Funny that people try to predict future inflation rates.

Don’t get me wrong, inflation is a huge concern for those considering retirement, but what can you actually do about it?

Let’s start by trying to understand what the interest rate “should” be in the first place. Here is a hint: it is not zero.

What is the “desired” interest rate?

Why is there inflation?

Let’s keep it simple. Theoretically, we like “low” inflation because this is the best way to prevent deflation. And that is why there is inflation.

There is inflation because that is halfway between the economy-killers of deflation and hyperinflation.

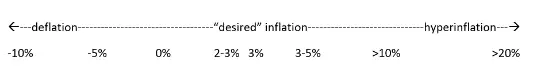

So, look at my line graph above. All the way on the left is deflation and on the right is hyperinflation.

Technically deflation is any negative interest rate. Deflation will kill your economy. Think of it this way: if something is going to be x% cheaper next week or next year, why would you ever buy it today?

And that is the economy-killing key of deflation. You will never buy anything today because it will be cheaper tomorrow. If no one spends any money today, tomorrow never comes, and prices continue their downward spiral due to lack of demand. Even zero percent annual inflation is bad because we want to encourage people to spend money today, not tomorrow.

So Zero percent interest rate is “too low.” It is below our “desired” inflation, as seen above.

I won’t get into hyperinflation, but anything over 20% is “bad.”

Finally, “desired” inflation is somewhere between 2-5%. Let’s talk about that.

What is “Desired” Inflation?

So, since we don’t want hyperinflation or deflation, we want the interest rate to be somewhere above zero.

Does that make sense? An economy with no inflation teeters too close to the wrecking point, which is deflation, so we tolerate “low” inflation levels.

Thus “low” inflation is “desired” because it best prevents killing the entire economy and maybe the culture.

Desired inflation is probably 2-3%. But it is also ok if it is 3-5% over long periods. That can happen, and you can plan for that type of inflation with a good retirement plan. Even 10% inflation over a few years is ok.

The issue with inflation in the 10-20% range is that it is unstable. Right, that means if you are running that “hot,” you are too close to hyperinflation (and likely have economic or political instability to boot).

So, desired inflation is essentially homeostasis for the economy. We want to keep the body temperature of the economy (the inflation rate) in the normal range so that we don’t get hypothermia (deflation) and develop multi-system organ failure (failures of banking and credit systems). We don’t get hyperthermia (hyperinflation) and develop a fever (prices going up so quickly that you must buy them today, which increases demand, increasing prices).

At either end, there is a feedback loop that destroys the economy. It is a negative feedback loop that deflates away your economy on one end and a positive feedback loop that makes goods unaffordable on the other.

Who Controls Inflation?

Who controls inflation? In the US, the consumer controls inflation.

This is because both deflation and hyperinflation are consumer stories.

Don’t get me wrong, bad government (fiscal) and economic policies can and do wreck economies and cultures. But in the modern-day United States, the consumer sets interest rates. We spend our money and substitute depending on our desires and prices.

The Fed changes the overnight borrowing rate in response to the data. They don’t do it willy-nilly; they have a plan but are constantly hit in the face by data. The Fed is, by definition, reactionary. What are they responding to? How much the consumer is spending vs. substituting.

In summary, as long as the interest rate is 2-10%, consumers control inflation. But, above and beyond that, you are bound to get government intervention which may or may not work.

But in the 2-5% range, the consume controls inflation. And at that range, why bother to do anything, since all is “normal?”

How did Inflation “get out of control” Recently?

Why did inflation get out of control recently?

I have news for you. Inflation of 8.6% is normal. It is fine. Really. Don’t panic.

Inflation is not out of control right now. It is normal.

What Will Future Interest Rates Be?

What will happen to interest rates in the future?

I can tell you exactly what will happen to interest rates in the future. They will go up, and they will go down!

This is like predicting how much rain you will get next summer. You can likely predict the average temperature and rainfall next summer, but that doesn’t tell you exactly how much dry grass you will have next summer. And how bad the fire season will be.

So, I know the average changes in interest rates a year from now, I just don’t know if it will be a hot and dry summer or a wet and cool one. Or maybe there will be a tornado or flood, which means next summer will be a wreck. That happens too with exogenous shocks like coronavirus, wars, and weather.

Also, like weather, there is the climate. Over millennia, areas of the earth have warmed and cooled differentially. This has happened over the decades with the economy. The last 40 years have been a period of lowering interest rates and thus great for bonds.

What will the next 40 years bring?

What Will Future Interest Rates Be?

Theoretically, credit is less expensive now than in the past. That is, it is easier to collect your debts now than 1000 years ago; thus, you need less interest to loan out money.

Since you require less interest to loan out money (because there is a much higher chance you will get your money back now than in the historical past), interest rates on money are less expensive now than historically.

Over the last 100 years, the average interest rate has been about 3%. Future interest rates will be about 3%, or they will be higher or lower.

Summary- Desire and Interest Rates

Well, there you have it. We control inflation when it is in the desired range. When it is not, the government is sure to step in and wreck the already tumbling block tower.

We desire inflation because it is better than the alternatives.

Inflation will continue to be normal for the extended future. If it is not normal for more than a year or two, start planning for the end of the economy.

Yes–the end of the economy. That is a pinch of salty tongue in cheek, but still difficult to plan for. Why not plan for what you can control, which is that the desired interest rate will continue to be desirable next summer. And that the fire season is not too bad, either.

Funny that people try to predict future inflation rates.

Don’t get me wrong, inflation is a huge concern for those considering retirement, but what can you actually do about it?

Let’s start by trying to understand what the interest rate “should” be in the first place. Here is a hint: it is not zero.

What is the “desired” interest rate?

Why is there inflation?

Let’s keep it simple. Theoretically, we like “low” inflation because this is the best way to prevent deflation. And that is why there is inflation.

There is inflation because that is halfway between the economy-killers of deflation and hyperinflation.

So, look at my line graph above. All the way on the left is deflation and on the right is hyperinflation.

Technically deflation is any negative interest rate. Deflation will kill your economy. Think of it this way: if something is going to be x% cheaper next week or next year, why would you ever buy it today?

And that is the economy-killing key of deflation. You will never buy anything today because it will be cheaper tomorrow. If no one spends any money today, tomorrow never comes, and prices continue their downward spiral due to lack of demand. Even zero percent annual inflation is bad because we want to encourage people to spend money today, not tomorrow.

So Zero percent interest rate is “too low.” It is below our “desired” inflation, as seen above.

I won’t get into hyperinflation, but anything over 20% is “bad.”

Finally, “desired” inflation is somewhere between 2-5%. Let’s talk about that.

What is “Desired” Inflation?

So, since we don’t want hyperinflation or deflation, we want the interest rate to be somewhere above zero.

Does that make sense? An economy with no inflation teeters too close to the wrecking point, which is deflation, so we tolerate “low” inflation levels.

Thus “low” inflation is “desired” because it best prevents killing the entire economy and maybe the culture.

Desired inflation is probably 2-3%. But it is also ok if it is 3-5% over long periods. That can happen, and you can plan for that type of inflation with a good retirement plan. Even 10% inflation over a few years is ok.

The issue with inflation in the 10-20% range is that it is unstable. Right, that means if you are running that “hot,” you are too close to hyperinflation (and likely have economic or political instability to boot).

So, desired inflation is essentially homeostasis for the economy. We want to keep the body temperature of the economy (the inflation rate) in the normal range so that we don’t get hypothermia (deflation) and develop multi-system organ failure (failures of banking and credit systems). We don’t get hyperthermia (hyperinflation) and develop a fever (prices going up so quickly that you must buy them today, which increases demand, increasing prices).

At either end, there is a feedback loop that destroys the economy. It is a negative feedback loop that deflates away your economy on one end and a positive feedback loop that makes goods unaffordable on the other.

Who Controls Inflation?

Who controls inflation? In the US, the consumer controls inflation.

This is because both deflation and hyperinflation are consumer stories.

Don’t get me wrong, bad government (fiscal) and economic policies can and do wreck economies and cultures. But in the modern-day United States, the consumer sets interest rates. We spend our money and substitute depending on our desires and prices.

The Fed changes the overnight borrowing rate in response to the data. They don’t do it willy-nilly; they have a plan but are constantly hit in the face by data. The Fed is, by definition, reactionary. What are they responding to? How much the consumer is spending vs. substituting.

In summary, as long as the interest rate is 2-10%, consumers control inflation. But, above and beyond that, you are bound to get government intervention which may or may not work.

But in the 2-5% range, the consume controls inflation. And at that range, why bother to do anything, since all is “normal?”

How did Inflation “get out of control” Recently?

Why did inflation get out of control recently?

I have news for you. Inflation of 8.6% is normal. It is fine. Really. Don’t panic.

Inflation is not out of control right now. It is normal.

What Will Future Interest Rates Be?

What will happen to interest rates in the future?

I can tell you exactly what will happen to interest rates in the future. They will go up, and they will go down!

This is like predicting how much rain you will get next summer. You can likely predict the average temperature and rainfall next summer, but that doesn’t tell you exactly how much dry grass you will have next summer. And how bad the fire season will be.

So, I know the average changes in interest rates a year from now, I just don’t know if it will be a hot and dry summer or a wet and cool one. Or maybe there will be a tornado or flood, which means next summer will be a wreck. That happens too with exogenous shocks like coronavirus, wars, and weather.

Also, like weather, there is the climate. Over millennia, areas of the earth have warmed and cooled differentially. This has happened over the decades with the economy. The last 40 years have been a period of lowering interest rates and thus great for bonds.

What will the next 40 years bring?

What Will Future Interest Rates Be?

Theoretically, credit is less expensive now than in the past. That is, it is easier to collect your debts now than 1000 years ago; thus, you need less interest to loan out money.

Since you require less interest to loan out money (because there is a much higher chance you will get your money back now than in the historical past), interest rates on money are less expensive now than historically.

Over the last 100 years, the average interest rate has been about 3%. Future interest rates will be about 3%, or they will be higher or lower.

Summary- Desire and Interest Rates

Well, there you have it. We control inflation when it is in the desired range. When it is not, the government is sure to step in and wreck the already tumbling block tower.

We desire inflation because it is better than the alternatives.

Inflation will continue to be normal for the extended future. If it is not normal for more than a year or two, start planning for the end of the economy.

Yes–the end of the economy. That is a pinch of salty tongue in cheek, but still difficult to plan for. Why not plan for what you can control, which is that the desired interest rate will continue to be desirable next summer. And that the fire season is not too bad, either.

Originally Posted on fiphysician.com