How Well Do I Sleep at Night vs. How Rich Do I Want the Kids to Be?

Investing in retirement is all about tradeoffs. Of course, all decisions are tradeoffs—when you choose one path, you can’t go down the other—but let’s focus on retirement investing!

What are the major tradeoffs you face when investing during retirement?

Remember, this blog is for those who have oversaved for retirement. This is a safe space to discuss first-world problems! If you have oversaved for retirement, you need to decide on your asset allocation: how well do I sleep at night vs. how rich do I want the kids to be?

How Well do I Sleep at Night vs. How Rich do I Want the Kids to Be?

If you have oversaved for retirement, you could stuff your mattress with cash, and you’d be ok (unless there is a fire in your home).

Or conversely, you could stay 100% invested in equities and survive the badness that is reverse dollar-cost averaging (sequence of returns risk). Even if you sell stocks at all-time lows, you’ll have plenty of money left over at the end of your life.

How do you decide if you could be 100/0 or 0/100 and be just fine?

I like this tradeoff: how well do you sleep at night vs. how rich do you want the kids to be?

Let’s look at two ways to slice this pie: time segmentation (bucketing) or total returns.

How Rich Do You Want the Kids to Be: Time Segmentation

And by the way, this could be for charity, grandkids, or anyone else. The point is, you don’t need all the money, so what do you do with it?

Bucketing (mental accounting or time segmentation) makes sense to some people. If, say, you had a $4M nest egg but only needed $2M of it, you could consider the asset allocation of your $2M different from the kids’ $2M.

Say you wanted to be 60/40 with your portfolio and 100/0 with the kid’s portfolio. Open up two different IRAs and two different brokerage accounts (or whatever accounts you have) and label them separately. In one account, yours, go the traditional 60/40. On the other, please take all the risk you want (since the kids won’t get it for 20 or more years); go 100/0.

Well, smoosh the two together, and you get 80/20 for your overall asset allocation.

This is:

- Time segmentation: I need one account soon (mine is 60/40) and one account later (kids is 100/0)

- Mental accounting: my account and the kid’s account

- Buckets: my bucket and the kid’s bucket

But, in summary, you are 80/20.

How Well Do You Sleep at Night? Total Return

Because the dirty little secret of mental accounting (it is not a secret, by the way) is that it all collapses down to one asset allocation on your portfolio.

Say you have 20% of your money in cash for the “now” bucket, 60% of your money as 60/40 for the “soon” bucket, and the last 20% of your money 100% equities for the “later” bucket. Well, you are 60/40. You have just given the buckets different labels and titles to feel more comfortable spending the cash now while being more aggressively invested for later.

Some suggest that those who like optionality but have a “safety-first” attitude should follow the bucket approach. You like knowing where the now, soon, and later money is, giving you the option to spend more now. But you also don’t want to invest aggressively with the funds set to be consumed soon. So, you have the buckets.

Again, the whole portfolio collapses down to one overall asset allocation.

Instead, many of us like the total return approach. Just have your portfolio allocated to promote sound asset location principles.

Because, remember, money is fungible.

This is important. Otherwise, you get stuck thinking that you need to have five years’ worth of withdrawals in your brokerage account because you will be spending from it soon. But you are not supposed to have bonds and cash in your brokerage account due to tax drag.

What to do? Remember, money is fungible.

So, say you have stocks in your brokerage account, but you need the money, and the market is down. Just sell your stocks in your brokerage account, then sell bonds to buy those same stocks in your IRA. This is (-) stocks (-) bonds (+) stocks. In the total return approach, you have sold bonds to pay for your expenses out of your brokerage account (which doesn’t have any bonds because you want to be tax-efficient!).

Summary: How Well Do I Want to Sleep At Night vs. How Rich Do I Want the Kids to Be

If you have oversaved, you have the luxury of having whatever asset allocation makes you sleep well at night. If you sleep well on a pile of cash, have at it!

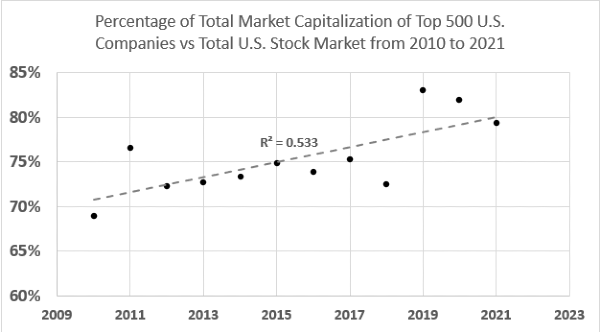

Conversely, we know over time that stocks will outperform cash, bonds, and just about everything else (aside from leveraged real estate and the occasional small business).

How well do you sleep at night vs. how right do you want the kids to be?

If you want to take risks (and you know that you don’t need the money anyway), you (or, more aptly, the kids since it is their money) can take as much risk as you want.

You might think you don’t want to give the money away right now because you might need it in 20 years for absurd and improbable long-term care expenses. But, of course, it is better to spend your money on things that you and the kids enjoy, to share experiences with them while you are still alive.

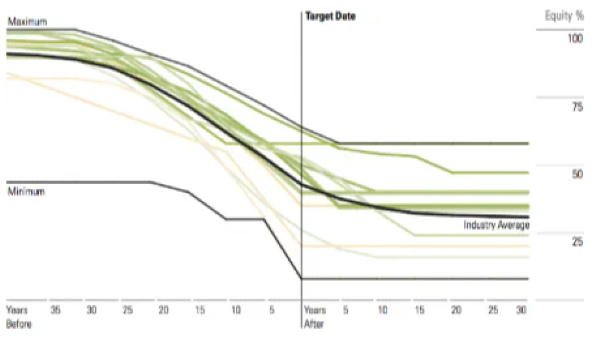

But if you leave the money to the kids (or to charity) when you pass, you can (and perhaps should) take more risk with it. Consider a pre-retirement glidepath that is personalized to your needs.

You can do that by mental accounting or by total return. But you, you over saver you, can be 100/0 or 90/10 or whatever you want because you know you have plenty of safer money. You have won the game. So play with the money you don’t need.

How Well Do I Sleep at Night vs. How Rich Do I Want the Kids to Be?

Investing in retirement is all about tradeoffs. Of course, all decisions are tradeoffs—when you choose one path, you can’t go down the other—but let’s focus on retirement investing!

What are the major tradeoffs you face when investing during retirement?

Remember, this blog is for those who have oversaved for retirement. This is a safe space to discuss first-world problems! If you have oversaved for retirement, you need to decide on your asset allocation: how well do I sleep at night vs. how rich do I want the kids to be?

How Well do I Sleep at Night vs. How Rich do I Want the Kids to Be?

If you have oversaved for retirement, you could stuff your mattress with cash, and you’d be ok (unless there is a fire in your home).

Or conversely, you could stay 100% invested in equities and survive the badness that is reverse dollar-cost averaging (sequence of returns risk). Even if you sell stocks at all-time lows, you’ll have plenty of money left over at the end of your life.

How do you decide if you could be 100/0 or 0/100 and be just fine?

I like this tradeoff: how well do you sleep at night vs. how rich do you want the kids to be?

Let’s look at two ways to slice this pie: time segmentation (bucketing) or total returns.

How Rich Do You Want the Kids to Be: Time Segmentation

And by the way, this could be for charity, grandkids, or anyone else. The point is, you don’t need all the money, so what do you do with it?

Bucketing (mental accounting or time segmentation) makes sense to some people. If, say, you had a $4M nest egg but only needed $2M of it, you could consider the asset allocation of your $2M different from the kids’ $2M.

Say you wanted to be 60/40 with your portfolio and 100/0 with the kid’s portfolio. Open up two different IRAs and two different brokerage accounts (or whatever accounts you have) and label them separately. In one account, yours, go the traditional 60/40. On the other, please take all the risk you want (since the kids won’t get it for 20 or more years); go 100/0.

Well, smoosh the two together, and you get 80/20 for your overall asset allocation.

This is:

But, in summary, you are 80/20.

How Well Do You Sleep at Night? Total Return

Because the dirty little secret of mental accounting (it is not a secret, by the way) is that it all collapses down to one asset allocation on your portfolio.

Say you have 20% of your money in cash for the “now” bucket, 60% of your money as 60/40 for the “soon” bucket, and the last 20% of your money 100% equities for the “later” bucket. Well, you are 60/40. You have just given the buckets different labels and titles to feel more comfortable spending the cash now while being more aggressively invested for later.

Some suggest that those who like optionality but have a “safety-first” attitude should follow the bucket approach. You like knowing where the now, soon, and later money is, giving you the option to spend more now. But you also don’t want to invest aggressively with the funds set to be consumed soon. So, you have the buckets.

Again, the whole portfolio collapses down to one overall asset allocation.

Instead, many of us like the total return approach. Just have your portfolio allocated to promote sound asset location principles.

Because, remember, money is fungible.

This is important. Otherwise, you get stuck thinking that you need to have five years’ worth of withdrawals in your brokerage account because you will be spending from it soon. But you are not supposed to have bonds and cash in your brokerage account due to tax drag.

What to do? Remember, money is fungible.

So, say you have stocks in your brokerage account, but you need the money, and the market is down. Just sell your stocks in your brokerage account, then sell bonds to buy those same stocks in your IRA. This is (-) stocks (-) bonds (+) stocks. In the total return approach, you have sold bonds to pay for your expenses out of your brokerage account (which doesn’t have any bonds because you want to be tax-efficient!).

Summary: How Well Do I Want to Sleep At Night vs. How Rich Do I Want the Kids to Be

If you have oversaved, you have the luxury of having whatever asset allocation makes you sleep well at night. If you sleep well on a pile of cash, have at it!

Conversely, we know over time that stocks will outperform cash, bonds, and just about everything else (aside from leveraged real estate and the occasional small business).

How well do you sleep at night vs. how right do you want the kids to be?

If you want to take risks (and you know that you don’t need the money anyway), you (or, more aptly, the kids since it is their money) can take as much risk as you want.

You might think you don’t want to give the money away right now because you might need it in 20 years for absurd and improbable long-term care expenses. But, of course, it is better to spend your money on things that you and the kids enjoy, to share experiences with them while you are still alive.

But if you leave the money to the kids (or to charity) when you pass, you can (and perhaps should) take more risk with it. Consider a pre-retirement glidepath that is personalized to your needs.

You can do that by mental accounting or by total return. But you, you over saver you, can be 100/0 or 90/10 or whatever you want because you know you have plenty of safer money. You have won the game. So play with the money you don’t need.

Originally Posted in FiPhysician