Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

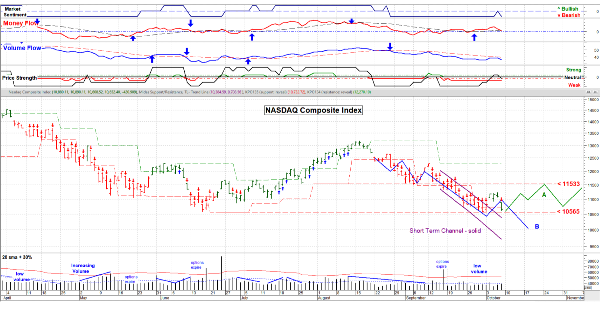

October 7, 2022 - Here’s my quick read of this market: We are either in a broad “Bottoming” / base building process (scenario ‘A’, green lines) or headed lower (scenario ‘B’, blue lines). (see chart) The market rocketed up about 5% early in the week and then gave it all back late in the week. This is typical of a nervous market where folks are trying to anticipate the next move, which causes ‘Shorts’ / Hedges to cover their positions and buy. The technical term is a “Short Squeeze”.

What is causing this nervousness is the very fast rise in interest rates and a large amount of debt / loans that are affected by interest rates. The market (according to CME interest rates futures) is expecting 80% chance of another .75% interest rate rise come November (Bearish). Watch for the latest CPI (Consumer Price Index) data that will be coming out on Thursday. That could be a big mover in either direction, as the FED is keying off of inflation data, and that drives their decision on interest rates.

What will confirm that a move has “legs” will be how the US Dollar and Treasury Bonds react. A lower US $ and stable or high bond prices (lower rates) would be Bullish and support at least a longer run higher. Of course the opposite is true too.

I am very heavy in Cash waiting for a sign of at least a ‘tradable bounce’ . . . . in either direction. I’d like to think that the worst is behind us but proof of that is not easy nor plentiful. This market is nervous and right now the institutions are staying hedged and away. Me too. ** Have a good week**. …. Tom ….

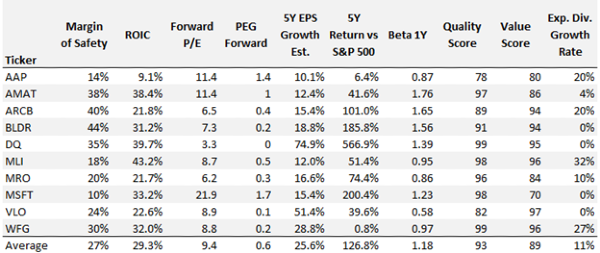

Sector data at: www.Special-Risk.net Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.