Business Overview

Bristol-Myers Squibb was created as the result of a merger between Bristol-Myers and Squibb on October 4th, 1989. Bristol-Myers can trace its corporate beginnings back to 1887. Today the company is a leading drug maker of cardiovascular and anti-cancer therapeutics, with annual revenues of about $46 billion.

With the $74 billion acquisition of Celgene, the company has transformed itself into an industry giant that can generate strong results even through a recession. Celgene generated almost two-thirds of its revenue from Revlimid, which treats multiple myeloma and other cancers.

On July 27th, 2022, Bristol-Myers reported second quarter results for the period ending June 30th, 2022. Revenue was up 1.7% to $11.9 billion, beating expectations by $400 million. Adjusted earnings-per-share of $1.93 was an 18% increase over $1.63 earned in the prior year quarter.

When looking at specific drugs, Revlimid sales declined 22% to $2.5 billion due to lower demand as a result of its loss of patent exclusivity. Further weakness is anticipated for this product.

Eliquis, which prevents blood clots, grew 16% to $3.2 billion due largely to strength in the U.S. and key international markets. Eliquis has become the top oral anticoagulant in several international markets since 2019. The drug had nearly $11 billion in revenue for FY 2021.

Opdivo, which treats cancers such as advanced renal carcinoma, was up by 8% to $2.1 billion as a result of continued higher demand across multiple indications and geographies.

Lastly, Revenue for Orencia, which treats rheumatoid arthritis, grew 8% to $876 million.

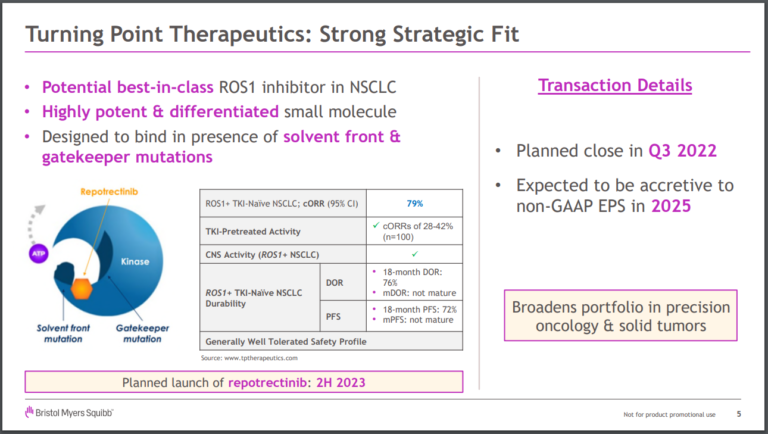

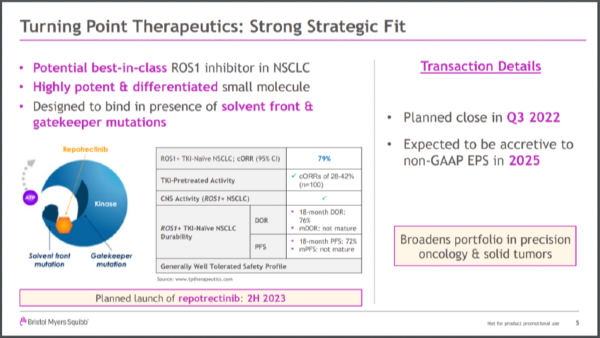

In June, Brystol-Myers Squibb announced a definitive merger agreement with Turning Point Therapeutics, Inc. (NASDAQ: TPTX). Brystol-Myers will acquire Turning Point for $76.00 per share, all in cash, for roughly $4.1 billion. The acquisition is expected to close during Q3 2022.

Bristol-Myers updated 2022 guidance as well. The company now expects revenue of $46 billion for the year, down from $47 billion previously. Adjusted earnings-per-share is still projected to come in at $7.44 to $7.74. Revlimid is expected to generate $9.0 to $9.5 billion in sales.

Growth Prospects

Brystol-Myers will continue to build on its pharmaceutical portfolio. Both through organic research & development, and acquisitions.

Brystol-Myers Squibb has grown massively through acquisitions. Celgene was one large acquisition which the company is about finished digesting.

And now, the company is acquiring Turning Point Therapeutics. The Turning Point acquisition will expand the company’s precision oncology and solid tumor portfolio with the addition of Repotrectinib and other pipeline assets. Repotrectinib is a potential best-in-class therapy for non-small cell lung cancer and other advanced solid tumors.

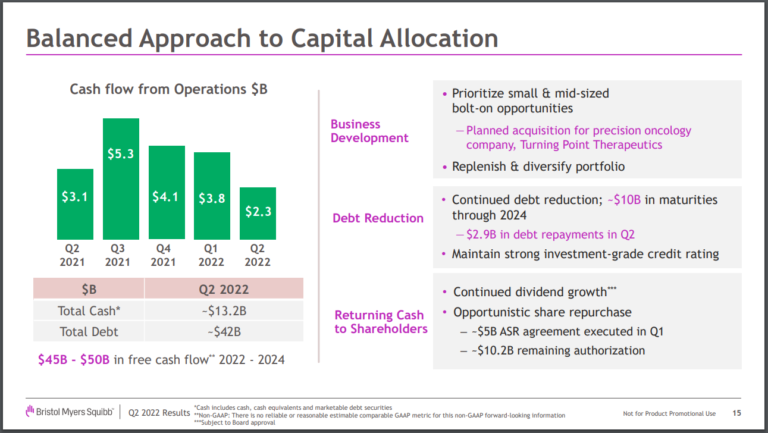

The company is also continuing to repurchase shares as part of its $15 billion December 2021 share repurchase authorization. Brystol-Myers still has $10.2 billion remaining on its authorization, which accounts for about 6.4% of total shares outstanding. This will further add to the company’s per-share earnings.

We expect Brystol-Myers Squibb will grow earnings-per-share at a rate of 3% annually in the intermediate term. This is following three years of very strong earnings growth.

Competitive Advantages & Recession Performance

The company’s competitive advantage is its ability to either produce or acquire patents for pharmaceuticals with high potential revenue. Bristol-Myers’ top three selling pharmaceuticals, Revlimid, Opdivo and Eliquis, have shown solid growth rates and are expected to see high peak annual sales. To note, is that Revlimid has now lost patent exclusivity in certain markets.

Bristol-Myers has strong recession resiliency and saw earnings increase during the last recession, which is not uncommon for drug companies. Even in a recession, healthcare is a necessity and people will seek treatment for health problems, especially cancers.

Valuation & Expected Returns

Shares of Bristol-Myers Squibb have traded for an average price-to-earnings multiple of around 21.1. Shares are now trading far below this average, which indicates that shares could be undervalued at the current 9.9 times earnings.

Our fair value estimate for Bristol-Myers Squibb stock is 13.5 times earnings. If this proves correct, the stock will benefit from a 6.4% annualized gain in its returns through 2027.

Shares of Bristol-Myers Squibb currently yield 2.9%, which is identical to its average yield of 2.9%. On a dividend yield basis, BMY shares seem to be trading in-line with fair value.

The current dividend payout is adequately covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, BMY has a payout ratio of only 28%. Bristol-Myers Squibb has so far increased its dividend for 15 consecutive years. We anticipate continued mid single-digit dividend increases in the years to come.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 11.8% per year over the next five years. This makes Bristol-Myers Squibb a buy.

Final Thoughts

Brystol-Myers Squibb is a healthcare giant that is active in acquiring new drugs. The company made a massive $72 billion acquisition of Celgene in recent years and is now acquiring Turning Point Therapeutics for $4.1 billion.

The company has grown earnings by more than 20% per year on average over the last five and ten years. This explosive growth has enabled the company to continue growing its dividend. Brystol-Myers has increased its dividend for fifteen consecutive years, marking it as a Dividend Contender.

With strong total return expectations of 11.8% per year over the next five years, Brystol-Myers Squibb stock is a buy for long-term dividend growth investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Business Overview

Bristol-Myers Squibb was created as the result of a merger between Bristol-Myers and Squibb on October 4th, 1989. Bristol-Myers can trace its corporate beginnings back to 1887. Today the company is a leading drug maker of cardiovascular and anti-cancer therapeutics, with annual revenues of about $46 billion.

With the $74 billion acquisition of Celgene, the company has transformed itself into an industry giant that can generate strong results even through a recession. Celgene generated almost two-thirds of its revenue from Revlimid, which treats multiple myeloma and other cancers.

On July 27th, 2022, Bristol-Myers reported second quarter results for the period ending June 30th, 2022. Revenue was up 1.7% to $11.9 billion, beating expectations by $400 million. Adjusted earnings-per-share of $1.93 was an 18% increase over $1.63 earned in the prior year quarter.

When looking at specific drugs, Revlimid sales declined 22% to $2.5 billion due to lower demand as a result of its loss of patent exclusivity. Further weakness is anticipated for this product.

Eliquis, which prevents blood clots, grew 16% to $3.2 billion due largely to strength in the U.S. and key international markets. Eliquis has become the top oral anticoagulant in several international markets since 2019. The drug had nearly $11 billion in revenue for FY 2021.

Opdivo, which treats cancers such as advanced renal carcinoma, was up by 8% to $2.1 billion as a result of continued higher demand across multiple indications and geographies.

Lastly, Revenue for Orencia, which treats rheumatoid arthritis, grew 8% to $876 million.

In June, Brystol-Myers Squibb announced a definitive merger agreement with Turning Point Therapeutics, Inc. (NASDAQ: TPTX). Brystol-Myers will acquire Turning Point for $76.00 per share, all in cash, for roughly $4.1 billion. The acquisition is expected to close during Q3 2022.

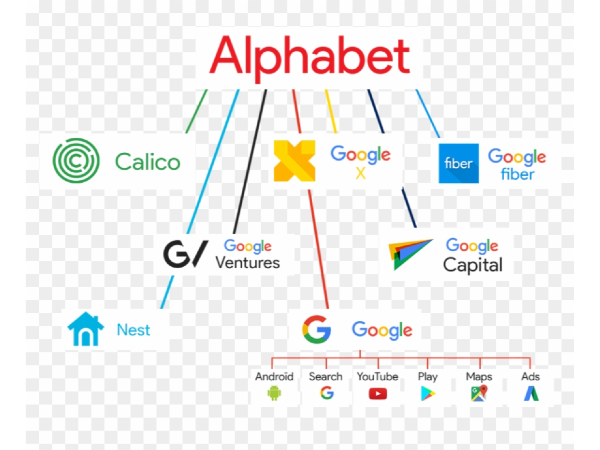

Source: Investor Presentation

Bristol-Myers updated 2022 guidance as well. The company now expects revenue of $46 billion for the year, down from $47 billion previously. Adjusted earnings-per-share is still projected to come in at $7.44 to $7.74. Revlimid is expected to generate $9.0 to $9.5 billion in sales.

Growth Prospects

Brystol-Myers will continue to build on its pharmaceutical portfolio. Both through organic research & development, and acquisitions.

Brystol-Myers Squibb has grown massively through acquisitions. Celgene was one large acquisition which the company is about finished digesting.

And now, the company is acquiring Turning Point Therapeutics. The Turning Point acquisition will expand the company’s precision oncology and solid tumor portfolio with the addition of Repotrectinib and other pipeline assets. Repotrectinib is a potential best-in-class therapy for non-small cell lung cancer and other advanced solid tumors.

Source: Investor Presentation

The company is also continuing to repurchase shares as part of its $15 billion December 2021 share repurchase authorization. Brystol-Myers still has $10.2 billion remaining on its authorization, which accounts for about 6.4% of total shares outstanding. This will further add to the company’s per-share earnings.

We expect Brystol-Myers Squibb will grow earnings-per-share at a rate of 3% annually in the intermediate term. This is following three years of very strong earnings growth.

Competitive Advantages & Recession Performance

The company’s competitive advantage is its ability to either produce or acquire patents for pharmaceuticals with high potential revenue. Bristol-Myers’ top three selling pharmaceuticals, Revlimid, Opdivo and Eliquis, have shown solid growth rates and are expected to see high peak annual sales. To note, is that Revlimid has now lost patent exclusivity in certain markets.

Bristol-Myers has strong recession resiliency and saw earnings increase during the last recession, which is not uncommon for drug companies. Even in a recession, healthcare is a necessity and people will seek treatment for health problems, especially cancers.

Valuation & Expected Returns

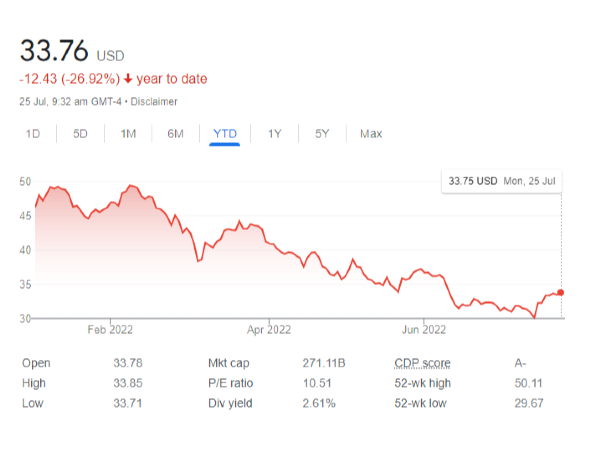

Shares of Bristol-Myers Squibb have traded for an average price-to-earnings multiple of around 21.1. Shares are now trading far below this average, which indicates that shares could be undervalued at the current 9.9 times earnings.

Our fair value estimate for Bristol-Myers Squibb stock is 13.5 times earnings. If this proves correct, the stock will benefit from a 6.4% annualized gain in its returns through 2027.

Shares of Bristol-Myers Squibb currently yield 2.9%, which is identical to its average yield of 2.9%. On a dividend yield basis, BMY shares seem to be trading in-line with fair value.

The current dividend payout is adequately covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, BMY has a payout ratio of only 28%. Bristol-Myers Squibb has so far increased its dividend for 15 consecutive years. We anticipate continued mid single-digit dividend increases in the years to come.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 11.8% per year over the next five years. This makes Bristol-Myers Squibb a buy.

Final Thoughts

Brystol-Myers Squibb is a healthcare giant that is active in acquiring new drugs. The company made a massive $72 billion acquisition of Celgene in recent years and is now acquiring Turning Point Therapeutics for $4.1 billion.

The company has grown earnings by more than 20% per year on average over the last five and ten years. This explosive growth has enabled the company to continue growing its dividend. Brystol-Myers has increased its dividend for fifteen consecutive years, marking it as a Dividend Contender.

With strong total return expectations of 11.8% per year over the next five years, Brystol-Myers Squibb stock is a buy for long-term dividend growth investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Originally Posted on suredividend.com