Have you ever wondered how airplanes stay light but super strong? Or how your smartphone screen resists scratches despite all the chaos in your pocket? The secret is advanced materials—the superhero substances shaping the world around us!

From ultra-tough ceramics to futuristic nano-coatings, these materials are revolutionizing industries, pushing technology to new limits, and making everyday objects stronger, lighter, and more efficient. Whether it's aerospace, medicine, or green energy, advanced materials are the unsung heroes of innovation.

In this guide, we'll explore the cutting-edge world of advanced materials, uncovering their incredible properties and how they’re driving scientific breakthroughs. So buckle up—it's time for a thrilling ride through the molecular magic behind the technologies of tomorrow!

Understanding Advanced Materials

Ever wonder how airplanes stay strong but lightweight or how medical implants last for years without breaking down? That’s the magic of advanced materials! Unlike traditional materials, these high-tech substances are engineered for superior strength, durability, and efficiency. Think nanomaterials, biomaterials, and smart materials—each designed to push the limits of science and technology. Whether it’s self-healing concrete, heat-resistant ceramics, or ultra-light composites, advanced materials are revolutionizing industries from aerospace to healthcare.

But here’s the catch—developing and commercializing these materials isn’t easy. Scientists and engineers must balance cost, scalability, and performance to bring these innovations to market. Factors like manufacturing complexity, regulatory approvals, and industry demand play a huge role in determining whether a new material makes it big or stays in the lab. With breakthroughs happening every day, advanced materials are shaping the future—one molecule at a time!

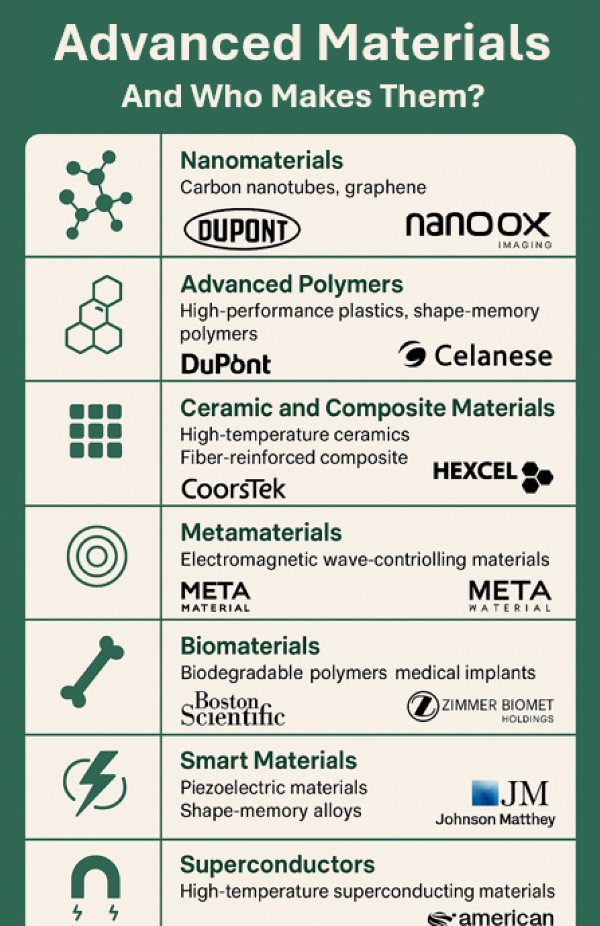

Major Types of Advanced Materials and Their Producers

In this guide, we’ll explore the major types of advanced materials, breaking down their incredible properties and the companies leading the charge in their production. Whether it’s nanomaterials that make electronics ultra-fast or biomaterials that help heal the human body, these innovations are shaping the future.

Nanomaterials: The Tiny Titans of Science!

Nanomaterials are super small but super powerful! These materials, like carbon nanotubes and graphene, are engineered at the atomic level to be stronger than steel, lighter than air, and more conductive than copper. They’re used in everything from flexible electronics to drug delivery systems, making them essential for cutting-edge technology. Their unique properties come from their nano-scale structure, which allows them to behave in ways that traditional materials simply can’t.

But here’s the kicker—nanomaterials are expensive to produce, and scaling them up for mass use is a challenge. That’s where companies like Applied Materials (AMAT) and Nano-X Imaging (NNOX) come in. These firms are pioneering new manufacturing techniques to make nanomaterials more accessible, driving innovation in semiconductors, medical imaging, and energy storage.

Advanced Polymers: The Shape-Shifting Superstars!

Polymers are everywhere—from plastic bottles to medical implants—but advanced polymers take things to the next level. These materials include high-performance plastics and shape-memory polymers, which can bend, stretch, and even return to their original shape when exposed to heat or light. They’re used in biomedical devices, aerospace components, and even self-healing materials.

Leading the charge in advanced polymers are DuPont de Nemours (DD) and Celanese Corporation (CE). These companies are developing next-gen polymers that improve durability, flexibility, and sustainability, making them essential for industries ranging from automotive to healthcare.

Ceramic and Composite Materials: Tougher Than Ever!

Ceramics and composites are built to withstand extreme conditions. Whether it’s high-temperature ceramics used in jet engines or fiber-reinforced composites that make lightweight aircraft, these materials are strong, heat-resistant, and incredibly durable. They’re essential for space exploration, defense, and advanced manufacturing.

Companies like Hexcel Corporation (HXL) and CoorsTek (private) are leading the way in high-performance ceramics and composites, supplying industries that demand unmatched strength and reliability.

Metamaterials: The Science of Invisibility!

Metamaterials are mind-blowing—they can bend light, manipulate sound, and even make objects invisible! These materials are engineered to control electromagnetic waves, making them perfect for stealth technology, advanced optics, and wireless communication.

One of the biggest players in this space is Metamaterial Inc. (MMAT), which is developing next-gen optical and electromagnetic solutions for industries like telecommunications and aerospace.

Biomaterials: Science That Heals!

Biomaterials are designed to work inside the human body, helping with tissue regeneration, medical implants, and drug delivery. From biodegradable polymers to synthetic bone replacements, these materials are changing healthcare forever.

Leading the charge are Boston Scientific (BSX) and Zimmer Biomet Holdings (ZBH), which are developing cutting-edge biomaterials for medical devices, prosthetics, and regenerative medicine.

Smart Materials: The Future of Adaptability!

Smart materials react to their environment—they can change shape, generate electricity, or even heal themselves! Think piezoelectric materials that convert pressure into electricity or shape-memory alloys that return to their original form.

Companies like Nippon Steel Corporation (NPSCY) and Johnson Matthey (JMAT) are pushing the boundaries of smart materials, making them essential for robotics, aerospace, and medical applications.

Superconductors: The Power of Zero Resistance!

Superconductors are the ultimate conductors—they allow electricity to flow without resistance, making them perfect for high-speed trains, MRI machines, and quantum computing. These materials work at extremely low temperatures, but researchers are developing high-temperature superconductors to make them more practical.

One of the leaders in this field is American Superconductor Corporation (AMSC), which is pioneering superconducting technology for energy grids, transportation, and advanced computing.

And there you have it—advanced materials are shaping the future! Whether it’s nanotech, biomaterials, or superconductors, these innovations are changing industries and driving scientific breakthroughs.

How Advanced Materials Impact Industry Growth

Hey, science fans! Advanced materials aren’t just cool—they’re driving the future of industry! These high-tech substances, from nanomaterials to biomaterials, are revolutionizing everything from electronics to aerospace. The demand for advanced materials is skyrocketing because they offer lighter, stronger, and more efficient solutions. Industries like automotive, healthcare, and renewable energy are pushing for materials that improve performance while reducing environmental impact.

But here’s the kicker—producing these materials isn’t easy! Companies like Applied Materials and Hexcel Corporation are leading the charge, but global supply chains face challenges like raw material shortages and geopolitical tensions. Inflation, interest rates, and commodity cycles also play a huge role in determining costs and profitability. As industries evolve, advanced materials will continue to be the backbone of innovation!

📌 Sources:

Performance Analysis: Historical and Current Trends

Let’s talk money and materials! Advanced material stocks have seen wild price swings over the years, driven by breakthroughs in technology. When graphene was first introduced, investors rushed to buy stocks in companies developing it. Similarly, superconductors and metamaterials have seen price spikes when new applications hit the market.

But here’s the deal—stock movements aren’t just about science. They’re tied to macroeconomic trends, industry demand, and investor sentiment. Companies like Applied Materials (AMAT) have seen steady growth, while others have faced volatility due to supply chain disruptions. Understanding past returns helps investors spot the winners in this fast-moving sector!

📌 Sources:

ESG and Sustainability Considerations in Advanced Materials

Science rules—but so does sustainability! Advanced materials are changing the game in environmental responsibility. While some materials require energy-intensive production, companies are working on greener alternatives. Biodegradable polymers and low-carbon composites are leading the charge in reducing environmental impact.

Major players like Morgan Advanced Materials and Huber Advanced Materials are investing in ESG initiatives, focusing on carbon reduction, ethical sourcing, and waste management. As industries shift toward sustainable solutions, advanced materials will play a huge role in shaping a cleaner future!

📌 Sources:

Risks Associated with Advanced Material Stocks

Hold onto your lab coats—investing in advanced materials isn’t always smooth sailing! Market volatility is a major concern, with stock prices fluctuating due to supply chain disruptions, regulatory changes, and geopolitical tensions. When rare earth elements face export restrictions, prices can skyrocket overnight!

Liquidity and regulatory risks also impact investment decisions. Some companies struggle with scaling production, while others face government regulations that limit growth. Investors need to stay informed and diversify their portfolios to manage these risks effectively!

📌 Sources:

Opportunities and Investment Strategies

Ready to invest in the future of materials? Advanced material stocks offer huge potential, but smart investors know how to balance risk and reward. Long-term strategies focus on companies with strong R&D, while short-term traders look for breakthrough announcements that drive stock prices up.

ETFs like Fidelity MSCI Materials ETF (FMAT) provide diversified exposure, while futures contracts allow investors to bet on price movements. Whether you’re in it for the long haul or quick gains, advanced materials are a key player in modern investment strategies!

📌 Sources:

And there you have it—advanced materials are shaping industries and investment strategies alike! Whether you’re a science geek or a market analyst, these innovations are changing the world one molecule at a time. 🚀 Science rules! 🚀

Final Thoughts

Science rules, and so do advanced materials! Whether it’s nanomaterials making electronics faster, biomaterials revolutionizing healthcare, or superconductors powering new energy grids, these innovations are reshaping industries and investment opportunities alike.

As technology evolves, advanced materials will continue to be the backbone of scientific breakthroughs. From cutting-edge research to stock market trends, staying informed on these developments is key for both scientists and investors. So whether you're building the future or investing in it, one thing is clear—advanced materials are the molecules of tomorrow! 🚀

🔥 Dive Into the Hottest Material Stocks! 🔥

Ready to uncover the best investment opportunities in materials? These powerful industries are shaping the future—don't miss out!

📌 Read More About Material Stocks

📈 The Top Material Stocks – Discover market movers!

🔍 What is Considered a Material Stock? – Get the facts!

🏗️ Construction Material Stocks – Build wealth with strong picks!

🌲 Best Lumber Stocks – Invest in timber titans!

🌐 Global & Industrial Picks

🌍 Top International Material Stocks – Go beyond borders!

⚙️ What are Materials Stocks? – Understanding the industry!

🔩 Which Copper Stocks are Best? – Copper power plays!

💰 Material Stocks with Dividends – Earn passive income!

⚡ Cutting-Edge Advanced Materials

🚀 Top Rare Earth Stocks – Essential for tech innovation!

🏭 What are the Advanced Materials Companies? – Leaders in new-age materials!

🔬 What are Examples of Advanced Material? – The next frontier!

📊 Advanced Material ETFs – Diversify smartly!

💡 How to Invest in Nanomaterials – Stay ahead of the curve!

🚀 Don’t just read about it—take action today! Start building your portfolio with the best material stocks now!

Have you ever wondered how airplanes stay light but super strong? Or how your smartphone screen resists scratches despite all the chaos in your pocket? The secret is advanced materials—the superhero substances shaping the world around us!

From ultra-tough ceramics to futuristic nano-coatings, these materials are revolutionizing industries, pushing technology to new limits, and making everyday objects stronger, lighter, and more efficient. Whether it's aerospace, medicine, or green energy, advanced materials are the unsung heroes of innovation.

In this guide, we'll explore the cutting-edge world of advanced materials, uncovering their incredible properties and how they’re driving scientific breakthroughs. So buckle up—it's time for a thrilling ride through the molecular magic behind the technologies of tomorrow!

Understanding Advanced Materials

Ever wonder how airplanes stay strong but lightweight or how medical implants last for years without breaking down? That’s the magic of advanced materials! Unlike traditional materials, these high-tech substances are engineered for superior strength, durability, and efficiency. Think nanomaterials, biomaterials, and smart materials—each designed to push the limits of science and technology. Whether it’s self-healing concrete, heat-resistant ceramics, or ultra-light composites, advanced materials are revolutionizing industries from aerospace to healthcare.

But here’s the catch—developing and commercializing these materials isn’t easy. Scientists and engineers must balance cost, scalability, and performance to bring these innovations to market. Factors like manufacturing complexity, regulatory approvals, and industry demand play a huge role in determining whether a new material makes it big or stays in the lab. With breakthroughs happening every day, advanced materials are shaping the future—one molecule at a time!

Major Types of Advanced Materials and Their Producers

In this guide, we’ll explore the major types of advanced materials, breaking down their incredible properties and the companies leading the charge in their production. Whether it’s nanomaterials that make electronics ultra-fast or biomaterials that help heal the human body, these innovations are shaping the future.

Nanomaterials: The Tiny Titans of Science!

Nanomaterials are super small but super powerful! These materials, like carbon nanotubes and graphene, are engineered at the atomic level to be stronger than steel, lighter than air, and more conductive than copper. They’re used in everything from flexible electronics to drug delivery systems, making them essential for cutting-edge technology. Their unique properties come from their nano-scale structure, which allows them to behave in ways that traditional materials simply can’t.

But here’s the kicker—nanomaterials are expensive to produce, and scaling them up for mass use is a challenge. That’s where companies like Applied Materials (AMAT) and Nano-X Imaging (NNOX) come in. These firms are pioneering new manufacturing techniques to make nanomaterials more accessible, driving innovation in semiconductors, medical imaging, and energy storage.

Advanced Polymers: The Shape-Shifting Superstars!

Polymers are everywhere—from plastic bottles to medical implants—but advanced polymers take things to the next level. These materials include high-performance plastics and shape-memory polymers, which can bend, stretch, and even return to their original shape when exposed to heat or light. They’re used in biomedical devices, aerospace components, and even self-healing materials.

Leading the charge in advanced polymers are DuPont de Nemours (DD) and Celanese Corporation (CE). These companies are developing next-gen polymers that improve durability, flexibility, and sustainability, making them essential for industries ranging from automotive to healthcare.

Ceramic and Composite Materials: Tougher Than Ever!

Ceramics and composites are built to withstand extreme conditions. Whether it’s high-temperature ceramics used in jet engines or fiber-reinforced composites that make lightweight aircraft, these materials are strong, heat-resistant, and incredibly durable. They’re essential for space exploration, defense, and advanced manufacturing.

Companies like Hexcel Corporation (HXL) and CoorsTek (private) are leading the way in high-performance ceramics and composites, supplying industries that demand unmatched strength and reliability.

Metamaterials: The Science of Invisibility!

Metamaterials are mind-blowing—they can bend light, manipulate sound, and even make objects invisible! These materials are engineered to control electromagnetic waves, making them perfect for stealth technology, advanced optics, and wireless communication.

One of the biggest players in this space is Metamaterial Inc. (MMAT), which is developing next-gen optical and electromagnetic solutions for industries like telecommunications and aerospace.

Biomaterials: Science That Heals!

Biomaterials are designed to work inside the human body, helping with tissue regeneration, medical implants, and drug delivery. From biodegradable polymers to synthetic bone replacements, these materials are changing healthcare forever.

Leading the charge are Boston Scientific (BSX) and Zimmer Biomet Holdings (ZBH), which are developing cutting-edge biomaterials for medical devices, prosthetics, and regenerative medicine.

Smart Materials: The Future of Adaptability!

Smart materials react to their environment—they can change shape, generate electricity, or even heal themselves! Think piezoelectric materials that convert pressure into electricity or shape-memory alloys that return to their original form.

Companies like Nippon Steel Corporation (NPSCY) and Johnson Matthey (JMAT) are pushing the boundaries of smart materials, making them essential for robotics, aerospace, and medical applications.

Superconductors: The Power of Zero Resistance!

Superconductors are the ultimate conductors—they allow electricity to flow without resistance, making them perfect for high-speed trains, MRI machines, and quantum computing. These materials work at extremely low temperatures, but researchers are developing high-temperature superconductors to make them more practical.

One of the leaders in this field is American Superconductor Corporation (AMSC), which is pioneering superconducting technology for energy grids, transportation, and advanced computing.

And there you have it—advanced materials are shaping the future! Whether it’s nanotech, biomaterials, or superconductors, these innovations are changing industries and driving scientific breakthroughs.

How Advanced Materials Impact Industry Growth

Hey, science fans! Advanced materials aren’t just cool—they’re driving the future of industry! These high-tech substances, from nanomaterials to biomaterials, are revolutionizing everything from electronics to aerospace. The demand for advanced materials is skyrocketing because they offer lighter, stronger, and more efficient solutions. Industries like automotive, healthcare, and renewable energy are pushing for materials that improve performance while reducing environmental impact.

But here’s the kicker—producing these materials isn’t easy! Companies like Applied Materials and Hexcel Corporation are leading the charge, but global supply chains face challenges like raw material shortages and geopolitical tensions. Inflation, interest rates, and commodity cycles also play a huge role in determining costs and profitability. As industries evolve, advanced materials will continue to be the backbone of innovation!

📌 Sources:

Performance Analysis: Historical and Current Trends

Let’s talk money and materials! Advanced material stocks have seen wild price swings over the years, driven by breakthroughs in technology. When graphene was first introduced, investors rushed to buy stocks in companies developing it. Similarly, superconductors and metamaterials have seen price spikes when new applications hit the market.

But here’s the deal—stock movements aren’t just about science. They’re tied to macroeconomic trends, industry demand, and investor sentiment. Companies like Applied Materials (AMAT) have seen steady growth, while others have faced volatility due to supply chain disruptions. Understanding past returns helps investors spot the winners in this fast-moving sector!

📌 Sources:

ESG and Sustainability Considerations in Advanced Materials

Science rules—but so does sustainability! Advanced materials are changing the game in environmental responsibility. While some materials require energy-intensive production, companies are working on greener alternatives. Biodegradable polymers and low-carbon composites are leading the charge in reducing environmental impact.

Major players like Morgan Advanced Materials and Huber Advanced Materials are investing in ESG initiatives, focusing on carbon reduction, ethical sourcing, and waste management. As industries shift toward sustainable solutions, advanced materials will play a huge role in shaping a cleaner future!

📌 Sources:

Risks Associated with Advanced Material Stocks

Hold onto your lab coats—investing in advanced materials isn’t always smooth sailing! Market volatility is a major concern, with stock prices fluctuating due to supply chain disruptions, regulatory changes, and geopolitical tensions. When rare earth elements face export restrictions, prices can skyrocket overnight!

Liquidity and regulatory risks also impact investment decisions. Some companies struggle with scaling production, while others face government regulations that limit growth. Investors need to stay informed and diversify their portfolios to manage these risks effectively!

📌 Sources:

Opportunities and Investment Strategies

Ready to invest in the future of materials? Advanced material stocks offer huge potential, but smart investors know how to balance risk and reward. Long-term strategies focus on companies with strong R&D, while short-term traders look for breakthrough announcements that drive stock prices up.

ETFs like Fidelity MSCI Materials ETF (FMAT) provide diversified exposure, while futures contracts allow investors to bet on price movements. Whether you’re in it for the long haul or quick gains, advanced materials are a key player in modern investment strategies!

📌 Sources:

And there you have it—advanced materials are shaping industries and investment strategies alike! Whether you’re a science geek or a market analyst, these innovations are changing the world one molecule at a time. 🚀 Science rules! 🚀

Final Thoughts

Science rules, and so do advanced materials! Whether it’s nanomaterials making electronics faster, biomaterials revolutionizing healthcare, or superconductors powering new energy grids, these innovations are reshaping industries and investment opportunities alike.

As technology evolves, advanced materials will continue to be the backbone of scientific breakthroughs. From cutting-edge research to stock market trends, staying informed on these developments is key for both scientists and investors. So whether you're building the future or investing in it, one thing is clear—advanced materials are the molecules of tomorrow! 🚀

🔥 Dive Into the Hottest Material Stocks! 🔥

Ready to uncover the best investment opportunities in materials? These powerful industries are shaping the future—don't miss out!

📌 Read More About Material Stocks

📈 The Top Material Stocks – Discover market movers!

🔍 What is Considered a Material Stock? – Get the facts!

🏗️ Construction Material Stocks – Build wealth with strong picks!

🌲 Best Lumber Stocks – Invest in timber titans!

🌐 Global & Industrial Picks

🌍 Top International Material Stocks – Go beyond borders!

⚙️ What are Materials Stocks? – Understanding the industry!

🔩 Which Copper Stocks are Best? – Copper power plays!

💰 Material Stocks with Dividends – Earn passive income!

⚡ Cutting-Edge Advanced Materials

🚀 Top Rare Earth Stocks – Essential for tech innovation!

🏭 What are the Advanced Materials Companies? – Leaders in new-age materials!

🔬 What are Examples of Advanced Material? – The next frontier!

📊 Advanced Material ETFs – Diversify smartly!

💡 How to Invest in Nanomaterials – Stay ahead of the curve!

🚀 Don’t just read about it—take action today! Start building your portfolio with the best material stocks now!