Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

December 23, 2022 - Well we’re almost there . . . the end of 2022 is right in front of us. And the most impactful categories were Ukraine (oil & commodities) and Inflation (interest rates & economy). The biggest question is just how much and how fast will the world economies react to the economic slowdown driven by central banks increasing interest rates.

The whole idea is to dampen consumer demand without over doing it; a delicate balance. Slowing economic growth will also slow revenues which hit profits / earnings, and we know that in the long run, profits (or the hope of them) drive stock prices. 2023 looks to be a very tepid year and hopefully no worse than that. With the possibility of a recession comes a likely leg lower in the markets. It’s hard to say that current stock prices are considered a “Value” since the price to earnings ratio remains above historic levels in most cases.

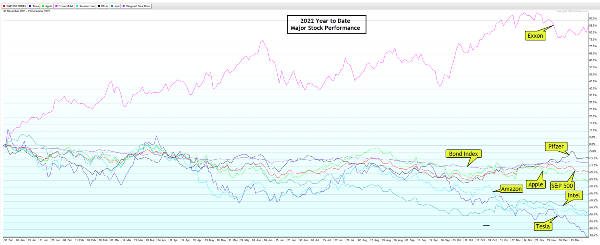

I’ve randomly select stocks in major sectors to compare their performance over the past year (to date). As you can see about the only place to ride out 2022 was in the Energy sectors.

That’s about it. Next week will be a low volume period with many folks on vacation. And with low volume can also bring volatility in prices. We’ve likely seen all of the year-end tax selling by now. I think we’ll have to wait until 2023 begins to get a feel of where things are likely headed. I’m heavy in Cash for the time being.

*Wishing you & your family a Happy Holiday Season and a Prosperous New Year. * ……… Tom ……….. Price chart by StockCharts.com; table by www.HighGrowthStock.com. Used with permission.