Using RMDs to Assess Asset Allocation

Asset Allocation Using RMDs

Can you use RMDs to help determine your asset allocation in the retirement drawdown phase?

Imagine you are living off your assets (taking an income from your nest egg). What might your asset allocation be to minimize the sequence of returns risk due to RMDs?

Like most traditional DIY investors, you have had an asset allocation for your entire investing career. Should that asset allocation change now that you are in the drawdown phase, also known as the retirement withdrawal or distribution phase?

Asset Allocation during Drawdown

This is a more theoretical discussion. See Asset Allocation Five Years from Retirement if you want an actual number.

Let’s discuss asset allocation using RMDs. Like asset allocation in accumulation, it is not a simple answer. Or rather, unlike asset allocation in accumulation, you don’t hear many people consider anything beyond an ultra-conservative 30/70 type of portfolio like you see in target-date funds.

If you want to understand your asset allocation during drawdown, how can Required Minimum Distributions (RMDs) help inform your decision?

Some folks must take RMDs even if they don’t need them. So if we look at RMDs, how does that inform our asset allocation in the drawdown phase?

RMD Asset Allocation Strategy

Even if you have oversaved for retirement, once RMDs begin, you must start withdrawals from your pre-tax retirement accounts every year, even if you don’t want the money!

What should your asset allocation be given these unnecessary RMDs? This is an important consideration, as most gloss over this topic or suggests 50/50, or 30/70, or the like.

But what if we decide first how much “Safer Money” we need just to take out the RMDs? After all, we don’t need the money. So then, how aggressively can you invest (asset allocation strategy) for unneeded RMDs?

Asset Allocation for RMDs

How aggressive can our asset allocation be in an IRA when we know unnecessary RMDs are coming?

Do you want to avoid selling equities when they are down? For example, if the market has crashed and you have to take your RMD, it might be nice to have some “Safer Money” you can withdraw instead of selling stocks.

So, how much Safer Money do you need in your pre-tax retirement accounts (henceforward called IRAs) to prevent RMDs from forcing you to sell low?

We know the market can be down for a long duration before it recovers. But, since you are forced to take distributions, what percentage of your pre-tax retirement accounts do you need in “Safer Money” (cash and bonds) to not sell equities when they are down?

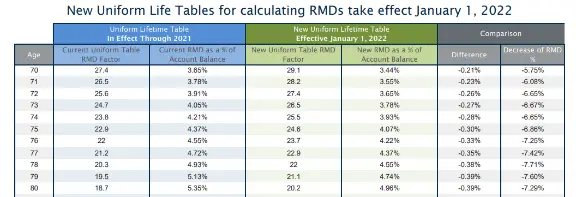

I will use the new RMD table below, so we might as well introduce it now.

New RMD Table in 2022

The RMD table changed in 2022. Have a look:

Above, you can see “old” and “new” RMD calculations starting at age 72. This is the uniform life table updated for 2022; most folks use it to calculate their yearly RMD percentage.

The “old” RMD factor at age 72 is 25.6, and the “new” one is 27.4. This means you used to be forced to take 3.91% of your pre-tax money at age 72, and now it is 3.65%. Not a big difference, but it is a 6.65% decrease.

The new uniform life table considers that folks are living longer and thus “need” to withdraw at a slower pace to account for longevity. Of course, most folks take out more than their RMD every year… but those folks are not my typical audience.

Now that we know the new RMDs in 2022, let’s discuss sequence risk and how much safer money you might want in your pre-tax retirement accounts.

Sequence Risk and RMDs

If you have oversaved for retirement, you may aggressively invest in your IRA.

While you should de-risk before retirement, if you don’t “need” the money, you can invest aggressively in your 70s and 80s for your kids or charity. As I say, at that point, asset allocation concerns the tradeoffs of sleeping well at night vs. making the kids rich.

Since you are forced to take out RMDs every year (whether you want to or not), there are unique sequence risk considerations.

Usually, when we talk about Sequence of Returns Risk, we talk about the five years before and ten years after you start portfolio withdrawals in retirement.

Here, we are talking about forced pre-tax distribution due to RMDs. These are fully taxable.

If you are forced to sell equities when they are down (because you have no “Safer Money” in your IRA—after all, you are aggressively invested since you don’t need the money), then a couple of bad years might impede the overall returns.

So, if you must take out 30% of your IRA in the next couple of years, should you have at least that amount in “Safer Money,” or is it ok to be 100% stocks? How much safer money do you need from the forced RMDs, and what should your asset allocation be due to RMDs?

Let’s answer that question in a second, but first, is RMD sequence risk an issue of fungibility or taxes?

Consider the fungibility of your IRA and brokerage accounts for a second.

Wait, What about money’s Fungibility in my IRA and Brokerage Account?

I might lose some people here, but that’s ok. Skip this section if you aren’t a nerd.

When RMDs force you to sell pre-tax equities when they are down, you cannot “just” adjust your overall asset allocation to make up for it.

Yes, money is fungible, and the inverse of the above is true. But while your brokerage account is fungible with your IRA, your IRA is not fungible with your brokerage account because of taxation.

First, if you are forced to sell equities from your brokerage account when the market is down, you can adjust your overall asset allocation and be fine. Fungible.

As an example, think about this for a second:

You need cash from your brokerage account, but it is 100% equities (as you might see if you have a good asset location strategy). So if the market is down and you sell stocks low, aren’t you committing the cardinal sin of investing by selling low and locking in losses?

No, not really. Say you have bonds in your IRA. You can exchange some of those bonds for stocks while you sell the stocks in your brokerage account. So you have sold stocks and then sold bonds and bought stocks. That is [(-) stocks plus (-) bonds plus (+) stocks], which works out to just selling bonds!

[The dark underbelly of fungibility is that you must calculate the after-tax equivalence to get your asset allocation the same as before, but that is complicated, and most don’t bother… But, of course, suppose you want to bother. In that case, you might decrease your brokerage account by your capital gains rate, your IRA by your effective tax rate, and then adjust your asset allocation accordingly, but your head might explode.]

But it is not the same if you are FORCED to take RMDs instead of choosing to take money from your brokerage account.

With RMDs, if you sell stocks low but don’t need the money, you can turn around and buy those same equities in your brokerage account with the liberated money.

The amount invested is actually decreased by your marginal tax bracket (rather than effective) as, since you don’t need the money for expenses, they are the last dollars out of your IRA. Moreover, since you are practicing good asset location hygiene, you don’t have bonds just sitting around in your brokerage account, which is fungible.

If I haven’t lost you by now, you are smarter than me.

But the long and the short of it: Since RMDs increase over time, even if you don’t need the money, you should have Safer Money in your IRA as you age. This is because you will never catch up when you are forced to sell equities low (and then pay marginal taxes on them) only to re-invest the money in a taxable brokerage account. Not fungible, even if we use after-tax equivalence.

Conclusion- RMD Asset Allocation Strategy

So, in summary, you need 1, 3, or 5 years of RMDs kept as safer money to prevent you from selling equities when they are down.

One year if you are extremely aggressive and don’t want a lot of cash and bonds in your IRA. One year of safer money is, of course, easy to calculate. If equities are up when you take your RMD, sell enough to meet your RMD and a little extra to account for the increase in RMD next year. Have one year of cash or bonds (or even long-term bonds) that slowly increases over time as your RMD increases.

If you are more moderate (and understand that this is, in toto, a super-aggressive strategy to begin with), you might have three years of RMDs in Safer Money.

If you are conservative, consider five years of Safer Money.

Here is what you need: (at the stated age, three years or five years of RMDs require this percentage in safer money)

AT 72

At 80

At 90

Even if you can tolerate a high equity allocation in retirement because you don’t need the money, you might want to decrease your asset allocation over time to prevent you from selling equities low.

This is the “Safer Money” in your IRA. Since you are forced to take the money out, it has a unique sequence risk as you age. As stated with incredible perspicacity, this is due to tax issues rather than fungibility concerns. (I’m happy to be proven incorrect on the topic.)

But beyond a point, there is a theoretical risk that you could wind up with less money if you are too aggressive in your IRA and don’t account for RMDs during a bear market.

So, we have decided that if you don’t need the RMDs, you can be pretty aggressive in your asset allocation during drawdown because all you need is the safer money.

Using RMDs to Assess Asset Allocation

Asset Allocation Using RMDs

Can you use RMDs to help determine your asset allocation in the retirement drawdown phase?

Imagine you are living off your assets (taking an income from your nest egg). What might your asset allocation be to minimize the sequence of returns risk due to RMDs?

Like most traditional DIY investors, you have had an asset allocation for your entire investing career. Should that asset allocation change now that you are in the drawdown phase, also known as the retirement withdrawal or distribution phase?

Asset Allocation during Drawdown

This is a more theoretical discussion. See Asset Allocation Five Years from Retirement if you want an actual number.

Let’s discuss asset allocation using RMDs. Like asset allocation in accumulation, it is not a simple answer. Or rather, unlike asset allocation in accumulation, you don’t hear many people consider anything beyond an ultra-conservative 30/70 type of portfolio like you see in target-date funds.

If you want to understand your asset allocation during drawdown, how can Required Minimum Distributions (RMDs) help inform your decision?

Some folks must take RMDs even if they don’t need them. So if we look at RMDs, how does that inform our asset allocation in the drawdown phase?

RMD Asset Allocation Strategy

Even if you have oversaved for retirement, once RMDs begin, you must start withdrawals from your pre-tax retirement accounts every year, even if you don’t want the money!

What should your asset allocation be given these unnecessary RMDs? This is an important consideration, as most gloss over this topic or suggests 50/50, or 30/70, or the like.

But what if we decide first how much “Safer Money” we need just to take out the RMDs? After all, we don’t need the money. So then, how aggressively can you invest (asset allocation strategy) for unneeded RMDs?

Asset Allocation for RMDs

How aggressive can our asset allocation be in an IRA when we know unnecessary RMDs are coming?

Do you want to avoid selling equities when they are down? For example, if the market has crashed and you have to take your RMD, it might be nice to have some “Safer Money” you can withdraw instead of selling stocks.

So, how much Safer Money do you need in your pre-tax retirement accounts (henceforward called IRAs) to prevent RMDs from forcing you to sell low?

We know the market can be down for a long duration before it recovers. But, since you are forced to take distributions, what percentage of your pre-tax retirement accounts do you need in “Safer Money” (cash and bonds) to not sell equities when they are down?

I will use the new RMD table below, so we might as well introduce it now.

New RMD Table in 2022

The RMD table changed in 2022. Have a look:

Above, you can see “old” and “new” RMD calculations starting at age 72. This is the uniform life table updated for 2022; most folks use it to calculate their yearly RMD percentage.

The “old” RMD factor at age 72 is 25.6, and the “new” one is 27.4. This means you used to be forced to take 3.91% of your pre-tax money at age 72, and now it is 3.65%. Not a big difference, but it is a 6.65% decrease.

The new uniform life table considers that folks are living longer and thus “need” to withdraw at a slower pace to account for longevity. Of course, most folks take out more than their RMD every year… but those folks are not my typical audience.

Now that we know the new RMDs in 2022, let’s discuss sequence risk and how much safer money you might want in your pre-tax retirement accounts.

Sequence Risk and RMDs

If you have oversaved for retirement, you may aggressively invest in your IRA.

While you should de-risk before retirement, if you don’t “need” the money, you can invest aggressively in your 70s and 80s for your kids or charity. As I say, at that point, asset allocation concerns the tradeoffs of sleeping well at night vs. making the kids rich.

Since you are forced to take out RMDs every year (whether you want to or not), there are unique sequence risk considerations.

Usually, when we talk about Sequence of Returns Risk, we talk about the five years before and ten years after you start portfolio withdrawals in retirement.

Here, we are talking about forced pre-tax distribution due to RMDs. These are fully taxable.

If you are forced to sell equities when they are down (because you have no “Safer Money” in your IRA—after all, you are aggressively invested since you don’t need the money), then a couple of bad years might impede the overall returns.

So, if you must take out 30% of your IRA in the next couple of years, should you have at least that amount in “Safer Money,” or is it ok to be 100% stocks? How much safer money do you need from the forced RMDs, and what should your asset allocation be due to RMDs?

Let’s answer that question in a second, but first, is RMD sequence risk an issue of fungibility or taxes?

Consider the fungibility of your IRA and brokerage accounts for a second.

Wait, What about money’s Fungibility in my IRA and Brokerage Account?

I might lose some people here, but that’s ok. Skip this section if you aren’t a nerd.

When RMDs force you to sell pre-tax equities when they are down, you cannot “just” adjust your overall asset allocation to make up for it.

Yes, money is fungible, and the inverse of the above is true. But while your brokerage account is fungible with your IRA, your IRA is not fungible with your brokerage account because of taxation.

First, if you are forced to sell equities from your brokerage account when the market is down, you can adjust your overall asset allocation and be fine. Fungible.

As an example, think about this for a second:

You need cash from your brokerage account, but it is 100% equities (as you might see if you have a good asset location strategy). So if the market is down and you sell stocks low, aren’t you committing the cardinal sin of investing by selling low and locking in losses?

No, not really. Say you have bonds in your IRA. You can exchange some of those bonds for stocks while you sell the stocks in your brokerage account. So you have sold stocks and then sold bonds and bought stocks. That is [(-) stocks plus (-) bonds plus (+) stocks], which works out to just selling bonds!

[The dark underbelly of fungibility is that you must calculate the after-tax equivalence to get your asset allocation the same as before, but that is complicated, and most don’t bother… But, of course, suppose you want to bother. In that case, you might decrease your brokerage account by your capital gains rate, your IRA by your effective tax rate, and then adjust your asset allocation accordingly, but your head might explode.]

But it is not the same if you are FORCED to take RMDs instead of choosing to take money from your brokerage account.

With RMDs, if you sell stocks low but don’t need the money, you can turn around and buy those same equities in your brokerage account with the liberated money.

The amount invested is actually decreased by your marginal tax bracket (rather than effective) as, since you don’t need the money for expenses, they are the last dollars out of your IRA. Moreover, since you are practicing good asset location hygiene, you don’t have bonds just sitting around in your brokerage account, which is fungible.

If I haven’t lost you by now, you are smarter than me.

But the long and the short of it: Since RMDs increase over time, even if you don’t need the money, you should have Safer Money in your IRA as you age. This is because you will never catch up when you are forced to sell equities low (and then pay marginal taxes on them) only to re-invest the money in a taxable brokerage account. Not fungible, even if we use after-tax equivalence.

Conclusion- RMD Asset Allocation Strategy

So, in summary, you need 1, 3, or 5 years of RMDs kept as safer money to prevent you from selling equities when they are down.

One year if you are extremely aggressive and don’t want a lot of cash and bonds in your IRA. One year of safer money is, of course, easy to calculate. If equities are up when you take your RMD, sell enough to meet your RMD and a little extra to account for the increase in RMD next year. Have one year of cash or bonds (or even long-term bonds) that slowly increases over time as your RMD increases.

If you are more moderate (and understand that this is, in toto, a super-aggressive strategy to begin with), you might have three years of RMDs in Safer Money.

If you are conservative, consider five years of Safer Money.

Here is what you need: (at the stated age, three years or five years of RMDs require this percentage in safer money)

AT 72

At 80

At 90

Even if you can tolerate a high equity allocation in retirement because you don’t need the money, you might want to decrease your asset allocation over time to prevent you from selling equities low.

This is the “Safer Money” in your IRA. Since you are forced to take the money out, it has a unique sequence risk as you age. As stated with incredible perspicacity, this is due to tax issues rather than fungibility concerns. (I’m happy to be proven incorrect on the topic.)

But beyond a point, there is a theoretical risk that you could wind up with less money if you are too aggressive in your IRA and don’t account for RMDs during a bear market.

So, we have decided that if you don’t need the RMDs, you can be pretty aggressive in your asset allocation during drawdown because all you need is the safer money.

Originally Posted in FiPhysician