The Fed's 8-Second Bull Ride

The Fed is on a bull right now, midway through the 8 seconds. The economy is bucking, trying to let gravity and chaos reign above data and order.

We all know not to “fight” the Fed. But, it’s going to try and ride that bull.

How is the ride going? I’ve got a few seconds left to tell you.

The Fed in the Bull Chute

Image the Fed as a cowboy in a bull chute, getting ready for an eight-second ride.

In bull riding, both the bull and rider are judged, each responsible for 50% of the final score.

The same might be said about the Fed and the economy, and the ride is just as crazy!

But the important thing to note is that the better bull you have, the better your score. So not only does the bull add to the total, but you score better on a good bull!

The Fed has 8 seconds to show us what it’s got. What has it got? It has a rope around a bull; hold on for dear life!

Think about it this way: the Fed doesn’t set interest rates or hire people. It is only armed with a few cowboy tools: instincts born from experience, a glove, and a tiny bull rope called the Federal Funds Rate.

If the Fed gets a good bull, they will do well.

What kind of bull did we get in 2008? We should get a re-ride option for that bull (inside joke). But, more importantly, what kind of bull do we have in 2022? That’s a good question!

First, how do we score the Fed’s 8-second bull ride? With the dual mandate.

The Dual Mandate: Fed vs. Bull

The Fed is given a dual mandate by congress:

- Maximize Employment

- Maintain Low and Predictable Interest Rates

In other words: avoid recessions and depressions. As these bad times follow eras of extravagant excess (usually marked by easy credit and insatiable corporate profit motive), the Fed is always reacting to ongoing economic data. Just like how a cowboy reacts to a bull.

The economy is the bull; the fed the rider.

As the Fed steps onto the bull’s back, it has some tools.

First off, a glove and a bull rope. Then, you got a select few other cowboys helping you get set just right before you nod. Next, you got your instincts and experience being thrown every time you get on (how else do you get off?). That is the history of the economy and the Fed.

Finally, as you start your 8-second ride, pull another rope tight around the bull’s groin just to make him buck harder. Remember, the harder he bucks, but higher you score. I’m not going to tell you which tool is which, but what does the Fed do to really make the economy buck hard?

But ultimately, you never know what kind of bull you have until you look him in the face with your butt in the dirt. Eight seconds on a bull happens too fast to do anything but hold on. So that’s what the Fed is doing now.

Since all we have just a slight concussion now, dazed and bleary-eyed, let’s spend a few seconds thinking about what the Fed is trying to accomplish as the clowns cajole the bull into the bullpen.

What is the Fed Trying to Ride?

When the Fed sits on the back of the bull, the plan is to safely jump off after 8 seconds. In all likelihood, however, they will find another way down.

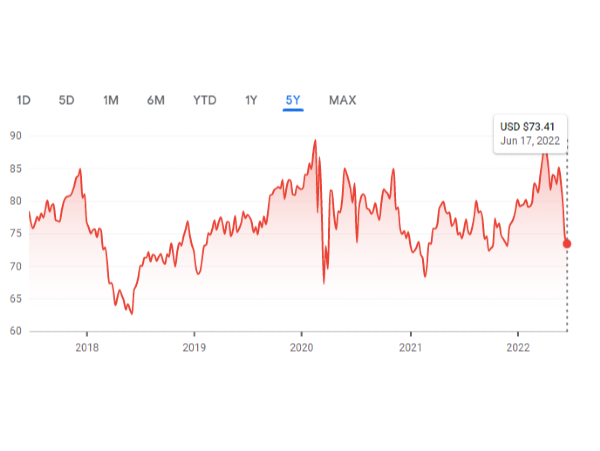

Currently, the Fed is on a bull: the 2022 Bear Market.

Since we have bull and bear markets, maybe I should have imagined the Fed riding a bear instead. Had I done that, I’d be forced to tell you a bear joke (since I live in Montana and bears eat most of the tourists). When chased by a bear, you don’t have to be faster than the bear, just faster than your friend. Maybe that’s how the Fed deals with Foreign Countries… Try to run just a little faster than they do.

Regardless, the bull is going to do what the bull is going to do, and after the fact, we can score the ride.

What is a good score for the Fed’s bull ride of 2022? A “soft” landing with 3-4% intermediate-term inflation. Yes, inflation will be higher.

Why Inflation Will be Higher

We are in a new era, perhaps, one of higher inflation for the intermediate term.

In the modern economy, inflation “should be” about 3%, and we have been closer to 2% in recent decades.

So, it is not surprising that inflation is higher than average. This is expected as a consequence of reversion to the mean.

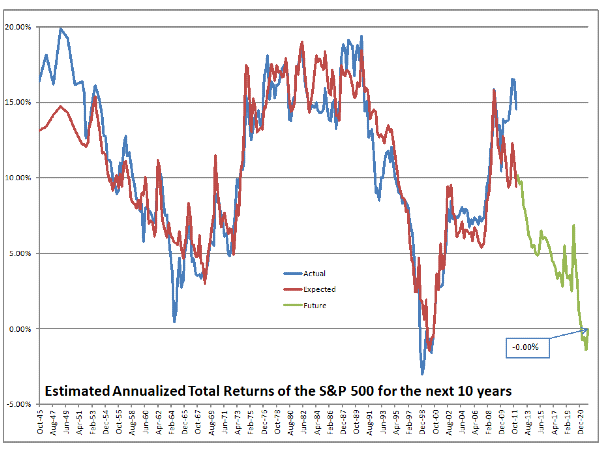

But the mean can and does change! You hear this a lot when people are talking about CAPE ratios. How expensive “should” company stock be compared to historical norms. While the interest rate greatly affects stocks (cheap money is thought to drive up all asset prices), inflation is not an independent variable.

That is, interest rates depend on everything else in the economy.

And the Fed does not set interest rates. Instead, they set an overnight rate that banks use to lend money to each other (among other things). This is then a “leash” on the dog what is interest rates. As you walk along, the dog goes up and down, back and forth, and around you, limited by the length of the leash. The leash controls the dog unless the dog is stronger than you are, in which case you will be dragged along with the running dog.

I’m mixing metaphors here, but I don’t want to try and put a leash on a bull. And y’all call a “rope” a “lasso,” which would confuse everyone if I start talking about lassoing a bull. My kids always want to rope a calf… the problem is how do you get the rope off?

And this is getting long, so let’s make one final point.

Unemployment is the other dual mandate. But the judges have changed the way they score it.

How to Understand Unemployment

Let’s look at unemployment and the effect a recession has on it.

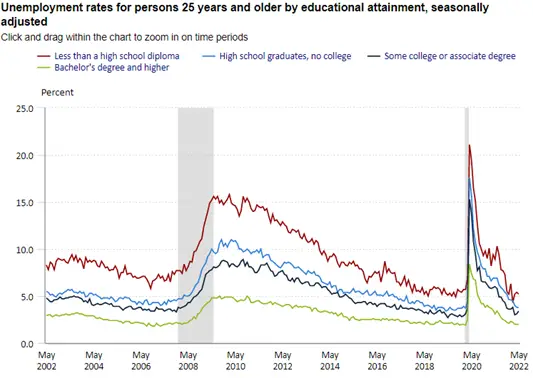

Let’s use education as a surrogate for socioeconomic status. Above, you can see the last 20 years of unemployment data for those 25 years and older by education. Note less than a high school diploma (in red) is always the highest. Also, note that it spikes the highest and comes down more slowly after a recession. Conversely, those with a bachelor’s degree and higher (green) have much smaller relative increases in unemployment after a recession.

In summary, a recession is worse for those already at risk of joblessness and economic harm from a downturn. Instead of focusing just on employment, watch the Fed focus on the employment of those most at risk. Want to see rates tick down in the future? Follow that red line!

What is the Fed Thinking (on the Bull)

So, some inflation is good because that keeps us away from deflationary concerns.

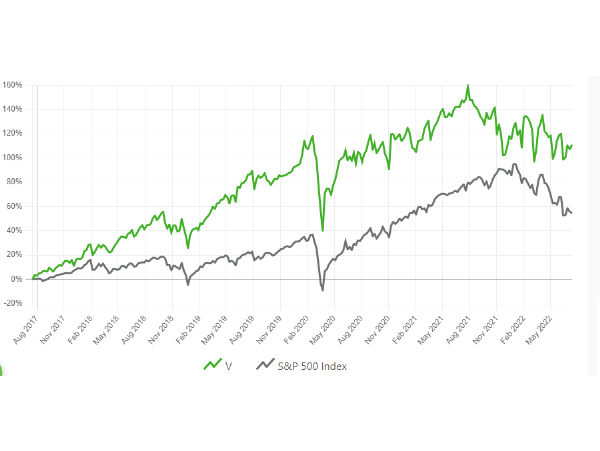

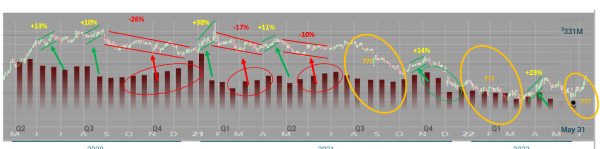

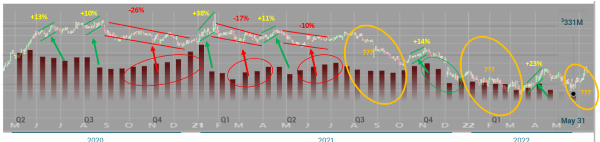

Too much inflation can cause unemployment (especially among those at risk) and stock market crashes (think rich people). Recently, the Fed has been accused of pampering the stock market (think the “taper tantrum”).

Now, they are accused of being behind the curve and missing inflation.

What haven’t we seen yet? A spike in unemployment.

When it spikes, watch the data on socioeconomic status and see if that has a better correlation with the Federal Fund Rate than the stock market. I bet a good ride minimizes the effect the current recession has on the unemployment of those of vulnerable socioeconomic status.

Specifically, watch the Fed focus on the vulnerable populations’ unemployment levels, which are more sensitive to economic downturns and linger longer after upturns in the economy.

What Kind of Bull is the Fed Riding in 2022?

Where are we right now? We have crazy high employment! Unemployment numbers may be at record lows, which is especially remarkable given that we are already likely in a recession.

The Fed is willing to let inflation run hot. Short term they will try to bring it down, but rather than watch the stock market to see when they loosen credit (by easing interest rates), follow unemployment, especially among those of disadvantaged socioeconomic status.

While the Fed has some tools, in the end, the quality of this bull (the current economic crisis) will determine the Fed’s score. The Fed’s goal: hang on, get off semi-safely, and live to ride another bull. The Fed desires inflation to be about 3-4%.

As to the bull we are riding in 2022? This particular bull is in bear market territory, which makes it a juicy one for a good score. A soft landing certainly seems possible. I guess it depends on how thick the dirt is packed, and of course, on how you land once bucked off.

The Fed's 8-Second Bull Ride

The Fed is on a bull right now, midway through the 8 seconds. The economy is bucking, trying to let gravity and chaos reign above data and order.

We all know not to “fight” the Fed. But, it’s going to try and ride that bull.

How is the ride going? I’ve got a few seconds left to tell you.

The Fed in the Bull Chute

Image the Fed as a cowboy in a bull chute, getting ready for an eight-second ride.

In bull riding, both the bull and rider are judged, each responsible for 50% of the final score.

The same might be said about the Fed and the economy, and the ride is just as crazy!

But the important thing to note is that the better bull you have, the better your score. So not only does the bull add to the total, but you score better on a good bull!

The Fed has 8 seconds to show us what it’s got. What has it got? It has a rope around a bull; hold on for dear life!

Think about it this way: the Fed doesn’t set interest rates or hire people. It is only armed with a few cowboy tools: instincts born from experience, a glove, and a tiny bull rope called the Federal Funds Rate.

If the Fed gets a good bull, they will do well.

What kind of bull did we get in 2008? We should get a re-ride option for that bull (inside joke). But, more importantly, what kind of bull do we have in 2022? That’s a good question!

First, how do we score the Fed’s 8-second bull ride? With the dual mandate.

The Dual Mandate: Fed vs. Bull

The Fed is given a dual mandate by congress:

The economy is the bull; the fed the rider.

As the Fed steps onto the bull’s back, it has some tools.

First off, a glove and a bull rope. Then, you got a select few other cowboys helping you get set just right before you nod. Next, you got your instincts and experience being thrown every time you get on (how else do you get off?). That is the history of the economy and the Fed.

Finally, as you start your 8-second ride, pull another rope tight around the bull’s groin just to make him buck harder. Remember, the harder he bucks, but higher you score. I’m not going to tell you which tool is which, but what does the Fed do to really make the economy buck hard?

But ultimately, you never know what kind of bull you have until you look him in the face with your butt in the dirt. Eight seconds on a bull happens too fast to do anything but hold on. So that’s what the Fed is doing now.

Since all we have just a slight concussion now, dazed and bleary-eyed, let’s spend a few seconds thinking about what the Fed is trying to accomplish as the clowns cajole the bull into the bullpen.

What is the Fed Trying to Ride?

When the Fed sits on the back of the bull, the plan is to safely jump off after 8 seconds. In all likelihood, however, they will find another way down.

Currently, the Fed is on a bull: the 2022 Bear Market.

Since we have bull and bear markets, maybe I should have imagined the Fed riding a bear instead. Had I done that, I’d be forced to tell you a bear joke (since I live in Montana and bears eat most of the tourists). When chased by a bear, you don’t have to be faster than the bear, just faster than your friend. Maybe that’s how the Fed deals with Foreign Countries… Try to run just a little faster than they do.

Regardless, the bull is going to do what the bull is going to do, and after the fact, we can score the ride.

What is a good score for the Fed’s bull ride of 2022? A “soft” landing with 3-4% intermediate-term inflation. Yes, inflation will be higher.

Why Inflation Will be Higher

We are in a new era, perhaps, one of higher inflation for the intermediate term.

In the modern economy, inflation “should be” about 3%, and we have been closer to 2% in recent decades.

So, it is not surprising that inflation is higher than average. This is expected as a consequence of reversion to the mean.

But the mean can and does change! You hear this a lot when people are talking about CAPE ratios. How expensive “should” company stock be compared to historical norms. While the interest rate greatly affects stocks (cheap money is thought to drive up all asset prices), inflation is not an independent variable.

That is, interest rates depend on everything else in the economy.

And the Fed does not set interest rates. Instead, they set an overnight rate that banks use to lend money to each other (among other things). This is then a “leash” on the dog what is interest rates. As you walk along, the dog goes up and down, back and forth, and around you, limited by the length of the leash. The leash controls the dog unless the dog is stronger than you are, in which case you will be dragged along with the running dog.

I’m mixing metaphors here, but I don’t want to try and put a leash on a bull. And y’all call a “rope” a “lasso,” which would confuse everyone if I start talking about lassoing a bull. My kids always want to rope a calf… the problem is how do you get the rope off?

And this is getting long, so let’s make one final point.

Unemployment is the other dual mandate. But the judges have changed the way they score it.

How to Understand Unemployment

Let’s look at unemployment and the effect a recession has on it.

Let’s use education as a surrogate for socioeconomic status. Above, you can see the last 20 years of unemployment data for those 25 years and older by education. Note less than a high school diploma (in red) is always the highest. Also, note that it spikes the highest and comes down more slowly after a recession. Conversely, those with a bachelor’s degree and higher (green) have much smaller relative increases in unemployment after a recession.

In summary, a recession is worse for those already at risk of joblessness and economic harm from a downturn. Instead of focusing just on employment, watch the Fed focus on the employment of those most at risk. Want to see rates tick down in the future? Follow that red line!

What is the Fed Thinking (on the Bull)

So, some inflation is good because that keeps us away from deflationary concerns.

Too much inflation can cause unemployment (especially among those at risk) and stock market crashes (think rich people). Recently, the Fed has been accused of pampering the stock market (think the “taper tantrum”).

Now, they are accused of being behind the curve and missing inflation.

What haven’t we seen yet? A spike in unemployment.

When it spikes, watch the data on socioeconomic status and see if that has a better correlation with the Federal Fund Rate than the stock market. I bet a good ride minimizes the effect the current recession has on the unemployment of those of vulnerable socioeconomic status.

Specifically, watch the Fed focus on the vulnerable populations’ unemployment levels, which are more sensitive to economic downturns and linger longer after upturns in the economy.

What Kind of Bull is the Fed Riding in 2022?

Where are we right now? We have crazy high employment! Unemployment numbers may be at record lows, which is especially remarkable given that we are already likely in a recession.

The Fed is willing to let inflation run hot. Short term they will try to bring it down, but rather than watch the stock market to see when they loosen credit (by easing interest rates), follow unemployment, especially among those of disadvantaged socioeconomic status.

While the Fed has some tools, in the end, the quality of this bull (the current economic crisis) will determine the Fed’s score. The Fed’s goal: hang on, get off semi-safely, and live to ride another bull. The Fed desires inflation to be about 3-4%.

As to the bull we are riding in 2022? This particular bull is in bear market territory, which makes it a juicy one for a good score. A soft landing certainly seems possible. I guess it depends on how thick the dirt is packed, and of course, on how you land once bucked off.

Originally Posted on fiphysician.com