Overview of Cash Management

Cash Flow - Investing in your future self & Reducing Debt

Before we jump into debt reduction, we want to emphasize two things in regard to debt and cash flow.

We often think about cash flow by looking in the rear-view mirror. What came in and went out last month or last year. Remember, the importance of building awareness.

Once we have that awareness established it’s easier to understand how an investment to your future self helps cover cash flow gaps.

Examples:

Having an emergency fund or savings due to irregular income, a work transition, or the inevitable emergency.

Building a reserve to cover basic expenses if you want to take a sabbatical or decide to start your own business.

Or

Saving and investing for your future self whether. Retirement or the life path you have chosen.

Using investment income, passive income, and investment principle to cover your cash flow needs.

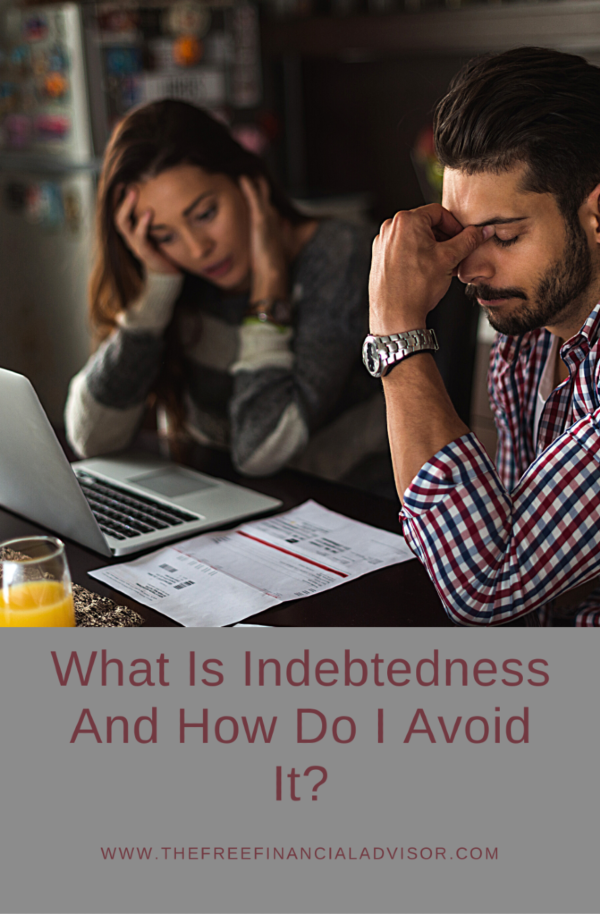

Reducing debt & avoiding bad debt.

We’ll go into more depth on good debt vs bad debt next month. Here’s a shortlist of debt adders to avoid:

- To pay for a vacation

- To purchase designer apparel

- To pay off other debt (unless there’s an advantage to you by consolidating or transferring the balance)

- To buy gifts for others

- To get furniture for your place

None of these are things that appreciate in value. You’re often left with debt and nothing to show for it. Instead of using credit cards or loans to pay for consumable goods, save up and use cash. That way you enjoy your purchase without worrying about paying for it later.

Reducing Debt is another form of investing in your future self. Because it will reduce your future expenses and it can also help alleviate the stress that comes along with that feeling of owing others.

The first place to look to reduce debt is to see if there’s a benefit to refinancing your current debt. Debt to consider for refinancing could be your home, your vehicle, or student loans.

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. Finding a lower rate could entail paying less if all other factors stay the same (term or # of payments). Ultimately, we are looking to reduce the overall interest to be paid while also reducing your monthly payment. This is one way where reducing debt and debt payment has a positive impact on your cash flow (reducing your expenses).

More to come on debt management in the month of May. If you want to explore whether refinancing is a good option for you or any other cash flow strategies. Schedule an Intro Call, a no-obligation consultation with one of our team members.

Output and Awareness

Build Awareness & Pay Yourself First

Let's talk about the second part of cash flow- what's going out. Some of these outflows are our necessary day-to-day living expenses, while others are based on our decisions.

At the end of the day, it's on you to weigh those decisions and how they impact your goals and values.

Usually, these spending decisions are part of essential conversations we must have about budgeting. But, let's take a different approach today. Instead of focusing on the word “budget” or the idea of one, let's focus on the word “awareness”.

Being aware is a process of understanding where your money is going. It can also help you answer questions such as "is my money being directed towards my values?" and "is there a way for me to find more money to put towards my goals?"

Various apps or tools can help you be more aware by giving you a monthly snapshot of your cash flows. Apps like Mint.com, Nerd Wallet, Every Dollar, YNAB (You Need A Budget) can link your bank accounts, credit cards, and more. Better, they also separate your transactions by category.

Whether it's via one of these apps, a tool through your bank account, a spreadsheet, or paper and pencil, we recommend that you establish a routine. The longer you track your outflows, the better you'll get at building awareness too. You'll have more insight to compare how your spending changed from one year to the next.

With all this said about being aware, the most important practice you can implement is paying yourself first. Paying yourself refers to holding yourself accountable and ensuring that you are funding the goals you have determined to work on first.

Understandably, we may not be able to fully fund all of our goals at once. So you have to make sure that you know your most important goals and what is acceptable with your current cash flow situation to put towards those goals. Once you do this, set up a system to automate the funding of those goals, preferably before your income ever reaches your spending or checking account.

How to Increase Income

Last week we began to discuss Cash Flow.

When you think of Cash Flow, think of your money coming in as a flowing body of water.

If you're employed, think of your primary source of income as the river. Think of your other income streams flowing into your household as tributaries. After all, they're called income streams, right?

First, let's see how you can increase your primary source of income. You can always ask for a raise, negotiate your salary for a new job offer, or find something that's paying you what you deserve.

However, if there's one thing we learned this past year, we learned how important it is to have multiple income streams. We never know what's around the corner and what we rely on today may not be there tomorrow.

There are many different ways you can do this:

Sell Your Skills: The freelance market is global and growing. With sites like Upwork, you can find plenty of opportunities that match your skill set.

Create and Sell a Product: The list of things that you can create and sell is endless. If this is something you want to embark on, the best approach may be to focus on a hobby or passion. Let your creative side loose and turn it into a profit.

Reselling: Do you have items in your house that you no longer have a need or use for? You can likely find a market and a buyer. Take Facebook Marketplace, eBay, or Craigslist, for example.

Gig Economy: You can always drive for Uber or Lyft or deliver food for DoorDash and GrubHub, for example. Having a car and a smartphone can allow you to pick up some extra cash on a schedule that works for you.

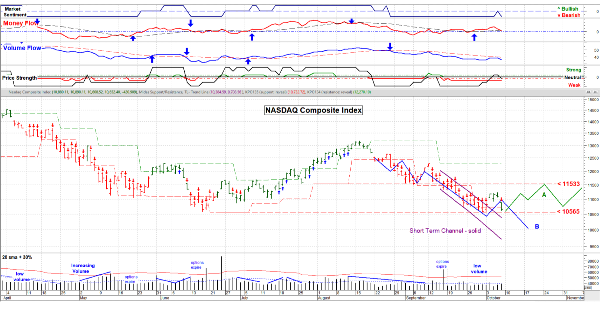

Invest in Stocks or Bonds: No matter your investing style, your holdings pay out dividends or interest payments monthly or quarterly. Growth stocks, while riskier, may offer enticing returns. It's best to start young and reinvest this income to take advantage of compounding.

Invest in Real Estate: Passive investing through real estate is a great additional income stream. It could be separate property or properties that receive a rental income. You can also rent out a room or do short-term rentals of your primary place of residence via platforms like AirBnb. These income streams can also help you reduce your expenses or pay down debt.

Conclusion

To start reducing debt and start building wealth, you must get your cash management under control. Start by building awareness. Don't be afraid to look at your money. Next, pay your savings first. Finally, grow your cash flow with other income generating strategies.

Overview of Cash Management

Cash Flow - Investing in your future self & Reducing Debt

Before we jump into debt reduction, we want to emphasize two things in regard to debt and cash flow.

We often think about cash flow by looking in the rear-view mirror. What came in and went out last month or last year. Remember, the importance of building awareness.

Once we have that awareness established it’s easier to understand how an investment to your future self helps cover cash flow gaps.

Examples:

Having an emergency fund or savings due to irregular income, a work transition, or the inevitable emergency.

Building a reserve to cover basic expenses if you want to take a sabbatical or decide to start your own business.

Or

Saving and investing for your future self whether. Retirement or the life path you have chosen.

Using investment income, passive income, and investment principle to cover your cash flow needs.

Reducing debt & avoiding bad debt.

We’ll go into more depth on good debt vs bad debt next month. Here’s a shortlist of debt adders to avoid:

None of these are things that appreciate in value. You’re often left with debt and nothing to show for it. Instead of using credit cards or loans to pay for consumable goods, save up and use cash. That way you enjoy your purchase without worrying about paying for it later.

Reducing Debt is another form of investing in your future self. Because it will reduce your future expenses and it can also help alleviate the stress that comes along with that feeling of owing others.

The first place to look to reduce debt is to see if there’s a benefit to refinancing your current debt. Debt to consider for refinancing could be your home, your vehicle, or student loans.

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. Finding a lower rate could entail paying less if all other factors stay the same (term or # of payments). Ultimately, we are looking to reduce the overall interest to be paid while also reducing your monthly payment. This is one way where reducing debt and debt payment has a positive impact on your cash flow (reducing your expenses).

More to come on debt management in the month of May. If you want to explore whether refinancing is a good option for you or any other cash flow strategies. Schedule an Intro Call, a no-obligation consultation with one of our team members.

Output and Awareness

Build Awareness & Pay Yourself First

Let's talk about the second part of cash flow- what's going out. Some of these outflows are our necessary day-to-day living expenses, while others are based on our decisions. At the end of the day, it's on you to weigh those decisions and how they impact your goals and values.

Usually, these spending decisions are part of essential conversations we must have about budgeting. But, let's take a different approach today. Instead of focusing on the word “budget” or the idea of one, let's focus on the word “awareness”.

Being aware is a process of understanding where your money is going. It can also help you answer questions such as "is my money being directed towards my values?" and "is there a way for me to find more money to put towards my goals?" Various apps or tools can help you be more aware by giving you a monthly snapshot of your cash flows. Apps like Mint.com, Nerd Wallet, Every Dollar, YNAB (You Need A Budget) can link your bank accounts, credit cards, and more. Better, they also separate your transactions by category.

Whether it's via one of these apps, a tool through your bank account, a spreadsheet, or paper and pencil, we recommend that you establish a routine. The longer you track your outflows, the better you'll get at building awareness too. You'll have more insight to compare how your spending changed from one year to the next.

With all this said about being aware, the most important practice you can implement is paying yourself first. Paying yourself refers to holding yourself accountable and ensuring that you are funding the goals you have determined to work on first. Understandably, we may not be able to fully fund all of our goals at once. So you have to make sure that you know your most important goals and what is acceptable with your current cash flow situation to put towards those goals. Once you do this, set up a system to automate the funding of those goals, preferably before your income ever reaches your spending or checking account.

How to Increase Income

Last week we began to discuss Cash Flow. When you think of Cash Flow, think of your money coming in as a flowing body of water. If you're employed, think of your primary source of income as the river. Think of your other income streams flowing into your household as tributaries. After all, they're called income streams, right? First, let's see how you can increase your primary source of income. You can always ask for a raise, negotiate your salary for a new job offer, or find something that's paying you what you deserve. However, if there's one thing we learned this past year, we learned how important it is to have multiple income streams. We never know what's around the corner and what we rely on today may not be there tomorrow. There are many different ways you can do this:

Sell Your Skills: The freelance market is global and growing. With sites like Upwork, you can find plenty of opportunities that match your skill set.

Create and Sell a Product: The list of things that you can create and sell is endless. If this is something you want to embark on, the best approach may be to focus on a hobby or passion. Let your creative side loose and turn it into a profit.

Reselling: Do you have items in your house that you no longer have a need or use for? You can likely find a market and a buyer. Take Facebook Marketplace, eBay, or Craigslist, for example.

Gig Economy: You can always drive for Uber or Lyft or deliver food for DoorDash and GrubHub, for example. Having a car and a smartphone can allow you to pick up some extra cash on a schedule that works for you.

Invest in Stocks or Bonds: No matter your investing style, your holdings pay out dividends or interest payments monthly or quarterly. Growth stocks, while riskier, may offer enticing returns. It's best to start young and reinvest this income to take advantage of compounding.

Invest in Real Estate: Passive investing through real estate is a great additional income stream. It could be separate property or properties that receive a rental income. You can also rent out a room or do short-term rentals of your primary place of residence via platforms like AirBnb. These income streams can also help you reduce your expenses or pay down debt.

Conclusion

To start reducing debt and start building wealth, you must get your cash management under control. Start by building awareness. Don't be afraid to look at your money. Next, pay your savings first. Finally, grow your cash flow with other income generating strategies.