The table below showcases the top industrial gas stocks based on investment attractiveness. We took into account dividend yield, payout ratio, and market growth.

Industrial Gas Stocks Ranked by Investment Attractiveness

| Rank |

Stock |

Dividend Yield |

Payout Ratio |

Products & Applications |

| 1 |

Linde PLC (NYSE: LIN) |

1.32% |

43.57% |

Produces atmospheric and process gases for manufacturing, healthcare, and clean energy |

| 2 |

Air Products and Chemicals, Inc. (NYSE: APD) |

2.65% |

104.07% |

Specializes in hydrogen production, industrial gases for refining, electronics, and food processing |

| 3 |

Chart Industries, Inc. (NYSE: GTLS) |

6.73% |

82.42% |

Manufactures cryogenic equipment for LNG, hydrogen, and industrial gas storage |

| 4 |

Air Liquide (EPA: AI) |

1.89% |

50.68% |

Supplies gases for healthcare, electronics, and manufacturing, with a strong focus on hydrogen and carbon capture. |

| 5 |

Taiyo Nippon Sanso Corporation (TYO: 4091) |

1.09% |

21.04% |

Provides high-purity gases for steel, semiconductors, and healthcare |

| 6 |

Messer Group |

N/A |

NA |

Privately held company specializing in industrial, medical, and specialty gases |

Sources:

Introduction

Industrial gas stocks? Oh, you better believe they’re worth a closer look! This sector is the unsung hero of global industry—fuels manufacturing, healthcare, semiconductors, even green energy. And here’s the kicker: demand is rock solid, contracts are long-term, and margins are juicy. These companies print cash while powering the world, making them a must-watch for any savvy investor. We’ll break down why these stocks are so attractive, how they thrive in economic cycles, and what key players are dominating the space. Strap in, because there’s serious money to be made!

Understanding Industrial Gas Stocks

Industrial gas companies? Oh, these are the backbone of modern industry! They produce and supply the essential gases—oxygen, nitrogen, hydrogen—that keep everything running, from steel production to semiconductor fabs to hospitals. This isn’t some volatile commodity play, and it’s definitely not an ETF basket of mixed assets. No, these stocks are cash machines, powered by long-term contracts, pricing power, and recession-resistant demand. Whether the economy is booming or sputtering, industries still need their gases—giving these stocks a steady edge over commodity-linked plays that rise and fall with market swings.

Now, let’s talk about profitability. The secret sauce? Scale, contracts, and innovation. The biggest players—think Air Liquide, Linde, Air Products—they don’t just sell gas, they integrate deep into supply chains, securing multi-year deals with customers who can’t afford disruptions. Add in high-margin specialty gases, green hydrogen initiatives, and efficiency improvements, and you’ve got a sector that’s primed for growth AND resilience. Investors love these stocks for their defensive nature AND upside potential—it’s a rare combination in today’s market.

Major Industrial Gas Companies

Linde PLC is the world’s largest industrial gas supplier, operating across multiple industries, including healthcare, manufacturing, and energy. The company specializes in atmospheric gases like oxygen, nitrogen, and argon, as well as process gases such as hydrogen and carbon dioxide. Linde’s operations are structured into four regional business units—Western Europe, the Americas, Asia & Eastern Europe, and South Pacific & Africa—ensuring a global footprint with localized expertise. The company’s engineering division also plays a crucial role in designing and constructing gas processing plants, reinforcing its leadership in industrial gas technology.

A key driver of Linde’s success is its ability to secure long-term contracts with major industrial clients, ensuring stable revenue streams. The company has also been investing heavily in clean energy solutions, including hydrogen production and carbon capture technologies, aligning with global sustainability trends. With a strong financial position and a commitment to innovation, Linde continues to expand its influence in industrial gas markets worldwide.

Air Products and Chemicals, Inc. is a leading global supplier of industrial gases, serving industries such as refining, electronics, and food processing. The company is particularly strong in hydrogen production, playing a crucial role in the energy transition by supporting clean hydrogen initiatives. Air Products operates over 750 production facilities across 50 countries, ensuring a robust supply chain for its customers. Its extensive pipeline network and on-site gas generation capabilities provide cost-effective solutions for industrial clients.

Profitability in Air Products is driven by its ability to maintain long-term contracts and develop large-scale hydrogen projects. The company has been expanding its presence in sustainable energy, investing in carbon capture and hydrogen fuel technologies. With a strong dividend history and a focus on operational efficiency, Air Products remains a top choice for investors seeking stability and growth in the industrial gas sector.

Air Liquide (EPA: AI)

Air Liquide is a European industrial gas powerhouse with operations spanning over 70 countries. The company provides essential gases for healthcare, electronics, and manufacturing, with a strong emphasis on innovation. Air Liquide’s research and development efforts focus on hydrogen energy, carbon capture, and specialty gases for semiconductor production. Its U.S. operations, including Airgas, further strengthen its global presence, making it a dominant player in the industry.

Air Liquide’s profitability is supported by its diversified portfolio and strategic investments in clean energy. The company has been actively expanding its hydrogen infrastructure, positioning itself as a leader in sustainable industrial solutions. With a strong balance sheet and a commitment to technological advancements, Air Liquide continues to drive growth in the global industrial gas market.

Messer Group

Messer Group is the largest privately held industrial gas company, operating across North America, South America, Europe, and Asia. The company specializes in industrial, medical, and specialty gases, catering to diverse industries such as food processing, healthcare, and electronics. Messer’s operations are built on a foundation of safety, reliability, and customer-focused solutions, ensuring long-term partnerships with industrial clients.

Despite being privately owned, Messer competes effectively with publicly traded giants by leveraging its deep industry expertise and technological innovations. The company has been expanding its footprint through strategic acquisitions and investments in advanced gas applications. Messer’s commitment to sustainability and operational excellence makes it a formidable player in the industrial gas sector.

Taiyo Nippon Sanso Corporation

Taiyo Nippon Sanso Corporation is a leading industrial gas supplier in Asia, serving industries such as steel, semiconductors, and healthcare. The company’s operations focus on high-purity gases, specialty gases, and advanced gas technologies for industrial applications. Taiyo Nippon Sanso has been actively expanding its presence in hydrogen energy and semiconductor manufacturing, aligning with global technological advancements.

The company’s profitability is driven by its strong market position in Japan and strategic partnerships across Asia. Taiyo Nippon Sanso continues to invest in research and development, enhancing its capabilities in gas purification and environmental solutions. With a commitment to innovation and sustainability, the company remains a key player in the Asian industrial gas market.

Chart Industries specializes in cryogenic equipment and industrial gas solutions, serving industries such as energy, healthcare, and manufacturing. The company’s operations focus on designing and manufacturing storage tanks, heat exchangers, and gas processing systems. Chart’s expertise in liquefied natural gas (LNG) and hydrogen technologies positions it as a critical player in the clean energy transition.

Chart Industries’ profitability is driven by its ability to provide innovative solutions for gas storage and distribution. The company has been expanding its presence in carbon capture and hydrogen infrastructure, supporting global sustainability efforts. With a strong engineering foundation and a commitment to technological advancements, Chart Industries continues to be a leader in cryogenic and industrial gas solutions.

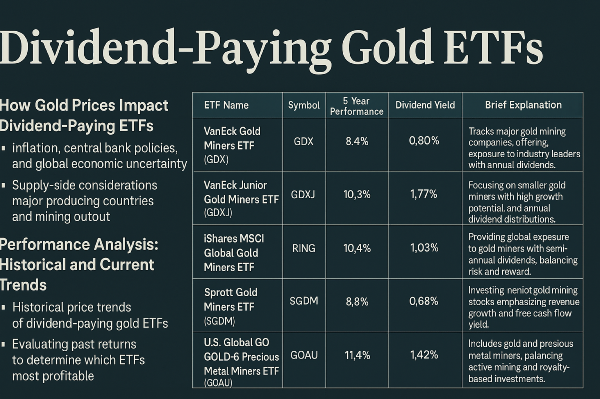

How Industrial Gas Prices Impact Stock Performance

Industrial gas prices are a major lever in stock performance, and investors better pay attention! Demand stays strong because these gases are essential—manufacturing, healthcare, semiconductors, even clean energy all rely on them.

But supply? That’s where the game gets interesting. The biggest players—Linde, Air Products, Air Liquide—they control pricing through long-term contracts, but raw material costs and distribution challenges still factor in. Now, throw in macro trends like inflation, rising interest rates, and fluctuating commodity cycles—suddenly, margins get squeezed, and stocks react fast. The best industrial gas companies thrive by managing costs while locking in high-value customers, making them solid plays even when the economy gets rocky. Smart investors know: pricing power and resilience equal long-term gains!

Performance Analysis: Historical and Current Trends

Industrial gas stocks are built for long-haul gains! Historically, they’ve shown steady, upward trends, largely insulated from wild market swings—why? Because industrial demand never quits! Manufacturing, healthcare, energy, semiconductors all NEED these gases, creating a reliable revenue stream for giants like Linde, Air Products, and Air Liquide. When industry ramps up, these stocks climb; when things cool down, their long-term contracts cushion the blow. And let’s talk returns—investors love these companies for their strong dividends, solid cash flow, and ability to outperform in volatile markets. If you’re hunting for consistency with upside potential, industrial gas stocks are a portfolio powerhouse!

ESG and Sustainability Considerations in Industrial Gas Investing

Industrial gas stocks got ESG written all over them! Sure, producing gases like hydrogen, nitrogen, and oxygen takes energy, but the biggest players—Linde, Air Products, Air Liquide—are turning sustainability into a profit engine. These companies are leading the charge in carbon capture, green hydrogen, and emissions reduction, partnering with industries to make operations cleaner AND more efficient.

Investors love the ESG tailwind—governments are pushing clean energy, corporate buyers want sustainability, and industrial gas firms are cashing in on both. Long-term? This sector isn’t just adapting, it’s THRIVING as the demand for clean solutions ramps up. Betting on industrial gas means betting on the future of sustainable industry!

Risks Associated with Industrial Gas Stocks

Industrial gas stocks are solid plays, but don’t think they’re risk-free! Market volatility can hit even the best, especially when commodity prices fluctuate—energy costs, raw materials, logistics all factor in. Liquidity isn’t a huge issue for giants like Linde or Air Products, but regulatory shifts? Now THAT can shake things up—carbon taxes, environmental laws, and safety regulations all impact operations and profitability.

And let’s not forget geopolitics—supply chains cross borders, and global tensions can disrupt production, inflate costs, and even reshape trade policies. Smart investors know: watch the macro trends, hedge against uncertainty, and always bet on companies with strong pricing power and diversified markets!

Opportunities and Investment Strategies

Industrial gas stocks are absolute powerhouses in a diversified portfolio! These companies thrive on long-term contracts, stable demand, and global industrial expansion, making them excellent defensive plays. Now, strategy matters—long-term investors love these stocks for consistent dividends, steady growth, and insulation from wild commodity swings, while short-term traders can capitalize on earnings beats and macro-driven momentum. Compared to ETFs or commodity futures, industrial gas stocks offer a blend of stability AND upside potential—less volatility than raw materials, but more direct exposure to market cycles than broad-sector ETFs. The play here? Own the biggest names, ride the global industrial tailwind, and let compound growth do the heavy lifting!

Conclusion

Industrial gas stocks aren’t just another corner of the market—they’re foundational to global industry, providing essential materials for manufacturing, healthcare, energy, and tech. Their stability, pricing power, and innovation in clean energy solutions make them attractive investments, offering both resilience and growth potential.

Whether navigating macroeconomic shifts, ESG trends, or geopolitical risks, top players like Linde, Air Products, and Air Liquide continue to lead the charge. For investors looking for a mix of reliability and upside, industrial gas stocks present a compelling case for long-term portfolio strength!

🔥 Must-Read Material Stock Picks! 🚀

Looking to dive deeper into materials stocks and uncover the best investment opportunities? Check out these powerful insights! 📊

🏗️ Top Material Stock Insights

🌎 Global & Specialized Material Plays

🔬 Industrial & Rare Earth Stocks

💡 Stay Ahead in Materials Investing – Click through and explore these top-tier insights! ✅

Industrial Gas Stocks Ranked by Investment Attractiveness

Sources:

Introduction

Industrial gas stocks? Oh, you better believe they’re worth a closer look! This sector is the unsung hero of global industry—fuels manufacturing, healthcare, semiconductors, even green energy. And here’s the kicker: demand is rock solid, contracts are long-term, and margins are juicy. These companies print cash while powering the world, making them a must-watch for any savvy investor. We’ll break down why these stocks are so attractive, how they thrive in economic cycles, and what key players are dominating the space. Strap in, because there’s serious money to be made!

Understanding Industrial Gas Stocks

Industrial gas companies? Oh, these are the backbone of modern industry! They produce and supply the essential gases—oxygen, nitrogen, hydrogen—that keep everything running, from steel production to semiconductor fabs to hospitals. This isn’t some volatile commodity play, and it’s definitely not an ETF basket of mixed assets. No, these stocks are cash machines, powered by long-term contracts, pricing power, and recession-resistant demand. Whether the economy is booming or sputtering, industries still need their gases—giving these stocks a steady edge over commodity-linked plays that rise and fall with market swings.

Now, let’s talk about profitability. The secret sauce? Scale, contracts, and innovation. The biggest players—think Air Liquide, Linde, Air Products—they don’t just sell gas, they integrate deep into supply chains, securing multi-year deals with customers who can’t afford disruptions. Add in high-margin specialty gases, green hydrogen initiatives, and efficiency improvements, and you’ve got a sector that’s primed for growth AND resilience. Investors love these stocks for their defensive nature AND upside potential—it’s a rare combination in today’s market.

Major Industrial Gas Companies

Linde PLC (NYSE: LIN)

Linde PLC is the world’s largest industrial gas supplier, operating across multiple industries, including healthcare, manufacturing, and energy. The company specializes in atmospheric gases like oxygen, nitrogen, and argon, as well as process gases such as hydrogen and carbon dioxide. Linde’s operations are structured into four regional business units—Western Europe, the Americas, Asia & Eastern Europe, and South Pacific & Africa—ensuring a global footprint with localized expertise. The company’s engineering division also plays a crucial role in designing and constructing gas processing plants, reinforcing its leadership in industrial gas technology.

A key driver of Linde’s success is its ability to secure long-term contracts with major industrial clients, ensuring stable revenue streams. The company has also been investing heavily in clean energy solutions, including hydrogen production and carbon capture technologies, aligning with global sustainability trends. With a strong financial position and a commitment to innovation, Linde continues to expand its influence in industrial gas markets worldwide.

Air Products and Chemicals, Inc. (NYSE: APD)

Air Products and Chemicals, Inc. is a leading global supplier of industrial gases, serving industries such as refining, electronics, and food processing. The company is particularly strong in hydrogen production, playing a crucial role in the energy transition by supporting clean hydrogen initiatives. Air Products operates over 750 production facilities across 50 countries, ensuring a robust supply chain for its customers. Its extensive pipeline network and on-site gas generation capabilities provide cost-effective solutions for industrial clients.

Profitability in Air Products is driven by its ability to maintain long-term contracts and develop large-scale hydrogen projects. The company has been expanding its presence in sustainable energy, investing in carbon capture and hydrogen fuel technologies. With a strong dividend history and a focus on operational efficiency, Air Products remains a top choice for investors seeking stability and growth in the industrial gas sector.

Air Liquide (EPA: AI)

Air Liquide is a European industrial gas powerhouse with operations spanning over 70 countries. The company provides essential gases for healthcare, electronics, and manufacturing, with a strong emphasis on innovation. Air Liquide’s research and development efforts focus on hydrogen energy, carbon capture, and specialty gases for semiconductor production. Its U.S. operations, including Airgas, further strengthen its global presence, making it a dominant player in the industry.

Air Liquide’s profitability is supported by its diversified portfolio and strategic investments in clean energy. The company has been actively expanding its hydrogen infrastructure, positioning itself as a leader in sustainable industrial solutions. With a strong balance sheet and a commitment to technological advancements, Air Liquide continues to drive growth in the global industrial gas market.

Messer Group

Messer Group is the largest privately held industrial gas company, operating across North America, South America, Europe, and Asia. The company specializes in industrial, medical, and specialty gases, catering to diverse industries such as food processing, healthcare, and electronics. Messer’s operations are built on a foundation of safety, reliability, and customer-focused solutions, ensuring long-term partnerships with industrial clients.

Despite being privately owned, Messer competes effectively with publicly traded giants by leveraging its deep industry expertise and technological innovations. The company has been expanding its footprint through strategic acquisitions and investments in advanced gas applications. Messer’s commitment to sustainability and operational excellence makes it a formidable player in the industrial gas sector.

Taiyo Nippon Sanso Corporation

Taiyo Nippon Sanso Corporation is a leading industrial gas supplier in Asia, serving industries such as steel, semiconductors, and healthcare. The company’s operations focus on high-purity gases, specialty gases, and advanced gas technologies for industrial applications. Taiyo Nippon Sanso has been actively expanding its presence in hydrogen energy and semiconductor manufacturing, aligning with global technological advancements.

The company’s profitability is driven by its strong market position in Japan and strategic partnerships across Asia. Taiyo Nippon Sanso continues to invest in research and development, enhancing its capabilities in gas purification and environmental solutions. With a commitment to innovation and sustainability, the company remains a key player in the Asian industrial gas market.

Chart Industries, Inc. (NYSE: GTLS)

Chart Industries specializes in cryogenic equipment and industrial gas solutions, serving industries such as energy, healthcare, and manufacturing. The company’s operations focus on designing and manufacturing storage tanks, heat exchangers, and gas processing systems. Chart’s expertise in liquefied natural gas (LNG) and hydrogen technologies positions it as a critical player in the clean energy transition.

Chart Industries’ profitability is driven by its ability to provide innovative solutions for gas storage and distribution. The company has been expanding its presence in carbon capture and hydrogen infrastructure, supporting global sustainability efforts. With a strong engineering foundation and a commitment to technological advancements, Chart Industries continues to be a leader in cryogenic and industrial gas solutions.

How Industrial Gas Prices Impact Stock Performance

Industrial gas prices are a major lever in stock performance, and investors better pay attention! Demand stays strong because these gases are essential—manufacturing, healthcare, semiconductors, even clean energy all rely on them.

But supply? That’s where the game gets interesting. The biggest players—Linde, Air Products, Air Liquide—they control pricing through long-term contracts, but raw material costs and distribution challenges still factor in. Now, throw in macro trends like inflation, rising interest rates, and fluctuating commodity cycles—suddenly, margins get squeezed, and stocks react fast. The best industrial gas companies thrive by managing costs while locking in high-value customers, making them solid plays even when the economy gets rocky. Smart investors know: pricing power and resilience equal long-term gains!

Performance Analysis: Historical and Current Trends

Industrial gas stocks are built for long-haul gains! Historically, they’ve shown steady, upward trends, largely insulated from wild market swings—why? Because industrial demand never quits! Manufacturing, healthcare, energy, semiconductors all NEED these gases, creating a reliable revenue stream for giants like Linde, Air Products, and Air Liquide. When industry ramps up, these stocks climb; when things cool down, their long-term contracts cushion the blow. And let’s talk returns—investors love these companies for their strong dividends, solid cash flow, and ability to outperform in volatile markets. If you’re hunting for consistency with upside potential, industrial gas stocks are a portfolio powerhouse!

ESG and Sustainability Considerations in Industrial Gas Investing

Industrial gas stocks got ESG written all over them! Sure, producing gases like hydrogen, nitrogen, and oxygen takes energy, but the biggest players—Linde, Air Products, Air Liquide—are turning sustainability into a profit engine. These companies are leading the charge in carbon capture, green hydrogen, and emissions reduction, partnering with industries to make operations cleaner AND more efficient. Investors love the ESG tailwind—governments are pushing clean energy, corporate buyers want sustainability, and industrial gas firms are cashing in on both. Long-term? This sector isn’t just adapting, it’s THRIVING as the demand for clean solutions ramps up. Betting on industrial gas means betting on the future of sustainable industry!

Risks Associated with Industrial Gas Stocks

Industrial gas stocks are solid plays, but don’t think they’re risk-free! Market volatility can hit even the best, especially when commodity prices fluctuate—energy costs, raw materials, logistics all factor in. Liquidity isn’t a huge issue for giants like Linde or Air Products, but regulatory shifts? Now THAT can shake things up—carbon taxes, environmental laws, and safety regulations all impact operations and profitability. And let’s not forget geopolitics—supply chains cross borders, and global tensions can disrupt production, inflate costs, and even reshape trade policies. Smart investors know: watch the macro trends, hedge against uncertainty, and always bet on companies with strong pricing power and diversified markets!

Opportunities and Investment Strategies

Industrial gas stocks are absolute powerhouses in a diversified portfolio! These companies thrive on long-term contracts, stable demand, and global industrial expansion, making them excellent defensive plays. Now, strategy matters—long-term investors love these stocks for consistent dividends, steady growth, and insulation from wild commodity swings, while short-term traders can capitalize on earnings beats and macro-driven momentum. Compared to ETFs or commodity futures, industrial gas stocks offer a blend of stability AND upside potential—less volatility than raw materials, but more direct exposure to market cycles than broad-sector ETFs. The play here? Own the biggest names, ride the global industrial tailwind, and let compound growth do the heavy lifting!

Conclusion

Industrial gas stocks aren’t just another corner of the market—they’re foundational to global industry, providing essential materials for manufacturing, healthcare, energy, and tech. Their stability, pricing power, and innovation in clean energy solutions make them attractive investments, offering both resilience and growth potential. Whether navigating macroeconomic shifts, ESG trends, or geopolitical risks, top players like Linde, Air Products, and Air Liquide continue to lead the charge. For investors looking for a mix of reliability and upside, industrial gas stocks present a compelling case for long-term portfolio strength!

🔥 Must-Read Material Stock Picks! 🚀

Looking to dive deeper into materials stocks and uncover the best investment opportunities? Check out these powerful insights! 📊

🏗️ Top Material Stock Insights

🌎 Global & Specialized Material Plays

🔬 Industrial & Rare Earth Stocks

💡 Stay Ahead in Materials Investing – Click through and explore these top-tier insights! ✅