Are you looking forward to investing in stock markets? If yes, then you should check out our latest article on the best gym stocks to invest in.

As the global economy continues to recover, investors are starting to look at the stock market once again. The long bear market has caused many investors to miss out on some great investment opportunities. This is why they are now looking to get back into the game.

Investors are beginning to see the benefits of buying shares again. In recent years, many companies have seen their share prices skyrocket due to improving economic conditions. This means that there are plenty of growth opportunities for savvy investors.

Read Also:

AMC Stock forecast, Five below stock, GME Stock forecast

Gym Equipment Companies

Fitness equipment companies make products that allow you to work out safely and effectively. These companies sell everything from dumbbells to treadmills and even offer accessories like yoga mats and towels. Many fitness equipment companies have a wide variety of products and services to choose from. In fact, some specialize in just certain types of equipment.

The following fitness equipment companies are publicly traded

Should I buy Gym Stock?

Gym membership has become a necessity for almost everyone these days. If you don’t want to spend too much on membership, then investing in a good gym stock might be a better option.

Gym memberships are expected to increase at a compound annual growth rate (CAGR) of 6% from 2017 to 2023. This means that the number of gyms worldwide will double every five years.

Gym stocks are expected to outperform the overall market over the next five years. The top five gyms on the stock market are expected to deliver strong earnings growth and return on equity (ROE).

Gym stocks to buy now:

- Planet Fitness (PLNT

- Peloton Interactive (PTON)

- Nautilus Group (NLS)

- Bellring Brands LLC (BRBR)

- Lululemon Athletica (LULU)

Read more:

Top Consumer Discretionary Stocks

Best Fitness Stocks: Xponential Fitness (XPOF)

Xponential Fitness (NYSE: XPOF) specializes in developing and running pricey gyms with cutting-edge workout equipment. The business offers "pilates, barre, cycling, stretching, rowing, yoga, boxing, dancing, running, and functional training," to be more precise. The New York Times describes pilates as "low-weight resistance training that can help our current bodies in important ways, strengthening the core muscles around the spine," for those who are unfamiliar with the discipline. And the term barre refers to a group of exercises, especially those performed at a high intensity, using floor or parallel bars as resistance. These workouts target muscles such as the hamstrings, glutes, core, shoulders, arms, and hands, helping you tone and strengthen them.

The impact of inflation on wealthy Americans is not nearly as negative as it is on poorer consumers, who likely make up the majority of Xponential's clientele. Affluent people's spending in the US and other developed nations is likely to increase as the stock market continues to recover. In addition to the United States, Xponential franchisees work in 11 other nations.

In light of these facts, I'm not surprised that Xponential's financial results have improved significantly over the last few quarters.

For instance, the company's revenue increased to $50.4 million in the first quarter of 2022 from $29.1 million in the first quarter of 2021 and $31.8 million in the first quarter of 2020. The company's gross profit in the first quarter increased to $32.2 million from $19 million in the first quarter of 2020 and $18.8 million in the same period of 2021.

Just 2.2 is the trailing price-to-revenue ratio for the XPOF stock. That's incredibly low for a business that seems to be expanding quickly.

Best fitness stocks: Lululemon (LULU)

Clothing for yoga practitioners is Lululemon's (NASDAQ: LULU) specialty, and the yoga industry is flourishing. In support of that claim, Research and Markets recently published a report that estimated:

At a compound annual growth rate (CAGR) of 5.7%, the market for yoga mats is projected to increase from $10.76 billion in 2021 to $11.37 billion in 2022. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6% to reach $14.36 billion in 2026.

Anecdotally, I've overheard a lot more of my male and female friends and acquaintances mention taking yoga classes than ever before. It is because that yoga helps to attach our body, soul and mind. During COVID-19 I have observed that people were doing yoga regularly to kept them away from stress, mental depression and anxiety.

These considerations make it unsurprising to me that Lululemon's performance keeps accelerating. The company's top line increased to $6.26 billion in the year that ended in January from $4.4 billion the year before and $3.29 billion in its fiscal year that ended in February 2019. In the meantime, its operating income increased to $1.37 billion from $706 million in the year that ended in February 2018 and $813 million in 2017.

Planet Fitness (PLNT)

In a November 2017 report, Planet Fitness (NYSE: PLNT) a publicly traded fitness company stated that usage and membership trends at its gyms were both increasing.

This upward trend seems to have continued into Q1, as revenue increased to $173 million from $118 million in Q1 2020 and $100 million during the same period a year earlier. Its top line increased to $607 million in the past year that ended in March, barely changing from its 2019 sales of $639 million. The business is successful because its operating income for the year that ended in March was $181 million, compared to $158 million for all of 2021 and $235 million for all of 2019.

Randolph Konik, an analyst at financial services company Jeffries, predicted that Planet Fitness, which charges relatively low membership fees, would perform extremely well during a recession in a note to investors dated June 15. That's because consumers will want less expensive and more convenient alternatives during a recession. On the PLNT stock, Konik maintained a "buy" rating and a $115 price target.

F45 Training (NYSE: FXLV)

Fitness franchisor F45 Training Holdings Inc. offers customers functional 45-minute workouts that incorporate elements of functional, circuit, and high-intensity interval training. It mainly offers workouts through its digitally interconnected studio network. As of December 31, 2021, the business ran 1,749 studios altogether. It operates internationally as well as in the United States, South America, Australia, New Zealand, and nearby island nations. In March 2019, the business changed its name from Flyhalf Holdings Inc. to F45 Training Holdings Inc. The corporate headquarters of F45 Training Holdings Inc. are in Austin, Texas, and it was founded in 2013.

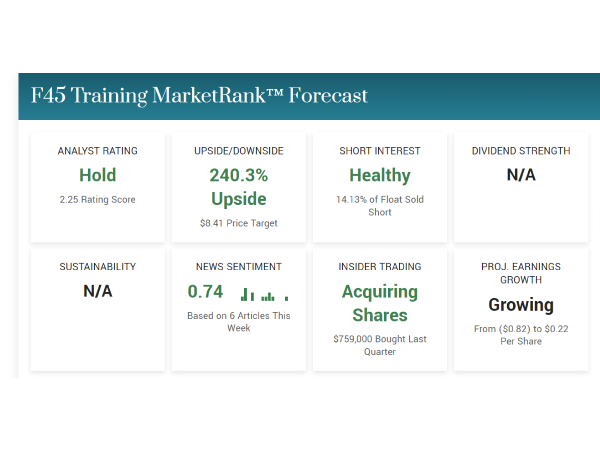

F45 stock Analysis

Are Gym Stocks Safe Investments?

What is safe investment? This question has been asked since time immemorial. All investments come with risks, but some are more risky than others. The safest way to invest your money is through government bonds or bank savings accounts. If you want to get the highest return on investment, then you should consider investing in stock.

Losses from safe investments are unlikely. The return on safe investments will be lower as a result of this safety, which has a cost. So we can say that the lower the return, the lower the risk.

Read More:

The Top Safe Investments

Is Gym group a buy?

In the past year, The Gym Group has received "buy," "hold," and "sell" ratings from 4 Wall Street analysts. 3 buy ratings and 1 hold rating are both currently present for the stock. Wall Street analysts generally agree that investors should "buy" GYM shares.

Is Gold's gym publicly traded?

The Gold's gym is privately owned. Robert Rowling's TRT Holdings purchased it from its prior owner, private equity firm Brockway Moran & Partners, in 2004 for about $158 million. The business was purchased by Brockway Moran in 1999 for over $50 million. The Dallas metropolitan area is where corporate headquarters are located.

Are you looking forward to investing in stock markets? If yes, then you should check out our latest article on the best gym stocks to invest in.

As the global economy continues to recover, investors are starting to look at the stock market once again. The long bear market has caused many investors to miss out on some great investment opportunities. This is why they are now looking to get back into the game.

Investors are beginning to see the benefits of buying shares again. In recent years, many companies have seen their share prices skyrocket due to improving economic conditions. This means that there are plenty of growth opportunities for savvy investors.

Read Also: AMC Stock forecast, Five below stock, GME Stock forecast

Gym Equipment Companies

Fitness equipment companies make products that allow you to work out safely and effectively. These companies sell everything from dumbbells to treadmills and even offer accessories like yoga mats and towels. Many fitness equipment companies have a wide variety of products and services to choose from. In fact, some specialize in just certain types of equipment.

The following fitness equipment companies are publicly traded

Should I buy Gym Stock?

Gym membership has become a necessity for almost everyone these days. If you don’t want to spend too much on membership, then investing in a good gym stock might be a better option.

Gym memberships are expected to increase at a compound annual growth rate (CAGR) of 6% from 2017 to 2023. This means that the number of gyms worldwide will double every five years.

Gym stocks are expected to outperform the overall market over the next five years. The top five gyms on the stock market are expected to deliver strong earnings growth and return on equity (ROE).

Gym stocks to buy now:

Read more: Top Consumer Discretionary Stocks

Best Fitness Stocks: Xponential Fitness (XPOF)

Xponential Fitness (NYSE: XPOF) specializes in developing and running pricey gyms with cutting-edge workout equipment. The business offers "pilates, barre, cycling, stretching, rowing, yoga, boxing, dancing, running, and functional training," to be more precise. The New York Times describes pilates as "low-weight resistance training that can help our current bodies in important ways, strengthening the core muscles around the spine," for those who are unfamiliar with the discipline. And the term barre refers to a group of exercises, especially those performed at a high intensity, using floor or parallel bars as resistance. These workouts target muscles such as the hamstrings, glutes, core, shoulders, arms, and hands, helping you tone and strengthen them.

The impact of inflation on wealthy Americans is not nearly as negative as it is on poorer consumers, who likely make up the majority of Xponential's clientele. Affluent people's spending in the US and other developed nations is likely to increase as the stock market continues to recover. In addition to the United States, Xponential franchisees work in 11 other nations.

In light of these facts, I'm not surprised that Xponential's financial results have improved significantly over the last few quarters.

For instance, the company's revenue increased to $50.4 million in the first quarter of 2022 from $29.1 million in the first quarter of 2021 and $31.8 million in the first quarter of 2020. The company's gross profit in the first quarter increased to $32.2 million from $19 million in the first quarter of 2020 and $18.8 million in the same period of 2021.

Just 2.2 is the trailing price-to-revenue ratio for the XPOF stock. That's incredibly low for a business that seems to be expanding quickly.

Best fitness stocks: Lululemon (LULU)

Clothing for yoga practitioners is Lululemon's (NASDAQ: LULU) specialty, and the yoga industry is flourishing. In support of that claim, Research and Markets recently published a report that estimated:

At a compound annual growth rate (CAGR) of 5.7%, the market for yoga mats is projected to increase from $10.76 billion in 2021 to $11.37 billion in 2022. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6% to reach $14.36 billion in 2026.

Anecdotally, I've overheard a lot more of my male and female friends and acquaintances mention taking yoga classes than ever before. It is because that yoga helps to attach our body, soul and mind. During COVID-19 I have observed that people were doing yoga regularly to kept them away from stress, mental depression and anxiety.

These considerations make it unsurprising to me that Lululemon's performance keeps accelerating. The company's top line increased to $6.26 billion in the year that ended in January from $4.4 billion the year before and $3.29 billion in its fiscal year that ended in February 2019. In the meantime, its operating income increased to $1.37 billion from $706 million in the year that ended in February 2018 and $813 million in 2017.

Planet Fitness (PLNT)

In a November 2017 report, Planet Fitness (NYSE: PLNT) a publicly traded fitness company stated that usage and membership trends at its gyms were both increasing.

This upward trend seems to have continued into Q1, as revenue increased to $173 million from $118 million in Q1 2020 and $100 million during the same period a year earlier. Its top line increased to $607 million in the past year that ended in March, barely changing from its 2019 sales of $639 million. The business is successful because its operating income for the year that ended in March was $181 million, compared to $158 million for all of 2021 and $235 million for all of 2019.

Randolph Konik, an analyst at financial services company Jeffries, predicted that Planet Fitness, which charges relatively low membership fees, would perform extremely well during a recession in a note to investors dated June 15. That's because consumers will want less expensive and more convenient alternatives during a recession. On the PLNT stock, Konik maintained a "buy" rating and a $115 price target.

F45 Training (NYSE: FXLV)

Fitness franchisor F45 Training Holdings Inc. offers customers functional 45-minute workouts that incorporate elements of functional, circuit, and high-intensity interval training. It mainly offers workouts through its digitally interconnected studio network. As of December 31, 2021, the business ran 1,749 studios altogether. It operates internationally as well as in the United States, South America, Australia, New Zealand, and nearby island nations. In March 2019, the business changed its name from Flyhalf Holdings Inc. to F45 Training Holdings Inc. The corporate headquarters of F45 Training Holdings Inc. are in Austin, Texas, and it was founded in 2013.

F45 stock Analysis

Are Gym Stocks Safe Investments?

What is safe investment? This question has been asked since time immemorial. All investments come with risks, but some are more risky than others. The safest way to invest your money is through government bonds or bank savings accounts. If you want to get the highest return on investment, then you should consider investing in stock.

Losses from safe investments are unlikely. The return on safe investments will be lower as a result of this safety, which has a cost. So we can say that the lower the return, the lower the risk.

Read More: The Top Safe Investments

Is Gym group a buy?

In the past year, The Gym Group has received "buy," "hold," and "sell" ratings from 4 Wall Street analysts. 3 buy ratings and 1 hold rating are both currently present for the stock. Wall Street analysts generally agree that investors should "buy" GYM shares.

Is Gold's gym publicly traded?

The Gold's gym is privately owned. Robert Rowling's TRT Holdings purchased it from its prior owner, private equity firm Brockway Moran & Partners, in 2004 for about $158 million. The business was purchased by Brockway Moran in 1999 for over $50 million. The Dallas metropolitan area is where corporate headquarters are located.