As a follower of the stock market, you most likely might have heard analysts or commentators referring to what are called Price Earnings Ratios (PER). In this article, Piggy would like to demystify PER ratios and also educate folks on how they can make use of this metric to pick stocks on the market.

The Price Earnings Ratio (PER) is a simple multiple that compares the current share price to the most recently reported earnings per share. This is usually referred to as the Historic PER and considers full year earnings. The time period involved is not the same for each side. Current price is today’s known price but earnings may be weeks or months out of date. In other words, price per share is a technical signal and the value of earnings per share is fundamental. PERs therefore combine a technical value (price) with a fundamental value (earnings) and each side applies to a different time period.

In essence, the PER indicates the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company’s earnings. This is why the PER is sometimes referred to as the price multiple because it shows how much investors are willing to pay per dollar of earnings. If a company was currently trading at a PER of 30x, the interpretation is that an investor is willing to pay $30 for $1 of current earnings.

The most important issue is how one makes use of PERs to make decisions on the stock market. As a general rule, the PER is considered moderate when it is found between 10x and 25x. Below that, there may be a lack of interest among investors; above that, the stock might be overpriced. A low PER could point to not just a lack of interest but a real bargain priced stock. High PER is not always an overpriced stock but could be one that has greater than average potential for future growth.

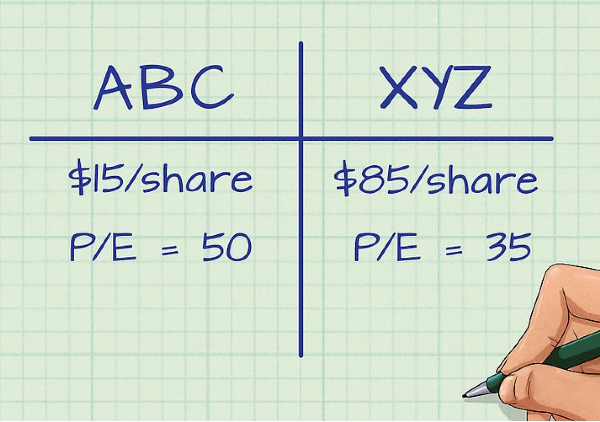

It is worth noting that a single PER does not reveal much about the trend over time and cannot be relied upon for any accurate conclusions. Piggy recommends that one uses the PER as a comparative tool when considering companies in the same sector. Comparing the PER of a telecommunications and a food company, for example, may lead inaccurate conclusions. Generally, companies with lower PERs than their peers are more attractive. A variation to this is called Forward PER. This is based on an estimate of future earnings per share. The problem with using estimates is that the result lacks reliability. The forward PER provides some benefit for analysts but the conclusions drawn depend on whose earnings estimate is used.

Join a piggybankadvisor.com WhatsApp based social trading group today by following the link; https://chat.whatsapp.com/GOqNASPbCFWEyNDb5AWG28

Open a Free IronFX Demo Trading Account today in three simple steps by following the link; https://www.ironfx.com.bm/en/register?utm_source=13073443&utm_medium=ib_link&utm_campaign=IB

Download the piggybankadvisor.com Android App using the link; https://play.google.com/store/apps/details?id=com.piggybankadvisor.piggybankadvisor

As a follower of the stock market, you most likely might have heard analysts or commentators referring to what are called Price Earnings Ratios (PER). In this article, Piggy would like to demystify PER ratios and also educate folks on how they can make use of this metric to pick stocks on the market.

The Price Earnings Ratio (PER) is a simple multiple that compares the current share price to the most recently reported earnings per share. This is usually referred to as the Historic PER and considers full year earnings. The time period involved is not the same for each side. Current price is today’s known price but earnings may be weeks or months out of date. In other words, price per share is a technical signal and the value of earnings per share is fundamental. PERs therefore combine a technical value (price) with a fundamental value (earnings) and each side applies to a different time period.

In essence, the PER indicates the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company’s earnings. This is why the PER is sometimes referred to as the price multiple because it shows how much investors are willing to pay per dollar of earnings. If a company was currently trading at a PER of 30x, the interpretation is that an investor is willing to pay $30 for $1 of current earnings.

The most important issue is how one makes use of PERs to make decisions on the stock market. As a general rule, the PER is considered moderate when it is found between 10x and 25x. Below that, there may be a lack of interest among investors; above that, the stock might be overpriced. A low PER could point to not just a lack of interest but a real bargain priced stock. High PER is not always an overpriced stock but could be one that has greater than average potential for future growth.

It is worth noting that a single PER does not reveal much about the trend over time and cannot be relied upon for any accurate conclusions. Piggy recommends that one uses the PER as a comparative tool when considering companies in the same sector. Comparing the PER of a telecommunications and a food company, for example, may lead inaccurate conclusions. Generally, companies with lower PERs than their peers are more attractive. A variation to this is called Forward PER. This is based on an estimate of future earnings per share. The problem with using estimates is that the result lacks reliability. The forward PER provides some benefit for analysts but the conclusions drawn depend on whose earnings estimate is used.

Join a piggybankadvisor.com WhatsApp based social trading group today by following the link; https://chat.whatsapp.com/GOqNASPbCFWEyNDb5AWG28

Open a Free IronFX Demo Trading Account today in three simple steps by following the link; https://www.ironfx.com.bm/en/register?utm_source=13073443&utm_medium=ib_link&utm_campaign=IB

Download the piggybankadvisor.com Android App using the link; https://play.google.com/store/apps/details?id=com.piggybankadvisor.piggybankadvisor

Originally posted on piggybankadvisor.com