Introduction

Value investing is about finding stocks trading below their intrinsic worth, offering the potential for outsized returns when the market recognizes their true value. While large-cap value stocks often dominate headlines, the small-cap universe—companies with market capitalizations between $300 million and $2 billion—offers a fertile hunting ground for value investors. In 2025, small-cap stocks are trading at some of the most attractive valuations in decades, presenting compelling opportunities for those willing to look beyond the market’s giants.

This essay explores why small-cap stocks are so appealing for value investors right now, the characteristics that define the best small-cap value opportunities, and the strategies and risks involved in this dynamic segment of the market.

Why Small-Cap Value Now? The Case for Opportunity

- Historic Valuation Discounts

Small-cap stocks are currently trading at near all-time valuation discounts to large caps, particularly on a forward price-to-earnings (P/E) basis. After more than a decade of underperformance, the gap between small- and large-cap valuations is the widest since the dot-com bubble2356. This broad-based discount has punished all small companies equally, even those with strong profits and growth, creating a target-rich environment for value investors.

- Resilient Fundamentals Amid Market Neglect

Despite the influx of unprofitable and speculative companies (especially post-SPAC boom), the core of the small-cap universe remains fundamentally sound. Profit margins for profitable small caps have stayed stable, and many are growing earnings and sales at a healthy pace28. Yet, the market’s broad brush has left these gems undervalued, offering the classic value investor’s setup: quality at a discount.

- Earnings Growth Acceleration

After trailing large caps in earnings and sales growth for several years, small caps as a group are expected to see their earnings growth accelerate and surpass large caps in 202536. This inflection, combined with low valuations, sets the stage for strong returns as the market re-rates these stocks.

- Sector Diversification and M&A Tailwinds

Small-cap value stocks offer much more diverse sector exposure than the IT- and communication-heavy S&P 50036.Sectors like financials, industrials, and consumer discretionary are well-represented. Additionally, the environment is ripe for mergers and acquisitions (M&A), with small caps often being prime targets—an added catalyst for value realization36.

What Makes a Great Small-Cap Value Stock?

Not all cheap stocks are good value. The best small-cap value opportunities share several key traits:

● Consistent Profitability: Focus on companies with a track record of positive earnings and stable or improving margins.

● Strong Balance Sheets: Look for manageable debt, ample liquidity, and prudent capital allocation. While small caps, on average, have more leverage, a third of Russell 2000 companies actually have net cash—more than large caps28.

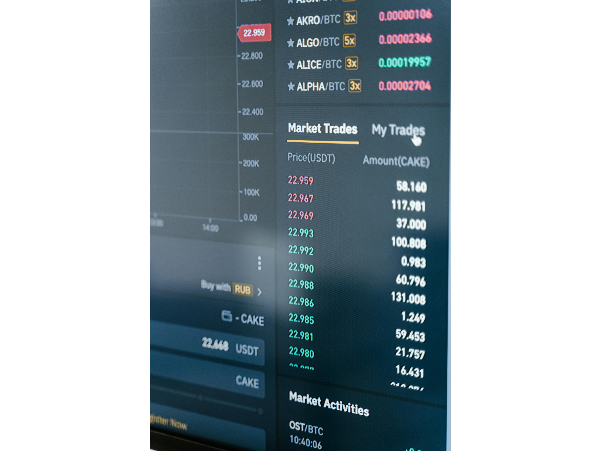

● Low Valuation Multiples: Seek out stocks trading at low P/E, price-to-book (P/B), or price-to-sales (P/S) ratios compared to their history and peers.

● Earnings Growth Potential: Companies poised for an earnings rebound or with clear growth drivers are more likely to be re-rated by the market.

● Catalysts for Revaluation: These may include improving economic conditions, sector tailwinds, management changes, or the potential for M&A.

Why Active Management Matters

The small-cap universe is heterogeneous, with a mix of profitable and unprofitable companies. About 25% of the Russell 2000 have negative earnings, and these have underperformed profitable peers by 9% over the past decade, with 50% more volatility7. Passive index exposure can dilute returns with low-quality names. Active managers, however, can sift through the noise, focusing on the most attractive value opportunities and avoiding the pitfalls of unprofitable or overleveraged firms.

Strategies for Value Investing in Small Caps

- Diversification

Given the higher volatility and company-specific risk in small caps, diversification across sectors and business models is essential. Global small-cap funds or diversified portfolios can help manage risk4.

- Fundamental Analysis

Deep research into financial statements, management quality, and industry dynamics is crucial. Focus on companies with strong cash flows, sustainable competitive advantages, and clear growth paths.

- Monitor Valuation Metrics

Compare valuation multiples to historical averages and industry peers. Look for stocks trading at discounts to their own history and the broader market45.

- Watch for M&A Activity

Small-cap value stocks are frequent M&A targets, especially when trading at depressed valuations. An uptick in deal activity can provide a significant boost to share prices346.

Examples of Small-Cap Value Stocks

While the best opportunities will vary by region and sector, here are some archetypes and fund approaches:

Company/Fund Sector/Focus Value Proposition

T. Rowe Price US Smaller Companies Fund US Small/Mid-Cap Focuses on both value and growth

abrdn Global Smaller Companies Fund Global Diversified Exposure to undervalued global small caps

Janus Henderson European Smaller Companies Europe Diversified Half portfolio in sub-€1bn companies

Unicorn UK Smaller Companies UK Small-Cap Value Targets undervalued UK small caps

VT Downing Unique Opportunities Fund UK/Europe Value Focus on M&A and deep value

For individual stocks, look for companies in financials, industrials, and consumer discretionary sectors with low P/E ratios, strong balance sheets, and positive earnings trends.

Risks and Considerations

● Higher Volatility: Small-cap stocks are more volatile than large caps, with bigger price swings and liquidity risks45.

● Interest Rate Sensitivity: Small caps, on average, have more floating-rate debt, making them more sensitive to rising rates. However, this risk is concentrated in a minority of companies, and many small caps have net cash28.

● Quality Dispersion: The influx of low-quality, unprofitable companies (especially post-SPAC boom) requires careful stock selection28.

● Economic Sensitivity: Small-cap value stocks are more short-cycle and sensitive to domestic economic conditions. They tend to outperform during periods of economic acceleration, but may lag in downturns36.

Outlook for 2025 and Beyond

The outlook for small-cap value stocks is bright. As earnings growth accelerates, valuations remain near historic lows, and M&A activity picks up, value investors are well-positioned to benefit. Sector diversification, a more accommodative regulatory stance, and a shift in investor focus away from mega-cap tech all point to a favorable environment for small-cap value.

Historically, small-cap value has outperformed over almost any medium- to long-term holding period, especially during economic recoveries and periods of market rotation. With active management and disciplined stock selection, investors can capture the upside while managing the risks inherent in this space

Conclusion

Small-cap stocks offer some of the best value opportunities in the market today. Trading at historic discounts, with accelerating earnings growth and broad sector exposure, they present a compelling case for value investors willing to do the work. While risks remain—especially around quality dispersion and volatility—active management, diversification, and a focus on fundamentals can help investors unlock the potential of this dynamic market segment. As the investment landscape shifts in 2025, the best small-cap value stocks may deliver the kind of returns that have made value investing a timeless strategy.

Introduction Value investing is about finding stocks trading below their intrinsic worth, offering the potential for outsized returns when the market recognizes their true value. While large-cap value stocks often dominate headlines, the small-cap universe—companies with market capitalizations between $300 million and $2 billion—offers a fertile hunting ground for value investors. In 2025, small-cap stocks are trading at some of the most attractive valuations in decades, presenting compelling opportunities for those willing to look beyond the market’s giants. This essay explores why small-cap stocks are so appealing for value investors right now, the characteristics that define the best small-cap value opportunities, and the strategies and risks involved in this dynamic segment of the market.

Why Small-Cap Value Now? The Case for Opportunity

What Makes a Great Small-Cap Value Stock? Not all cheap stocks are good value. The best small-cap value opportunities share several key traits: ● Consistent Profitability: Focus on companies with a track record of positive earnings and stable or improving margins. ● Strong Balance Sheets: Look for manageable debt, ample liquidity, and prudent capital allocation. While small caps, on average, have more leverage, a third of Russell 2000 companies actually have net cash—more than large caps28. ● Low Valuation Multiples: Seek out stocks trading at low P/E, price-to-book (P/B), or price-to-sales (P/S) ratios compared to their history and peers. ● Earnings Growth Potential: Companies poised for an earnings rebound or with clear growth drivers are more likely to be re-rated by the market. ● Catalysts for Revaluation: These may include improving economic conditions, sector tailwinds, management changes, or the potential for M&A.

Why Active Management Matters The small-cap universe is heterogeneous, with a mix of profitable and unprofitable companies. About 25% of the Russell 2000 have negative earnings, and these have underperformed profitable peers by 9% over the past decade, with 50% more volatility7. Passive index exposure can dilute returns with low-quality names. Active managers, however, can sift through the noise, focusing on the most attractive value opportunities and avoiding the pitfalls of unprofitable or overleveraged firms.

Strategies for Value Investing in Small Caps

Examples of Small-Cap Value Stocks While the best opportunities will vary by region and sector, here are some archetypes and fund approaches: Company/Fund Sector/Focus Value Proposition T. Rowe Price US Smaller Companies Fund US Small/Mid-Cap Focuses on both value and growth abrdn Global Smaller Companies Fund Global Diversified Exposure to undervalued global small caps Janus Henderson European Smaller Companies Europe Diversified Half portfolio in sub-€1bn companies Unicorn UK Smaller Companies UK Small-Cap Value Targets undervalued UK small caps VT Downing Unique Opportunities Fund UK/Europe Value Focus on M&A and deep value For individual stocks, look for companies in financials, industrials, and consumer discretionary sectors with low P/E ratios, strong balance sheets, and positive earnings trends.

Risks and Considerations ● Higher Volatility: Small-cap stocks are more volatile than large caps, with bigger price swings and liquidity risks45. ● Interest Rate Sensitivity: Small caps, on average, have more floating-rate debt, making them more sensitive to rising rates. However, this risk is concentrated in a minority of companies, and many small caps have net cash28. ● Quality Dispersion: The influx of low-quality, unprofitable companies (especially post-SPAC boom) requires careful stock selection28. ● Economic Sensitivity: Small-cap value stocks are more short-cycle and sensitive to domestic economic conditions. They tend to outperform during periods of economic acceleration, but may lag in downturns36.

Outlook for 2025 and Beyond The outlook for small-cap value stocks is bright. As earnings growth accelerates, valuations remain near historic lows, and M&A activity picks up, value investors are well-positioned to benefit. Sector diversification, a more accommodative regulatory stance, and a shift in investor focus away from mega-cap tech all point to a favorable environment for small-cap value. Historically, small-cap value has outperformed over almost any medium- to long-term holding period, especially during economic recoveries and periods of market rotation. With active management and disciplined stock selection, investors can capture the upside while managing the risks inherent in this space

Conclusion Small-cap stocks offer some of the best value opportunities in the market today. Trading at historic discounts, with accelerating earnings growth and broad sector exposure, they present a compelling case for value investors willing to do the work. While risks remain—especially around quality dispersion and volatility—active management, diversification, and a focus on fundamentals can help investors unlock the potential of this dynamic market segment. As the investment landscape shifts in 2025, the best small-cap value stocks may deliver the kind of returns that have made value investing a timeless strategy.