Investors, listen up—because if you're sleeping on the industrial gas sector, you’re missing out on a powerhouse that’s fueling the world in more ways than one! We’re talking about the unsung heroes of manufacturing, energy, healthcare, and beyond—oxygen, nitrogen, hydrogen—these gases keep industries humming and profits soaring.

What’s driving this explosive growth? Megatrends like clean energy, semiconductor demand, and precision manufacturing. Companies in this space are locking in high-margin, long-term contracts, creating stability in a market where volatility is the name of the game.

So, why should you care? Because industrial gases aren't just another commodity—they’re a strategic play with pricing power, sustainability tailwinds, and serious dividend potential. If you want to ride the wave of innovation and solid returns, industrial gas stocks are must-watch material. Let’s dive in! 💥

Industrial Gas Market Fundamentals

The industrial gas market is the backbone of global industries, supplying essential gases like oxygen, nitrogen, and hydrogen to power manufacturing, healthcare, and energy production. These gases aren’t just commodities—they’re strategic assets driving efficiency and innovation. From welding and food preservation to semiconductor fabrication and medical applications, industrial gases are everywhere, making them a must-watch sector for investors looking for stability and long-term growth.

Leading the charge are Linde, Air Liquide, and Air Products, dominating the market with cutting-edge production and distribution networks. But here’s where it gets exciting—specialty gases like helium and argon are fueling advanced technologies, from space exploration to AI-driven chip manufacturing. As industries push for cleaner energy and precision engineering, demand for these gases is skyrocketing. Investors, take note: this sector isn’t just growing—it’s evolving into a high-margin, high-impact powerhouse!

Sources: Business Research Insights, Mordor Intelligence

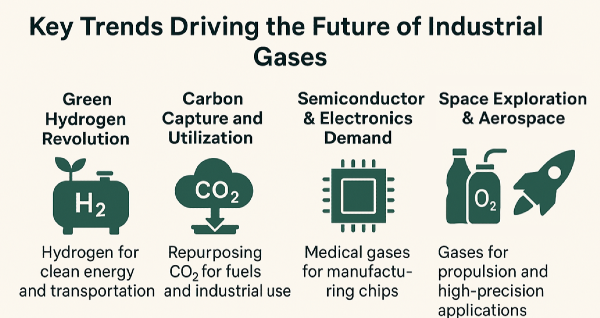

Key Trends Driving the Future of Industrial Gases

The Green Hydrogen Revolution is firing up, and industrial gas giants are at the center of it! Hydrogen is the golden ticket to decarbonization, fueling everything from clean transportation to grid-scale energy storage. With governments pouring billions into hydrogen infrastructure, companies like Linde and Air Products are locking in long-term contracts, making this a must-watch sector for investors looking to ride the renewable wave.

Carbon Capture and Utilization is no longer just a buzzword—it’s a game-changer! Industrial gases like CO₂ are being repurposed for synthetic fuels, enhanced oil recovery, and even food preservation. As ESG mandates tighten, companies investing in carbon capture tech are securing their future while cutting emissions. This isn’t just sustainability—it’s profitability!

The Semiconductor & Electronics Demand is skyrocketing, and purified gases are the unsung heroes behind every chip. High-purity nitrogen, argon, and helium are critical for precision manufacturing, and with AI, IoT, and EVs driving demand, gas suppliers are cashing in. Investors, take note—this sector is primed for explosive growth!

In Healthcare Innovations, medical gases are saving lives and driving profits. Oxygen therapy, cryogenic storage, and advanced respiratory treatments are fueling demand, especially post-pandemic. With an aging population and expanding healthcare infrastructure, industrial gas companies are sitting on a goldmine of opportunity!

The Food & Beverage Processing industry is leaning hard on industrial gases for preservation and packaging. CO₂ keeps beverages fizzy, nitrogen extends shelf life, and oxygen-free environments prevent spoilage. As consumer demand for fresh, minimally processed foods grows, gas suppliers are locking in steady revenue streams!

Finally, Space Exploration & Aerospace is pushing gas technology to new frontiers! Liquid oxygen and hydrogen power rockets, while specialty gases enable high-precision engineering. With commercial space travel and defense spending ramping up, industrial gas firms are fueling the future of exploration!

Sources: Air Source Industries, Ramdon, OJData

Major Industrial Gas Companies and Their Market Influence

The industrial gas sector is dominated by heavyweights like Linde, Air Liquide, and Air Products, each flexing their global footprint with cutting-edge innovations and high-margin contracts. Messer Group keeps things interesting as a privately held powerhouse, while Taiyo Nippon Sanso drives growth across Asia. And don’t sleep on Chart Industries—their cryogenic tech is fueling everything from hydrogen storage to space exploration. These companies aren’t just moving gases—they’re moving markets!

Read More: The Top Industrial Gas Companies

Emerging Technologies and Their Impact on Industrial Gases

AI-driven gas analytics are revolutionizing industrial gas operations, bringing real-time monitoring, predictive maintenance, and automated process optimization to the forefront. Companies leveraging AI are slashing costs, boosting efficiency, and locking in high-margin contracts by ensuring precise gas delivery and usage. This isn’t just automation—it’s a profit-driving machine that’s reshaping the industry!

Cryogenic advancements are supercharging storage and transportation, making liquid hydrogen, oxygen, and nitrogen more accessible than ever. With hydrogen fuel emerging as a cornerstone of clean energy, industrial gas giants are racing to refine cryogenic tech for grid-scale storage and fuel cell applications. Meanwhile, cutting-edge gas separation technologies are driving sustainability, enabling cleaner industrial processes and unlocking new revenue streams for forward-thinking companies. Investors, take note—this sector is primed for explosive growth!

Sources: Ramdon, OH&S Online, DesignHorizons

ESG and Sustainability Considerations in the Industrial Gas Industry

Booyah! Industrial gas producers are stepping up their game, slashing carbon emissions with renewable energy-powered production and carbon capture technologies. Hydrogen and oxygen are fueling carbon-neutral solutions, from green steel manufacturing to clean energy storage. Major players like Linde and Air Liquide are rolling out aggressive sustainability initiatives, locking in ESG-focused investors and securing long-term profitability. This isn’t just about compliance—it’s about winning the future!

Risks Facing the Industrial Gas Industry

Supply chain disruptions are shaking up global gas distribution, with geopolitical tensions and raw material shortages driving volatility. Regulatory hurdles around emissions and production standards are tightening, forcing companies to innovate or risk falling behind. And let’s not forget geopolitical risks—trade restrictions and shifting energy policies can send industrial gas pricing into a tailspin. Investors, stay sharp—this sector demands strategic positioning!

Investment Opportunities in the Industrial Gas Sector

Industrial gas stocks are primed for explosive growth, thanks to AI-driven analytics, hydrogen expansion, and cryogenic breakthroughs. ETFs tracking clean energy and industrial gases offer diversified exposure, while dividend-paying giants like Air Products and Linde provide steady returns. Long-term, the sector’s high-margin contracts and sustainability tailwinds make it a must-watch for investors looking to ride the next wave of industrial innovation! 🚀

Sources: JPT, Womble Bond Dickinson, Investopedia, Mordor Intelligence

Final Thoughts

The industrial gas sector isn’t just keeping the world running—it’s fueling the future with cutting-edge innovations, sustainability breakthroughs, and rock-solid investment opportunities. Whether it’s hydrogen leading the clean energy revolution, AI optimizing efficiency, or cryogenic advancements redefining storage, this industry is proving its resilience and profitability.

For investors, the key is recognizing high-margin opportunities, tracking geopolitical and regulatory shifts, and positioning early in game-changing technologies. If you’re not watching industrial gases, you’re missing out on a sector that’s quietly dominating global infrastructure. Stay sharp, stay strategic, and ride the momentum!.

🔥 Must-Read Material Stock Picks! 🚀

Looking to dive deeper into materials stocks and uncover the best investment opportunities? Check out these powerful insights! 📊

🏗️ Top Material Stock Insights

🌎 Global & Specialized Material Plays

🔬 Industrial & Rare Earth Stocks

💡 Stay Ahead in Materials Investing – Click through and explore these top-tier insights! ✅

Investors, listen up—because if you're sleeping on the industrial gas sector, you’re missing out on a powerhouse that’s fueling the world in more ways than one! We’re talking about the unsung heroes of manufacturing, energy, healthcare, and beyond—oxygen, nitrogen, hydrogen—these gases keep industries humming and profits soaring.

What’s driving this explosive growth? Megatrends like clean energy, semiconductor demand, and precision manufacturing. Companies in this space are locking in high-margin, long-term contracts, creating stability in a market where volatility is the name of the game.

So, why should you care? Because industrial gases aren't just another commodity—they’re a strategic play with pricing power, sustainability tailwinds, and serious dividend potential. If you want to ride the wave of innovation and solid returns, industrial gas stocks are must-watch material. Let’s dive in! 💥

Industrial Gas Market Fundamentals

The industrial gas market is the backbone of global industries, supplying essential gases like oxygen, nitrogen, and hydrogen to power manufacturing, healthcare, and energy production. These gases aren’t just commodities—they’re strategic assets driving efficiency and innovation. From welding and food preservation to semiconductor fabrication and medical applications, industrial gases are everywhere, making them a must-watch sector for investors looking for stability and long-term growth.

Leading the charge are Linde, Air Liquide, and Air Products, dominating the market with cutting-edge production and distribution networks. But here’s where it gets exciting—specialty gases like helium and argon are fueling advanced technologies, from space exploration to AI-driven chip manufacturing. As industries push for cleaner energy and precision engineering, demand for these gases is skyrocketing. Investors, take note: this sector isn’t just growing—it’s evolving into a high-margin, high-impact powerhouse!

Sources: Business Research Insights, Mordor Intelligence

Key Trends Driving the Future of Industrial Gases

The Green Hydrogen Revolution is firing up, and industrial gas giants are at the center of it! Hydrogen is the golden ticket to decarbonization, fueling everything from clean transportation to grid-scale energy storage. With governments pouring billions into hydrogen infrastructure, companies like Linde and Air Products are locking in long-term contracts, making this a must-watch sector for investors looking to ride the renewable wave.

Carbon Capture and Utilization is no longer just a buzzword—it’s a game-changer! Industrial gases like CO₂ are being repurposed for synthetic fuels, enhanced oil recovery, and even food preservation. As ESG mandates tighten, companies investing in carbon capture tech are securing their future while cutting emissions. This isn’t just sustainability—it’s profitability!

The Semiconductor & Electronics Demand is skyrocketing, and purified gases are the unsung heroes behind every chip. High-purity nitrogen, argon, and helium are critical for precision manufacturing, and with AI, IoT, and EVs driving demand, gas suppliers are cashing in. Investors, take note—this sector is primed for explosive growth!

In Healthcare Innovations, medical gases are saving lives and driving profits. Oxygen therapy, cryogenic storage, and advanced respiratory treatments are fueling demand, especially post-pandemic. With an aging population and expanding healthcare infrastructure, industrial gas companies are sitting on a goldmine of opportunity!

The Food & Beverage Processing industry is leaning hard on industrial gases for preservation and packaging. CO₂ keeps beverages fizzy, nitrogen extends shelf life, and oxygen-free environments prevent spoilage. As consumer demand for fresh, minimally processed foods grows, gas suppliers are locking in steady revenue streams!

Finally, Space Exploration & Aerospace is pushing gas technology to new frontiers! Liquid oxygen and hydrogen power rockets, while specialty gases enable high-precision engineering. With commercial space travel and defense spending ramping up, industrial gas firms are fueling the future of exploration!

Sources: Air Source Industries, Ramdon, OJData

Major Industrial Gas Companies and Their Market Influence

The industrial gas sector is dominated by heavyweights like Linde, Air Liquide, and Air Products, each flexing their global footprint with cutting-edge innovations and high-margin contracts. Messer Group keeps things interesting as a privately held powerhouse, while Taiyo Nippon Sanso drives growth across Asia. And don’t sleep on Chart Industries—their cryogenic tech is fueling everything from hydrogen storage to space exploration. These companies aren’t just moving gases—they’re moving markets!

Emerging Technologies and Their Impact on Industrial Gases

AI-driven gas analytics are revolutionizing industrial gas operations, bringing real-time monitoring, predictive maintenance, and automated process optimization to the forefront. Companies leveraging AI are slashing costs, boosting efficiency, and locking in high-margin contracts by ensuring precise gas delivery and usage. This isn’t just automation—it’s a profit-driving machine that’s reshaping the industry!

Cryogenic advancements are supercharging storage and transportation, making liquid hydrogen, oxygen, and nitrogen more accessible than ever. With hydrogen fuel emerging as a cornerstone of clean energy, industrial gas giants are racing to refine cryogenic tech for grid-scale storage and fuel cell applications. Meanwhile, cutting-edge gas separation technologies are driving sustainability, enabling cleaner industrial processes and unlocking new revenue streams for forward-thinking companies. Investors, take note—this sector is primed for explosive growth!

Sources: Ramdon, OH&S Online, DesignHorizons

ESG and Sustainability Considerations in the Industrial Gas Industry

Booyah! Industrial gas producers are stepping up their game, slashing carbon emissions with renewable energy-powered production and carbon capture technologies. Hydrogen and oxygen are fueling carbon-neutral solutions, from green steel manufacturing to clean energy storage. Major players like Linde and Air Liquide are rolling out aggressive sustainability initiatives, locking in ESG-focused investors and securing long-term profitability. This isn’t just about compliance—it’s about winning the future!

Risks Facing the Industrial Gas Industry

Supply chain disruptions are shaking up global gas distribution, with geopolitical tensions and raw material shortages driving volatility. Regulatory hurdles around emissions and production standards are tightening, forcing companies to innovate or risk falling behind. And let’s not forget geopolitical risks—trade restrictions and shifting energy policies can send industrial gas pricing into a tailspin. Investors, stay sharp—this sector demands strategic positioning!

Investment Opportunities in the Industrial Gas Sector

Industrial gas stocks are primed for explosive growth, thanks to AI-driven analytics, hydrogen expansion, and cryogenic breakthroughs. ETFs tracking clean energy and industrial gases offer diversified exposure, while dividend-paying giants like Air Products and Linde provide steady returns. Long-term, the sector’s high-margin contracts and sustainability tailwinds make it a must-watch for investors looking to ride the next wave of industrial innovation! 🚀

Sources: JPT, Womble Bond Dickinson, Investopedia, Mordor Intelligence

Final Thoughts

The industrial gas sector isn’t just keeping the world running—it’s fueling the future with cutting-edge innovations, sustainability breakthroughs, and rock-solid investment opportunities. Whether it’s hydrogen leading the clean energy revolution, AI optimizing efficiency, or cryogenic advancements redefining storage, this industry is proving its resilience and profitability.

For investors, the key is recognizing high-margin opportunities, tracking geopolitical and regulatory shifts, and positioning early in game-changing technologies. If you’re not watching industrial gases, you’re missing out on a sector that’s quietly dominating global infrastructure. Stay sharp, stay strategic, and ride the momentum!.

🔥 Must-Read Material Stock Picks! 🚀

Looking to dive deeper into materials stocks and uncover the best investment opportunities? Check out these powerful insights! 📊

🏗️ Top Material Stock Insights

🌎 Global & Specialized Material Plays

🔬 Industrial & Rare Earth Stocks

💡 Stay Ahead in Materials Investing – Click through and explore these top-tier insights! ✅