Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

Three weeks ago I offered to write a series of articles on how many professional investors select stocks. I asked for a response to gage interest, and well, it was rather disappointing to say the least (3 positive, 0 negative out of +2,600 views). So I’ll only be doing a one off article since I’ve got that completed.

It will provide an outline of **the three "pillars" that one should master in order to become successful. ** They are: Psychology (a.k.a. gut feelings), defining your "Edge", and controlling Risk.

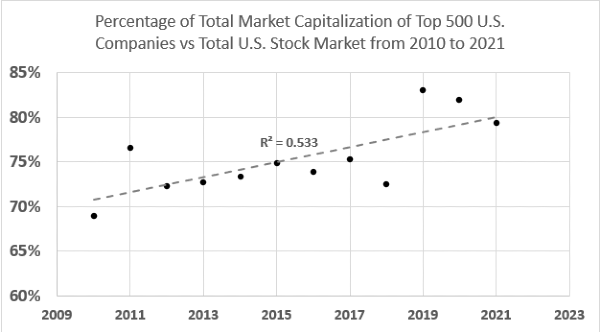

I’ve got to conclude that folks are just interested in what others are thinking; kind of like a 'stock idea' version of social media. That’s all well and good for friendly entertainment, but just know that folks who have studied investing are likely on “the other side” of your trade, and that increases your risk. It’s been that way for centuries.

Have a Good Week. .......... Tom ..........