I sat down with John Collins to discuss why retirement planning is important. He is a wealth educator and financial advisor at Transamerica who became a financial professional because he watched friends and family struggle with their financial security. He specializes in retirement planning as well as estate and personal financial planning.

When we speak via a Zoom (ZM) conference call, he is on a work trip in Denver. In between client meetings and time with his visiting family, we sit down with John to learn about retirement planning. You can watch the full interview here.

Why is Retirement Planning Important

People will spend more time planning for vacations in their lifetime instead of planning for retirement. However, while a vacation is somewhere you may go, retirement is an inevitable destination. Just like a successful vacation, a successful retirement needs to be planned.

What does Retirement Planning Mean?

When you're young, retirement planning is not on your radar. But retirement planning should start as soon as you start work. Retirement planning is the process of setting a plan so that you can have the financial resources necessary to live the life you want to live after you have stopped working. Retirement planning is most important early in your career. The process balances your financial needs when you're young and the financial needs of yourself and your family when you are older.

When Should Someone Start Planning to Retire?

You should start planning right now especially if you are researching retirement questions online. It’s important to see the whole financial picture.

If you’re afraid of looking at your financial situation, you may have an issue with your money script.

Check out this article on money scripts to help overcome financial anxiety.

You’re going to make life stops when you buy your first home or you get married. But an inevitable stop is retirement. Regardless if you’re in your 20s, 30s, or 40s, you need to start planning today. Since you will end up at this destination, you want a clearly defined strategy and go beyond just hoping for the best.

Five Things You Must Prepare for to Retire Successfully

1. Have a Strategy

Say you’re self employed and you don’t have an employer plan, what’s your strategy then? Are you going to use a Roth IRA, a 401k, or real estate? Will you be receiving a pension? Do you trust your pension to provide enough financial support when you retire?

Failing to have a strategy is a common pitfall in retirement planning. When you develop a retirement strategy, you define your road map with the following decisions:

2. Get Help, Sit with a Professional

Retirement planning is homework you do not know the answers to. Sitting down with a professional helps you do the retirement homework. You may want to read books and articles about retirement planning, but ultimately you want a professional to fill in the details so you can see the whole picture.

When you work with a retirement planner, their mission is to ensure you build a road map to retire comfortably. They will build a retirement plan with you.

Check out this retirement planning example

You want to make sure you really like the professional, you feel comfortable with the professional, and you can trust that professional. This is crucial because you’ll be letting them access personal information, your hopes, and your fears. The relationship could span decades, and you're looking for a trusted advisor to guide you.

Very few people can build a house by themselves. Don’t DIY your retirement planning.

3. The Economy Affecting Your Strategy

When you’re planning for your retirement, you may be looking 30 years into the future. External economic and government policy factors can potentially unravel your plan if you don’t take potential changes into account.

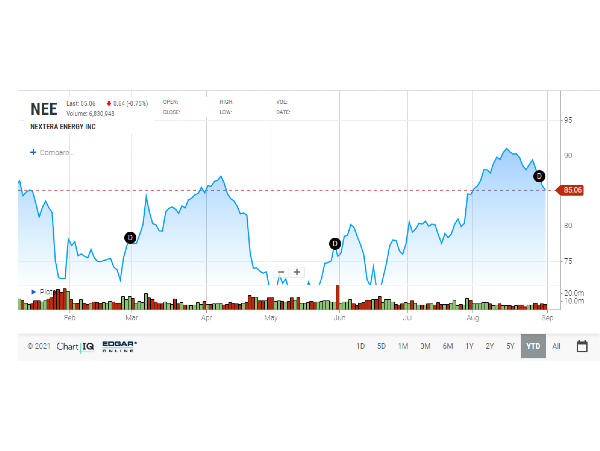

The most visceral external impact is a downturn in the stock market. When building a retirement plan, you must take into consideration a potential draw down of the stock market. Historical draw downs can go as much as 40%, and by no means does the past indicate it couldn’t be worse in the future.

A financial professional will assess this kind of risk by suggesting investments that would be minimally impacted by a market crash.

Check out our top 10 safe investments

A financial professional may suggest safe investments like dividend stocks or utility stocks.

Taxes, depending on when you’re retiring, will have an impact on your plan. Taxes not only play into your personal income, but also affect the taxes on your investments. By using the right retirement account for your investments, you may be able to forego paying taxes on your investment earnings until you retire.

Inflation will also have an effect on your plan. If inflation out paces your earnings, you suddenly are unable to buy everything in your budget. The worst U.S. inflation post World War II was 13.3% back in 1979[1]. And while that seems like a historical anomaly, inflation hit 8.3% in 2022. Inflation erodes the value of money. At 10% inflation, a $5 cheeseburger will cost you $5.50 by the end of the year. A retirement planner will take these scenarios into consideration when you plan out your retirement budget. This ensures you’ll have income streams to provide for you even if inflation runs rampant.

When you build your financial plan, you will take into account how much exposure your strategy has to different economic factors so that you don’t leave anything to chance.

4. Prepare for your Family

Am I planning for myself or for myself and others? In one example, John Collins spoke to a family looking to improve their retirement plan. The couple seemed to have done everything right. but they didn’t plan for their two kids' college, or for their kids temporarily living with them after college. Because of these family costs not taken into account, the husband had to go back to work. It’s important to plan not just for yourself but to support your family as well in case an unforeseen event occurs.

5. Health in retirement planning

Health is an important factor in retirement planning. If you are in your 60s, a serious health condition may not let you afford your retirement lifestyle. Having an emergency fund for your health is vital in retirement. With a retirement planner, you can take into consideration different health plans with the right deductibles and copays to minimize health risks.

Check out our full interview with John Collins

References

I sat down with John Collins to discuss why retirement planning is important. He is a wealth educator and financial advisor at Transamerica who became a financial professional because he watched friends and family struggle with their financial security. He specializes in retirement planning as well as estate and personal financial planning.

When we speak via a Zoom (ZM) conference call, he is on a work trip in Denver. In between client meetings and time with his visiting family, we sit down with John to learn about retirement planning. You can watch the full interview here.

Why is Retirement Planning Important

People will spend more time planning for vacations in their lifetime instead of planning for retirement. However, while a vacation is somewhere you may go, retirement is an inevitable destination. Just like a successful vacation, a successful retirement needs to be planned.

What does Retirement Planning Mean?

When you're young, retirement planning is not on your radar. But retirement planning should start as soon as you start work. Retirement planning is the process of setting a plan so that you can have the financial resources necessary to live the life you want to live after you have stopped working. Retirement planning is most important early in your career. The process balances your financial needs when you're young and the financial needs of yourself and your family when you are older.

When Should Someone Start Planning to Retire?

You should start planning right now especially if you are researching retirement questions online. It’s important to see the whole financial picture.

If you’re afraid of looking at your financial situation, you may have an issue with your money script.

Check out this article on money scripts to help overcome financial anxiety.

You’re going to make life stops when you buy your first home or you get married. But an inevitable stop is retirement. Regardless if you’re in your 20s, 30s, or 40s, you need to start planning today. Since you will end up at this destination, you want a clearly defined strategy and go beyond just hoping for the best.

Five Things You Must Prepare for to Retire Successfully

1. Have a Strategy

Say you’re self employed and you don’t have an employer plan, what’s your strategy then? Are you going to use a Roth IRA, a 401k, or real estate? Will you be receiving a pension? Do you trust your pension to provide enough financial support when you retire?

Failing to have a strategy is a common pitfall in retirement planning. When you develop a retirement strategy, you define your road map with the following decisions:

2. Get Help, Sit with a Professional

Retirement planning is homework you do not know the answers to. Sitting down with a professional helps you do the retirement homework. You may want to read books and articles about retirement planning, but ultimately you want a professional to fill in the details so you can see the whole picture.

When you work with a retirement planner, their mission is to ensure you build a road map to retire comfortably. They will build a retirement plan with you.

You want to make sure you really like the professional, you feel comfortable with the professional, and you can trust that professional. This is crucial because you’ll be letting them access personal information, your hopes, and your fears. The relationship could span decades, and you're looking for a trusted advisor to guide you.

Very few people can build a house by themselves. Don’t DIY your retirement planning.

3. The Economy Affecting Your Strategy

When you’re planning for your retirement, you may be looking 30 years into the future. External economic and government policy factors can potentially unravel your plan if you don’t take potential changes into account.

The most visceral external impact is a downturn in the stock market. When building a retirement plan, you must take into consideration a potential draw down of the stock market. Historical draw downs can go as much as 40%, and by no means does the past indicate it couldn’t be worse in the future. A financial professional will assess this kind of risk by suggesting investments that would be minimally impacted by a market crash.

A financial professional may suggest safe investments like dividend stocks or utility stocks.

Taxes, depending on when you’re retiring, will have an impact on your plan. Taxes not only play into your personal income, but also affect the taxes on your investments. By using the right retirement account for your investments, you may be able to forego paying taxes on your investment earnings until you retire.

Inflation will also have an effect on your plan. If inflation out paces your earnings, you suddenly are unable to buy everything in your budget. The worst U.S. inflation post World War II was 13.3% back in 1979[1]. And while that seems like a historical anomaly, inflation hit 8.3% in 2022. Inflation erodes the value of money. At 10% inflation, a $5 cheeseburger will cost you $5.50 by the end of the year. A retirement planner will take these scenarios into consideration when you plan out your retirement budget. This ensures you’ll have income streams to provide for you even if inflation runs rampant.

When you build your financial plan, you will take into account how much exposure your strategy has to different economic factors so that you don’t leave anything to chance.

4. Prepare for your Family

Am I planning for myself or for myself and others? In one example, John Collins spoke to a family looking to improve their retirement plan. The couple seemed to have done everything right. but they didn’t plan for their two kids' college, or for their kids temporarily living with them after college. Because of these family costs not taken into account, the husband had to go back to work. It’s important to plan not just for yourself but to support your family as well in case an unforeseen event occurs.

5. Health in retirement planning

Health is an important factor in retirement planning. If you are in your 60s, a serious health condition may not let you afford your retirement lifestyle. Having an emergency fund for your health is vital in retirement. With a retirement planner, you can take into consideration different health plans with the right deductibles and copays to minimize health risks.

Check out our full interview with John Collins

References

1. U.S. inflation rate by year and forecast