Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

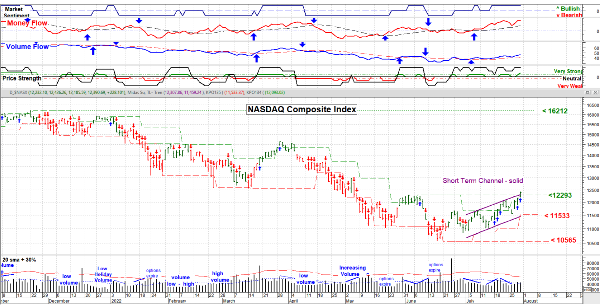

July 29, 2022 – The question on the mind of many is: “Was that the bottom?” I’ll get right to it with a definitive ‘Maybe’. I’ll list the Pro’s and Con’s so you can decide:

The Bottom Is In –

The Bottom Is Not In –

So now what? I’m expecting a pull back early next week. The amount of that pullback and the volume that it creates should be an indication of the strength of this market. I found it curious that oil / energy and consumer discretionary sectors were doing very well last Friday. Not exactly what you’d expect to see if an economy was going into a recessionary period. Short covering or is somebody getting very optimistic early?

Right now I’d say what we are seeing is a ‘Tradeable Bottom’ within a Bear market, which means that a retest of the lows is likely. I could be wrong, but I’ll wait for a firm*(er)* confirmation on my daily chart.

Let’s keep an eye on the price action next week. If things are truly strong any dip will be bought and we may have an improved price structure to work with for the rest of the year. But right now, I’m not totally convinced. Have a good week. ……… Tom ………

Price chart by MetaStock; pie chart & table by www.HighGrowthStock.com. Used with permission. More Sector information at: www.Special-Risk.net