Key Takeaways

- Money scripts are your belief system around money

- There are four different beliefs systems about money, all bad in the extreme

- An accountability partner, like Freeman Capital, can help you improve how you think and feel about money, which can have positive effects on your financial system and mental health

- Measuring your financial health is very important so long as it doesn't consume you

- Meditation can help you refocus how you think about money and help your financial health

An intro to Money Scripts

Ever thought about how you feel about money?

Believe it or not, the way you think about money has a significant effect on your ability to grow and build wealth.

Ready for some harsh truths? Most of us were taught very little about money growing up, and we weren’t raised to have healthy money habits. You may have grown up hearing that “money is the root of all evil.” Maybe you witnessed your parents struggling to pay the bills.

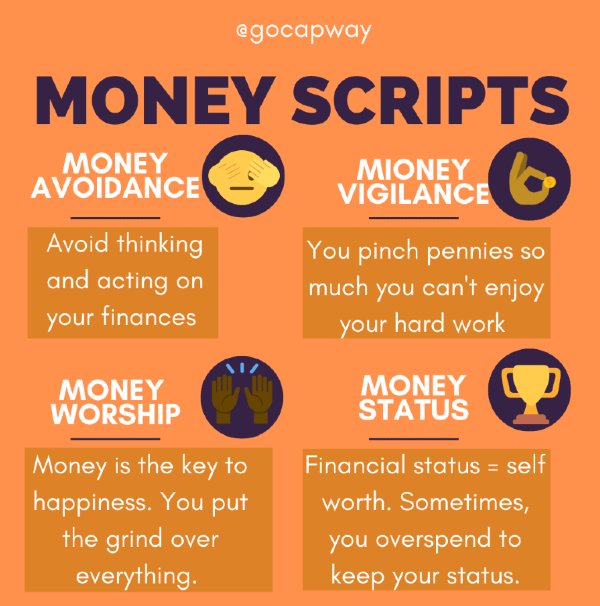

Research conducted by financial psychologist and researcher Brad Klontz showed that people have four different belief systems about money. Aka, money scripts:

- Money avoidance: Money anxiety. Avoidance of thinking or talking about money.

- Money worship: Money solves all problems. More money you have, the better.

- Money status: Self-worth=net worth

- Money vigilance: Disciplined approach to finances and frugal with their money.

Many of these money scripts can lead to unproductive or even destructive financial behaviors. It can be a real challenge to reach financial goals if you fall into any of these scripts at an extreme-level.

Can you identify with any of the money scripts? Are you wondering how you can shift some of your unproductive thoughts and improve your financial habits?

We will discuss how you can develop more positive financial behaviors no matter which money script you identify with.

Accountability Partners

We’re going to take things a step further and discuss how having an accountability partner can improve the way you think about money. Regardless of what money script you fall under.

If you’re a money avoider, an accountability partner can nudge you to regularly review your financial situation. An accountability partner can also help you achieve a greater awareness of your personal finances while highlighting the positives.

If you’re a money worshipper, an accountability partner can help you focus on giving and strengthening your relationships. They can remind you that relationships are far more important than money.

For the status seekers, an accountability partner can help separate your self-worth from your net worth. An accountability partner can also help you align your spending with your goals and values. Plus, an accountability partner can help you strive to be healthy in all areas of your life (physical, mental, spiritual).

Lastly, an accountability partner can help the money vigilant feel more comfortable discussing money. They can encourage you to set up a financial plan and remind you that it’s okay to enjoy the fruits of your labor!

If you are looking for an affordable accountability partner, check out Freeman Capital.

Money Scripts and Measurement

Measuring your progress in key financial areas is vital to building wealth. Your financial health can be measured using factors such as credit score, debt-to-income ratio, net worth, and retirement savings. But what happens when we look at these financial measures through the lens of our money script?

Money avoiders might not be aware of where they stand regarding these variables (although they should be).

The money vigilant probably pursues these factors down to the very last penny- and maybe borderline obsessively.

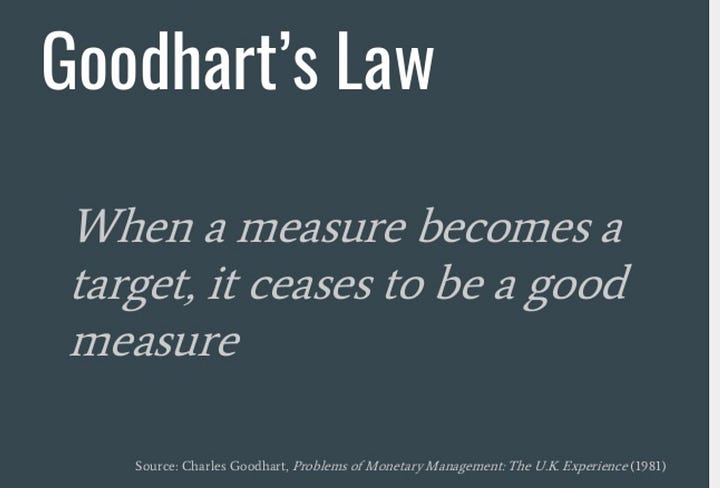

If you’re a money worshipper or status seeker, check out Goodhart’s Law. Briefly, Goodhart’s Law, developed by British economist Charles Goodhart, states that “when a measure becomes a target, it ceases to be a good measure.”

What does this mean? Measurement is only useful when it guides you and adds context to the big picture- not when it consumes you. In other words, if you’re a money worshipper or status seeker, watch out for losing sight of what’s most important in life.

To sum it all up, being aware of your key financial measurements is an essential component of building wealth. However, it’s equally important to have the proper perspective when assessing what these measurements mean and how they fit into your overall well-being.

Why to avoid “Mental Accounting"

Overspending and a lack of a budget can be the top reasons you can't get your finances in order.

But what about Mental Accounting?

Mental Accounting could be one of the most destructive financial behaviors we have and can lead to spending money we don't actually have yet.

For example, you may have a stimulus payment on the way. But no stimulus bill is official yet. Will your spending behavior change, based on the news reports? Will you purchase something that wasn't quite in your budget yesterday?

This potential stimulus check is just one example of this. Mental Accounting can also occur when you hear news about a raise, a bonus, tax refunds, or even when you have higher investment gains than you expected. Overspending on credit cards can cause poor Mental Accounting behaviors too. You're spending more money than you actually have in your budget.

So how can we solve this? For one, treat unexpected income in the same manner as your regular income. If the money isn't physically in your account yet, then that is money you simply don't have.

You can also set-up an emergency fund or reserves savings account at a different institution from your checking account.

Separating accounts for your goals can work in your favor. If the money you save for your emergency fund shows in your everyday spending account, for example, it's more likely that it will be spent than if it was in its own account.

We are less likely to touch this money when it's elsewhere because we encounter additional decision points - a psychological hurdle encouraging us to stop and think.

Meditating on your personal finances.

Source: NPR

What is meditation? It may mean different things to different people. We'll describe it as a time to check-in with yourself, focus on your breath, and practice compassion.

Meditation is a great new habit to adopt in your personal life. However, it won't be perfect. Like anything, there are hurdles in establishing a new routine. It is challenging to dedicate the time, consistently add it to your life, and give yourself permission to learn and improve.

If you ever attempted to meditate, you likely found your mind wandering. Within the first few minutes or less, you may have become distracted, checked your smartphone, or went back to doing whatever you were doing before. It is not that you are "bad" at meditating. It is just that it is new and takes practice. Nothing comes easy, and meditation is no exception. Distractions consume our lives, and we are continually moving from one time-consuming demand to another. Therefore, sitting in silence and letting your breath guide, you can take multiple tries and consistent effort. Quieting a racing mind doesn't happen by simply turning on a switch.

These same hurdles can occur for people that claim that they plan to work on their personal finances. You sit down to review your monthly income and expenses, and then a text message leads you astray. You may be interested in learning more about investing or your 401(K) structure and then get overwhelmed when you begin to research or navigate the landscape.

Working on yourself is the most challenging part when adopting any new hobby, habit, or interest. Acknowledging this is crucial and can help your focus. Tell yourself that it is ok to be where you are right now. Be accepting and compassionate of yourself and your situation. If you remain focused, consistent, and resilient, you will improve. Allow yourself to be aware first and keep taking baby steps towards the direction you want to go.

Key Takeaways

An intro to Money Scripts

Source: CapWay

Ever thought about how you feel about money?

Believe it or not, the way you think about money has a significant effect on your ability to grow and build wealth.

Ready for some harsh truths? Most of us were taught very little about money growing up, and we weren’t raised to have healthy money habits. You may have grown up hearing that “money is the root of all evil.” Maybe you witnessed your parents struggling to pay the bills.

Research conducted by financial psychologist and researcher Brad Klontz showed that people have four different belief systems about money. Aka, money scripts:

Many of these money scripts can lead to unproductive or even destructive financial behaviors. It can be a real challenge to reach financial goals if you fall into any of these scripts at an extreme-level.

Can you identify with any of the money scripts? Are you wondering how you can shift some of your unproductive thoughts and improve your financial habits?

We will discuss how you can develop more positive financial behaviors no matter which money script you identify with.

Accountability Partners

Source: Inc.com

We’re going to take things a step further and discuss how having an accountability partner can improve the way you think about money. Regardless of what money script you fall under.

If you’re a money avoider, an accountability partner can nudge you to regularly review your financial situation. An accountability partner can also help you achieve a greater awareness of your personal finances while highlighting the positives.

If you’re a money worshipper, an accountability partner can help you focus on giving and strengthening your relationships. They can remind you that relationships are far more important than money.

For the status seekers, an accountability partner can help separate your self-worth from your net worth. An accountability partner can also help you align your spending with your goals and values. Plus, an accountability partner can help you strive to be healthy in all areas of your life (physical, mental, spiritual).

Lastly, an accountability partner can help the money vigilant feel more comfortable discussing money. They can encourage you to set up a financial plan and remind you that it’s okay to enjoy the fruits of your labor!

If you are looking for an affordable accountability partner, check out Freeman Capital.

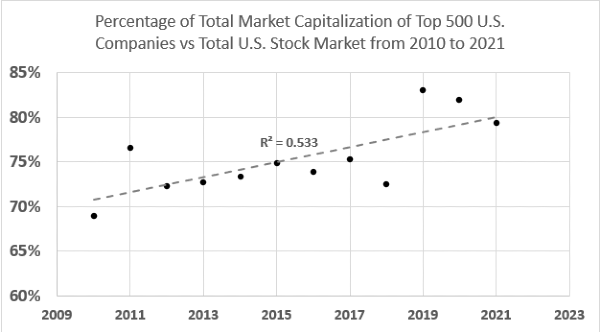

Money Scripts and Measurement

Source: Medium

Measuring your progress in key financial areas is vital to building wealth. Your financial health can be measured using factors such as credit score, debt-to-income ratio, net worth, and retirement savings. But what happens when we look at these financial measures through the lens of our money script?

Money avoiders might not be aware of where they stand regarding these variables (although they should be).

The money vigilant probably pursues these factors down to the very last penny- and maybe borderline obsessively.

If you’re a money worshipper or status seeker, check out Goodhart’s Law. Briefly, Goodhart’s Law, developed by British economist Charles Goodhart, states that “when a measure becomes a target, it ceases to be a good measure.”

What does this mean? Measurement is only useful when it guides you and adds context to the big picture- not when it consumes you. In other words, if you’re a money worshipper or status seeker, watch out for losing sight of what’s most important in life.

To sum it all up, being aware of your key financial measurements is an essential component of building wealth. However, it’s equally important to have the proper perspective when assessing what these measurements mean and how they fit into your overall well-being.

Why to avoid “Mental Accounting"

Source: TheDrum

Overspending and a lack of a budget can be the top reasons you can't get your finances in order.

But what about Mental Accounting?

Mental Accounting could be one of the most destructive financial behaviors we have and can lead to spending money we don't actually have yet.

For example, you may have a stimulus payment on the way. But no stimulus bill is official yet. Will your spending behavior change, based on the news reports? Will you purchase something that wasn't quite in your budget yesterday?

This potential stimulus check is just one example of this. Mental Accounting can also occur when you hear news about a raise, a bonus, tax refunds, or even when you have higher investment gains than you expected. Overspending on credit cards can cause poor Mental Accounting behaviors too. You're spending more money than you actually have in your budget.

So how can we solve this? For one, treat unexpected income in the same manner as your regular income. If the money isn't physically in your account yet, then that is money you simply don't have.

You can also set-up an emergency fund or reserves savings account at a different institution from your checking account.

Separating accounts for your goals can work in your favor. If the money you save for your emergency fund shows in your everyday spending account, for example, it's more likely that it will be spent than if it was in its own account.

We are less likely to touch this money when it's elsewhere because we encounter additional decision points - a psychological hurdle encouraging us to stop and think.

Meditating on your personal finances.

Source: NPR

What is meditation? It may mean different things to different people. We'll describe it as a time to check-in with yourself, focus on your breath, and practice compassion. Meditation is a great new habit to adopt in your personal life. However, it won't be perfect. Like anything, there are hurdles in establishing a new routine. It is challenging to dedicate the time, consistently add it to your life, and give yourself permission to learn and improve.

If you ever attempted to meditate, you likely found your mind wandering. Within the first few minutes or less, you may have become distracted, checked your smartphone, or went back to doing whatever you were doing before. It is not that you are "bad" at meditating. It is just that it is new and takes practice. Nothing comes easy, and meditation is no exception. Distractions consume our lives, and we are continually moving from one time-consuming demand to another. Therefore, sitting in silence and letting your breath guide, you can take multiple tries and consistent effort. Quieting a racing mind doesn't happen by simply turning on a switch.

These same hurdles can occur for people that claim that they plan to work on their personal finances. You sit down to review your monthly income and expenses, and then a text message leads you astray. You may be interested in learning more about investing or your 401(K) structure and then get overwhelmed when you begin to research or navigate the landscape.

Working on yourself is the most challenging part when adopting any new hobby, habit, or interest. Acknowledging this is crucial and can help your focus. Tell yourself that it is ok to be where you are right now. Be accepting and compassionate of yourself and your situation. If you remain focused, consistent, and resilient, you will improve. Allow yourself to be aware first and keep taking baby steps towards the direction you want to go.