Actionable Items for You:

- The best thing to know about retirement savings accounts is that everyone should have one. Get started today, it’s not too late.

Let's concentrate on taking advantage of what’s offered to you, likely, by your employers. Or if you’re self-employed, ways to take advantage of government incentives in retirement savings accounts. In the August issues of Money Mondays, we’re going to cover topics such as:

- Financial Independence before your retirement age - FIRE (Financial Independence Retire Early), FIRN (Financial Independence Retire Never), or not thinking about retirement and building that passive income.

- Employee 401 (k) - The easiest way to start and potentially get an extra boost via company matching.

- Retirement Plans for the self-employed

- Retirement income planning

No 401K

Your job doesn’t offer a 401(k)? Start with these four options today instead.

Actionable Items for You:

- If your employer doesn’t offer 401(k)’s, you have plenty of options available - getting the right accounts in place will help you build that retirement nest egg. An IRA or a health savings account might fit the bill for you.

- If you’re self-employed, there are plenty of options too - possibly a solo 401(k) or a simplified employee pension (SEP) IRA. Health savings accounts are there for you, too.

Last week we talked about the benefits of taking full advantage of your employer 401(k) match. But what if your employer doesn’t offer that? Or what if you’re self-employed? There’s plenty of programs in place for you as well, you just have to know where to start.

If you earn income from an employer and don’t have access to a 401(k), look into Roth and Traditional IRAs.

In a Roth IRA contributions are taxed now, but those savings are accessible tax-free in retirement. I.e., you can use this account to build tax-free savings that your future self will thank you for. This is in contrast to a Traditional IRA that gives you a tax deduction now, but taxes are paid when you start to withdrawal from this account in the future. Your future self will still thank you, but maybe not as much.

The biggest difference between these two and which one to use really depends on your current income levels. In general, the higher your current income, the more likely a traditional IRA will make sense, and vice-versa. There are some stipulations - for example, you can contribute up to $6,000 to either type of IRA in 2021, or $7,000 if you’re over 50 years old, and qualifying for a Roth IRA depends on your income. You need to make a modified adjusted gross income (MAGI) between $125,000-$140,000 in 2021 if you are single, or filing as a married couple your MAGI needs to be between $198,000 and $208,000. No income limits for that traditional IRA, though.

If you’re self-employed, you have an additional option. Consider a solo 401(k) instead, as it will likely be your best option. They allow for much more in contributions than the limits set in the IRAs above, with a limit of $19,500 per year in 2021 along with 25% of your profits, up to a max of $58,000 this year. We showed you how powerful a small amount can be over a long time period last week, these can add up to big money. Contributions to your 401(k) are tax-deductible as well, giving you a break from Uncle Sam.

If you’re self-employed and looking for an easy way to save, consider a simplified employee pension (SEP) IRA. These are easier to get going than a solo 401(k) so if you’re in a time crunch or deadline, or confused about the process for the 401(k), this is a great way to start. You can contribute 25% of your income to these vehicles for savings, so it’ll depend on how much money you make - if your income is low, a 401(k) would likely be a better option.

Finally, a health savings account is a great option for everybody, and if you don’t have one, you probably should. Funds can be invested and withdrawn tax-free later in life or for qualified health care expenses. One stipulation is that they can only be used via a high-deductible healthcare plan - so if that’s you, definitely get on this savings account train.

The 101 on 401ks

Step 1 to building more wealth: take advantage of that 401(k) match (fully) from your employer

Actionable Items for You:

- Want free money? Your employer might offer 401(k) matching funds. Make sure you take full advantage.

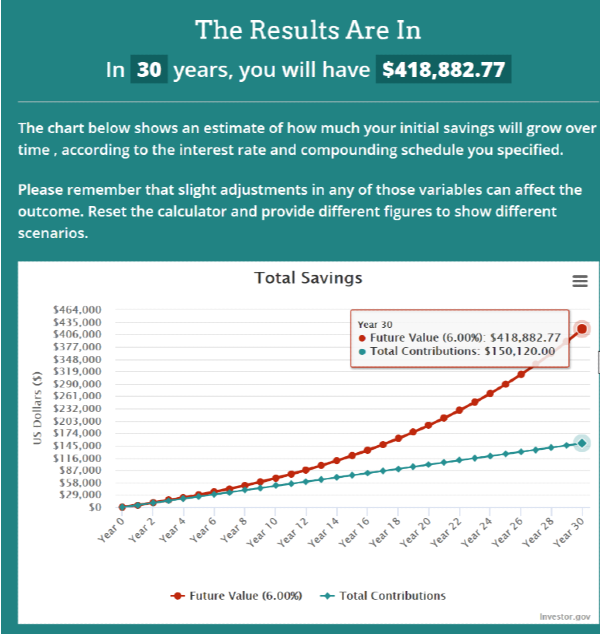

- A small match can mean a lot in 30 years with the power of compound interest. Have some fun with the calculator.

Want $419,000 for free? We have a nice easy trick for you. Check if your employer has a 401(k) matching plan, and whether you are utilizing it fully.

We talked last week about how you need to focus on purpose, to use money and retirement planning as a tool to build your lifestyle. This is one of the easier ways to get on track.

Employer-matching 401(k)s generally run about 3-5% of your salary, and the way it works is the more you put into your account, the more they will match. I.E. If you’re only putting 2% of your salary into your 401(k), your employer will only match 2%. But if they offer it up to 5%, you’re missing out on free money.

That can be big bucks. Say you make $100,000 a year in salary. If you put $2,000 (2%) in your 401(k), your employer matches $2,000, so your effective salary is now $102,000. But if they offer to match up to $5,000, you could be getting an extra $3,000 a year for doing something (saving) you should be doing anyway!

The benefits are clear - the employer reduces their income via a deduction on payments to you, you get a free cash benefit that grows tax-free in your 401(k) until it is withdrawn, and it can have a massive impact with a small sacrifice now with the power of compound interest.

$5,000 yearly compounded monthly at 6% for 30 years gets you almost an extra $419,000… and that’s just the free money from your employer.

Have some fun with the calculator here.

Focus on Purpose

Retire the idea of retirement - Focus on Purpose

Actionable Items for You:

- Retire the idea of retirement - Focus on Purpose

- Use money and retirement plans as a tool to get that ultimate life

Retirement is a strange thing. If you turn on the television, radio, or open a magazine you are bound to see some advertisement about a Wealth Management or Insurance company having the retirement solutions to get you to a point in time, a number, your green path, or whatever the selling point or fear tactic to get your hard earned cash.

Work hard for decades and you’ll get to the end game, you get to leave work behind, relax, unwind, travel - and then what? We all long for something more meaningful for the final 20+ years of our lives.

Retirement is a relatively new concept, invented in the 19th century by the Chancellor of Germany, Otto Von Bismarck. Initially, the age of retirement was set at age 70 and then lowered to age 65. Other countries adopted the concept and then in the early/mid 20th-century corporations began taking the burden off by offering pensions to lifelong employees.

It wasn’t until 1978 that the 401(k) came into tax law to allow for employees to self-fund their retirement and since then Retirement has become a Cash cow for the Financial Industry. We have built a social construct and have been marketed to believe that spending the last 20-30 years of our life idly spending our wealth is the only way to live.

The problem? Studies show this to be unhealthy both mentally and physically.

After recently being gifted the Book the Blue Zones, finding the above Venn Diagram and checking out the book titled Ikigai – The Japanese Secret to a Long and Happy Life by Hector Garcia, I found my solution to our retirement myth. The concept of Ikigai – which translates in Japanese to “the reason you wake up in the morning” - made me realize that the Japanese don’t have a translation for the word “retirement”. Nothing in their language describes the concept of stopping work completely.

So let’s change retirement goals to life goals. Ask yourself a few questions.

- What do you love? What does the world need? What you are good at? And what you can get paid for?

- Save With Purpose - for your purpose

That’s why you have to figure out what makes it worth it for you do it anyway. A savings goal without purpose isn’t a goal at all. Find your purpose, make a plan, and hit some milestones along the way. Retirement is a fabrication, building your life is real.

Want some help setting some milestones? Reach out to us today.

Source: The Motley Fool

Actionable Items for You:

Let's concentrate on taking advantage of what’s offered to you, likely, by your employers. Or if you’re self-employed, ways to take advantage of government incentives in retirement savings accounts. In the August issues of Money Mondays, we’re going to cover topics such as:

No 401K

Your job doesn’t offer a 401(k)? Start with these four options today instead.

Source: USA Today

Actionable Items for You:

Last week we talked about the benefits of taking full advantage of your employer 401(k) match. But what if your employer doesn’t offer that? Or what if you’re self-employed? There’s plenty of programs in place for you as well, you just have to know where to start.

If you earn income from an employer and don’t have access to a 401(k), look into Roth and Traditional IRAs.

In a Roth IRA contributions are taxed now, but those savings are accessible tax-free in retirement. I.e., you can use this account to build tax-free savings that your future self will thank you for. This is in contrast to a Traditional IRA that gives you a tax deduction now, but taxes are paid when you start to withdrawal from this account in the future. Your future self will still thank you, but maybe not as much.

The biggest difference between these two and which one to use really depends on your current income levels. In general, the higher your current income, the more likely a traditional IRA will make sense, and vice-versa. There are some stipulations - for example, you can contribute up to $6,000 to either type of IRA in 2021, or $7,000 if you’re over 50 years old, and qualifying for a Roth IRA depends on your income. You need to make a modified adjusted gross income (MAGI) between $125,000-$140,000 in 2021 if you are single, or filing as a married couple your MAGI needs to be between $198,000 and $208,000. No income limits for that traditional IRA, though.

If you’re self-employed, you have an additional option. Consider a solo 401(k) instead, as it will likely be your best option. They allow for much more in contributions than the limits set in the IRAs above, with a limit of $19,500 per year in 2021 along with 25% of your profits, up to a max of $58,000 this year. We showed you how powerful a small amount can be over a long time period last week, these can add up to big money. Contributions to your 401(k) are tax-deductible as well, giving you a break from Uncle Sam.

If you’re self-employed and looking for an easy way to save, consider a simplified employee pension (SEP) IRA. These are easier to get going than a solo 401(k) so if you’re in a time crunch or deadline, or confused about the process for the 401(k), this is a great way to start. You can contribute 25% of your income to these vehicles for savings, so it’ll depend on how much money you make - if your income is low, a 401(k) would likely be a better option.

Finally, a health savings account is a great option for everybody, and if you don’t have one, you probably should. Funds can be invested and withdrawn tax-free later in life or for qualified health care expenses. One stipulation is that they can only be used via a high-deductible healthcare plan - so if that’s you, definitely get on this savings account train.

The 101 on 401ks

Step 1 to building more wealth: take advantage of that 401(k) match (fully) from your employer

Source: tehcpa.net

Actionable Items for You:

Want $419,000 for free? We have a nice easy trick for you. Check if your employer has a 401(k) matching plan, and whether you are utilizing it fully.

We talked last week about how you need to focus on purpose, to use money and retirement planning as a tool to build your lifestyle. This is one of the easier ways to get on track.

Employer-matching 401(k)s generally run about 3-5% of your salary, and the way it works is the more you put into your account, the more they will match. I.E. If you’re only putting 2% of your salary into your 401(k), your employer will only match 2%. But if they offer it up to 5%, you’re missing out on free money.

That can be big bucks. Say you make $100,000 a year in salary. If you put $2,000 (2%) in your 401(k), your employer matches $2,000, so your effective salary is now $102,000. But if they offer to match up to $5,000, you could be getting an extra $3,000 a year for doing something (saving) you should be doing anyway!

The benefits are clear - the employer reduces their income via a deduction on payments to you, you get a free cash benefit that grows tax-free in your 401(k) until it is withdrawn, and it can have a massive impact with a small sacrifice now with the power of compound interest. $5,000 yearly compounded monthly at 6% for 30 years gets you almost an extra $419,000… and that’s just the free money from your employer.

Have some fun with the calculator here.

Focus on Purpose

Retire the idea of retirement - Focus on Purpose

Source: Performance Excellence Network

Actionable Items for You:

Retirement is a strange thing. If you turn on the television, radio, or open a magazine you are bound to see some advertisement about a Wealth Management or Insurance company having the retirement solutions to get you to a point in time, a number, your green path, or whatever the selling point or fear tactic to get your hard earned cash.

Work hard for decades and you’ll get to the end game, you get to leave work behind, relax, unwind, travel - and then what? We all long for something more meaningful for the final 20+ years of our lives.

Retirement is a relatively new concept, invented in the 19th century by the Chancellor of Germany, Otto Von Bismarck. Initially, the age of retirement was set at age 70 and then lowered to age 65. Other countries adopted the concept and then in the early/mid 20th-century corporations began taking the burden off by offering pensions to lifelong employees.

It wasn’t until 1978 that the 401(k) came into tax law to allow for employees to self-fund their retirement and since then Retirement has become a Cash cow for the Financial Industry. We have built a social construct and have been marketed to believe that spending the last 20-30 years of our life idly spending our wealth is the only way to live.

The problem? Studies show this to be unhealthy both mentally and physically. After recently being gifted the Book the Blue Zones, finding the above Venn Diagram and checking out the book titled Ikigai – The Japanese Secret to a Long and Happy Life by Hector Garcia, I found my solution to our retirement myth. The concept of Ikigai – which translates in Japanese to “the reason you wake up in the morning” - made me realize that the Japanese don’t have a translation for the word “retirement”. Nothing in their language describes the concept of stopping work completely. So let’s change retirement goals to life goals. Ask yourself a few questions.

That’s why you have to figure out what makes it worth it for you do it anyway. A savings goal without purpose isn’t a goal at all. Find your purpose, make a plan, and hit some milestones along the way. Retirement is a fabrication, building your life is real. Want some help setting some milestones? Reach out to us today.