Who is the Greater Fool?

To put it in the crudest of terms, a greater fool is someone who is dumber than you. At the poker table, if you can’t figure out who the patsy is, it’s probably you. At an auction, the person who grossly overbids because he’s emotionally attached to the artifact is a greater fool. And in investing, the person who buys the stock that you clearly overpaid for is a greater fool. Here are some categories of greater fools in the investment world.

- Bag holders – the last buyers just before the market tanks.

- FOMOs – buyers whose sole motivation is a fear of missing out on a good thing.

- Day traders – overconfident speculators who believe they can out-trade the professionals.

- Performance chasers – impatient types who quickly dump their recent losers and buy the recent winners.

- Dumb Money – investors who have no plan, no strategy, no information, and no self-control.

- Story traders – investors who buy stocks based on how exciting the story sounds.

Are You the Greater Fool?

One of my favorite TV shows is HBO’s The Newsroom. The guy who wrote the show, Aaron Sorkin, is known for fast-paced, snappy dialog. In the final episode of season 1, economics reporter Sloan Sabbith (played by Olivia Munn) tells her boss, anchorman Will McAvoy (played by Jeff Daniels):

“The greater fool is someone with the perfect blend of

self-delusion and ego to think that he can succeed where others

have failed. This whole country was built by greater fools.”

The greater fool theory is a bedrock principle of investing. It’s the belief that one can make money by speculating on future prices, because there will always be a “greater fool” who will come along and pay more than what you paid, even if you paid too much. It relies on the assumption that someone else will be left holding the bag when the price gets too high and the bubble bursts. Speculation based on a belief in the greater fool theory is a great way to make a lot of money, as long as the greater fool doesn’t turn out to be you.

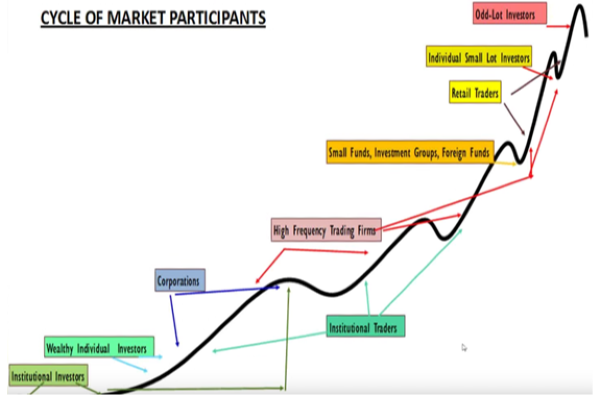

Greater Fools in the stock market

In the stock market, the greater fool theory comes into play when the price of a stock has gone up so much that it’s no longer being driven by rising intrinsic values, but by expectations that irrational bidders for the stock can always be found, and they will be there – ready to buy – when you are ready to sell.

According to the theory, any price, no matter how high, can be justified by a rational buyer under the belief that another party – an irrational buyer – is willing to pay an even higher price.

Those who subscribe to the greater fool theory will often make questionable investments, not because they believe that the current price is attractive, but rather because they believe that they will be able to sell to someone else at an even higher price.

So, the question we need to address is this: should we ever buy an overpriced stock based on the premise that we can make money because of the greater fool theory? There is ample evidence that greater fools do exist, but can we count on them to show up when we need them? In my view the answer is no, for three reasons.

Reason 1. The first has to do with an important characteristic of greater fools: they are heat-seekers. They are attracted to stocks that are hot. They are not interested in value stocks or steady performers. They want action. So, the first problem we have to deal with is the impatience that greater fools have for any hot stock that stumbles, has a hiccup, or otherwise cools off – even temporarily. At the first sign of trouble, these trend-chasers will disappear and move on to the next hot stock. And when that happens, who is left behind, holding the bag? You are.

Reason 2. The second has to do with a characteristic of the market itself. It’s well understood by experienced investors that returns are mean-reverting, which is just a fancy way to say that what goes up must come down. Stock prices are subject to the laws of gravity, and when the price of a hot stock gets too far above its’ average, it will eventually come back down. Here again we are faced with a problem of timing. There is no way for us to know ahead of time when this mean-reversion will happen. And if you happen to be holding the bag when it does, don’t count on the greater fools to be there for you.

Reason 3. The third reason has to do with time. Playing the greater fool game is time-intensive. To do it successfully requires that you pay attention, because price trends can reverse on a dime. It requires checking the stock price at least daily, if not several times throughout the day. Do you have the time, patience, and discipline to do that? Some people do and might even thrive on that kind of action. But most of us have other, more important things to do with our time. Unless you’re a full-time day trader, I would not recommend playing the greater fool game.

Does this mean that investing has to be dull and boring? Of course not. There are plenty of stocks that are fairly priced, or even underpriced, and are still capable of blasting off like a rocket. The smart approach is to buy them when they are cheap and sell them when they are fairly valued. That’s an entirely different game, and it has the great advantage of not forcing you to depend on the kindness of strangers – the greater fools.

So how can you know which stocks are overpriced and which ones are underpriced? There are many stock screening tools out there, and some of them are free, at least in a dumbed-down version. Morningstar, StockRover, Zacks, and your local broker are good places to look.

I keep my own list, which I update weekly and share with clients and subscribers to my newsletter. If you would like to see the latest list of the 10 most overpriced and 10 most underpriced stocks, send me an email at info@zeninvesor.org and I’ll send it right away, with my compliments.

Who is the Greater Fool?

To put it in the crudest of terms, a greater fool is someone who is dumber than you. At the poker table, if you can’t figure out who the patsy is, it’s probably you. At an auction, the person who grossly overbids because he’s emotionally attached to the artifact is a greater fool. And in investing, the person who buys the stock that you clearly overpaid for is a greater fool. Here are some categories of greater fools in the investment world.

Are You the Greater Fool?

One of my favorite TV shows is HBO’s The Newsroom. The guy who wrote the show, Aaron Sorkin, is known for fast-paced, snappy dialog. In the final episode of season 1, economics reporter Sloan Sabbith (played by Olivia Munn) tells her boss, anchorman Will McAvoy (played by Jeff Daniels):

“The greater fool is someone with the perfect blend of self-delusion and ego to think that he can succeed where others have failed. This whole country was built by greater fools.”

The greater fool theory is a bedrock principle of investing. It’s the belief that one can make money by speculating on future prices, because there will always be a “greater fool” who will come along and pay more than what you paid, even if you paid too much. It relies on the assumption that someone else will be left holding the bag when the price gets too high and the bubble bursts. Speculation based on a belief in the greater fool theory is a great way to make a lot of money, as long as the greater fool doesn’t turn out to be you.

Greater Fools in the stock market

In the stock market, the greater fool theory comes into play when the price of a stock has gone up so much that it’s no longer being driven by rising intrinsic values, but by expectations that irrational bidders for the stock can always be found, and they will be there – ready to buy – when you are ready to sell.

According to the theory, any price, no matter how high, can be justified by a rational buyer under the belief that another party – an irrational buyer – is willing to pay an even higher price.

Those who subscribe to the greater fool theory will often make questionable investments, not because they believe that the current price is attractive, but rather because they believe that they will be able to sell to someone else at an even higher price.

So, the question we need to address is this: should we ever buy an overpriced stock based on the premise that we can make money because of the greater fool theory? There is ample evidence that greater fools do exist, but can we count on them to show up when we need them? In my view the answer is no, for three reasons.

Reason 1. The first has to do with an important characteristic of greater fools: they are heat-seekers. They are attracted to stocks that are hot. They are not interested in value stocks or steady performers. They want action. So, the first problem we have to deal with is the impatience that greater fools have for any hot stock that stumbles, has a hiccup, or otherwise cools off – even temporarily. At the first sign of trouble, these trend-chasers will disappear and move on to the next hot stock. And when that happens, who is left behind, holding the bag? You are.

Reason 2. The second has to do with a characteristic of the market itself. It’s well understood by experienced investors that returns are mean-reverting, which is just a fancy way to say that what goes up must come down. Stock prices are subject to the laws of gravity, and when the price of a hot stock gets too far above its’ average, it will eventually come back down. Here again we are faced with a problem of timing. There is no way for us to know ahead of time when this mean-reversion will happen. And if you happen to be holding the bag when it does, don’t count on the greater fools to be there for you.

Reason 3. The third reason has to do with time. Playing the greater fool game is time-intensive. To do it successfully requires that you pay attention, because price trends can reverse on a dime. It requires checking the stock price at least daily, if not several times throughout the day. Do you have the time, patience, and discipline to do that? Some people do and might even thrive on that kind of action. But most of us have other, more important things to do with our time. Unless you’re a full-time day trader, I would not recommend playing the greater fool game.

Does this mean that investing has to be dull and boring? Of course not. There are plenty of stocks that are fairly priced, or even underpriced, and are still capable of blasting off like a rocket. The smart approach is to buy them when they are cheap and sell them when they are fairly valued. That’s an entirely different game, and it has the great advantage of not forcing you to depend on the kindness of strangers – the greater fools.

So how can you know which stocks are overpriced and which ones are underpriced? There are many stock screening tools out there, and some of them are free, at least in a dumbed-down version. Morningstar, StockRover, Zacks, and your local broker are good places to look.

I keep my own list, which I update weekly and share with clients and subscribers to my newsletter. If you would like to see the latest list of the 10 most overpriced and 10 most underpriced stocks, send me an email at info@zeninvesor.org and I’ll send it right away, with my compliments.

Originally Posted on zeninvestor.org