Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

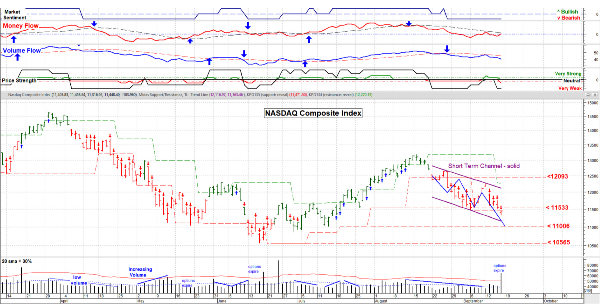

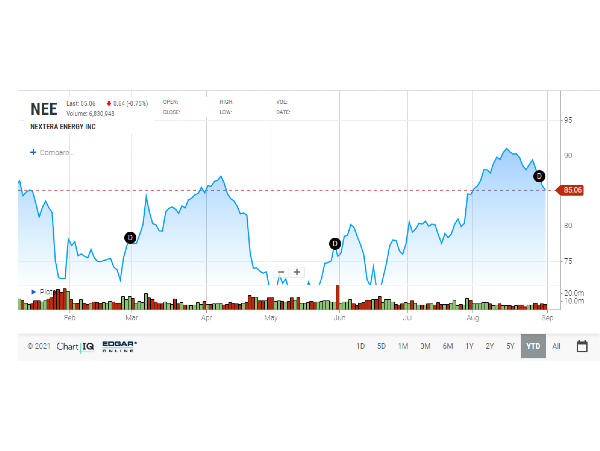

September 16, 2022 - If you’re having a hard time figuring out this market you’re not alone. There has been near record amounts of option hedge buying over the past couple of weeks by big institutions. Since it’s VERY hard to liquidate their positions without affecting the prices in the market they try to reduce risk (of falling prices) by using option strategies. Stats show many retail traders rushed in late July (about $2 billion) convinced that the bottom was in; boy did they get burned !

Friday was a day for September options to expire. Monday we’ll get a chance to see just how many contracts closed out (expired) and how many just got “rolled forward” into the October month. That will be an indication of how confident the “big guys/gals” are about the future. I doubt that there will be a surge of optimism since the next FED meeting will wrap up on September 21. Make no mistake . . . it’s all about recession fears and earnings, and interest rates give a hint about those key metrics. The FedEx announcement of removing forward earnings guidance on Thursday put fear back into the market.

Another thing to watch is the US Dollar. It’s very 'toppy' now. If the Dollar falls, the markets tend to go up, if it remains strong or higher, well . . . we could very well see lower prices. My totally guess about the next couple of weeks is the interest rates go higher, recession fears rekindle and we head toward the previous lows. Just an opinion; we have to trade the market in front of us and not rely of opinions.

Have a good week. ............. Tom ............ Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission. more information at: www.Special-Risk.net