How do I handle my stock portfolio during a market downturn? How do I cope with seeing my stocks drop in value? Should I sell? Should I keep investing? These questions came up recently in the Simply Investing Forum. This blog post will answer these questions.

Focus on quality dividend stocks

In this blog post I will assume you are asking about your dividend stocks that you purchased when they passed the 12 Rules of Simply Investing (in other words quality stocks). I will ignore the following situations:

- you are day trading and want to know when to buy and sell

- you are wondering what to do with your non-dividend stocks

- you are wondering what to do with your crypto stocks

Let's continue with the assumption that your quality dividend stocks have gone down in price, just like every other stock when the market tanks.

Start with the past

I've been a dividend investor for more than 22 years, and I've witnessed first hand the following market crashes:

Tech bubble crash (1999-2000)

- 2001 the 9/11 crash

- 2003 start of Iraq war

- 2008-2009 financial crisis

- 2010 flash crash

- 2020 coronavirus crash

Here are some common threads with every crash:

- no one can predict how long the crash will last

- the media and internet goes into a frenzy and predicts "the great recession" is coming

- sentiment is always very low, it's very hard for people to get optimistic, and they believe that "this time is different"

- every crash has been followed by a recovery

Today we are experiencing the above 4 bullet points again.

Quick question: how much did you lose?

I know it's painful to watch your stock go RED, but remember this is only a temporary situation. Quick question: You buy a stock for $25 it goes down to $20 how much money did you lose? You have lost nothing if you don't sell, you still own the same number of shares and the company is still paying you a dividend. The company is still producing recession proof products, and making money, the stock price does not reflect the reality of a company's financial health.

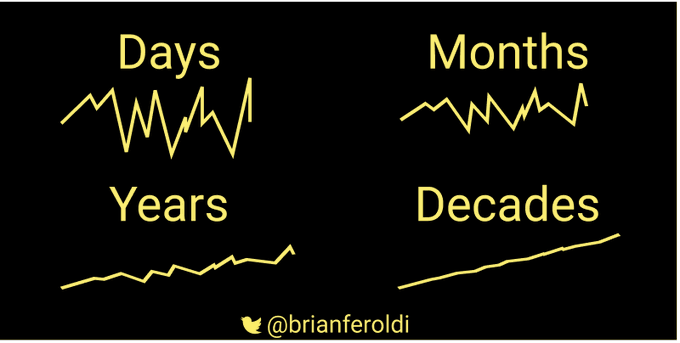

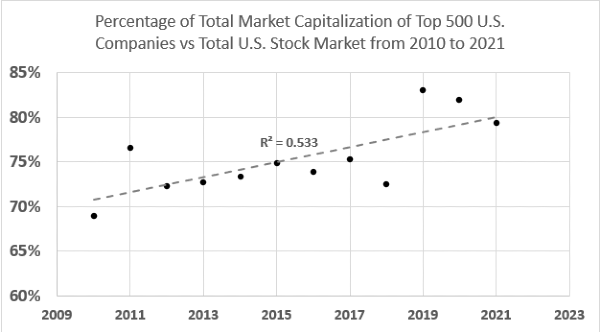

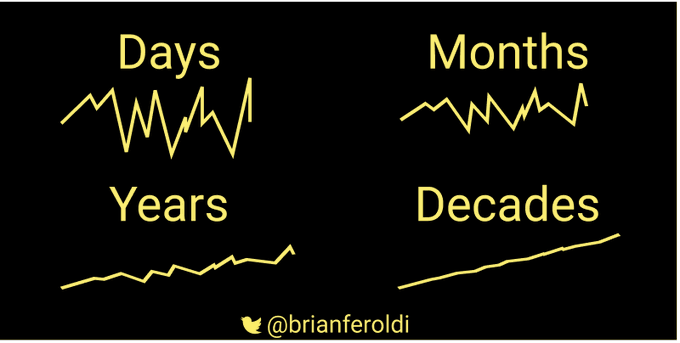

Stock prices go up and down all the time, but in the long-term the trend continues to go upward.

Remember we are long-term investors we think in terms of decades, not days, weeks, or months.

Our focus

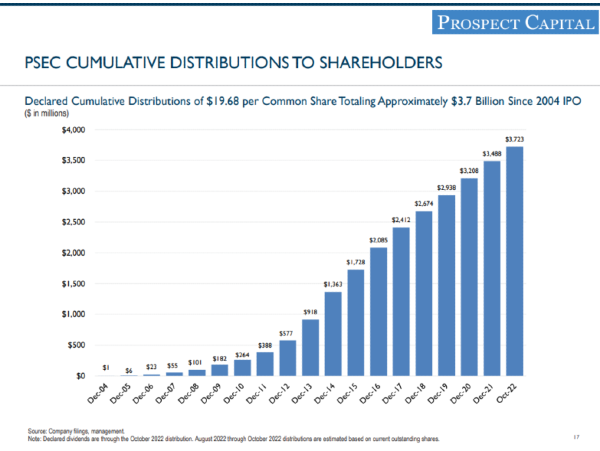

Our priority is on the dividends, the amount of income being generated by your portfolio, the focus is not on the stock price, we want to see the dividend income from your portfolio grow every year, regardless of what happens in the stock market.

Should you sell?

The worst time to sell is when stocks prices are low, you solidify your losses and you cut your stream of dividends from that company.

A client recently asked "Both my INTC and WBA are down, should I sell if a stock is down 5% or 10%.?"

I don't have a specific % of loss, but I do discuss the reasons to sell a stock in the Simply Investing Course, in the following two lessons:

- Lesson 20 - When should you sell your stock?

- Lesson 21 - Guidelines for selling your stock

I understand that both INTC and WBA have dropped in price recently. In fact, more stocks will drop in price if the stock market crashes or there is a recession. This is normal and it is supposed to happen every 6 to10 years.

Dividend income is key

Our priority is not on the stock price, our priority is on the dividend income. Walgreens has been consecutively increasing its dividend for 46 years. INTC has been consecutively increasing its dividend for 7 years.

As long as the companies are profitable (in the long-term) and they continue to increase their dividend, and they pass the majority of the 12 Rules of Simply Investing, then it is best to hold for the growing income (dividends).

Stock prices change every day, there is no need to panic and sell when the price drops, this is the worst time to sell. We are long-term investors (10 years or more). Based on history, INTC and Walgreens should be worth more in 10 years than they are today, and their dividend should continue to increase.

Watch for red flags

Here are some red flags that would make me think about selling:

- has the company announced a dividend reduction?

- is the EPS negative for many months?

- is the company consistently losing money?

- did the CEO or CFO get fired for making false financial reports?

Notice my red flags are serious in nature, but they do not consider a drop in the share price.

We are long-term investors

If the market crashes next month, every stock you buy today will be down next month. Do not panic and sell when the stock price drops. Owning a stock for less than 2-3 years, and worrying about the stock price is not recommended. Remember we are long-term investors, we think in terms of decades.

My strategies with a down market

Here are my strategies for coping in this down market:

- I remind my self that this too shall pass

- I focus on the dividend income, the stock price is not a priority

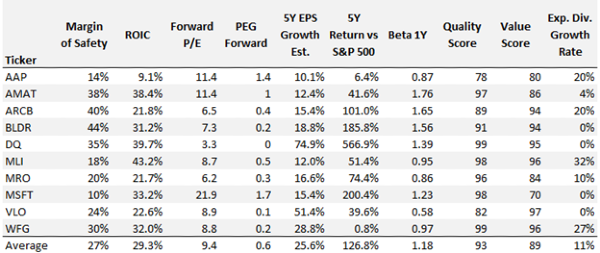

- I continue to seek out quality dividend stocks when they are undervalued

- I ignore the noise in the media and online

- I think long-term, my time horizon is in decades not years

- The 12 Rules of Simply Investing help me to stay on track

I'm here to help

I can help you to start investing today and focus on selecting the right dividend stocks when they are priced low (undervalued), why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. Follow my approach to investing to help you get started right away, so you don't have to wait on the sidelines any longer. I also built the ultimate tool (that I wish I had when I started investing in 1999) to help dividend investors focus on quality stocks for long-term growth. The sooner you start investing the sooner you will be on your path to financial freedom.

Did you enjoy reading this article? If so, I encourage you to sign up for my free newsletter and have these articles delivered via email once a month … for free!

Learn how you can avoid the most common (and costly) investing mistakes, download my free guide today: "Are you making these top 5 investing mistakes?"

How do I handle my stock portfolio during a market downturn? How do I cope with seeing my stocks drop in value? Should I sell? Should I keep investing? These questions came up recently in the Simply Investing Forum. This blog post will answer these questions.

Focus on quality dividend stocks

In this blog post I will assume you are asking about your dividend stocks that you purchased when they passed the 12 Rules of Simply Investing (in other words quality stocks). I will ignore the following situations:

Let's continue with the assumption that your quality dividend stocks have gone down in price, just like every other stock when the market tanks.

Start with the past

I've been a dividend investor for more than 22 years, and I've witnessed first hand the following market crashes:

Tech bubble crash (1999-2000)

Here are some common threads with every crash:

Today we are experiencing the above 4 bullet points again.

Quick question: how much did you lose?

I know it's painful to watch your stock go RED, but remember this is only a temporary situation. Quick question: You buy a stock for $25 it goes down to $20 how much money did you lose? You have lost nothing if you don't sell, you still own the same number of shares and the company is still paying you a dividend. The company is still producing recession proof products, and making money, the stock price does not reflect the reality of a company's financial health.

Stock prices go up and down all the time, but in the long-term the trend continues to go upward.

Remember we are long-term investors we think in terms of decades, not days, weeks, or months.

Our focus

Our priority is on the dividends, the amount of income being generated by your portfolio, the focus is not on the stock price, we want to see the dividend income from your portfolio grow every year, regardless of what happens in the stock market.

Should you sell?

The worst time to sell is when stocks prices are low, you solidify your losses and you cut your stream of dividends from that company.

A client recently asked "Both my INTC and WBA are down, should I sell if a stock is down 5% or 10%.?" I don't have a specific % of loss, but I do discuss the reasons to sell a stock in the Simply Investing Course, in the following two lessons:

I understand that both INTC and WBA have dropped in price recently. In fact, more stocks will drop in price if the stock market crashes or there is a recession. This is normal and it is supposed to happen every 6 to10 years.

Dividend income is key

Our priority is not on the stock price, our priority is on the dividend income. Walgreens has been consecutively increasing its dividend for 46 years. INTC has been consecutively increasing its dividend for 7 years.

As long as the companies are profitable (in the long-term) and they continue to increase their dividend, and they pass the majority of the 12 Rules of Simply Investing, then it is best to hold for the growing income (dividends).

Stock prices change every day, there is no need to panic and sell when the price drops, this is the worst time to sell. We are long-term investors (10 years or more). Based on history, INTC and Walgreens should be worth more in 10 years than they are today, and their dividend should continue to increase.

Watch for red flags

Here are some red flags that would make me think about selling:

We are long-term investors

If the market crashes next month, every stock you buy today will be down next month. Do not panic and sell when the stock price drops. Owning a stock for less than 2-3 years, and worrying about the stock price is not recommended. Remember we are long-term investors, we think in terms of decades.

My strategies with a down market

Here are my strategies for coping in this down market:

I'm here to help

I can help you to start investing today and focus on selecting the right dividend stocks when they are priced low (undervalued), why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. Follow my approach to investing to help you get started right away, so you don't have to wait on the sidelines any longer. I also built the ultimate tool (that I wish I had when I started investing in 1999) to help dividend investors focus on quality stocks for long-term growth. The sooner you start investing the sooner you will be on your path to financial freedom.

Did you enjoy reading this article? If so, I encourage you to sign up for my free newsletter and have these articles delivered via email once a month … for free!

Learn how you can avoid the most common (and costly) investing mistakes, download my free guide today: "Are you making these top 5 investing mistakes?"

Originally Posted in Simply Investing