The New Investor Guide

Welcome to our community new investor guide. Bookmark and share this page so that you and others can get the best updated content for new investors.

When you find an investor guide out in the internet, they are usually static. They are ice bergs floating in cyber space, with nothing changing. Not this guide. Our new investor guide is built around our platform constantly finding the best new information to help new investors build their wealth.

Our guide uses the following criteria to trend articles to this guide:

- Content Freshness - How fresh the content is. Newer content will jump onto this guide if they are proven to be relevant

- Relevance - How relevant is the content to new investors. Our platform determines this based on the engagement on the article. This allows our guide to pivot to subjects new investors want to learn about

- Important - Our content creators are measured by the performance of their investment analysis. If someone can build a portfolio, then wouldn’t they give better guidance to new investors? Our platform prioritizes performance when trending financial literacy.

Stock ideas for new investors

Our platform is the most unique and transformative platform for new investors. We’ve ditched the idea of “following” and have created the largest draft system in the world. You can draft any investor on our platform. When you do, you will see the truth of how well they perform, how well they manage volatility, and how diversified they build portfolios.

We trend the ideas of our top draft picks in multiple topic lists. These topic lists are great starting points to discover new stock ideas and draft other investors.

Beginner Stocks

Our beginner stocks list trends the top stocks for beginners using the following criteria:

- The stock has risen steadily without significant downward movements

- The stock is well known, and its business and products can be understood by most people

- The stock may have a dividend that will help the new investor appreciate income from their investments

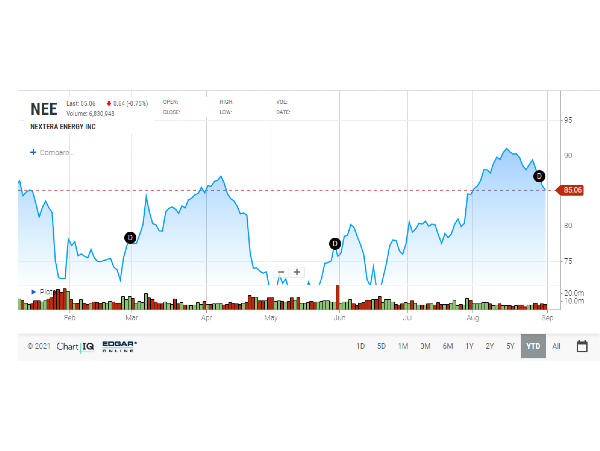

Utility Stocks

Our utility stock list is a continuously updated list of top Utility Stocks suggested by the top draft picks. Utility stocks are great beginner stocks and will typically meet our beginner stocks criteria. Utilities are typically less volatile than other sectors like consumer discretionary stocks. They also are well known by the investor as they are most likely paying a utility bill.

Consumer discretionary stocks are very popular with beginner investors. However, they are cyclical stocks, which mean their business will rise and fall dramatically during a recession and recovery. Its suggested that new investors start off with safer stocks, and when they feel comfortable then start investing in consumer discretionary stocks.

Safe Stocks

Safe stocks have a strong resistance to draw downs, low volatility, and may even have a dividend. The trade-off for being a safe stock is that these stocks will not appreciate significantly in value over time. For example, utility stocks, considered relatively safe stocks, under-performed the overall market throughout the 2010s.

Safe stocks are great for new investors who really need to get exposure immediately in the market. A common mistake new investors make is waiting to invest. New investors can use safe stocks to preserve their assets as they get their feet wet in the stock market.

How to Invest in Stocks as a Beginner

How to Start Investing

Read More – A Beginners Guide to Stock Investing in 5 Easy Steps

How Much Should a Beginner Start Investing with?

A new investor should start with $10. Certain brokerages charge $0.00 in commissions and provide fractional shares. You can buy fractional shares for $1 and with $10 you can build a diversified portfolio of 10 stocks. You can also diversify your portfolio by buying an S&P 500 ETF. This will provide exposure to a basket of over 500 stocks.

How Do I Educate Myself in Investing

Our platform has multiple guides besides this one to keep you updated on investing and financial literacy. Bookmark this investor guide and the following topics:

These are great lists to bookmark and share on social media.

New Investor Tips

- Have a long-term horizon. Prepare to own a stock for at least 2 years. Ideally 5 years.

- Don’t let your emotions guide you. If you are struggling with a fear of missing out (fomo) or a fear of loss, take a deep breath and wait 24hrs before you buy or sell the asset affecting you emotionally. If you buy stocks with a five year horizon, waiting one day will not matter

- Stocks can double, triple and quadruple in value. Don’t sell immediately for measly 5% gain

- Diversify your portfolio. Have at least 10 different stocks and ETFs

- Invest every month with at least $10 at a Brokerage with fractional shares and $0.00 commissions.

- Do not over trade stocks. Even if commissions are $0.00, you are losing money over trading at these brokerages because you’re not receiving optimal prices within the bid-ask spread. This is due to Robinhood’s (and other brokerages) revenue model of payment for order flow

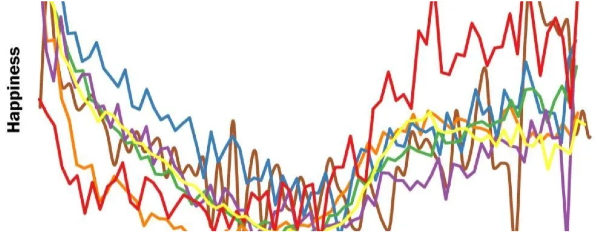

What is dollar-cost averaging?

Dollar cost averaging (DCA) is the practice of investing the same amount of money periodically (typically monthly) regardless of the price of your portfolio[1].

Pros of Dollar Cost Averaging

- Provides a plan to develop disciplined investing habits

- Will put more capital in stocks falling in value (buying low)

- For stocks with strong momentum, it will keep you buying into that momentum

- Removes emotions out of buying stocks and makes it a robotic process

Cons of Dollar Cost Averaging

- You all put capital into stocks rising in value (buying high)

- You are still buying stocks rising with a lot of momentum. If that momentum is unsustainable, then you’re buying over-valued stocks (buying high)

- The strategy doesn’t include a sell strategy. When you sell a stock is equally, if not more important, than deciding when to buy a stock

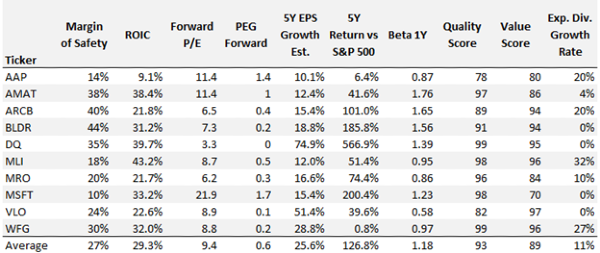

How to Choose Which Investments to Make?

Climb USA is an organization dedicated to promote financial literacy to financial groups and communities

Read More – How to Find Quality Stocks to Buy

What is the Best Way to Invest?

The best way to invest is based on the preference of your investment strategy. This will be based on your current life situation and your own personal feelings towards risk.

- Aggressive Strategy – This strategy is typically suggested to younger investors who have time to absorb market corrections. This is the riskiest strategy but can help grow a young investor’s assets faster. Aggressive strategies will tend more towards technology, energy, and consumer discretionary sectors.

- Balanced Strategy – This strategy is typically suggested to those who have been working for a couple of years and have built a significant portfolio. This strategy is also suggested to those uncomfortable with too much risk. This strategy blends a little aggression with moderate stock ideas and even some safer income strategies. Balanced strategies will tend more towards financials, healthcare, and Industrials

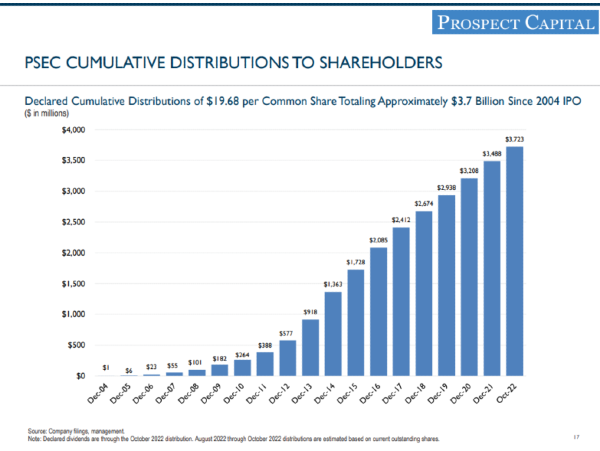

- Wealth Preservation – This strategy is typically suggested to those in retirement or about to retire. This strategy focuses on minimizing risk first and then trying to grow wealth. In this strategy, its better to keep the capital you than to risk any of it. Wealth preservation strategies will tend more towards safe investments, dividend stock (but not dividend growth stocks, may be too risky), utilities and bonds or bond ETFs)

References

The New Investor Guide

Welcome to our community new investor guide. Bookmark and share this page so that you and others can get the best updated content for new investors. When you find an investor guide out in the internet, they are usually static. They are ice bergs floating in cyber space, with nothing changing. Not this guide. Our new investor guide is built around our platform constantly finding the best new information to help new investors build their wealth.

Our guide uses the following criteria to trend articles to this guide:

Stock ideas for new investors

Our platform is the most unique and transformative platform for new investors. We’ve ditched the idea of “following” and have created the largest draft system in the world. You can draft any investor on our platform. When you do, you will see the truth of how well they perform, how well they manage volatility, and how diversified they build portfolios.

We trend the ideas of our top draft picks in multiple topic lists. These topic lists are great starting points to discover new stock ideas and draft other investors.

Beginner Stocks

Our beginner stocks list trends the top stocks for beginners using the following criteria:

Utility Stocks

Our utility stock list is a continuously updated list of top Utility Stocks suggested by the top draft picks. Utility stocks are great beginner stocks and will typically meet our beginner stocks criteria. Utilities are typically less volatile than other sectors like consumer discretionary stocks. They also are well known by the investor as they are most likely paying a utility bill.

Consumer discretionary stocks are very popular with beginner investors. However, they are cyclical stocks, which mean their business will rise and fall dramatically during a recession and recovery. Its suggested that new investors start off with safer stocks, and when they feel comfortable then start investing in consumer discretionary stocks.

Safe Stocks

Safe stocks have a strong resistance to draw downs, low volatility, and may even have a dividend. The trade-off for being a safe stock is that these stocks will not appreciate significantly in value over time. For example, utility stocks, considered relatively safe stocks, under-performed the overall market throughout the 2010s. Safe stocks are great for new investors who really need to get exposure immediately in the market. A common mistake new investors make is waiting to invest. New investors can use safe stocks to preserve their assets as they get their feet wet in the stock market.

How to Invest in Stocks as a Beginner

How to Start Investing

Read More – A Beginners Guide to Stock Investing in 5 Easy Steps

How Much Should a Beginner Start Investing with?

A new investor should start with $10. Certain brokerages charge $0.00 in commissions and provide fractional shares. You can buy fractional shares for $1 and with $10 you can build a diversified portfolio of 10 stocks. You can also diversify your portfolio by buying an S&P 500 ETF. This will provide exposure to a basket of over 500 stocks.

How Do I Educate Myself in Investing

Our platform has multiple guides besides this one to keep you updated on investing and financial literacy. Bookmark this investor guide and the following topics:

These are great lists to bookmark and share on social media.

New Investor Tips

What is dollar-cost averaging?

Dollar cost averaging (DCA) is the practice of investing the same amount of money periodically (typically monthly) regardless of the price of your portfolio[1].

Pros of Dollar Cost Averaging

Cons of Dollar Cost Averaging

How to Choose Which Investments to Make?

Climb USA is an organization dedicated to promote financial literacy to financial groups and communities

Read More – How to Find Quality Stocks to Buy

What is the Best Way to Invest?

The best way to invest is based on the preference of your investment strategy. This will be based on your current life situation and your own personal feelings towards risk.

References

1). What is Dollar Cost Averaging