Picture Sources from Pixabay. [1], [2]

How we Find the Top Metaverse Stocks

The top metaverse stocks are chosen from the community if the community tags a stock as a metaverse stock. Our algorithm cross-checks these tags against open source metaverse stock lists to double check if the stock qualifies for this metaverse stock list.

After that comes the data crunching. A stock analysis will reach the top of this list if it has the following properties:

Performance

Every stock rating is measured in the community. The cream of the crop rises to the top. We measure three key metrics:

As a whole, are the author’s stock ratings doing well?

Are the author’s stocks too volatile?

Has the author made enough stock ratings on the platform? A user should have at least 10 active stock ratings and less than 30 active stock ratings.

These metrics help determine if stock analysis written by the author should be amplified in stock lists.

Content Quality

Our algorithms check for content quality. The content should sufficiently support the author’s hypothesis as to why the stock rating they made is valid. Once we validate the content’s quality, we check if the content material is predictive of future appreciation. This aspect of the algorithm is in beta testing.

Predictive Power

So far, the last few measurements train our algorithm on how to pick correct stock ratings to showcase to the community. We are looking to showcase stock ratings that will positively affect our community’s wealth potential.

We measure the predictive performance of our algorithm, and then use what was learned to find other content with similar properties. We use multiple different metrics to find quality stock picks.

What are Metaverse Stocks?

To understand what a metaverse stock is, you need to know what the metaverse is.

The metaverse is a 3-D virtual world that is completely immersive to the user. This world can be accessed by an unlimited number of users, and they can interact with each in real time to experience a video game, conduct e-commerce, or have shared experiences.

Metaverse stocks can be the platforms that host the metaverse, the developers that build the metaverse content, or it can be companies that support auxiliary activities around the metaverse.

Some metaverse ETFs take the idea of auxiliary activities to include general support communities that supply microchips, cloud servers, and design solutions.

A classic example of a metaverse platform is Roblox. Think of Roblox as the multiverse of metaverses. Roblox senior leadership calls each metaverse on their platform an “experience”. You can build a roller coaster park, collect pets, or play paint ball with your friends online. Each experience is created by an independent developer team. This team earns their own revenue by users buying virtual goods and services inside the “experience”. Soon, these developers will have a new revenue stream unlocked with immersive ads.

Then there are developers that build content like Super League Gaming (SLGG).

This is a metaverse penny stock that creates 3-D virtual content, historically for name brands to advertise in the metaverse. They are a pure-play investment as a metaverse developer.

Then there are auxiliary activities that support the metaverse. Chip designers like Nvidia (NVDA) are central in providing the chip technology necessary to support the 3-D graphics of the metaverse. Many metaverse ETFs consider Adobe (ADBE) to be a metaverse stock as its software supports design around the metaverse.

How do Metaverse Stocks Earn Revenue?

Metaverse stocks are making billions in revenue; however, their sources of revenue are in the middle of an evolution. Right now, key earnings come from in-game purchases, purchase of software, or the purchase of DLC content.

But with Roblox starting an advertising platform, the source of metaverse ad revenue may evolve drastically in the next few years. Roblox is creating immersive ads that can change how Roblox earns revenue and how developers create content in the metaverse.

Metaverse Online Advertising

Metaverse online advertising is an evolving growth space in the metaverse. Roblox is leading the charge with its new advertising platform for the developers. These advertisements integrate seamlessly into the environment and can be supplemented with 3-D experiences surrounding the advertisements.

Metaverse online advertising is an evolving growth space in the metaverse. Roblox is leading the charge with its new advertising platform for the developers. These advertisements integrate seamlessly into the environment and can be supplemented with 3-D experiences surrounding the advertisements.

On the Roblox advertising page, a screen plays a movie trailer within the metaverse while characters from the movie can interact with the player’s avatars.

This new technology will likely revolutionize how content creators build simulations in the Roblox metaverse as they get more freedom to focus on user activity and less away from in-game purchases.

Metaverse Real Estate

Metaverse Real Estate boomed in 2022, but has fallen significantly since then. Metaverse real estate boomed as speculators entered the market and name brands joined in to stake a place in the metaverse.

Metaverse Real Estate boomed in 2022, but has fallen significantly since then. Metaverse real estate boomed as speculators entered the market and name brands joined in to stake a place in the metaverse.

However, it looks like a basic problem is starting to occur with virtual real estate: the metaverse is really a multiverse. Investors bought property on one experience; however, Roblox is changing the dynamics of real estate unintentionally.

The goal of virtual real estate is ultimately to gain user activity and attention. While virtual real estate can earn attention in one virtual world, an advertisement on Roblox can earn attention dynamically in millions of virtual worlds.

Developers in Roblox can control the virtual real estate in their own world and rent that space to brands. Brands don’t have to commit to one virtual space, but instead create their campaigns that are flexible across virtual space and time.

The concept of virtual real estate isn’t dead. As the metaverse evolves, core experiences will consistently attract users. These nodes will become hot areas for virtual real estate; however, this concept of buying virtual real estate may transform to just renting virtual real estate.

Metaverse Live Events and Virtual Goods

While live virtual events are still happening in the metaverse they have fallen significantly since the boom of metaverse activity in 2022. However, live virtual events look to have a strong future in the metaverse as live events get supplemented more and more with metaverse user activity.

Virtual goods on the other hand dominate the metaverse space as a large portion of revenue for metaverse developers. These are typically accessories for an avatar that can be worn on any avatar model and can be transferable to any metaverse. Virtual goods will continue to be an important aspect of the metaverse’s revenue even as advertising starts to capture a larger market share.

Should I invest in metaverse stock?

Metaverse stocks are a very diverse subsector of technology stocks. As an investor, you should research why the metaverse is growing before making an investment decision. Almost all forecasts show that the metaverse will grow by billions of dollars over the next decade, but it’s important to understand that this growth is driven by a younger audience and this growth is consolidating within a few key metaverse platforms.

Before investing in the metaverse, read these articles to fully grasp the investment landscape of the metaverse:

**How much is the metaverse worth in 2024? – Its critical to understand the current status of the metaverse in 2024. What was hot just last year, like virtual real estate, has been quiet in 2024. On the other hand, metaverse online advertising is starting to grow.

What will the metaverse replace? - The metaverse is seeping into multiple technology revenue streams including online advertising and social media. The metaverse is also supplementing live activities like virtual housing tours and concerts.

What will the metaverse be in five years - Its critical that investors can envision where the metaverse megatrend is going. This will help avoid certain investments that aren’t filtering into these paths.

How to buy shares in the metaverse?

Most large metaverse companies can be found on the stock market. There are three key investments you can buy to gain exposure to the metaverse: Large-cap and penny stocks or metaverse ETFs.

Overall, large-cap stocks are safer and diversified but lack focus on the metaverse. Penny stocks can be a metaverse pure play but are high in risk. And finally, metaverse ETFs are risky as many metaverse ETFs liquidated in the last few years. However, they give a basket of technology stocks that will benefit from the metaverse megatrend.

Large-Cap Metaverse Stocks

The first are large cap stocks and mega-cap stocks. The classic example is Microsoft (MSFT).

Microsoft is a really great example of the trade-offs you get when buying a large-cap metaverse stock. Microsoft only has one segment of its company focused on the metaverse which is its personal computing segment. This segment is comprised of not just video gaming, but also the windows operating system.

Hence, when you buy a large cap metaverse stock, you’re getting a diversified company that is only partially in the metaverse.

Metaverse Penny Stocks

There are multiple metaverse penny stocks investors can choose from. Some are pure play metaverse investments, while others are pure play video game sector investments. While these penny stocks could become very valuable in the future, they also have significant risk. Many of these stocks experience a price death spiral after leaping up to new highs in 2022, just to fall considerably after the hype died down.

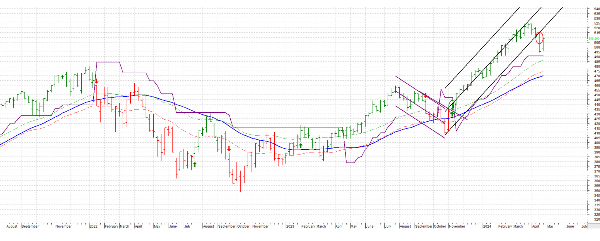

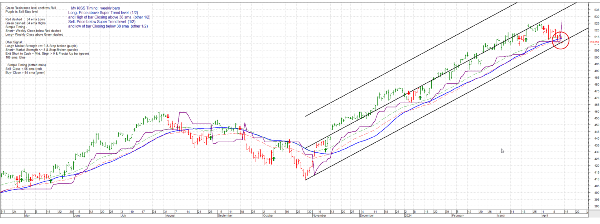

Example of a price death spiral that occurred to many metaverse penny stocks after 2022.

Metaverse ETFs

Read More: A list of every metaverse ETF ranked in 2024

Metaverse ETFs are a great way to diversify into the metaverse; however, there are two critical concerns an investor needs to be aware of. The first is that most metaverse ETFs are diversified, so you are investing in other technologies outside of the metaverse. Many mega-cap stocks like Microsoft, Apple, and Meta Platforms are in these ETFs even though these companies aren’t focused on the metaverse.

Believe it or not, Meta Platforms is currently not focused on the metaverse in 2024. Meta is still developing in the metaverse, but their resources are still spread out through their social media platforms and hardware.

The other problem is that many metaverse ETFs have failed or liquidated in the last couple of years. The collapse of the metaverse caused a ripple effect of liquidation across the segment, and the failure of many metaverse ETFs is a byproduct of this collapse.

However, there are still many ETFs to choose from. These ETFs vary in their focus on the metaverse, their profitability, and their fees.

The Metaverse Megatrend

The metaverse continues to grow, and all forecasts expect metaverse growth through the next decade.

This megatrend will continue regardless of which metaverse platforms are successful, and its going to involve the metaverse replacing traditional sectors. This includes social media, online advertising, and supplementing NFTs and cryptocurrency.

The Future of the Metaverse

What will the metaverse look like in 5 years?. Here are some key changes to look for.

Online Advertising Transformed - A younger generation will think in 3-D when they see an advertisement. Advertising will be engaging and integrated with the metaverse environment. The interaction will become more seamless and even become a part of the metaverse experience. Digital advertising revenue will be diverted from 2-D advertisements to 3-D immersive ads.

Consolidation of Platforms - Right now there is a battle for attention in the metaverse. There are winners and losers right now, and the winners are starting to consolidate. Expect all the metaverse platforms to start to condense to just a few platforms to choose from.

Integration of NFTs - Virtual goods are a highly lucrative part of the metaverse. As metaverse platforms consolidate, users will want to use their virtual goods in multiple metaverse platforms, NFTs may allow these virtual goods to be transferred between platforms while still maintaining the items uniqueness.

Picture Sources from Pixabay. [1], [2]

How we Find the Top Metaverse Stocks

The top metaverse stocks are chosen from the community if the community tags a stock as a metaverse stock. Our algorithm cross-checks these tags against open source metaverse stock lists to double check if the stock qualifies for this metaverse stock list.

After that comes the data crunching. A stock analysis will reach the top of this list if it has the following properties:

Performance

Every stock rating is measured in the community. The cream of the crop rises to the top. We measure three key metrics:

As a whole, are the author’s stock ratings doing well?

Are the author’s stocks too volatile?

Has the author made enough stock ratings on the platform? A user should have at least 10 active stock ratings and less than 30 active stock ratings.

These metrics help determine if stock analysis written by the author should be amplified in stock lists.

Content Quality

Our algorithms check for content quality. The content should sufficiently support the author’s hypothesis as to why the stock rating they made is valid. Once we validate the content’s quality, we check if the content material is predictive of future appreciation. This aspect of the algorithm is in beta testing.

Predictive Power

So far, the last few measurements train our algorithm on how to pick correct stock ratings to showcase to the community. We are looking to showcase stock ratings that will positively affect our community’s wealth potential. We measure the predictive performance of our algorithm, and then use what was learned to find other content with similar properties. We use multiple different metrics to find quality stock picks.

What are Metaverse Stocks?

To understand what a metaverse stock is, you need to know what the metaverse is. The metaverse is a 3-D virtual world that is completely immersive to the user. This world can be accessed by an unlimited number of users, and they can interact with each in real time to experience a video game, conduct e-commerce, or have shared experiences.

Metaverse stocks can be the platforms that host the metaverse, the developers that build the metaverse content, or it can be companies that support auxiliary activities around the metaverse. Some metaverse ETFs take the idea of auxiliary activities to include general support communities that supply microchips, cloud servers, and design solutions.

A classic example of a metaverse platform is Roblox. Think of Roblox as the multiverse of metaverses. Roblox senior leadership calls each metaverse on their platform an “experience”. You can build a roller coaster park, collect pets, or play paint ball with your friends online. Each experience is created by an independent developer team. This team earns their own revenue by users buying virtual goods and services inside the “experience”. Soon, these developers will have a new revenue stream unlocked with immersive ads.

Then there are developers that build content like Super League Gaming (SLGG). This is a metaverse penny stock that creates 3-D virtual content, historically for name brands to advertise in the metaverse. They are a pure-play investment as a metaverse developer.

Then there are auxiliary activities that support the metaverse. Chip designers like Nvidia (NVDA) are central in providing the chip technology necessary to support the 3-D graphics of the metaverse. Many metaverse ETFs consider Adobe (ADBE) to be a metaverse stock as its software supports design around the metaverse.

How do Metaverse Stocks Earn Revenue?

Metaverse stocks are making billions in revenue; however, their sources of revenue are in the middle of an evolution. Right now, key earnings come from in-game purchases, purchase of software, or the purchase of DLC content.

But with Roblox starting an advertising platform, the source of metaverse ad revenue may evolve drastically in the next few years. Roblox is creating immersive ads that can change how Roblox earns revenue and how developers create content in the metaverse.

Metaverse Online Advertising

On the Roblox advertising page, a screen plays a movie trailer within the metaverse while characters from the movie can interact with the player’s avatars. This new technology will likely revolutionize how content creators build simulations in the Roblox metaverse as they get more freedom to focus on user activity and less away from in-game purchases.

Metaverse Real Estate

However, it looks like a basic problem is starting to occur with virtual real estate: the metaverse is really a multiverse. Investors bought property on one experience; however, Roblox is changing the dynamics of real estate unintentionally.

The goal of virtual real estate is ultimately to gain user activity and attention. While virtual real estate can earn attention in one virtual world, an advertisement on Roblox can earn attention dynamically in millions of virtual worlds.

Developers in Roblox can control the virtual real estate in their own world and rent that space to brands. Brands don’t have to commit to one virtual space, but instead create their campaigns that are flexible across virtual space and time.

The concept of virtual real estate isn’t dead. As the metaverse evolves, core experiences will consistently attract users. These nodes will become hot areas for virtual real estate; however, this concept of buying virtual real estate may transform to just renting virtual real estate.

Metaverse Live Events and Virtual Goods

While live virtual events are still happening in the metaverse they have fallen significantly since the boom of metaverse activity in 2022. However, live virtual events look to have a strong future in the metaverse as live events get supplemented more and more with metaverse user activity.

Virtual goods on the other hand dominate the metaverse space as a large portion of revenue for metaverse developers. These are typically accessories for an avatar that can be worn on any avatar model and can be transferable to any metaverse. Virtual goods will continue to be an important aspect of the metaverse’s revenue even as advertising starts to capture a larger market share.

Should I invest in metaverse stock?

Metaverse stocks are a very diverse subsector of technology stocks. As an investor, you should research why the metaverse is growing before making an investment decision. Almost all forecasts show that the metaverse will grow by billions of dollars over the next decade, but it’s important to understand that this growth is driven by a younger audience and this growth is consolidating within a few key metaverse platforms.

Before investing in the metaverse, read these articles to fully grasp the investment landscape of the metaverse:

**How much is the metaverse worth in 2024? – Its critical to understand the current status of the metaverse in 2024. What was hot just last year, like virtual real estate, has been quiet in 2024. On the other hand, metaverse online advertising is starting to grow.

What will the metaverse replace? - The metaverse is seeping into multiple technology revenue streams including online advertising and social media. The metaverse is also supplementing live activities like virtual housing tours and concerts.

What will the metaverse be in five years - Its critical that investors can envision where the metaverse megatrend is going. This will help avoid certain investments that aren’t filtering into these paths.

How to buy shares in the metaverse?

Most large metaverse companies can be found on the stock market. There are three key investments you can buy to gain exposure to the metaverse: Large-cap and penny stocks or metaverse ETFs. Overall, large-cap stocks are safer and diversified but lack focus on the metaverse. Penny stocks can be a metaverse pure play but are high in risk. And finally, metaverse ETFs are risky as many metaverse ETFs liquidated in the last few years. However, they give a basket of technology stocks that will benefit from the metaverse megatrend.

Large-Cap Metaverse Stocks

The first are large cap stocks and mega-cap stocks. The classic example is Microsoft (MSFT). Microsoft is a really great example of the trade-offs you get when buying a large-cap metaverse stock. Microsoft only has one segment of its company focused on the metaverse which is its personal computing segment. This segment is comprised of not just video gaming, but also the windows operating system.

Hence, when you buy a large cap metaverse stock, you’re getting a diversified company that is only partially in the metaverse.

Metaverse Penny Stocks

There are multiple metaverse penny stocks investors can choose from. Some are pure play metaverse investments, while others are pure play video game sector investments. While these penny stocks could become very valuable in the future, they also have significant risk. Many of these stocks experience a price death spiral after leaping up to new highs in 2022, just to fall considerably after the hype died down.

Example of a price death spiral that occurred to many metaverse penny stocks after 2022.

Metaverse ETFs

Metaverse ETFs are a great way to diversify into the metaverse; however, there are two critical concerns an investor needs to be aware of. The first is that most metaverse ETFs are diversified, so you are investing in other technologies outside of the metaverse. Many mega-cap stocks like Microsoft, Apple, and Meta Platforms are in these ETFs even though these companies aren’t focused on the metaverse.

The other problem is that many metaverse ETFs have failed or liquidated in the last couple of years. The collapse of the metaverse caused a ripple effect of liquidation across the segment, and the failure of many metaverse ETFs is a byproduct of this collapse.

However, there are still many ETFs to choose from. These ETFs vary in their focus on the metaverse, their profitability, and their fees.

The Metaverse Megatrend

The metaverse continues to grow, and all forecasts expect metaverse growth through the next decade.

This megatrend will continue regardless of which metaverse platforms are successful, and its going to involve the metaverse replacing traditional sectors. This includes social media, online advertising, and supplementing NFTs and cryptocurrency.

The Future of the Metaverse

What will the metaverse look like in 5 years?. Here are some key changes to look for.

Online Advertising Transformed - A younger generation will think in 3-D when they see an advertisement. Advertising will be engaging and integrated with the metaverse environment. The interaction will become more seamless and even become a part of the metaverse experience. Digital advertising revenue will be diverted from 2-D advertisements to 3-D immersive ads.

Consolidation of Platforms - Right now there is a battle for attention in the metaverse. There are winners and losers right now, and the winners are starting to consolidate. Expect all the metaverse platforms to start to condense to just a few platforms to choose from.

Integration of NFTs - Virtual goods are a highly lucrative part of the metaverse. As metaverse platforms consolidate, users will want to use their virtual goods in multiple metaverse platforms, NFTs may allow these virtual goods to be transferred between platforms while still maintaining the items uniqueness.