Would you rather listen to this? I discuss this article in Episode 42 of The Best Interest Podcast, below.

Friend-of-the-blog Tyler knows I like a good math problem, so he asked me:

Question for you about paying off debt. Many people know about the “debt snowball” and the “debt avalanche.”

But I wonder if focusing on the debt that is costing you the most based on the rate and balance would have an advantage over just focusing on paying off the smaller balance with a higher rate?

First, let’s define some terms:

The “debt snowball” is an idea that you should focus on your smallest debt principal first.

The “debt avalanche” suggests focusing on your largest interest rates first.

And Tyler’s idea—I call it the “debt blizzard”—focuses on whichever debt has the largest monthly payment first.

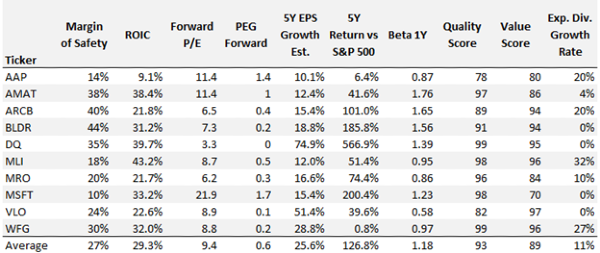

The table above aligns with these definitions (see the three columns on the right).

The table above aligns with these definitions (see the three columns on the right).

But, which method is mathematically best?

Surprise! Did you see the article title!? It’s the debt avalanche. Always. No matter what. Speaking of…did you see this crazy avalanche video?!

https://www.youtube.com/watch?v=MtXBhi54HAg

If you want to understand why, follow this logic:

All three methods eliminate the total loan principal. We need to find whichever method minimizes the interest paid. Do you agree?

So let’s say I give you $1.00. Just one. You decide to pay off some debt. Two things will happen:

You’ll decrease your remaining principal by $1.00

You’ll decrease your future interest payments by…well, we’d have to do some math.

But if you want to be most effective with that dollar, how would you do it? No matter which debt you target, you’re always decreasing your principal owed by $1.00. That’s not a differentiator. Your only “knob to turn” lies in the interest payments.

What’s the smart move? You should target whichever debt lowers your future interest payments the most. Agreed?

Well…that’s easy. In our example above, one debt is charging interest at 24%. That’s the debt we should target with this $1.00.

Now repeat, dollar after dollar…

As long as the 24% loan still exists, that one makes sense to target. Then the 8% loan, then 6%, then 4%.

As we said at the beginning: All three methods eliminate the total loan principal. Our method minimizes the interest payments.

We’ve just created the debt avalanche. That’s the optimal payoff plan.

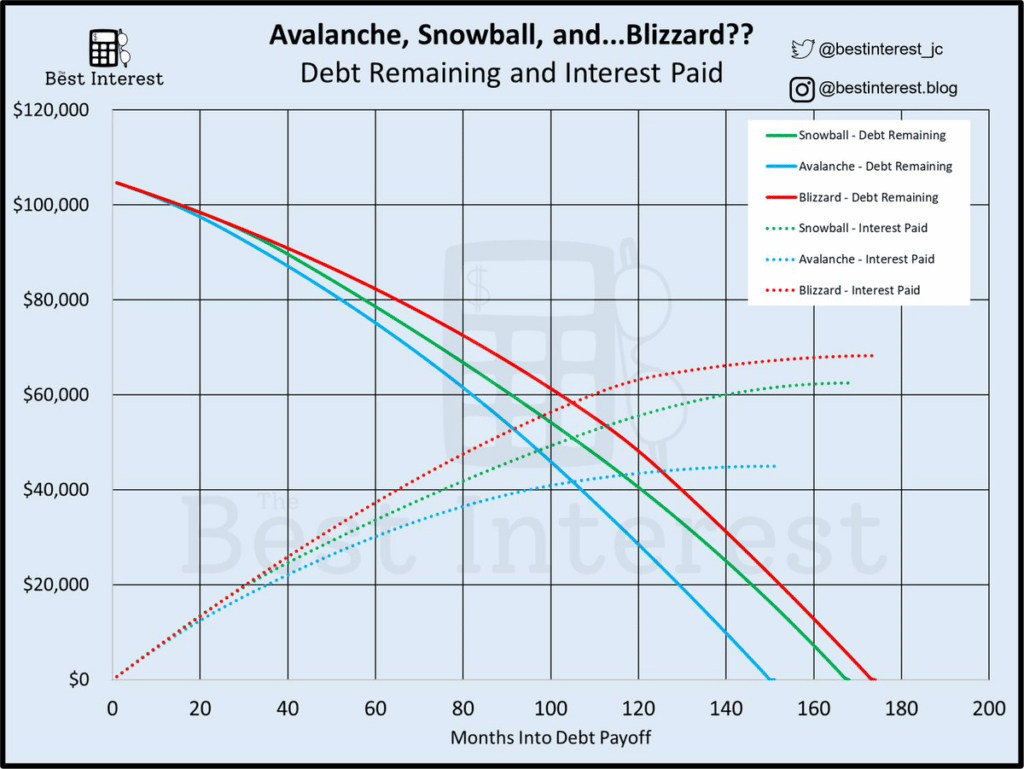

The chart above shows the exact payout schedule for our four loans using the three different methods (I assumed $1000 per month payments).

The chart above shows the exact payout schedule for our four loans using the three different methods (I assumed $1000 per month payments).

The solid lines track our debt over time. The dotted lines track how much interest we’ve paid.

The avalanche has both the shortest repayment period and the least interest paid.

The snowball’s and blizzard’s efficacies are dependent on the loans themselves. Sometimes they’ll work well, other times poorly. Because the snowball (which cares about principal) and the blizzard (which cares about monthly payments) are focused on the wrong metrics.

Yes – the snowball does have a non-financial benefit of “small wins.” By focusing on the smallest debt first, a person can build motivational momentum to continue their positive financial journey. This is phenomenal and could be a justifiable reason to use the debt snowball. The blizzard has psychological benefits too. But the avalanche would still be mathematically optimal.

Nothing ground-breaking here. But this should be helpful if you or people in your life are unsure how to approach paying off their debt.

Use the debt avalanche. Focus on the highest interest rates first.

Thank you for reading! If you enjoyed this article, Subscribe to get future articles emailed to your inbox.

-Jesse

Want to learn more about The Best Interest’s back story?[Read here[(https://bestinterest.blog/about/)

If you prefer to listen, check out The Best Interest Podcast, or listen to me on a bunch of other people’s podcasts.

This was written by The Best Interest, a free investing newsletter. Click https://bestinterest.blog/ to subscribe.

Would you rather listen to this? I discuss this article in Episode 42 of The Best Interest Podcast, below.

Friend-of-the-blog Tyler knows I like a good math problem, so he asked me:

First, let’s define some terms:

The “debt snowball” is an idea that you should focus on your smallest debt principal first. The “debt avalanche” suggests focusing on your largest interest rates first. And Tyler’s idea—I call it the “debt blizzard”—focuses on whichever debt has the largest monthly payment first.

But, which method is mathematically best?

Surprise! Did you see the article title!? It’s the debt avalanche. Always. No matter what. Speaking of…did you see this crazy avalanche video?!

https://www.youtube.com/watch?v=MtXBhi54HAg

If you want to understand why, follow this logic:

All three methods eliminate the total loan principal. We need to find whichever method minimizes the interest paid. Do you agree? So let’s say I give you $1.00. Just one. You decide to pay off some debt. Two things will happen:

You’ll decrease your remaining principal by $1.00

You’ll decrease your future interest payments by…well, we’d have to do some math.

But if you want to be most effective with that dollar, how would you do it? No matter which debt you target, you’re always decreasing your principal owed by $1.00. That’s not a differentiator. Your only “knob to turn” lies in the interest payments.

What’s the smart move? You should target whichever debt lowers your future interest payments the most. Agreed?

Well…that’s easy. In our example above, one debt is charging interest at 24%. That’s the debt we should target with this $1.00.

Now repeat, dollar after dollar…

As long as the 24% loan still exists, that one makes sense to target. Then the 8% loan, then 6%, then 4%.

As we said at the beginning: All three methods eliminate the total loan principal. Our method minimizes the interest payments.

We’ve just created the debt avalanche. That’s the optimal payoff plan.

The solid lines track our debt over time. The dotted lines track how much interest we’ve paid.

The avalanche has both the shortest repayment period and the least interest paid.

The snowball’s and blizzard’s efficacies are dependent on the loans themselves. Sometimes they’ll work well, other times poorly. Because the snowball (which cares about principal) and the blizzard (which cares about monthly payments) are focused on the wrong metrics.

Yes – the snowball does have a non-financial benefit of “small wins.” By focusing on the smallest debt first, a person can build motivational momentum to continue their positive financial journey. This is phenomenal and could be a justifiable reason to use the debt snowball. The blizzard has psychological benefits too. But the avalanche would still be mathematically optimal.

Nothing ground-breaking here. But this should be helpful if you or people in your life are unsure how to approach paying off their debt.

Use the debt avalanche. Focus on the highest interest rates first.

Thank you for reading! If you enjoyed this article, Subscribe to get future articles emailed to your inbox.

-Jesse

Want to learn more about The Best Interest’s back story?[Read here[(https://bestinterest.blog/about/)

If you prefer to listen, check out The Best Interest Podcast, or listen to me on a bunch of other people’s podcasts.

This was written by The Best Interest, a free investing newsletter. Click https://bestinterest.blog/ to subscribe.

Originally Posted on bestinterest.blog