Introduction

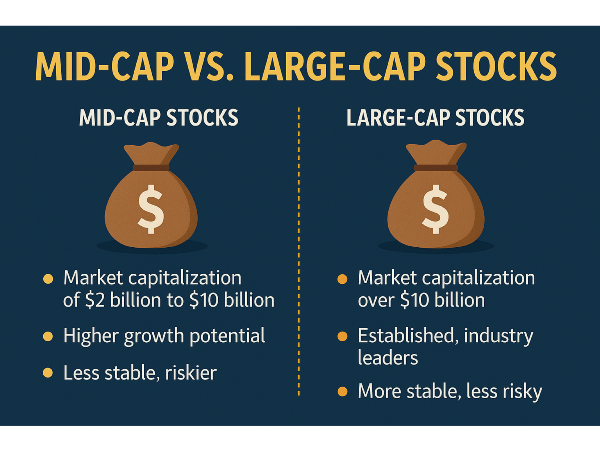

Midcap and large-cap stocks represent distinct segments of the market, each offering unique advantages for investors. Large-cap stocks belong to well-established companies with stable earnings and lower volatility, making them a preferred choice for conservative investors. Midcap stocks, on the other hand, consist of companies in a growth phase, often delivering higher returns but with increased risk. Investors compare these categories to balance stability and growth in their portfolios. While large-caps provide resilience during economic downturns, midcaps offer greater upside potential, making the decision between the two crucial for long-term investment strategies. Understanding their differences helps investors optimize asset allocation based on financial goals and market conditions.

Historical Performance Trends

Midcap stocks have historically demonstrated strong long-term returns, often outperforming large-cap stocks over extended periods. While large-cap stocks, represented by indices like the S&P 500, provide stability, midcaps offer higher growth potential due to their ability to scale. Over the past 25 years, the S&P MidCap 400 has delivered a total return of 985%, significantly surpassing the S&P 500’s 563% return. During economic downturns, large-cap stocks tend to outperform due to their established market positions and strong financials.

Companies like Apple AAPL and Microsoft MSFT provide stability in uncertain conditions. Conversely, midcaps thrive in growth phases, benefiting from increased investor confidence and expansion opportunities. The Russell MidCap Index has historically outpaced large-cap indices during recovery periods, reflecting the agility of midcap firms in adapting to market shifts. Large-cap ETFs, such as Vanguard S&P 500 ETF VOO, receive substantial inflows, reinforcing their dominance in passive investing. Meanwhile, midcap funds attract investors seeking higher returns, particularly in bullish markets. Understanding these dynamics allows investors to optimize their portfolios by balancing exposure to both midcap and large-cap stocks, ensuring resilience across different market conditions.

Sources

Investopedia

Four Pillar Freedom

Longtermtrends

Do Mid-Caps Outperform Large-Caps Over Time?

Mid-caps have historically outperformed large-caps over extended periods, particularly in growth phases. While large-caps offer stability, mid-caps provide higher return potential due to their ability to scale. Investors seeking long-term appreciation often allocate a portion of their portfolio to mid-cap stocks.

Risk and Volatility Comparison

While large-cap stocks, such as Apple AAPL and Microsoft MSFT, benefit from established revenue streams and strong financials, midcaps often experience greater price fluctuations. This increased volatility stems from their sensitivity to economic shifts, investor sentiment, and sector-specific trends. However, midcaps also offer higher return potential, making them attractive for investors willing to accept greater risk in pursuit of long-term gains.

Managing volatility in midcap investments requires strategic diversification and risk mitigation techniques. Investors can balance exposure by incorporating defensive sectors, such as healthcare and consumer staples, alongside growth-oriented midcaps. Funds like iShares Russell MidCap ETF IWR provide diversified access to midcap stocks, reducing individual stock risk while maintaining growth potential. Additionally, hedging strategies, such as options trading or allocating a portion of the portfolio to large-cap stocks, can help stabilize returns during market downturns. Understanding macroeconomic trends and sector performance is essential for navigating midcap volatility. Monitoring Federal Reserve policy decisions, inflation rates, and investor sentiment allows investors to make informed adjustments to their portfolios.

Sources

Shell Capital

FasterCapital

Virtus Investment Partners

Sector Allocation and Growth Potential

Midcap stocks often outperform large-caps in industries that experience rapid innovation and expansion. Sectors such as technology, healthcare, and industrials provide midcap companies with opportunities to scale, benefiting from emerging trends and market shifts. Companies in these industries frequently introduce disruptive technologies, allowing midcaps to capture growth before large-cap firms dominate the space. For example, midcap biotech firms often develop groundbreaking treatments, positioning themselves for acquisition or significant market share gains.

Large-cap stocks provide stability, particularly in defensive sectors such as consumer staples and financial services. Companies like Procter & Gamble PG and JPMorgan Chase JPM maintain strong financials and consistent earnings, making them reliable holdings during economic downturns. Large-cap firms benefit from established market positions, extensive resources, and brand recognition, reducing volatility compared to midcaps. Midcaps provide opportunities for higher returns in expansionary phases, while large-caps offer security during economic uncertainty. Funds such as iShares Russell MidCap ETF IWR and Vanguard S&P 500 ETF VOO enable investors to diversify across both categories, ensuring a well-rounded portfolio.

Sources

Investopedia

American Century

Quant Mutual

Market Trends Influencing Midcap and Large-Cap Stocks

Rising interest rates often lead investors to favor companies with strong financials and stable earnings, benefiting large-cap stocks that track established firms. Midcap stocks, however, tend to outperform in lower interest rate environments, as they rely on expansion opportunities and capital investments. Financial services and consumer staples sectors, which are heavily represented in large-cap stocks, tend to perform well in such environments. Companies like JPMorgan Chase JPM and Procter & Gamble PG provide resilience against market volatility, making them attractive holdings within large-cap portfolios.

Investor sentiment and fund flows also influence the success of midcap and large-cap stocks. Technology, healthcare, and industrials are key sectors that drive midcap investing, offering stability and growth potential. Healthcare companies such as Johnson & Johnson JNJ contribute to portfolio strength, particularly during periods of economic uncertainty. Investor sentiment impacts fund performance, with market participants favoring large-cap stocks during downturns and shifting toward midcap stocks in expansionary phases.

Sources

Investors Hangout

Markets.com

FasterCapital

Best Midcap and Large-Cap Investment Options

Midcap ETFs, such as iShares S&P Mid-Cap 400 Growth ETF IJK and Vanguard S&P Mid-Cap 400 Growth ETF IVOG, provide exposure to companies in expansion phases, offering higher return potential. Mutual funds like Principal MidCap R5 PMBPX and SPDR S&P 400 Mid Cap Growth ETF MDYG have demonstrated strong performance, making them attractive choices for investors looking to capitalize on midcap growth trends. Large-cap ETFs and funds offer stability, making them ideal for conservative investors.

Vanguard 500 Index Fund VFIAX and iShares S&P 500 Index Fund IVV provide broad market exposure, ensuring consistent returns with lower volatility. SPDR S&P 500 ETF Trust SPY remains a highly liquid option for active traders, while Schwab S&P 500 Index Fund SWPPX offers strong sector diversification. Balancing midcap and large-cap investments allows investors to optimize growth potential while maintaining resilience against market fluctuations. Midcap funds provide opportunities for higher returns in expansionary phases, while large-cap funds offer security during economic uncertainty. Understanding sector dynamics and market trends helps investors make informed decisions, aligning their strategies with financial objectives.

Sources

Morningstar

Forbes

U.S. News

Comparing Midcap and Large-Cap Stocks in Portfolio Strategy

Midcap stocks offer higher return opportunities due to their ability to scale, while large-cap stocks provide resilience during economic downturns. Investors seeking diversification often allocate funds across both categories to mitigate risk while capturing market expansion. ETFs such as iShares Russell MidCap ETF IWR and Vanguard S&P 500 ETF VOO enable investors to maintain exposure to both midcap and large-cap stocks, ensuring a balanced portfolio strategy. Large-cap stocks, such as JPMorgan Chase JPM and Procter & Gamble PG, are favored for their stability and consistent earnings. Midcap stocks, however, are integrated into portfolios to enhance growth potential, particularly in expansionary phases. Hedge funds and pension funds often adjust allocations based on macroeconomic indicators, ensuring optimal exposure to both stock categories.

Sources

FasterCapital

Money Under 30

Four Pillar Freedom

Conclusion

Midcap and large-cap stocks each offer distinct advantages, making them essential components of a balanced investment strategy. While large-caps provide stability and predictable returns, midcaps offer higher growth potential, particularly in expansion phases. Understanding economic trends, sector performance, and risk factors helps investors make informed allocation decisions. By strategically combining both stock categories, investors can optimize diversification, enhance portfolio resilience, and capitalize on evolving market opportunities for long-term success.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

Should I Invest in Large-Cap or Mid-Cap?- https://www.stockbossup.com/pages/post/38604/should-i-invest-in-large-cap-or-mid-cap

Introduction

Midcap and large-cap stocks represent distinct segments of the market, each offering unique advantages for investors. Large-cap stocks belong to well-established companies with stable earnings and lower volatility, making them a preferred choice for conservative investors. Midcap stocks, on the other hand, consist of companies in a growth phase, often delivering higher returns but with increased risk. Investors compare these categories to balance stability and growth in their portfolios. While large-caps provide resilience during economic downturns, midcaps offer greater upside potential, making the decision between the two crucial for long-term investment strategies. Understanding their differences helps investors optimize asset allocation based on financial goals and market conditions.

Historical Performance Trends

Midcap stocks have historically demonstrated strong long-term returns, often outperforming large-cap stocks over extended periods. While large-cap stocks, represented by indices like the S&P 500, provide stability, midcaps offer higher growth potential due to their ability to scale. Over the past 25 years, the S&P MidCap 400 has delivered a total return of 985%, significantly surpassing the S&P 500’s 563% return. During economic downturns, large-cap stocks tend to outperform due to their established market positions and strong financials.

Companies like Apple AAPL and Microsoft MSFT provide stability in uncertain conditions. Conversely, midcaps thrive in growth phases, benefiting from increased investor confidence and expansion opportunities. The Russell MidCap Index has historically outpaced large-cap indices during recovery periods, reflecting the agility of midcap firms in adapting to market shifts. Large-cap ETFs, such as Vanguard S&P 500 ETF VOO, receive substantial inflows, reinforcing their dominance in passive investing. Meanwhile, midcap funds attract investors seeking higher returns, particularly in bullish markets. Understanding these dynamics allows investors to optimize their portfolios by balancing exposure to both midcap and large-cap stocks, ensuring resilience across different market conditions.

Sources

Investopedia

Four Pillar Freedom

Longtermtrends

Risk and Volatility Comparison

While large-cap stocks, such as Apple AAPL and Microsoft MSFT, benefit from established revenue streams and strong financials, midcaps often experience greater price fluctuations. This increased volatility stems from their sensitivity to economic shifts, investor sentiment, and sector-specific trends. However, midcaps also offer higher return potential, making them attractive for investors willing to accept greater risk in pursuit of long-term gains.

Managing volatility in midcap investments requires strategic diversification and risk mitigation techniques. Investors can balance exposure by incorporating defensive sectors, such as healthcare and consumer staples, alongside growth-oriented midcaps. Funds like iShares Russell MidCap ETF IWR provide diversified access to midcap stocks, reducing individual stock risk while maintaining growth potential. Additionally, hedging strategies, such as options trading or allocating a portion of the portfolio to large-cap stocks, can help stabilize returns during market downturns. Understanding macroeconomic trends and sector performance is essential for navigating midcap volatility. Monitoring Federal Reserve policy decisions, inflation rates, and investor sentiment allows investors to make informed adjustments to their portfolios.

Sources

Shell Capital

FasterCapital

Virtus Investment Partners

Sector Allocation and Growth Potential

Midcap stocks often outperform large-caps in industries that experience rapid innovation and expansion. Sectors such as technology, healthcare, and industrials provide midcap companies with opportunities to scale, benefiting from emerging trends and market shifts. Companies in these industries frequently introduce disruptive technologies, allowing midcaps to capture growth before large-cap firms dominate the space. For example, midcap biotech firms often develop groundbreaking treatments, positioning themselves for acquisition or significant market share gains.

Large-cap stocks provide stability, particularly in defensive sectors such as consumer staples and financial services. Companies like Procter & Gamble PG and JPMorgan Chase JPM maintain strong financials and consistent earnings, making them reliable holdings during economic downturns. Large-cap firms benefit from established market positions, extensive resources, and brand recognition, reducing volatility compared to midcaps. Midcaps provide opportunities for higher returns in expansionary phases, while large-caps offer security during economic uncertainty. Funds such as iShares Russell MidCap ETF IWR and Vanguard S&P 500 ETF VOO enable investors to diversify across both categories, ensuring a well-rounded portfolio.

Sources

Investopedia

American Century

Quant Mutual

Market Trends Influencing Midcap and Large-Cap Stocks

Rising interest rates often lead investors to favor companies with strong financials and stable earnings, benefiting large-cap stocks that track established firms. Midcap stocks, however, tend to outperform in lower interest rate environments, as they rely on expansion opportunities and capital investments. Financial services and consumer staples sectors, which are heavily represented in large-cap stocks, tend to perform well in such environments. Companies like JPMorgan Chase JPM and Procter & Gamble PG provide resilience against market volatility, making them attractive holdings within large-cap portfolios.

Investor sentiment and fund flows also influence the success of midcap and large-cap stocks. Technology, healthcare, and industrials are key sectors that drive midcap investing, offering stability and growth potential. Healthcare companies such as Johnson & Johnson JNJ contribute to portfolio strength, particularly during periods of economic uncertainty. Investor sentiment impacts fund performance, with market participants favoring large-cap stocks during downturns and shifting toward midcap stocks in expansionary phases.

Sources

Investors Hangout

Markets.com

FasterCapital

Best Midcap and Large-Cap Investment Options

Midcap ETFs, such as iShares S&P Mid-Cap 400 Growth ETF IJK and Vanguard S&P Mid-Cap 400 Growth ETF IVOG, provide exposure to companies in expansion phases, offering higher return potential. Mutual funds like Principal MidCap R5 PMBPX and SPDR S&P 400 Mid Cap Growth ETF MDYG have demonstrated strong performance, making them attractive choices for investors looking to capitalize on midcap growth trends. Large-cap ETFs and funds offer stability, making them ideal for conservative investors.

Vanguard 500 Index Fund VFIAX and iShares S&P 500 Index Fund IVV provide broad market exposure, ensuring consistent returns with lower volatility. SPDR S&P 500 ETF Trust SPY remains a highly liquid option for active traders, while Schwab S&P 500 Index Fund SWPPX offers strong sector diversification. Balancing midcap and large-cap investments allows investors to optimize growth potential while maintaining resilience against market fluctuations. Midcap funds provide opportunities for higher returns in expansionary phases, while large-cap funds offer security during economic uncertainty. Understanding sector dynamics and market trends helps investors make informed decisions, aligning their strategies with financial objectives.

Sources

Morningstar

Forbes

U.S. News

Comparing Midcap and Large-Cap Stocks in Portfolio Strategy

Midcap stocks offer higher return opportunities due to their ability to scale, while large-cap stocks provide resilience during economic downturns. Investors seeking diversification often allocate funds across both categories to mitigate risk while capturing market expansion. ETFs such as iShares Russell MidCap ETF IWR and Vanguard S&P 500 ETF VOO enable investors to maintain exposure to both midcap and large-cap stocks, ensuring a balanced portfolio strategy. Large-cap stocks, such as JPMorgan Chase JPM and Procter & Gamble PG, are favored for their stability and consistent earnings. Midcap stocks, however, are integrated into portfolios to enhance growth potential, particularly in expansionary phases. Hedge funds and pension funds often adjust allocations based on macroeconomic indicators, ensuring optimal exposure to both stock categories.

Sources

FasterCapital

Money Under 30

Four Pillar Freedom

Conclusion

Midcap and large-cap stocks each offer distinct advantages, making them essential components of a balanced investment strategy. While large-caps provide stability and predictable returns, midcaps offer higher growth potential, particularly in expansion phases. Understanding economic trends, sector performance, and risk factors helps investors make informed allocation decisions. By strategically combining both stock categories, investors can optimize diversification, enhance portfolio resilience, and capitalize on evolving market opportunities for long-term success.

📌Read More About:

Top Large Cap Stocks- https://stockbossup.com/pages/topics/large-cap

Should I Invest in Large-Cap or Mid-Cap?- https://www.stockbossup.com/pages/post/38604/should-i-invest-in-large-cap-or-mid-cap