovation, agility, and rapid expansion, offering investors the potential for outsized returns over long investment horizons. In 2025, a combination of favorable macroeconomic trends, sector diversification, and strong fundamentals has positioned select small-cap stocks as compelling options for long-term growth investors256.

This essay explores why small-cap stocks are attractive for long-term growth, the characteristics that define the best candidates, and profiles several promising small-cap companies poised for sustained expansion. It also discusses the risks and strategies for investing in this dynamic market segment.

Why Invest in Small-Cap Stocks for Long-Term Growth?

- Higher Growth Potential

Small-cap companies often operate in emerging industries or niche markets, allowing them to grow revenues and earnings at a faster pace than mature large-cap firms. Their smaller size means they have more room to expand market share, innovate, and capitalize on new opportunities24. For example, a small-cap company that successfully launches a disruptive product can double or triple its value in a relatively short period.

- Innovation and Agility

Many small-cap firms are more agile and innovative, able to pivot quickly in response to changing market conditions and technological advancements. This agility enables them to stay ahead of trends and disrupt established industries—qualities that are especially valuable in fast-evolving sectors like biotech, fintech, and renewable energy24.

- Undervalued Opportunities

Due to limited analyst coverage and institutional ownership, small-cap stocks are often inefficiently priced. This creates opportunities for diligent investors to identify undervalued companies with strong fundamentals before the broader market recognizes their potential24.

- Diversification Benefits

Adding small-cap stocks to a portfolio enhances diversification, as these companies often operate in sectors and markets underrepresented by large-cap stocks. This can reduce overall portfolio risk and improve returns, especially when small-caps outperform during certain market cycles25.

- Historical Outperformance

Historically, small-cap stocks have outperformed large-caps over long investment horizons, particularly during economic recovery phases. Their ability to rebound quickly and capture growth opportunities makes them valuable components of a growth-oriented portfolio25.

Characteristics of the Best Small-Cap Stocks for Long-Term Growth

- Strong Fundamentals

Look for companies with consistent revenue and earnings growth, healthy balance sheets, and positive cash flow. These indicators suggest financial stability and the capacity to fund expansion6.

- Competitive Advantage

Companies with unique products, proprietary technology, or strong brand loyalty are better positioned to sustain growth and fend off competition26.

- Scalable Business Models

Firms that can efficiently scale operations without proportionally increasing costs are more likely to achieve sustainable growth24.

- Experienced Management

Leadership with a proven track record of executing growth strategies and managing risks is critical for long-term success36.

- Market Tailwinds

Operating in industries with favorable growth trends, such as technology, healthcare, renewable energy, or fintech, can amplify a company’s growth prospects246.

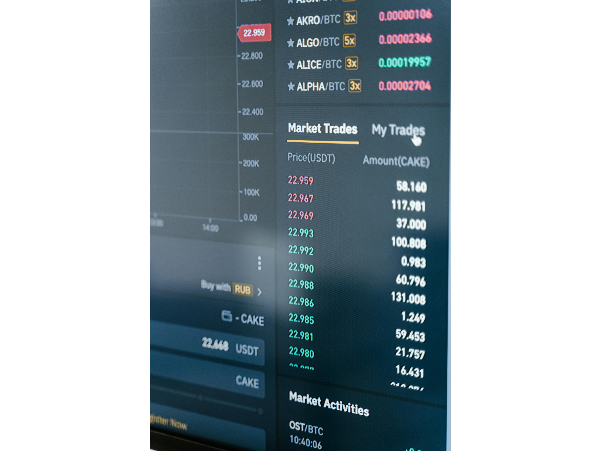

Promising Small-Cap Stocks for Long-Term Growth in 2025

The following companies exemplify the qualities of strong long-term growth candidates, drawn from diverse sectors and geographies:

Symbol Company Name Sector Market Cap Key Growth Driver Company Website

AEVA Aeva Technologies Inc. Technology $425M Lidar sensors for EVs aeva.com

ATRO Astronics Corp. Aerospace $820M Avionics, aerospace tech astronics.com

BFLY Butterfly Network Inc. Healthcare $1.1B Handheld ultrasound butterflynetwork.com

LQDT Liquidity Services Inc. E-Commerce $370M Online asset liquidation liquidityservices.com

NGVC Natural Grocers by Vitamin Cottage Consumer Staples $400M Organic groceries naturalgrocers.com

NGS Natural Gas Services Group Energy $345M Gas compression services ngsgi.com

OB Outbrain Inc. Ad Tech $653M AI-powered ad platform outbrain.com

Butterfly Network Inc. (BFLY):

Butterfly Network is gaining recognition for its handheld ultrasound devices, which leverage proprietary software, AI, and smartphone integration. The company reported a 35% year-over-year increase in quarterly revenue in 2024 and expects another 20% growth in 2025. With a vast addressable market and the potential for acquisition by larger medical device firms, Butterfly Network is well-positioned for long-term growth6.

Liquidity Services Inc. (LQDT):

LQDT operates e-commerce marketplaces and auction tools, specializing in quick inventory liquidation and government surplus sales. With a robust cash balance and no debt, the company reported a 111% share price increase in the past year and expects 35% revenue growth for the fiscal year. Liquidity Services is well-positioned for continued growth and stability amid potential volatility in 20256.

Natural Grocers by Vitamin Cottage (NGVC):

NGVC has benefited from the ongoing trend toward healthier eating, with a 490% increase over the past five years and a notable 49% rise in the last three months. The company reported a 9% revenue increase for fiscal 2024 and a 48% jump in operating income, driven by improved pricing and operational efficiency. NGVC’s focus on organic and healthy foods makes it a stable investment with growth potential in 20256.

Natural Gas Services Group Inc. (NGS):

NGS supplies natural gas compression equipment to U.S. energy producers. The company is diversified across various clients, providing some insulation from market volatility. With revenue expected to rise nearly 30% this year and another 15% projected for the next fiscal year, NGS has seen a 79% price increase over the past year in anticipation of continued strong performance6.

Outbrain Inc. (OB):

Outbrain delivers content-style ads across the web, leveraging AI and algorithm-driven advertising. As digital ad spending rises, Outbrain is forecasting a substantial 60% revenue growth rate for fiscal 2025, making it a small-cap advertising stock to watch6.

Risks and Considerations

Investing in small-cap stocks involves higher volatility, liquidity constraints, and sensitivity to economic cycles. Companies may face challenges such as limited resources, competitive pressures, and regulatory hurdles. Small-caps are also more susceptible to market sentiment and may experience larger price swings than large-caps24. Investors should conduct thorough due diligence, diversify holdings, and maintain a long-term perspective to manage these risks effectively246.

Strategies for Investing in Small-Cap Stocks

● Diversify: Spread investments across sectors and individual stocks to reduce company-specific risk24.

● Focus on Fundamentals: Prioritize companies with strong financials, competitive advantages, and scalable models6.

● Monitor Market Trends: Stay informed about sector developments, economic indicators, and company news24.

● Be Patient: Small-cap investing requires a long-term horizon to realize growth potential25.

Conclusion

Small-cap stocks offer compelling opportunities for long-term growth investors willing to embrace higher risk and volatility. Their potential for rapid expansion, innovation, and market disruption can lead to outsized returns over time. By focusing on companies with strong fundamentals, competitive advantages, and favorable market conditions, investors can build diversified portfolios that capture the growth potential of tomorrow’s market leaders256.

With careful research and disciplined investing, small-cap stocks can be valuable components of a growth-oriented investment strategy in 2025 and beyond.

Introduction Small-cap stocks—companies with market capitalizations between $300 million and $2 billion—are often overlooked in favor of their large-cap counterparts. Yet, these companies are frequently the engines of innovation, agility, and rapid expansion, offering investors the potential for outsized returns over long investment horizons. In 2025, a combination of favorable macroeconomic trends, sector diversification, and strong fundamentals has positioned select small-cap stocks as compelling options for long-term growth investors256. This essay explores why small-cap stocks are attractive for long-term growth, the characteristics that define the best candidates, and profiles several promising small-cap companies poised for sustained expansion. It also discusses the risks and strategies for investing in this dynamic market segment.

Why Invest in Small-Cap Stocks for Long-Term Growth?

Characteristics of the Best Small-Cap Stocks for Long-Term Growth

Promising Small-Cap Stocks for Long-Term Growth in 2025 The following companies exemplify the qualities of strong long-term growth candidates, drawn from diverse sectors and geographies: Symbol Company Name Sector Market Cap Key Growth Driver Company Website AEVA Aeva Technologies Inc. Technology $425M Lidar sensors for EVs aeva.com

ATRO Astronics Corp. Aerospace $820M Avionics, aerospace tech astronics.com

BFLY Butterfly Network Inc. Healthcare $1.1B Handheld ultrasound butterflynetwork.com

LQDT Liquidity Services Inc. E-Commerce $370M Online asset liquidation liquidityservices.com

NGVC Natural Grocers by Vitamin Cottage Consumer Staples $400M Organic groceries naturalgrocers.com

NGS Natural Gas Services Group Energy $345M Gas compression services ngsgi.com

OB Outbrain Inc. Ad Tech $653M AI-powered ad platform outbrain.com

Butterfly Network Inc. (BFLY): Butterfly Network is gaining recognition for its handheld ultrasound devices, which leverage proprietary software, AI, and smartphone integration. The company reported a 35% year-over-year increase in quarterly revenue in 2024 and expects another 20% growth in 2025. With a vast addressable market and the potential for acquisition by larger medical device firms, Butterfly Network is well-positioned for long-term growth6. Liquidity Services Inc. (LQDT): LQDT operates e-commerce marketplaces and auction tools, specializing in quick inventory liquidation and government surplus sales. With a robust cash balance and no debt, the company reported a 111% share price increase in the past year and expects 35% revenue growth for the fiscal year. Liquidity Services is well-positioned for continued growth and stability amid potential volatility in 20256. Natural Grocers by Vitamin Cottage (NGVC): NGVC has benefited from the ongoing trend toward healthier eating, with a 490% increase over the past five years and a notable 49% rise in the last three months. The company reported a 9% revenue increase for fiscal 2024 and a 48% jump in operating income, driven by improved pricing and operational efficiency. NGVC’s focus on organic and healthy foods makes it a stable investment with growth potential in 20256. Natural Gas Services Group Inc. (NGS): NGS supplies natural gas compression equipment to U.S. energy producers. The company is diversified across various clients, providing some insulation from market volatility. With revenue expected to rise nearly 30% this year and another 15% projected for the next fiscal year, NGS has seen a 79% price increase over the past year in anticipation of continued strong performance6. Outbrain Inc. (OB): Outbrain delivers content-style ads across the web, leveraging AI and algorithm-driven advertising. As digital ad spending rises, Outbrain is forecasting a substantial 60% revenue growth rate for fiscal 2025, making it a small-cap advertising stock to watch6.

Risks and Considerations Investing in small-cap stocks involves higher volatility, liquidity constraints, and sensitivity to economic cycles. Companies may face challenges such as limited resources, competitive pressures, and regulatory hurdles. Small-caps are also more susceptible to market sentiment and may experience larger price swings than large-caps24. Investors should conduct thorough due diligence, diversify holdings, and maintain a long-term perspective to manage these risks effectively246.

Strategies for Investing in Small-Cap Stocks ● Diversify: Spread investments across sectors and individual stocks to reduce company-specific risk24. ● Focus on Fundamentals: Prioritize companies with strong financials, competitive advantages, and scalable models6. ● Monitor Market Trends: Stay informed about sector developments, economic indicators, and company news24. ● Be Patient: Small-cap investing requires a long-term horizon to realize growth potential25.

Conclusion Small-cap stocks offer compelling opportunities for long-term growth investors willing to embrace higher risk and volatility. Their potential for rapid expansion, innovation, and market disruption can lead to outsized returns over time. By focusing on companies with strong fundamentals, competitive advantages, and favorable market conditions, investors can build diversified portfolios that capture the growth potential of tomorrow’s market leaders256. With careful research and disciplined investing, small-cap stocks can be valuable components of a growth-oriented investment strategy in 2025 and beyond.