In 1834, John Scott Russell walked for miles along the Union Canal in Scotland, following a “soliton wave,” just like in the GIF below. The wave never changed shape or size. It just kept going.

Waves, left uninterrupted, would travel forever. Scientists didn’t know this at that time. Russell’s walk was a turning point in physics. (We’ll get to investing in a minute, just stick with me.)

Let’s now travel east from Scotland to look at waves in the North Sea.

For centuries, sailors told stories of so-called “rogue waves.” At least, the sailors who survived those waves. In an otherwise calm sea, a giant “rogue” wave would rise unexpectedly and, in some cases, cause massive damage to an unlucky ship.

But, over those same centuries, experts didn’t believe the stories. Rogue waves were “dragons” of the sea. Scary, infrequent, but simply not real.

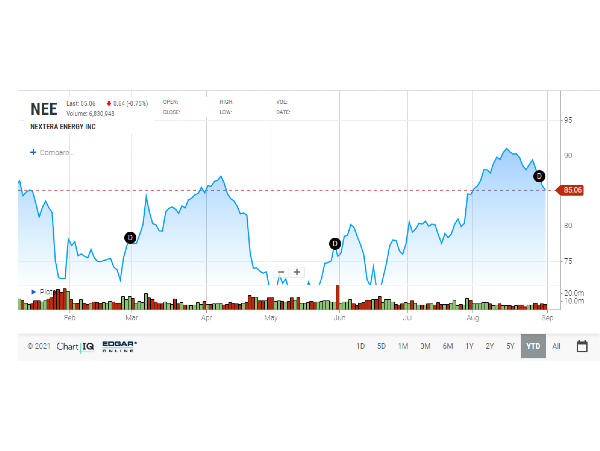

But in 1984 (yes – just 40 years ago), oceanographic research shocked the seafaring world. A 36-foot tall wave was detected in the North Sea on a day when every other wave was less than 10 feet. A true rogue.

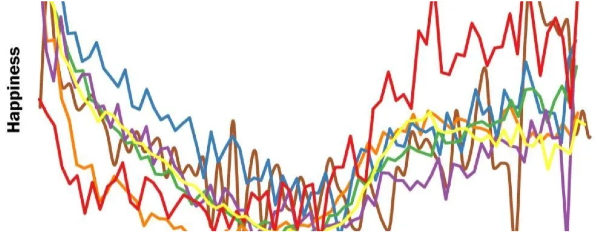

Wave data from the Gorm Platform, where a 36-foot wave was detected on a calm day.

Then in 1995, an 84-foot wave was detected in a storm when every other wave maxed out at 35 feet. Another rogue.

Where do these rogues come from? How can a huge wave seemingly come from nothing?

One simple theory involves “**constructive interference.**” When two waves cross paths, their peaks and valleys combine.

In the GIF below, the green and blue waves interfere with one another. Green moves left to right, blue from right to left. They interfere to produce the red wave.

Peak + peak = extra big red peak. Valley + valley = extra big red valley.

Constructive interference is likely a cause of rogue waves: multiple small waves happen to cross paths at the same spot in the ocean, producing an uncharacteristically large wave.

Many Inputs, One Signal

If a rogue wave is indeed caused by the constructive interference of many smaller waves, it’s hard for us to tell. We can’t see those small inputs. All we see is a giant fu$%#ng wave.

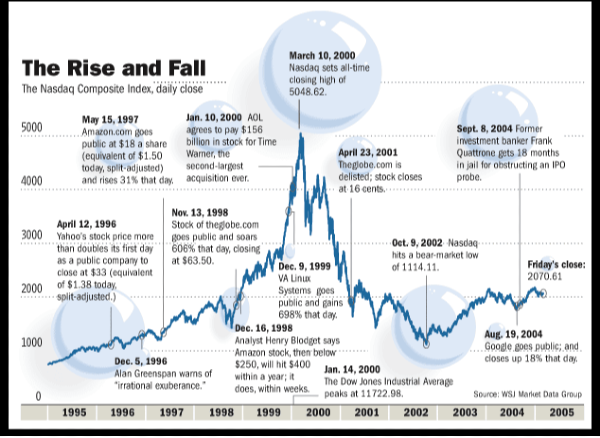

But rogue waves and constructive interference are a terrific metaphor for how markets (e.g. the stock market) work. Because just like the waves themselves, we can’t always decipher the various input behind the market’s prices.

Market forces can be thought of as distinct, small inputs. We’ll discuss those inputs in a second. Sometimes they combine to create “rogue” markets.

The most basic input are economic fundamentals. These are matters of fact. Revenue, profits, tax rates, interest rates, etc. Purely objective measures that describe the present-day and near-future state of companies and markets. Good fundamentals push markets higher. The wave grows…

Next are “rational” expectations about the long-term future. There are a mix of objective facts and subjective opinions, with investors making claims like, “Because of {these hard facts} I think {the market/this company} is going to do {my educated opinion} over the next 10 years.” Good expectations push markets higher. The wave grows…

And then there are “irrational” inputs, like:

Irrationality can be exuberant or pessimistic. It pushes highs too high and lows too low. A smorgasbord of recency bias, wishful thinking, commitment/consistency, and other behavioral shortcomings combine into what Charlie Munger calls a “lollapalooza.” I call it a rogue wave.

https://www.youtube.com/watch?v=orqFOGPTQ0w&t=1s

The challenging part, as investors, is deconstructing that rogue wave into its composite parts: how much is fundamental, how much is rational, and how much is complete bullshit?

It’s not easy to tell. We only get to view the wave as a whole. We see the market’s prices, but not how they’re arrived at. Informed analysts can, and should, do their best to determine fundamentals (and the other composite parts of asset prices). Only then can they determine if the irrationalists are being too optimistic or too pessimistic. And that idea—what’s the irrational opinion today?—harkens back to Benjamin Graham’s Mr. Market.

What if you’re not experienced enough to make these determinations? Simple. You shouldn’t try. It’s like sailing your Sunfish out to the open ocean. Even normal waves will crush you, let alone the rogue ones.

Instead, you’ve got to choose an investing strategy that ignores the waves altogether. Because waves in the market, unlike waves in the ocean, aren’t going to literally break your boat in half. They’ll cause discomfort, but they’ll pass (as long as you allow them to!).

I have terrific news for you. There are many ways for you amateur sailors to navigate the market’s seas. It’s all the stuff that we talk about here on The Best Interest.

- Invest for the long-term; ignore temporary waves.

- Keep fees low.

- Diversify and rebalance.

- If you’re going to abandon ship, stop. Hire an experienced captain instead.

- Learn as much about the sea as your possibly can. “An investment in knowledge pays the best interest.”

You don’t need to be a physicist or an oceanographer or a captain or an aerospace engineer.

In retrospect, the last couple years might have been rogue-ish, frothy with cheap money and exuberant expectations. If so, that wave is crashing around us right now. But that’s where this metaphor stops.

My ship is safe. Your ship, with your permission, is safe.

Seasick? Possibly. I know it’s not fun.

But this too shall pass.

Thank you for reading! If you enjoyed this article, Subscribe to get future articles emailed to your inbox.

-Jesse

P.S – I wrote a book! Check out the ebook here and the physical Amazon book here.

In 1834, John Scott Russell walked for miles along the Union Canal in Scotland, following a “soliton wave,” just like in the GIF below. The wave never changed shape or size. It just kept going.

Waves, left uninterrupted, would travel forever. Scientists didn’t know this at that time. Russell’s walk was a turning point in physics. (We’ll get to investing in a minute, just stick with me.)

Let’s now travel east from Scotland to look at waves in the North Sea.

For centuries, sailors told stories of so-called “rogue waves.” At least, the sailors who survived those waves. In an otherwise calm sea, a giant “rogue” wave would rise unexpectedly and, in some cases, cause massive damage to an unlucky ship.

But, over those same centuries, experts didn’t believe the stories. Rogue waves were “dragons” of the sea. Scary, infrequent, but simply not real.

But in 1984 (yes – just 40 years ago), oceanographic research shocked the seafaring world. A 36-foot tall wave was detected in the North Sea on a day when every other wave was less than 10 feet. A true rogue.

Wave data from the Gorm Platform, where a 36-foot wave was detected on a calm day.

Then in 1995, an 84-foot wave was detected in a storm when every other wave maxed out at 35 feet. Another rogue.

Where do these rogues come from? How can a huge wave seemingly come from nothing?

One simple theory involves “**constructive interference.**” When two waves cross paths, their peaks and valleys combine.

In the GIF below, the green and blue waves interfere with one another. Green moves left to right, blue from right to left. They interfere to produce the red wave.

Peak + peak = extra big red peak. Valley + valley = extra big red valley.

Constructive interference is likely a cause of rogue waves: multiple small waves happen to cross paths at the same spot in the ocean, producing an uncharacteristically large wave.

Many Inputs, One Signal

If a rogue wave is indeed caused by the constructive interference of many smaller waves, it’s hard for us to tell. We can’t see those small inputs. All we see is a giant fu$%#ng wave.

But rogue waves and constructive interference are a terrific metaphor for how markets (e.g. the stock market) work. Because just like the waves themselves, we can’t always decipher the various input behind the market’s prices.

Market forces can be thought of as distinct, small inputs. We’ll discuss those inputs in a second. Sometimes they combine to create “rogue” markets.

The most basic input are economic fundamentals. These are matters of fact. Revenue, profits, tax rates, interest rates, etc. Purely objective measures that describe the present-day and near-future state of companies and markets. Good fundamentals push markets higher. The wave grows…

Next are “rational” expectations about the long-term future. There are a mix of objective facts and subjective opinions, with investors making claims like, “Because of {these hard facts} I think {the market/this company} is going to do {my educated opinion} over the next 10 years.” Good expectations push markets higher. The wave grows…

And then there are “irrational” inputs, like:

Irrationality can be exuberant or pessimistic. It pushes highs too high and lows too low. A smorgasbord of recency bias, wishful thinking, commitment/consistency, and other behavioral shortcomings combine into what Charlie Munger calls a “lollapalooza.” I call it a rogue wave.

https://www.youtube.com/watch?v=orqFOGPTQ0w&t=1s

The challenging part, as investors, is deconstructing that rogue wave into its composite parts: how much is fundamental, how much is rational, and how much is complete bullshit?

It’s not easy to tell. We only get to view the wave as a whole. We see the market’s prices, but not how they’re arrived at. Informed analysts can, and should, do their best to determine fundamentals (and the other composite parts of asset prices). Only then can they determine if the irrationalists are being too optimistic or too pessimistic. And that idea—what’s the irrational opinion today?—harkens back to Benjamin Graham’s Mr. Market.

What if you’re not experienced enough to make these determinations? Simple. You shouldn’t try. It’s like sailing your Sunfish out to the open ocean. Even normal waves will crush you, let alone the rogue ones.

Instead, you’ve got to choose an investing strategy that ignores the waves altogether. Because waves in the market, unlike waves in the ocean, aren’t going to literally break your boat in half. They’ll cause discomfort, but they’ll pass (as long as you allow them to!).

I have terrific news for you. There are many ways for you amateur sailors to navigate the market’s seas. It’s all the stuff that we talk about here on The Best Interest.

You don’t need to be a physicist or an oceanographer or a captain or an aerospace engineer.

In retrospect, the last couple years might have been rogue-ish, frothy with cheap money and exuberant expectations. If so, that wave is crashing around us right now. But that’s where this metaphor stops.

My ship is safe. Your ship, with your permission, is safe.

Seasick? Possibly. I know it’s not fun.

But this too shall pass.

Thank you for reading! If you enjoyed this article, Subscribe to get future articles emailed to your inbox.

-Jesse

P.S – I wrote a book! Check out the ebook here and the physical Amazon book here.

Originally Posted on bestinterest.blog