Everyone loves to buy something on sale. For investors, that means finding undervalued stocks.

Although available during bull markets, investors usually find more cheap stocks during bear markets. Prices drop, sometimes falling too far, making some stocks a deal, like in 2022. Hence, now is a good time for investors to scour lists and find the best cheap stocks to buy.

Below is a list of the five great cheap stocks to buy now. But first, let’s explore this concept.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

What Are Cheap Stocks?

Cheap stocks are undervalued equities. That doesn’t mean stocks whose price is below a dollar amount. You should not buy a stock solely because it is priced below $10 per share, $5 per share, or some other price point. Some stocks are at a low price due to the company’s declining revenue.

Even worse, some companies’ businesses may be in decline, and they cannot recover. Buying stocks like these because they are priced low will probably cause a loss of principal. They are often cheap or undervalued for a reason and can usually go lower.

“A low-priced stock doesn’t mean it’s good value,” said Danielle Miura, Certified Financial Planner of Spark Financials in Ripon, California.

“A stock may be cheap in terms of the price per share. However, it may be worth very little if the company has little potential or serious issues.”

“Some of the lowest-priced stocks are penny stocks,” says Muira. “Penny stocks are not well regulated, provide less company information to investors, have a lower trading volume, and are vulnerable to scams.”

How To Find Cheap Stocks?

By their very nature, cheap stocks are harder to find than overvalued ones. The financial news is full of reports of stocks with double-digit or triple-digit gains. But often, they are overvalued. Eventually, stock valuations drop, and overvalued stocks suffer the most. In addition, some people and sites provide lists of low-priced stocks but don’t dig deeper.

“Most of these people don’t ever look at the nuts and bolts like the statement of cash flow, their financial ratios, their 10-Q, and 10-K, etc.,” said Certified Financial Planner Blaine Thiederman of Progress Wealth Management in Arvada, Colorado. “So understand the company and how it creates a profit.”

A way to find cheap stocks is to start with a stock screener and do some research on your own. One method is to examine price-to-earnings ratios (P/E ratios) for regular stocks or price-to-funds from operations (P/FFO) for real estate investment trusts (REITs). Both metrics are a measure of valuation.

For example, the stock price of Alphabet (GOOG, GOOGL) has declined almost 19% year-to-date (but it is still $118.12!) That certainly doesn’t sound cheap, but is it? How do we know? The P/E ratio tells us the stock is undervalued and cheap. The stock’s ratio is 22.6X, which is below its 5-year range of 23.3X and 27.4X, so not super cheap, but still a deal. We will include Alphabet as one of the best cheap stocks to buy now.

What Else To Look For in the Best Cheap Stocks To Buy Now

A low P/E or P/FFO ratio is the minimum criteria, but you should dig deeper. What other characteristics should a cheap stock have? An essential one is growth.

A business must be healthy and have some growth over time to generate increased revenue and earnings. If a company cannot grow at all, it will probably get surpassed by its competitors. Even worse, if a business declines, the stock price may go lower.

Next, ask yourself if the company is returning cash to shareholders. The two primary ways are dividends and share buybacks. Dividends return money directly to you, generating a passive income stream. A large enough stream will permit you to live from dividends in retirement. Share buybacks are good too, but you don’t receive cash.

Best Cheap Stocks To Buy Now

Below we provide a diversified list of the best cheap stocks to buy now.

1. Alphabet

Alphabet was formerly known as Google, and many still call it by that name. The company owns the world’s dominant search engine with more than 90% market share. Alphabet also owns YouTube, FitBit, Android, Chrome, Gmail, Google Cloud, Google Drive, Google Maps, Google Play, Nest, etc. The company is pervasive on the internet, and most people use its products or services daily.

The stock price has been under pressure because of recession fears. During recessions, advertising revenue falls, which Alphabet depends on (most of its revenue comes from search engine or YouTube advertising).

Google does not yet pay a dividend; however, it is one of the top companies for stock buybacks. The stock is cheap based on its P/E ratio trading below its 5-year and 10-year ranges. With Alphabet, investors can buy an innovative company and market leader.

- Ticker: GOOG, GOOGL

- Stock Price: $118.12

- Market Cap: $1.53 trillion

- Dividend Yield: None

- 1-Year Trailing Total Return: -13.72%

2. Verizon

Verizon Communications (VZ) is one of three leading cellphone providers in the US that together hold over 90% of the market. Besides mobile phone service, Verizon owns the FiOS fiber broadband network. The company offers services to consumers and businesses.

Verizon is struggling with slow growth in its core business because the cellphone service market is mature and has already consolidated. Hence, there are few acquisition targets. The next growth area is FiOS, but it is expensive to expand. Therefore, the stock price has dropped.

Verizon is undervalued based on a P/E ratio of about 8.6X, making it one of the best cheap stocks to buy now. For perspective – the S&P 500 Index’s average P/E ratio is approximately 21.4X. Moreover, Verizon’s ratio is far below the 5-year and 10-year ranges. Simultaneously, the dividend yield is roughly 5.8%, which is excellent for retirees desiring income.

- Ticker: VZ

- Stock Price: $44.42

- Market Cap: $186.55 billion

- Dividend Yield: 5.76%

- 1-Year Trailing Total Return: -19.78%

Related Articles About Verizon

3. Ally Financial

Ally Financial (ALLY) is a digital financial-services company. It mainly operates online, providing insurance, mortgages, car loans, fleet financing, commercial banking, etc. The firm was formerly known as GMAC and became Ally in 2010. Today, the stock is in the news because Warren Buffett is acquiring shares.

The firm is in a cyclical business, and recession fears hammered the stock price because the company’s products and services will likely experience lower demand during an economic slowdown. For instance, fewer people buying cars cuts demand for auto loans and insurance. People may also default on their loan repayments, which will increase losses. In another example, businesses may not need as many commercial banking products.

Ally is absurdly inexpensive and one of the best cheap stocks to buy now based on a P/E ratio of about 4.8X. Again, this value is well below the 5-year and 10-year ranges. The company pays a dividend, but the yield is only about 3.3%. If Warren Buffett is buying shares, it is worth researching the company.

- Ticker: ALLY

- Stock Price: $35.16

- Market Cap: $10.85 billion

- Dividend Yield: 3.27%

- 1-Year Trailing Total Return: -31.34%

4. Gilead

Gilead Sciences (GILD) is a large biopharmaceutical company that is probably not as well-known as the other companies on this list of the best cheap stocks to buy now. However, it is a leader in treating Human Immunodeficiency Virus (HIV), liver diseases, cancers, and Hepatitis C Virus (HCV).

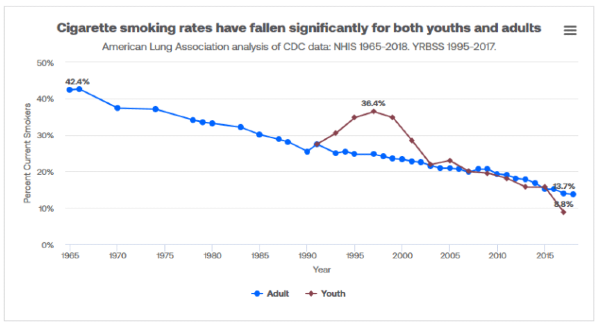

The company’s stock price is down for the year because of recession fears. But Gilead is also a victim of its success in treating HCV. The drugs are a cure; thus, the number of patients with hepatitis C is shrinking after peaking in 2015. Profits peaked in 2015 and have trended down since then. Consequently, the stock price is well off its all-time peak in 2015, despite a robust research and development pipeline.

Gilead’s P/E ratio is a low 9.8X, a value at the lower end of its 10-year range. Additionally, the dividend yield is excellent at 4.4%.

- Ticker: GILD

- Stock Price: $65.34

- Market Cap: $81.9 billion

- Dividend Yield: 4.41%

- 1-Year Trailing Total Return: -8.83%

5. Whirlpool

Whirlpool Corporation (WHR) is now the fifth best cheap stock to buy. Almost everyone knows about Whirlpool. The company makes most household appliances – washing machines, dryers, refrigerators, stoves, icemakers, etc. Their well-known brands are Whirlpool, Maytag, KitchenAid, JennAir, Amana, Roper, etc.

Whirlpool’s stock price is down approximately 30% year-to-date. The company also faces recession fears and a slowing real estate market. Home builders and new homeowners buy appliances, and home sales volumes are decreasing because of higher interest rates.

However, Whirlpool is ridiculously cheap at a P/E ratio of around 7.4X, much lower than the 5-year and 10-year averages. Interestingly, the company is still growing earnings and cash flow per share on a lower share count and higher margins. Investors get a 4%+ dividend yield too.

- Ticker: WHR

- Stock Price: $164.29

- Market Cap: $9.17 billion

- Dividend Yield: 4.17%

- 1-Year Trailing Total Return: -25.40%

Final Thoughts on Best Cheap Stocks To Buy Now

The above list of cheap stocks to buy now is a good place to start. Potential investors should do their research to build on the information provided above. Focusing on undervalued stocks can lead to outsized total returns because the market typically overreacts to poor economic news. Recession expectations are high, and shareholders have sold stocks to move to cash for safety. As a result, it may be a good time to invest in cheap stocks.

Disclosure: The author owns VZ

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.

This article by Prakash Kolli of Dividend Power originally appeared on Wealth of Geeks, and was republished with permission.

You can also read How Do Credit Cards Work? Are They Worth It?

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Everyone loves to buy something on sale. For investors, that means finding undervalued stocks.

Although available during bull markets, investors usually find more cheap stocks during bear markets. Prices drop, sometimes falling too far, making some stocks a deal, like in 2022. Hence, now is a good time for investors to scour lists and find the best cheap stocks to buy.

Below is a list of the five great cheap stocks to buy now. But first, let’s explore this concept.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

What Are Cheap Stocks?

Cheap stocks are undervalued equities. That doesn’t mean stocks whose price is below a dollar amount. You should not buy a stock solely because it is priced below $10 per share, $5 per share, or some other price point. Some stocks are at a low price due to the company’s declining revenue.

Even worse, some companies’ businesses may be in decline, and they cannot recover. Buying stocks like these because they are priced low will probably cause a loss of principal. They are often cheap or undervalued for a reason and can usually go lower.

“A low-priced stock doesn’t mean it’s good value,” said Danielle Miura, Certified Financial Planner of Spark Financials in Ripon, California.

“A stock may be cheap in terms of the price per share. However, it may be worth very little if the company has little potential or serious issues.”

“Some of the lowest-priced stocks are penny stocks,” says Muira. “Penny stocks are not well regulated, provide less company information to investors, have a lower trading volume, and are vulnerable to scams.”

How To Find Cheap Stocks?

By their very nature, cheap stocks are harder to find than overvalued ones. The financial news is full of reports of stocks with double-digit or triple-digit gains. But often, they are overvalued. Eventually, stock valuations drop, and overvalued stocks suffer the most. In addition, some people and sites provide lists of low-priced stocks but don’t dig deeper.

“Most of these people don’t ever look at the nuts and bolts like the statement of cash flow, their financial ratios, their 10-Q, and 10-K, etc.,” said Certified Financial Planner Blaine Thiederman of Progress Wealth Management in Arvada, Colorado. “So understand the company and how it creates a profit.”

A way to find cheap stocks is to start with a stock screener and do some research on your own. One method is to examine price-to-earnings ratios (P/E ratios) for regular stocks or price-to-funds from operations (P/FFO) for real estate investment trusts (REITs). Both metrics are a measure of valuation.

For example, the stock price of Alphabet (GOOG, GOOGL) has declined almost 19% year-to-date (but it is still $118.12!) That certainly doesn’t sound cheap, but is it? How do we know? The P/E ratio tells us the stock is undervalued and cheap. The stock’s ratio is 22.6X, which is below its 5-year range of 23.3X and 27.4X, so not super cheap, but still a deal. We will include Alphabet as one of the best cheap stocks to buy now.

What Else To Look For in the Best Cheap Stocks To Buy Now

A low P/E or P/FFO ratio is the minimum criteria, but you should dig deeper. What other characteristics should a cheap stock have? An essential one is growth.

A business must be healthy and have some growth over time to generate increased revenue and earnings. If a company cannot grow at all, it will probably get surpassed by its competitors. Even worse, if a business declines, the stock price may go lower.

Next, ask yourself if the company is returning cash to shareholders. The two primary ways are dividends and share buybacks. Dividends return money directly to you, generating a passive income stream. A large enough stream will permit you to live from dividends in retirement. Share buybacks are good too, but you don’t receive cash.

Best Cheap Stocks To Buy Now

Below we provide a diversified list of the best cheap stocks to buy now.

1. Alphabet

Alphabet was formerly known as Google, and many still call it by that name. The company owns the world’s dominant search engine with more than 90% market share. Alphabet also owns YouTube, FitBit, Android, Chrome, Gmail, Google Cloud, Google Drive, Google Maps, Google Play, Nest, etc. The company is pervasive on the internet, and most people use its products or services daily.

The stock price has been under pressure because of recession fears. During recessions, advertising revenue falls, which Alphabet depends on (most of its revenue comes from search engine or YouTube advertising).

Google does not yet pay a dividend; however, it is one of the top companies for stock buybacks. The stock is cheap based on its P/E ratio trading below its 5-year and 10-year ranges. With Alphabet, investors can buy an innovative company and market leader.

2. Verizon

Verizon Communications (VZ) is one of three leading cellphone providers in the US that together hold over 90% of the market. Besides mobile phone service, Verizon owns the FiOS fiber broadband network. The company offers services to consumers and businesses.

Verizon is struggling with slow growth in its core business because the cellphone service market is mature and has already consolidated. Hence, there are few acquisition targets. The next growth area is FiOS, but it is expensive to expand. Therefore, the stock price has dropped.

Verizon is undervalued based on a P/E ratio of about 8.6X, making it one of the best cheap stocks to buy now. For perspective – the S&P 500 Index’s average P/E ratio is approximately 21.4X. Moreover, Verizon’s ratio is far below the 5-year and 10-year ranges. Simultaneously, the dividend yield is roughly 5.8%, which is excellent for retirees desiring income.

Related Articles About Verizon

3. Ally Financial

Ally Financial (ALLY) is a digital financial-services company. It mainly operates online, providing insurance, mortgages, car loans, fleet financing, commercial banking, etc. The firm was formerly known as GMAC and became Ally in 2010. Today, the stock is in the news because Warren Buffett is acquiring shares.

The firm is in a cyclical business, and recession fears hammered the stock price because the company’s products and services will likely experience lower demand during an economic slowdown. For instance, fewer people buying cars cuts demand for auto loans and insurance. People may also default on their loan repayments, which will increase losses. In another example, businesses may not need as many commercial banking products.

Ally is absurdly inexpensive and one of the best cheap stocks to buy now based on a P/E ratio of about 4.8X. Again, this value is well below the 5-year and 10-year ranges. The company pays a dividend, but the yield is only about 3.3%. If Warren Buffett is buying shares, it is worth researching the company.

4. Gilead

Gilead Sciences (GILD) is a large biopharmaceutical company that is probably not as well-known as the other companies on this list of the best cheap stocks to buy now. However, it is a leader in treating Human Immunodeficiency Virus (HIV), liver diseases, cancers, and Hepatitis C Virus (HCV).

The company’s stock price is down for the year because of recession fears. But Gilead is also a victim of its success in treating HCV. The drugs are a cure; thus, the number of patients with hepatitis C is shrinking after peaking in 2015. Profits peaked in 2015 and have trended down since then. Consequently, the stock price is well off its all-time peak in 2015, despite a robust research and development pipeline.

Gilead’s P/E ratio is a low 9.8X, a value at the lower end of its 10-year range. Additionally, the dividend yield is excellent at 4.4%.

5. Whirlpool

Whirlpool Corporation (WHR) is now the fifth best cheap stock to buy. Almost everyone knows about Whirlpool. The company makes most household appliances – washing machines, dryers, refrigerators, stoves, icemakers, etc. Their well-known brands are Whirlpool, Maytag, KitchenAid, JennAir, Amana, Roper, etc.

Whirlpool’s stock price is down approximately 30% year-to-date. The company also faces recession fears and a slowing real estate market. Home builders and new homeowners buy appliances, and home sales volumes are decreasing because of higher interest rates.

However, Whirlpool is ridiculously cheap at a P/E ratio of around 7.4X, much lower than the 5-year and 10-year averages. Interestingly, the company is still growing earnings and cash flow per share on a lower share count and higher margins. Investors get a 4%+ dividend yield too.

Final Thoughts on Best Cheap Stocks To Buy Now

The above list of cheap stocks to buy now is a good place to start. Potential investors should do their research to build on the information provided above. Focusing on undervalued stocks can lead to outsized total returns because the market typically overreacts to poor economic news. Recession expectations are high, and shareholders have sold stocks to move to cash for safety. As a result, it may be a good time to invest in cheap stocks.

Disclosure: The author owns VZ

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.

This article by Prakash Kolli of Dividend Power originally appeared on Wealth of Geeks, and was republished with permission.

You can also read How Do Credit Cards Work? Are They Worth It?

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Originally Posted on dividendpower.org